Introduction

Corporate governance is the basic guarantee for the healthy and stable development of banking and insurance institutions, and directors and the board of directors are a key link. The new “Company Law” redefines the functions and responsibilities of directors and the board of directors, bringing changes and challenges to the director and board system of banking and insurance institutions.

This article will briefly sort out the impact of the new “Company Law” on directors and board governance of banking and insurance institutions based on the new “Company Law” and in combination with regulatory requirements.

I. Types of directors and selection procedures

1. Types of Directors

The directors of banking and insurance institutions are divided into four categories: executive directors, non-executive directors, independent directors and employee representative directors. There are certain differences between the types and connotations of directors stipulated in the Company Law.

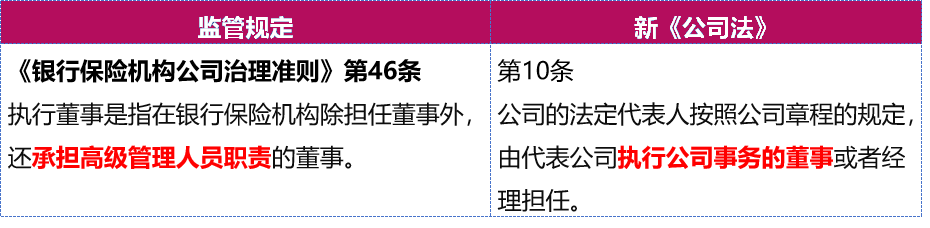

1. Executive Director

Comments

Compared with the original Company Law, the new Company Law has deleted the term “executive director”. The author understands that the scope of “directors who execute company affairs” stipulated in the new Company Law and the scope of executive directors of banking and insurance institutions at the regulatory level are basically the same.

The “Method for Performance Evaluation of Directors and Supervisors of Banking and Insurance Institutions (Trial)” sets forth clear requirements for the performance of directors’ duties. The duties and obligations of executive directors of banking and insurance institutions should cover the overall requirements for directors and the duty requirements for executive directors, including cooperating with the work of the board of supervisors, implementing the reporting system of senior management to the board of directors, and promoting the effective implementation of board resolutions.

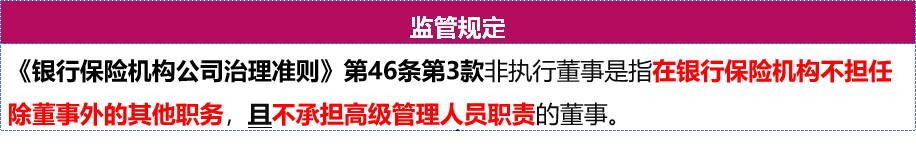

2. Non-executive Director

Comments

The new Company Law does not have the concept of “non-executive directors”. At the regulatory level, the directors of banking and insurance institutions mainly include executive directors and non-executive directors (including independent directors). The author understands that for employee directors, although they do not assume the responsibilities of senior management personnel, as company employees, they do not hold other positions besides directors. It is reasonable to distinguish them from non-executive directors and regard them as a separate category.

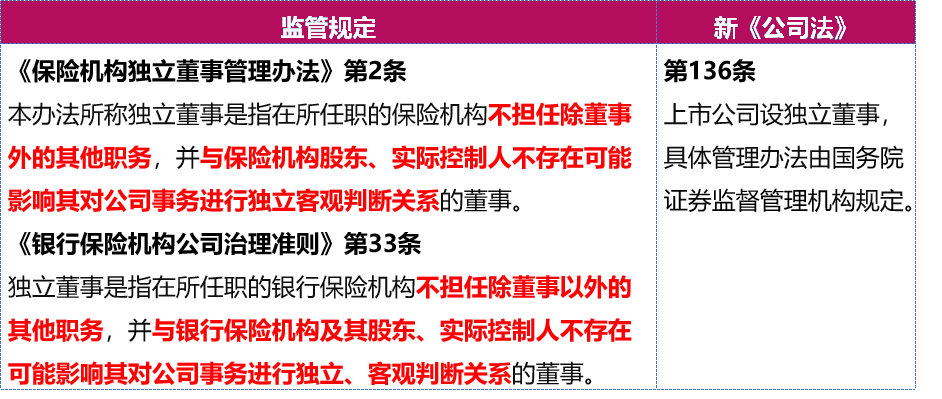

3. Independent Director

Comments

The new Company Law only requires listed companies to have independent directors, but does not require limited liability companies and non-listed joint stock companies to have independent directors.

