In the spirit of creating fairness, legal certainty and simplicity in the issuance of Tax Assessment Notice (SKP) resulting from tax audit and Notice of Tax Collection (STP) resulting from tax audit and/or other observation by tax authority, the Minister of Finance (MoF) issued new regulations concerning guidelines on the issuance of SKP and STP, i.e., Minister of Finance Regulation No. 80 of 2023 (PMK 80).

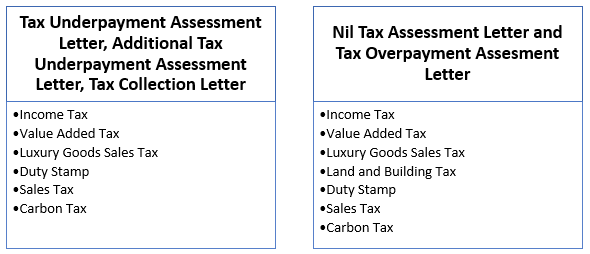

The types of SKP and STP that are regulated in PMK 80 are:

PMK 80 in general regulates the guidelines for:

- Procedures for the issuance of the SKP and STP

SKP

The SKP would be issued after the tax official has completed the audit process on the taxpayers.

STP

The STP would be issued based on (i) the result of tax administration data research, (ii) the audit results, or (iii) the result of re-audit.

- Deadline for the issuance of the SKP and STP

The SKP and STP in general would be issued five years at the latest after the period where the tax is payable or the end of a tax period, part of the tax year, or tax year. However, there are some exceptions for STPs that are issued for administrative sanctions in the form of interests or fines.

- Procedures for the delivery of the SKP and STP

The SKP and STP would be issued by the Directorate General of Taxation or the relevant tax authorities. The SKP and STP would be delivered in person, through mail, expedition or courier services, or electronically. What’s new under PMK 80 is that PMK 80 introduces the issuance of SKP and STP via electronic means. This introduction aligns with the rapid development in the use of technology. However, this method of delivery would only be applicable once the system is ready.

This PMK 80, which has been effective as 24 August 2023, revokes the following regulations:

- MoF Regulation No. 145/PMK.03/2012 as lastly amended by MoF Regulation No. 183/PMK.03/2015,

- MoF Regulation No. 255/PMK.03/2014,

- Certain articles of MoF Regulation No. 256/PMK.03/2014, and

- MoF Regulation No. 78/PMK.03/2016.

For Further Information, Please Contact:

MetaLAW, Legal Consultant, Jakarta, Indonesia

general@metalaw.id