Capital Gains Tax (“CGT“) has been introduced in Malaysia through the Budget 2024, marking a significant shift in the country’s tax landscape. On 29 December 2023, the Finance (No.2) Act 2023 (Finance Act) (“Act”) was gazette into law. Under the Act, effective from 1 January 2024, CGT is designed to levy taxes on profits derived from the sale of various capital assets, including stocks, bonds, real estate, and other investments[1].

The Government has also gazetted the Income Tax (Exemption) (No.7) Order 2023 (“Exemption Order“), where exemption from CGT is provided with the condition that the disposal of shares are exercised between 1 January 2024 to 29 February 2024[2]. This article analyses the key provisions outlined in the Act, and its implications for individuals and entities.

Scope of CGT:

Capital gains under CGT are deemed as income and taxed under the Income Tax Act 1967, through amendments under the Act 2023, underlining the integration of CGT within the broader tax framework. The scope of CGT is wide and encompasses both local and foreign capital assets.

CGT applies to disposal of:

(a) Shares of an unlisted Malaysian company; and

(b) Subject to conditions, shares of a controlled company incorporated outside Malaysia with real property interests in Malaysia or shares of another controlled company or both[3].

Additionally, for foreign incorporated companies, CGT applies when the value of Malaysian real property or shares in another controlled company comprises at least 75% of its total tangible assets[4].

Definition of Shares:

The definition of “shares” under CGT is broad, which includes stocks, loan stocks, debentures, and interests in non-share limited companies. It also includes options or other rights related to shares[5].

Applicability to Entities:

Entities such as companies, limited liability partnerships, trust bodies, and cooperative societies (“Entities“) fall under the purview of CGT[6]. However, individuals are excluded, and their disposals are governed by the Real Property Gains Tax Act 1976 for real property or shares in real property companies.

Certain exemptions are granted under CGT, including gains from approved initial public offerings (IPO), intergroup restricting, and venture capital companies. Unit trust is also exempted under the Section 61 (1) (b) of the Act, where it was stated that the gains from unit trust shall be treated as income of the trust body of the trust[7].

Filing and Payment:

CGT returns are required to be filed electronically, with payments due within 60 days of the asset disposal, and tax must be paid within 60 days from the date of disposal[8].

The definition of “disposal” means to sell, convey, transfer, assign, settle or alienate whether by agreement or by force of law and includes a reduction of share capital and purchase by a company of its own share[9].

The disposal date is determined by the agreement or completion date, with specific provisions for government approval. Disposal date means:

(a) date of agreement where there is a written agreement, or

(b) date of completion of disposal in situations where there is no written agreement[10].

The date of completion of a disposal in (b) means:

(i) the date on which the ownership of the capital asset disposed of is transferred by the person who disposes the capital asset; or

(ii) the date on which the whole of the amount or value of the consideration (in money or monies worth) for the transfer has been received by the person who disposes the capital asset[11].

The acquisition date is considered to be the same as the date when the seller officially transfers the assets to the buyer. In cases where government approval is needed for the transaction, the acquisition date will be the date when the government grants approval is needed for the transaction, the acquisition date will be the date when the government grants approval. If the approval comes with specific conditions, the acquisition date will be the day when all those conditions are met[12].

Tax Rates

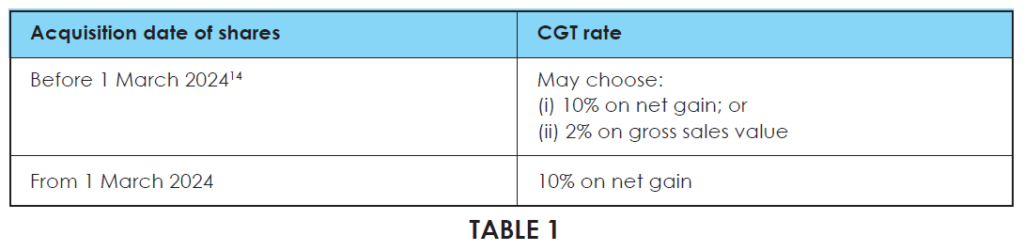

The tax rates under CGT vary based on the acquisition date of shares. Under the Exemption Act, the CGT rate based on the date of acquisition of shares are as shown on Table 1.[13]

For disposals of capital assets other than those referred to in the table above, the prevailing income tax rate applies to the Entities [15].

Capital Losses

In the event of capital losses, taxpayers can offset these losses against gains from the disposal of other capital assets. The ability to carry forward capital losses for up to 10 years provides a measure of flexibility in managing tax liabilities [16].

Deductions and adjustments

Entities subject to CGT can claim deductions in determining gains from the disposal of a capital asset. The adjusted income takes into account various factors, including expenditures to enhance or preserve the value of the asset and the consideration for its acquisition.

The gains or profits from selling a capital asset are determined separately for each disposal[17], and each disposal is treated as a separate source of gains or profits from the disposal of capital asset for that year of assessment[18].

The adjusted income from gains or profits related to the disposal of a capital asset is determined by[19]:

(a) Deducting from the amount or value of the consideration for the disposal of the capital asset at the time of disposal:

- Any expenditure wholly and exclusively incurred on the capital asset at any time after its acquisition by or on behalf of the Entities to enhance or preserve the value of the capital asset;

- Any expenditure wholly and exclusively incurred at any time after the acquisition of the capital asset by the Entities to establish, preserve or defend its title to, or to a right over, the capital asset; and

- The incidental costs to the Entities.

(b) Further deducting from the above result:

- Any sum received by the Entities as compensation for any damage or injury to the asset or for destruction or dissipation of the asset or for any depreciation or risk of depreciation of the asset;

- Any sum received by the specified entity under a policy of insurance for any kind of damage or injury to or the loss, destruction or depreciation of the asset; and

- Any sum forfeited to the specified entity as a deposit made in connection with an intended transfer of the capital asset.

Conclusion

The implementation of CGT in Malaysia marks a significant step toward modernizing the country’s tax structure and aligning it with international norms. As of 1 January 2024, Entities engaging in the sale of capital assets, both domestically and abroad, will be subject to the provisions outlined in the Act.

Entities subject to CGT must now adapt their financial strategies and compliance practices to the new tax landscape. As the nation navigates this new era of taxation, stakeholders must remain vigilant, stay informed on updates to the CGT framework, and seek professional advice to ensure compliance and optimize their financial positions.

- Section 4(aa) Income Tax Act 1967, tax is chargeable on income relating to gains or profits from the disposal of a capital asset.

- Section 2(2) Income Tax (Exemption) (No.7) Order 2023.

- Section 8 Finance (No.2) Act 2023, Proposed Section 15(c).

- Section 8 Finance (No.2) Act 2023, Proposed 15(c)(2)(b).

- Section 12 Finance (No.2) Act 2023, Proposed Section 65C.

- Section 12 Finance (No.2) Act 2023, Proposed 65D(1).

- Section 61(1)(b) Income Tax Act 1967, “provided that in the case of a unit trust, gains arising from the realization of investments shall be treated as income of the trust body of the trust under paragraph 4(aa).

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65C.

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65F(1).

- Section 12 Finance (No.2) Bill 2023, Proposed 65F(4).

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65E(3).

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65(E)(3).

- Section 2(2) Income Tax (Exemption) (No.7) 2023.

- Part XX1, Schedule 1 of the Income Tax Act 1967.

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65E(6).

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65E(1)(a).

- Section 12 Finance (No.2) Bill2023, Proposed Section 65E(1)(b).

- Section 12 Finance (No.2) Bill 2023, Proposed Section 65E(2).