According to regulatory requirements, banking and insurance institutions should establish an independent director system, and the number of independent directors should not be less than one-third of the total number of board members in principle. At the same time, the requirements for the establishment of independent directors in special circumstances are also stipulated. For example, according to Article 5 of the “Regulations on the Administration of Independent Directors of Insurance Institutions”, if an insurance institution has a controlling shareholder whose capital contribution or shareholding accounts for more than 50% of the registered capital or total share capital of the insurance institution, the proportion of independent directors to the board members must reach more than one-half.

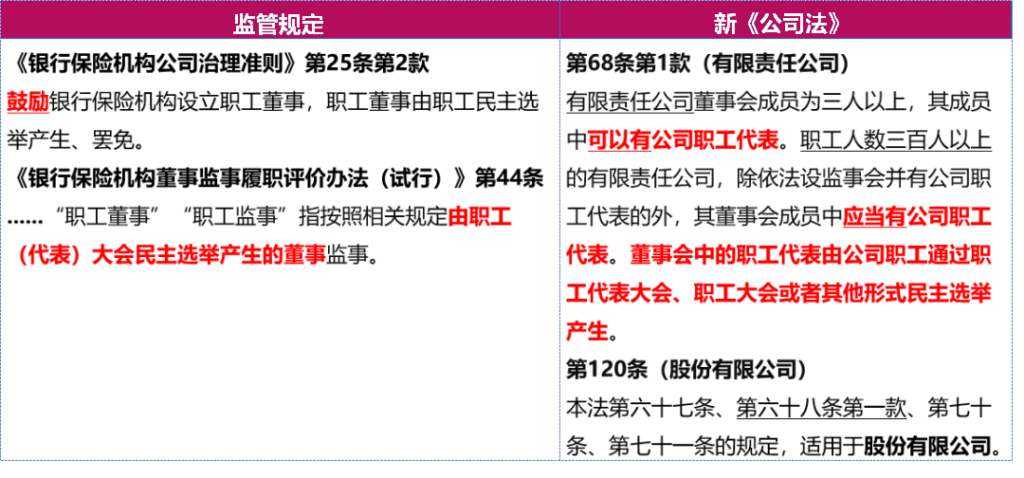

4. Employee Directors

Comments

The original Company Law stipulates that state-owned enterprises must have employee representatives, and limited liability companies and joint stock companies can have employee representative directors. Under the new Company Law, non-state-owned companies are distinguished by whether the number of employees reaches 300. If the number of employees reaches 300 or more, they must have employee representative directors, except for the case of “establishing a supervisory board and having company employee representatives”.

The author understands that, for banking and insurance institutions, although the current regulatory provisions encourage but do not require them to establish employee directors, after the new Company Law comes into effect, it will be necessary to confirm whether it is necessary to establish employee directors in combination with the establishment of the supervisory board.

(II) Procedures for the selection and appointment of directors

According to the new “Company Law”, employee representatives on the board of directors are democratically elected by the company’s employees through employee representative meetings, employee meetings or other forms of democratic elections, and non-employee directors are elected and replaced by the shareholders’ meeting.

Regarding the election of directors of banking and insurance institutions, regulatory provisions distinguish between independent directors, employee representative directors, and non-employee representative directors and put forward more detailed requirements.

