Introduction

In June 2023, Prime Minister of Malaysia, Dato’ Seri Anwar Ibrahim announced plans to attract a broader investor base for small and medium enterprises (“SMEs”) and the new economy. Pursuant to this, the Ministry of Finance (“MoF”) and Securities Commission (“SC”) will explore policies to encourage the establishment of family offices in Malaysia.[1] With interests sparked surrounding the topic of family office, this article aims to explore the concept of family offices, examining its implementation in terms of legal structure and potential tax incentives.

Family office is said to originate from Europe which subsequently became formalised in the United States of America by entities like the House of Morgan and the Rockefeller Global Family Office. Primarily driven by wealth management, the rise of the wealthy has prominently contributed to the recent surge in the establishment of family offices.[2] A family office is tailored for Ultra-High-Net-Worth individuals (“UHNWI”) and families, acting as a central hub for managing collective family wealth.

It provides a range of services such as investment oversight, financial management, tax services, philanthropy and professional advisory engagement. Particularly beneficial for sizable fortunes, it accommodates generational differences in responsibilities, ensuring the sustained growth of family wealth. In the context of family-owned businesses, the family office operates independently to manage profits, contributing significantly to family governance and the future development of the business.[3]

Structure and Legal Entity

Prior to setting up, it is pertinent to define the objectives and the structure of the family office. Family offices can be a single-family office (“SFO”) or multiple-family office (“MFO”) whereby the former serves a single affluent family, and the latter provides services to multiple affluent families. Several factors need to be considered in determining the suitable type such as the size of the family’s accumulated wealth, the intricacy of the family’s financial affairs, the number of members of the family in charge in decision-making and the needs and goals of the family.[4]

When establishing a family office, selecting the right legal entity is crucial, going beyond the choice of structure. The suitable entity depends on the jurisdiction and its governing laws, necessitating consideration of legal, tax, regulatory and jurisdiction-specific insights. As Malaysia is relatively a newcomer in this area, this article delves briefly into the concept and relevant laws concerning family office setup in other Asian jurisdictions apart from Malaysia, namely Singapore and Hong Kong.

• Family Office in Singapore

In terms of setting up a family office, private limited companies and trust stand as two of the most effective and favoured entities in Singapore.[5] The growth of SFO in particular, is rapidly expanding in Singapore.[6] Among the opted structure in Singapore with regards to SFO is by incorporating a holding company (which can be either a private limited company or a trust) that owns and oversees two entities which are 1) the investment fund as it holds the family’s assets and 2) the family office (which can also be a private limited company) that functions as the fund manager.

The investment fund in the above structure can be in the form of variable capital company (“VCC”). VCC was an innovative corporate structure introduced back in 2020 by Monetary Authority of Singapore (“MAS”) and the Accounting and Corporate Regulatory Authority of Singapore which is designed for investment funds and schemes.

Accordingly, the VCC serves as either an independent fund with a single investment portfolio or as an umbrella entity hosting multiple sub-funds, enabling the separation of portfolios and liabilities.

The consolidation of multiple funds within a single VCC may enhance cost-effectiveness.

A diagram illustrating the abovementioned SFO structure is as Diagram 1.[7]

MFO is subject to licensing and regulations under Singapore’s Securities and Futures Act 2001 (“SFA”) thereby requiring MFO to apply for Capital Market Services license from MAS. Conversely, SFO which manages the wealth of a specific family, is structured to be exempt from securities law regulations, granting the SFO the benefit of being free from licensing or regulations under the SFA. Alternatively, SFO can apply for exemption from licensing through MAS.

Family offices in Singapore may also benefit from tax incentive schemes on specific incomes derived from designated investments related to family funds. The fund within a family office based in Singapore has the option to seek tax incentive pursuant to a number of provisions set out in Singapore’s Income Tax Act 1947, as summarised below:

(1) Section 13D – Offshore Fund Exemption Scheme:

Singapore-based fund managers overseeing offshore funds can gain tax exemption by meeting ‘prescribed person’ criteria, without having a minimum for the number of assets or employees and there is also no requirement for MAS approval.[8]

(2) Section 13O – Onshore Fund Incentive Scheme:

Encouraging Singapore fund establishment, this scheme requires a consistent S$20 million fund size, Singapore incorporation, tax residency, and local business control.[9]

(3) Section 13U – Enhanced Tier Tax Incentive Scheme:

Applicable to both offshore and onshore funds, this scheme grants tax exemption on specified investments, with no restrictions on Singaporean investors and minimal jurisdiction constraints, requiring a minimum S$50 million fund size.[10]

Regardless of stringent qualification criteria for tax incentives, Singapore continues to stand out as one of the leading hubs for family offices. Affluent families are drawn to the prospect of nurturing and reaping the rewards of their investments within the sophisticated landscape of Singapore-based family offices.

