Singapore is sending a strong signal to the single family offices (‘SFOs‘) established here that they are encouraged to grow and expand on their philanthropic giving and activities from Singapore.

As the number of family offices continues to grow in Singapore, Singapore is now also placing greater emphasis on the quality of SFOs here and their wider contribution to the Singapore economy and society at large.

In line with this spirit, Singapore has made further adjustments to the fund tax exemption for new SFOs set up in Singapore so as to encourage them to deploy their capital more purposefully to benefit Singapore and the region and also to increase contributions towards environmental and social causes.

Both of these changes, announced by the Monetary Authority of Singapore (‘MAS‘) on 5 July 2023, are summarised in this article.

A. New Philanthropy Tax Incentive Scheme (‘PTIS’) for Singapore Family Offices

Many family offices in Singapore are already active in philanthropy and have set up family foundations that are registered as charities in Singapore. The growth in family foundations has followed the growth in the number of family offices in Singapore.

The present charity regime in Singapore has a bias towards doing good in Singapore as only donations that exclusively benefit the Singapore community will be allowed as a tax deduction whereas donations to foreign charities will not qualify for any tax deduction[1].

The introduction of PTIS changes this long-standing principle, as qualifying donors in Singapore (which have been nominated by its related Singapore family office) can now claim 100% tax deduction (capped at 40% of the donor’s statutory income) for Eligible Overseas Donations made through Qualifying Local Intermediaries.

PTIS awards may be granted from 1 January 2024 to 31 December 2028. Once approved, the award will be valid for 5 years from the date of approval (‘Incentive Approval Period‘). MAS has indicated that the application forms for PTIS should be available by 1 September 2023.

(I) Eligible SFO Applicants:

Only SFOs that are managing funds held through at least one Section 13O or 13U fund can qualify to apply for PTIS.

Hence the SFOs that only manage funds with Section 13D fund tax exemption and multi-family offices are not eligible to apply for PTIS.

(II) Approved Qualifying Donor Specified by the SFO Applicant:

The SFO Applicant must specify one Approved Qualifying Donor in its application which can be:

- The SFO itself;

- An ultimate beneficial owner of the Section 13O or 13U fund managed by the SFO (‘Relevant Fund’);

- A beneficiary of the Relevant Fund; or

- A related family business, being an unlisted corporate entity that is based in Singapore and whose largest shareholder belongs to the same family as the UBO(s) or Beneficiary(ies) of the Relevant Fund.

Generally, only one person can be named as the Approved Qualifying Donor for the entire Incentive Approval Period, any change will require MAS’ prior approval and will only be permitted upon the demise or ineligibility of the original Approved Qualifying Donor.

Unutilised tax deductions cannot be carried forward to offset against the Approved Qualifying Donor’s income for a subsequent Year of Assessment and cannot be transferred to another company of the same group under the Group Relief System.

(III) Eligible Overseas Donations:

For the purpose of PTIS, Eligible Overseas Donations made by the Approved Qualifying Donor can only comprise:

- Unconditional Cash donations made towards any charitable, benevolent, or philanthropic purpose whose main objective is to benefit persons, events or objects outside of Singapore; and

- If the donation is subject to any condition regarding the purpose for which it may be applied, then all of the following requirements must be satisfied:

If an Approved Qualifying Donor, or any connected person, should receive any benefit in consequence of making the donation, then the amount of donation qualifying for tax deduction will be reduced by the value of such benefit.

(IV) Qualifying Local Intermediaries:

Eligible Overseas Donations made by the Approved Qualifying Donor must be channelled through Qualifying Local Intermediaries, which can comprise of any one of the following entities:

- Selected registered and exempt Charities in Singapore with a valid fundraising permit for foreign charitable purposes;

- Charitable Institutions[2] and Non-Profit Organisations[3] established by financial institutions in Singapore, as specified by MAS;

- Selected Grantmakers under the MCCY’s grantmaker scheme (and this would, on a plain reading, potentially include family foundations that are registered as a charity in Singapore under the lighter touch Qualifying Grantmaker regime); and

- Other selected entities as approved by MAS.

MAS welcomes interested intermediaries to apply to it for consideration as Qualifying Local Intermediaries. The applicant entity must commit to meet the relevant requirements such as issuance of the PTIS Donation Acknowledgment Receipt to the Approved Qualifying Donor and other filing requirements.