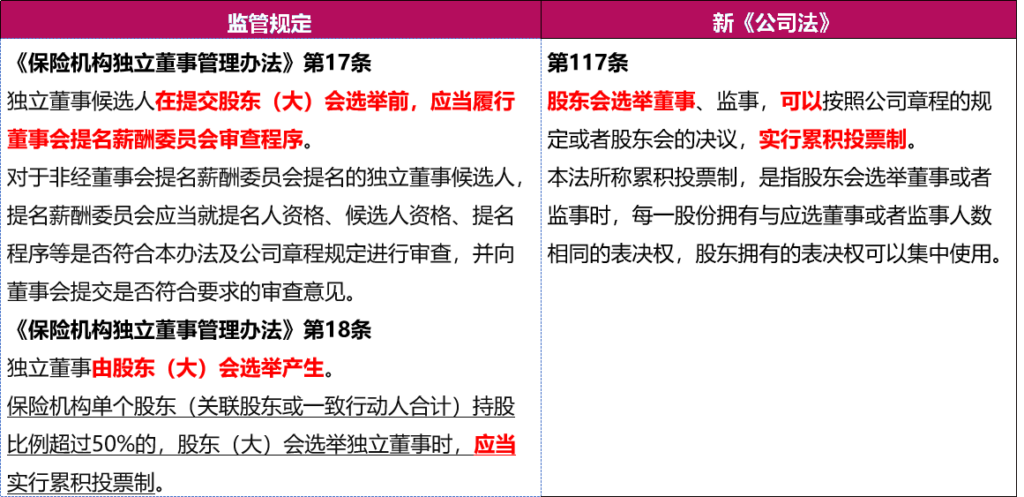

1. Independent Director

Comments

Independent directors are elected by the shareholders’ meeting. Before submitting their shares to the shareholders’ meeting for election, independent directors of insurance institutions shall comply with the review procedures of the remuneration committee (qualification of nominees and candidates, nomination procedures, etc.). If a single shareholder (related shareholders or persons acting in concert) of an insurance institution holds more than 50% of the shares, the shareholders’ (general) meeting shall adopt the cumulative voting system when electing independent directors. As I understand it, the role of the cumulative voting system is mainly to protect the interests of small and medium shareholders and prevent major shareholders from manipulating the board of directors. If a single shareholder of a banking and insurance institution holds more than 50% of the shares, but the number of shareholders is small and there are no small and medium shareholders, whether the cumulative voting system must be implemented is worth discussing.

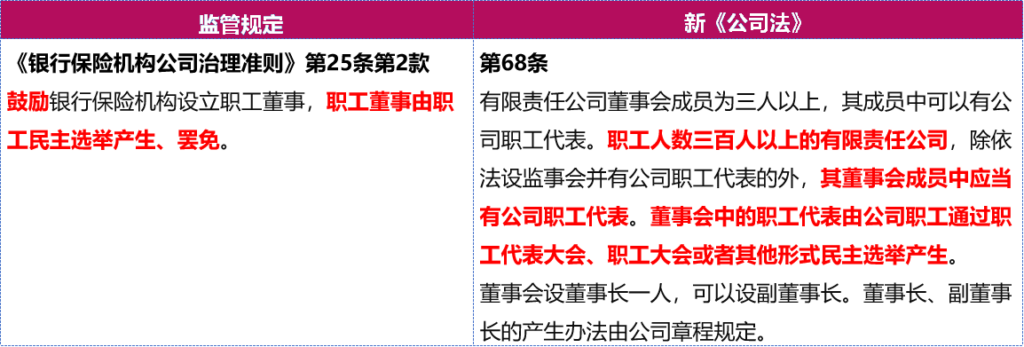

2. Employee Representative Director

Comments

With regard to the election of employee directors, there is no substantial difference between the banking and insurance regulatory provisions and the Company Law. They are elected by employee representative conferences, employee conferences or other democratic means.