• Family Office in Hong Kong

Hong Kong is one of the competitors in becoming the leading hub in family office industry. The Hong Kong Government aims to attract a minimum of 200 global top family offices to establish themselves in the city by 2025 and they also allocated HK$100 million to support family offices in Hong Kong.[11]

In Hong Kong, MFO typically serves multiple families and is often set up as a commercial venture, it would likely need to be incorporated as a legal entity, such as a limited liability company, and obtain a license under the Securities and Futures Ordinance of Hong Kong (“Ordinance”) before providing its services. A family office is obligated to obtain a license under the Ordinance if 3 conditions are met, 1) the services provided involve regulated activities 2) the family office operates as a business, and 3) the business is conducted within Hong Kong.[12]

As for SFO, Hong Kong appears to be emphasizing the attraction of UHNWI to establish SFOs. Similar to Singapore, which intensifies its booming family office industry with various tax incentives, Hong Kong follows suit by recently passing a bill in May 2023 on a cessionary tax regime for SFOs.

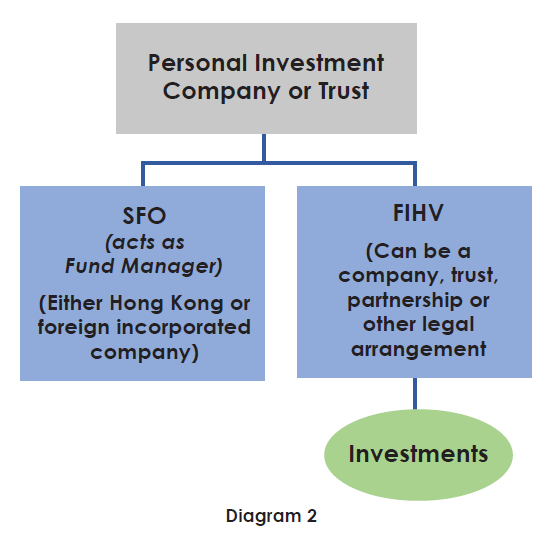

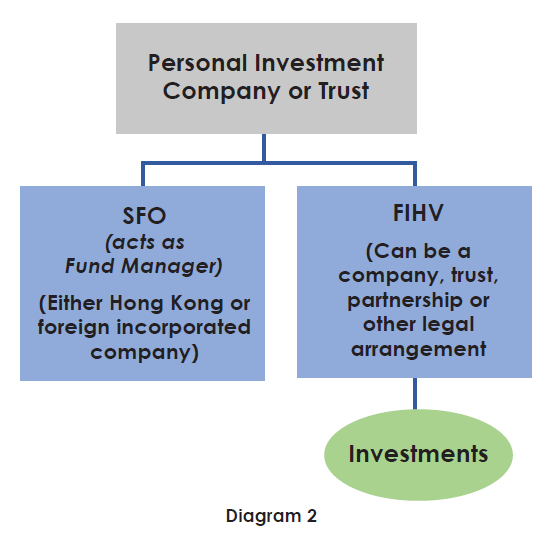

Under this regime, investment profits will be exempt from profits tax if certain conditions are met. One of the legal structures eligible for the tax concession is a family having a SFO and a Family-owned Investment Holding Vehicle (“FIHV”), constituting at least two types of vehicles.

Typically, families will directly own these 2 entities or hold them through a trust or a personal investment company. For SFO to be eligible under this new tax regime, the family assets managed must exceed HK$240 million, with at least 95% family ownership or 75% if held by tax-exempt charities, the SFO must be managed in Hong Kong, and a minimum of 75% of its profits should derive from serving the FIHV and its special purpose vehicles, including fees for its services.[13]

A diagram illustrating the SFO structure eligible for the tax exemption is as Diagram 2.[14]

It is evident from the measures implemented, both Hong Kong and Singapore have been competing to position themselves as key players in the family office industry.