(V) Qualifying Conditions to be fulfilled by the Eligible SFO:

For an SFO to be eligible for the PTIS, the SFO must appoint a Philanthropy Professional at the point of application (or within 6 months) and maintain that position throughout the 5-year Incentive Approval Period. This requirement can be fulfilled by:

- hiring a new Philanthropy Professional who must be Singapore tax resident earning a salary of more than S$3500 per month and be engaged substantially in managing the family’s philanthropic activities. A Philanthropy Professional cannot concurrently be an investment professional;

- changing an existing family office employee’s role to become the ‘Philanthropy Professional’; or

- engaging an External Service Provider (i.e. a third party philanthropy advisory service provider) based in Singapore to provide the family with contractual philanthropy advisory services. The External Service Provider may be engaged either by the SFO or the Approved Qualifying Donor.

In addition to the above condition, the Eligible SFO must also meet 2 other economic conditions in the financial year when each Eligible Overseas Donation is made within the 5-year Incentive Approval Period for such donation to qualify for tax deduction under the PTIS:

- Incur an additional S$200,000 in local business spending (measured relative to the local business spending incurred by the SFO in the FY preceding the date of application. In the case of an existing Section 13O fund which has previously been submitting total business spending in its annual filings instead of local business spending, there will need to be some adjustment to reflect the accurate local business spending amount as the baseline figure).

- Employ an additional local Professional Headcount (‘PHC’) who must be a Singapore citizen or PR based in Singapore with a salary of at least S$3,500 and who is substantially engaged in either philanthropic or fund management activities (and this is measured relative to the number of local PHCs within the SFO on the date prior to the date of application). This additional headcount can be the same person who is the first Philanthropy Professional hired by the SFO.

(VI) Relevant Documentation / Filings:

The Qualifying Local Intermediary must issue to the Approved Qualifying Donor a PTIS Donation Acknowledgment Receipt for the overseas donation, which the Approved Qualifying Donor is required to keep for at least 5 years.

For Approved Qualifying Donors who are individuals, the tax deduction for their overseas donations will be automatically allowed in their individual tax assessments. For non-individual Approved Qualifying Donors, the overseas donation must be manually included in their tax returns without attaching the PTIS Donation Acknowledgement Receipt (although IRAS may request for it).

To support a deduction claim under the PTIS, the Eligible SFO will also be required to submit an Annual Review Return (‘ARR‘) to MAS within 4 months of the end of its FY. The ARR will include a declaration that the relevant conditions for claiming the deduction have been fulfilled.

MAS also reserves the right to ask for further supporting documentation or auditor’s certification for information submitted.

Concluding Remarks on PTIS

PTIS offers an additional benefit to families with SFOs in Singapore who are keen to donate to foreign charitable causes. While there may appear to be multiple conditions to satisfy at first glance, the conditions are not particularly difficult to fulfil if the family is willing to put in place a more considered philanthropy policy so that the dedicated Philanthropy Professional or the external service provider could help to manage and plan to achieve the available deductions.

That being said, for many families, their charitable donations are not motivated by claiming tax deductions in Singapore, and hence their giving may continue in any event, with or without the PTIS. The PTIS would just be a silver lining if they should find it worthwhile to apply for it.