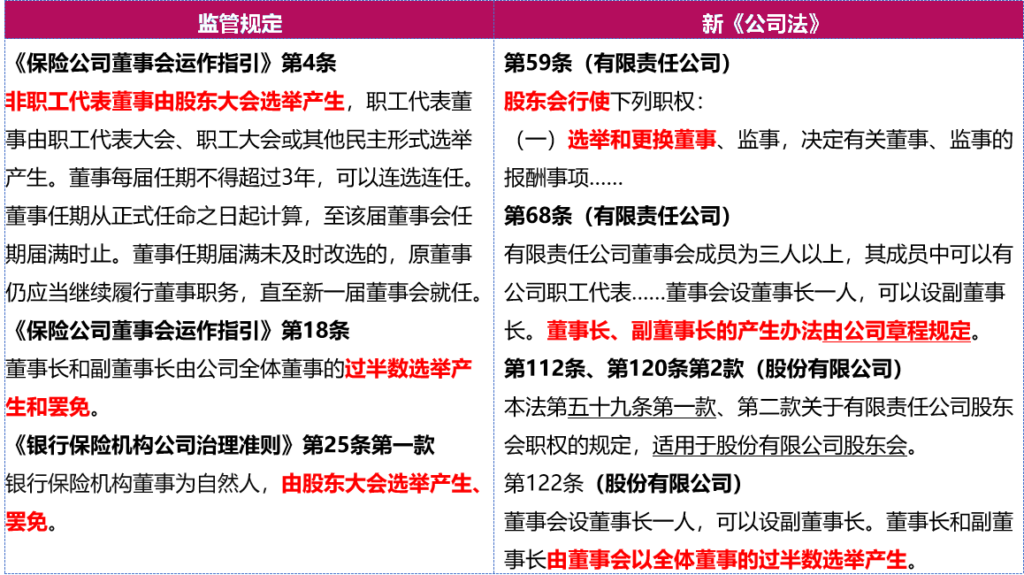

3. Non-employee representative directors

Comments

Non-employee representative directors of banking and insurance institutions are elected and removed by the shareholders’ meeting. As for the election of the chairman and vice-chairman, although under the new “Company Law”, the chairman and vice-chairman of a joint-stock company shall be elected by a majority of all directors, and the method for the election of the chairman and vice-chairman of a limited liability company shall be stipulated in the company’s articles of association, under the insurance supervision regulations, both joint-stock companies and limited liability companies shall be elected and removed by a majority of all directors.

II. Adjustment of current supervision and board operations

The Explanation on the Draft Amendment to the Company Law of the People’s Republic of China proposes to implement the requirements of the Party Central Committee on improving the modern enterprise system with Chinese characteristics, deeply summarize the practical experience of innovation in the company system in my country, and give companies greater autonomy in the establishment of corporate organizations. The revised contents of the new Company Law on the powers of the board of directors fully reflect the legislative purpose of “highlighting the status of the board of directors in corporate governance”.