• Family Office in Malaysia

While there are investment firms and wealth management companies (typically in the form of private limited companies)[15] in Malaysia that offer family office services, the industry is not as established or prominent in Malaysia as it is in Singapore and Hong Kong. It can be said that Malaysia is just starting to make its stride in this industry. The current Malaysian Government has expressed its intention to actively engage in efforts to facilitate and develop the market for family office domestically, aiming to align itself with its neighbouring country, Singapore.[16]

As of now, Malaysia lacks a dedicated regulatory framework or tax incentives for family offices. Consequently, those interested in establishing a family office may need to work with and rely on existing laws.

Nevertheless, the option of emulating structures from practices in other countries is viable, provided that it aligns with the legal framework of Malaysian laws.

Among the possible legal entities that may be considered to establish a family office in Malaysia relying on the existing laws, are as follows:

(1) Private Limited Company (Sdn Bhd)

As seen in Singapore and Hong Kong, family office can be incorporated via a private limited company in Malaysia. Such incorporation will be regulated under Companies Act 2016 and the company must be registered with Companies Commission of Malaysia (“CCM”). The company will be owned by the family members or a designated family holding company as shareholders with limited liability thereby protecting their personal assets.[17] The director(s) of the company can also be the family members or appointed individuals which may be professionals or experts in relation with private wealth management.

(2) Trust Company

Family office can also be operated in Malaysia in the form of a trust company, which involves incorporating a public company and application must be made to the Registrar of Companies to be registered as a trust company.[18] Trust companies in Malaysia are governed by Trust Companies Act (“TCA”) 1949 which sets out the requirements of registration, objects of trust companies as well as its operations. The objects of trust companies outlined in the TCA 1949, such as to accept and execute offices of trustee, to manage the properties on behalf of the owners and to act as investing and financial agent, establish the trust company as another ideal entity to function as a family office.[19] For tax-related matters, a trust company is treated as an independent entity, and its income is assessed separately from the personal income tax imposed on the trust beneficiaries. Regardless of whether a trust is classified as a non-resident trust, the standard corporate income tax rate in Malaysia stands at 24%. In the case of non-resident trusts, withholding tax is imposed on the trust’s earnings.[20]

(3) Labuan Entities

In the context of Labuan, an offshore jurisdiction promoted by Labuan International Business and Financial Centre (IBFC), there are various legal entities that can be established for setting up family offices. These entities are designed to provide services related to wealth management, asset protection, and succession planning specifically catering to UHNWI.[21] The entities are as follows:

(a) Labuan Trusts;

Labuan trusts can be set up for the purpose of establishing a family office and it does not need to be registered with Labuan Financial Service Authority (“Labuan FSA”) provided that the Labuan trust company must be used as one of the trustees. Labuan trusts are governed by Labuan Trusts Act 1996. They are open to both residents and non-residents. Non-residents can include Malaysian property in the trust, while Malaysian residents can place international assets. Approval from the regulator, Labuan FSA, is required for Malaysian residents seeking to include local property in the trust. In tax matters, a 3% tax is imposed on audited net profits and there is also a tax exemption on distributions made by Labuan trusts to the beneficiaries. This feature will be particularly appealing for a family office setup.[22]

(b) Labuan Foundations; and

Labuan foundation can be used as a family office as, it is a separate legal entity which can hold assets in its own name for the benefit of the beneficiaries or a particular purpose (akin to a company). Unlike traditional structures, Labuan foundations operate without shareholders and are managed by one or more officers. The foundation functions in accordance with its constituent documents, including the charter and articles, and is commonly utilized for private wealth management since it is allowed for Labuan foundation to be registered for non-charitable purposes. Labuan foundations fall under the regulation of the Labuan Foundations Act, whereas Labuan Islamic foundations are subject to governance under Part IX of the Labuan Islamic Financial Services and Securities Act 2010. Labuan foundation’s investment income from non-trading activities, such as dividends and interest, is exempt from tax under the Labuan Business Activity Tax Act 1990 (“LBATA”) provided that the specified substantial activity requirements are met.[23]