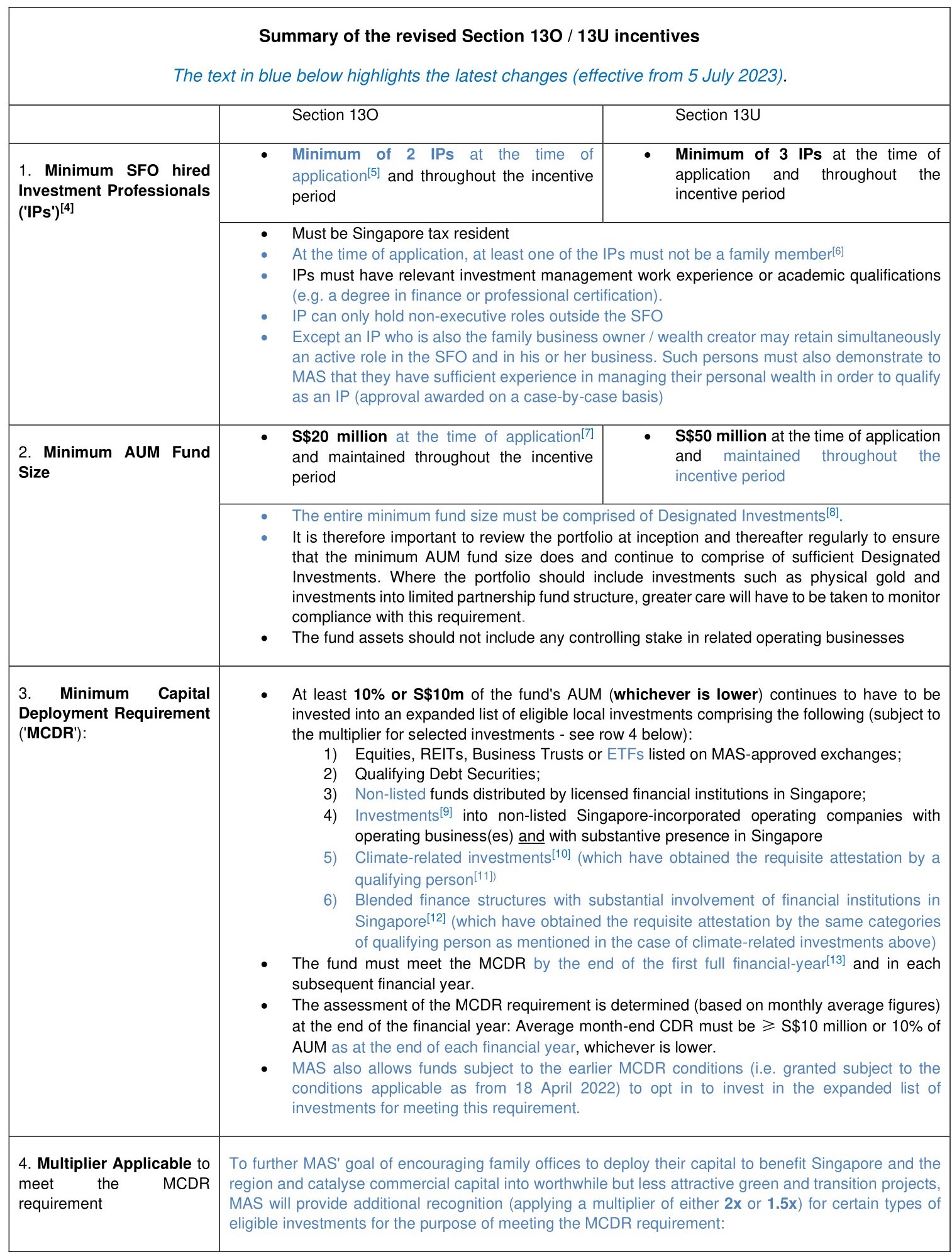

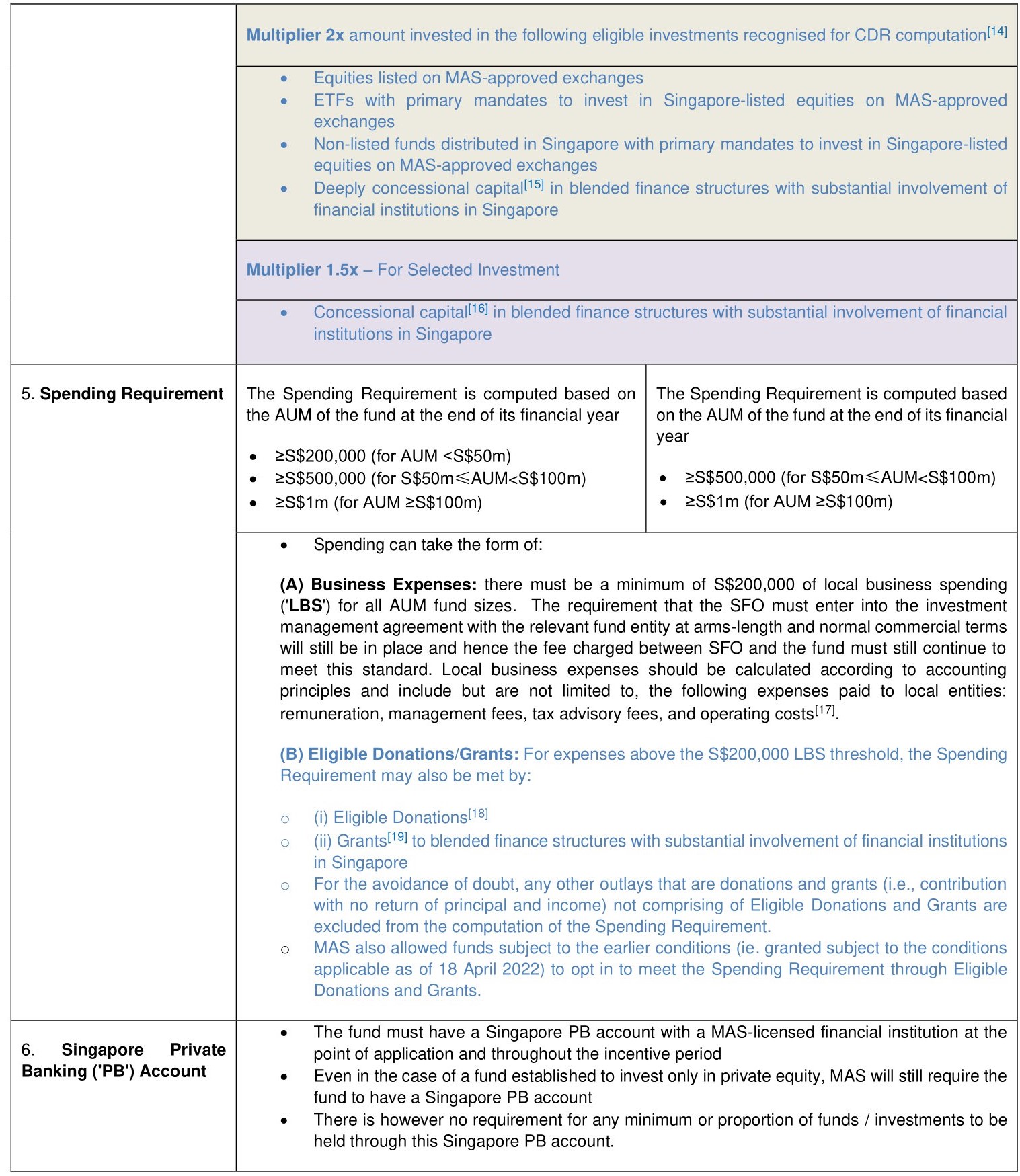

B. Changes to Section 13O / 13U fund tax exemptions supported by SFOs

MAS last tightened the Section 13O / 13U incentive criteria for funds managed by SFOs with effect from 18 April 2022 and the present round of amendments in part seeks to finetune and tighten some of the incentive criteria introduced in the earlier round (including removing the grace period offered to meet the enhanced criteria).

As with the previous round of tax changes, the latest changes only apply to funds managed by SFOs and not by multi-family offices (‘MFOs‘) or licensed fund managers and they only apply to new applications and will not affect (i) grants already approved or awarded by the MAS or (ii) where the application is still pending but the preliminary application was submitted to MAS prior to 5 July 2023.

However, for applications that have already been made to MAS prior to the change in the regime, should there be no communication with MAS for more than 12 months, then MAS may require the application to be restarted under the new criteria. And for any fund that has become dormant (ie has ceased to carry on business and has no income for any basis period), MAS also reserves the right to terminate the tax exempt status for such dormant fund.

A few observations in connection with the latest tax changes:

- SFOs need to put in place suitable monitoring processes / mechanism: For the new SFOs that will be subject to these revised conditions, they will need to ensure that it has in place proper procedure to monitor and ensure the compliance with the various requirements.

- AUM Falling below Minimum Fund Size:

- Singapore Licensed Fund Managers / Private Banks / Multi-Family Office as the family’s fund manager (‘FMC’) in lieu of setting up own SFO?

- Meeting the Spending Requirements through Eligible Donations & Grants: A key objective of the amendments is to encourage more economic spinoffs arising from the SFOs’ investments and donations. If donations made by the SFOs are kept in family foundations or charities that will not be required to spend down any specific amount or proportion within a specified period of time, this objective may then not be achieved. It therefore remains to be seen if MAS will further clarify or specify additional conditions to require the donations to be actually applied so that the community can actually benefit from the donations without indefinite or inordinate delay.

- To consider Section 13D instead?

For further information, please contact:

Stacy Choong, Partner, Withersworldwide

stacy.choong@withersworldwide.com