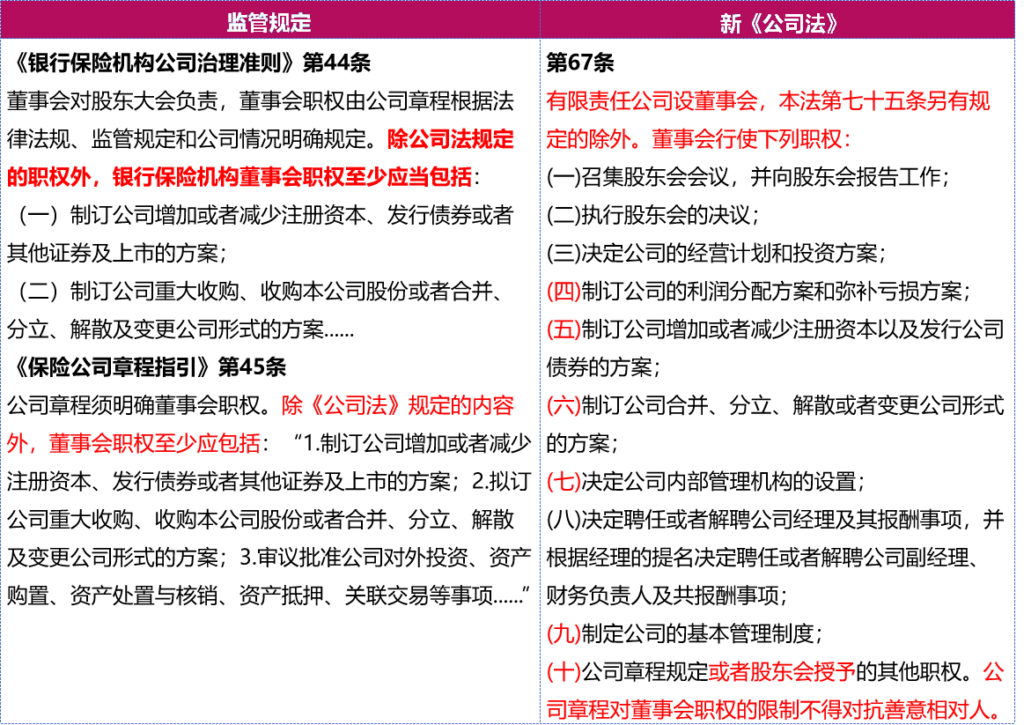

(I) Powers of the Board of Directors

Comments

In the new Company Law, the powers of the board of directors include statutory powers, powers stipulated in the articles of incorporation, and powers granted by the shareholders’ meeting. Compared with the original Company Law, the new Company Law deleted the statement that the board of directors is responsible to the shareholders’ meeting, and strengthened the independent status of the board of directors. At the same time, the new Company Law stipulates that the board of directors’ audit committee can exercise the powers of the board of supervisors, and the power of corporate supervision is transferred to the board of directors, and the supervisory function of the board of directors is strengthened.

According to Article 46 of the “Guidelines for the Articles of Association of Insurance Companies”, the articles of association of insurance companies must state that “the powers of the board of directors shall be exercised collectively by the board of directors. In principle, the statutory powers of the board of directors shall not be granted to the chairman, directors or other individuals and institutions. If authorization is necessary, it shall be carried out in accordance with the law through a resolution of the board of directors. Authorization shall be granted for each matter, and the powers of the board of directors shall not be granted to other institutions or individuals of the company in a general or permanent manner”. The statutory powers of the board of directors shall not be changed or deprived by means of the articles of association, resolutions of shareholders’ meetings, etc.

(II) Operation of the Board of Directors

Comments

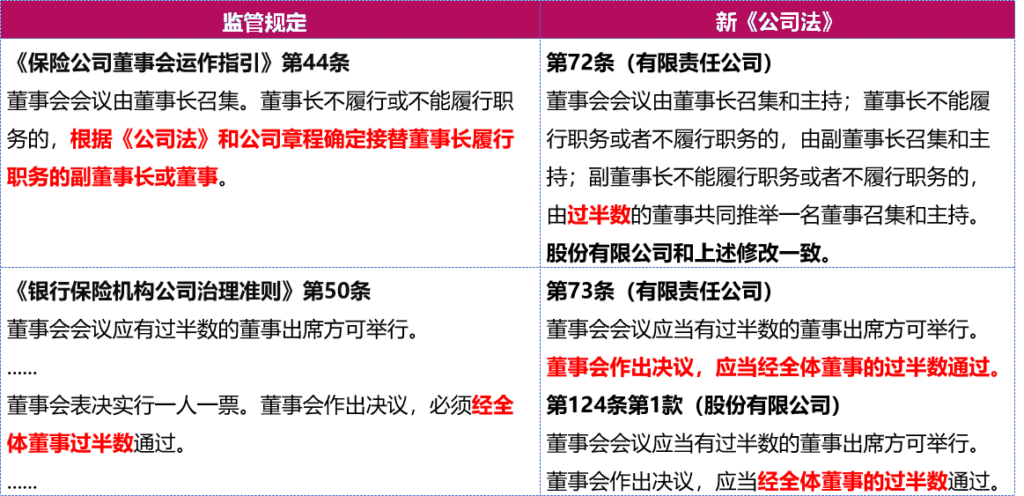

The new Company Law uniformly amends the terms for convening the board of directors of limited liability companies and joint stock companies, adjusting the requirement from “more than half” to “more than half” to avoid a voting deadlock. Banking and insurance institutions need to adjust the relevant provisions of the articles of association and rules of procedure of insurance companies regarding the convening of the board of directors and the board of supervisors in accordance with the requirements of the new Company Law.

With the implementation of the new Company Law, the corporate governance structure of banking and insurance institutions has undergone important changes. As the core of corporate governance, the strengthening of the functions of directors and the board of directors not only strengthens the internal supervision and decision-making mechanism of the company, but also provides a more solid legal basis for the sound operation of banking and insurance institutions.

Banking and insurance institutions need to ensure the effective implementation of the provisions of the new Company Law by revising their articles of association, improving internal governance structures, and strengthening director training.

For further information, please contact:

Liang Bing, Partner, Anjie Broad Law

liangbing@anjielaw.com