(c) Labuan Protected Cell Company (“Labuan PCC”)

Labuan PCC is a limited liability company with a legal entity that has the ability to form “cells”, each operating autonomously with separate assets and liabilities. Each cell is isolated and safeguarded from the debts and liabilities of other cells. Establishing a Labuan PCC could be a strategic investment solution for a family office managing the family’s assets. Labuan PCC has the flexibility to hold diverse assets or investments categorized into different classes, addressing various objectives such as multi-currency investments or different risk profiles. This structure allows cost efficiency, requiring only one board of directors and eliminating the need for multiple legal setups. Additionally, the family’s investments can be efficiently managed under a common fund manager.[24] Labuan Companies Act 1990 deals with its establishment, structure and operations of a Labuan PCC whereas its business activities are governed under the Labuan Financial Services and Securities Act 2010 and Labuan Islamic Financial Services and Securities Act 2010, for Shariah-compliant Labuan PCC.[25] Labuan PCC is subject to a tax rate of 3% applied to the audited net profits. The taxation is done on a consolidated basis, which means that the income generated by the cells within the PCC is combined and assessed collectively under the name of the Labuan PCC.[26]

In light of the above, there are several structures to be considered in setting up a family office in Malaysia. Now that the Malaysian Government has been vocal on pushing towards the development of family offices, it is imperative to proactively pursue its ambition to establish a prominent presence in the family office landscape. It must first address the concerns on the factors hindering the development of the industry such as its intricate regulatory framework, shortage of experienced professionals in this specialized industry, smaller market size compared to other family office hubs and currency risks due to the fact that changes in exchange rates can influence the value of investments and wealth held in different currencies.[27] The authorities need to devise a comprehensive and harmonious solution to address these challenges. Implementation of competitive tax incentives that can rival those of Hong Kong and Singapore should also be considered in the effort to position Malaysia as another premier hub for family offices in Asia.

For further information, please contact:

Dato’ Azmi Mohd Ali, Partner, Azmi & Associates

azmi@azmilaw.com

- Securities Commission Malaysia. (19 June 2023). Teks Ucapan YAB Dato’ Seri Anwar Bin Ibrahim, Perdana Menteri Malaysia, Sempena Majlis Pelancaran Rasmi Program Graduan Pasaran Modal. Securities Commission Malaysia. https://www.sc.com.my/bm/sumber/ucapan/teks-ucapan-yab-dato-seri-anwar-bin-ibrahimperdana-menteri-malaysia-sempena-majlis-pelancaran-rasmiprogram-graduan-pasaran-modal.

- Botha, Francois. (17 December 2018). The Rise of The Family Office: Where Do They Go Beyond 2019? Forbes. https://www.forbes.com/sites/francoisbotha/2018/12/17/the-rise-of-the-family-office-where-do-they-go-beyond-2019/?sh=7ae919af5795.

- MacFarlane’s. (2015). An Introduction to Family Offices. Accessed on 9 November 2023 from https://www.macfarlanes.com/media/1655/an-introduction-to-family-offices-pdb-oc-may-15.pdf.

- Oakwood & Drehem Capital Pte. Ltd. (13 June 2023). How to Set Up a Family Office in Singapore. LinkedIn. https://www.linkedin.com/pulse/how-set-up-family-office-singapore-oakwooddrehem-capital.

- Ayman Falak Medina. (11 October 2023). Singapore Family Office Setup: Structural Model and Entity Formation. ASEAN Briefing. https://www.aseanbriefing.com/news/singapore-family-officesetup-structural-model-and-entity-formation/.

- KPMG. (n.d.). Establishing a Family Office in Singapore https://assets.kpmg.com/content/dam/kpmg/sg/pdf/2021/11/Establishing-afamily-office-in-Singapore-Structure-considerations-and-taxincentive-schemes.pdf.

- Ayman Falak Medina. (11 October 2023). Singapore Family Office Setup: Structural Model and Entity Formation. ASEAN Briefing. https://www.aseanbriefing.com/news/singapore-family-officesetup-structural-model-and-entity-formation/.

- Ayman Falak Medina. (19 September 2023). Tax Incentive Requirements for Family Offices in Singapore. ASEAN Briefing. https://www.aseanbriefing.com/news/tax-incentive-requirements-forfamily-offices-in-singapore/#:~:text=Encouraging%20SFOs%20to%20conduct%20philanthropic,family%20office%20as%20a%20base.

- Dentons Rodyk. (17 July 2023). Updated Conditions for Single Family Offices Applying for the 13O and 13U Tax Incentives (with effect from July 5, 2023). https://dentons.rodyk.com/en/insights/alerts/2023/july/17/updated-conditions-for-single-family-officesapplying-for-the-13o-and-13u-tax-incentives#footnote2-ref.

- Ayman Falak Medina. (19 September 2023). Tax Incentive Requirements for Family Offices in Singapore. ASEAN Briefing.https://www.aseanbriefing.com/news/tax-incentive-requirements-forfamily-offices-insingapore/#:~:text=Encouraging%20SFOs%20to%20conduct%20philanthropic,family%20office%20as%20a%20base.

- Yiu Pak and Wong Echo. (17 October 2023). Hong Kong’s Family Office Push Falls Flat with Global Billionaires. Nikkei Asia. https://asia.nikkei.com/Business/Finance/Hong-Kong-s-family-office-push-falls-flat-with-global-billionaires.

- Securities and Futures Commission. (2023). Family Offices Quick Reference Guide to Licensing Requirements. Securities and Futures Commission of Hong Kong. https://www.sfc.hk/-media/EN/files/LIC/guide/pdf/SFC-Leaflet-2023-Family-Offices.pdf?rev=d03d3729dea447c1907b3acffe33e594.

- KPMG. (May 2023) Private Enterprise Series Hong Kong Family Office Tax Regime Bill Passed. Assets KPMG. https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2023/05/family-office-series-issue-1.pdf.

- Ibid.

- Cheng & Co Group. (n.d.). Family Office. Cheng & Co Group. https://chengco.com.my/wp/wealth-management/family-office/

- Singh, Habhajan. (10 July 2023) Malaysia’s Family Office Pipe Dream. The Malaysian Reserve. https://themalaysianreserve.com/2023/07/10/malaysias-family-office-pipe-dream/.

- Section 20 of Companies Act 2016.

- Section 3 of Trust Companies Act 1949.

- Section 8 of Trust Companies Act 1949.

- Relin Consultants. (21 September 2023). Setting Up A Malaysia Trust – Requirements, Process & Benefits. Relin Consultants. https://relinconsultants.com/setting-up-a-malaysia-trust/.

- Labuan IBFC Incorporated Sdn Bhd. (March 2023). Why Labuan IBFC for Wealth Management, Asset Protection and Succession Planning? Labuan IBFC. https://www.labuanibfc.com/clients/asset_52E835CC-1342-4701-B6FA-E2CD03AD74B4/contentms/img/publications/brochures/NEW-2023_WM.pdf.

- Labuan FSA. (n.d.). Labuan Trusts. Wealth Management FAQ. https://www.labuanfsa.gov.my/areas-of-business/financialservices/wealth-management/labuan-trusts/faq.

- Labuan FSA. (n.d.). Labuan Foundations. Wealth Management FAQ. https://www.labuanfsa.gov.my/areas-of-business/financialservices/wealth-management/labuan-foundations/faq.

- Labuan IBFC Incorporated Sdn Bhd. (March 2023). Why Labuan IBFC for Wealth Management, Asset Protection and Succession Planning? Labuan IBFC. https://www.labuanibfc.com/clients/asset_52E835CC-1342-4701-B6FA-E2CD03AD74B4/contentms/img/publications/brochures/NEW-2023_WM.pdf.

- Brighton International Group. (11 December 2017). Explore Asia’s Only Protected Cell Companies. Brighton International Group. https://www.brighton.asia/news/explore-asias-only-protectedcell-companies/.

- Labuan FSA. (n.d.). Insurance. Financial Services FAQ. https://www.labuanfsa.gov.my/areas-of-business/financial-services/insurance/faq.

- Sheila, M Jay. (27 June 2023). Malaysia’s Push for Family Offices. The Malaysian Reserve. https://themalaysianreserve.com/2023/06/27/malaysias-push-for-family-offices/