Malaysia’s Capital Gains Tax On The Disposal Of Shares.

Introduction

Effective 1 January 2024, gains or profits from the disposal of capital assets are classified as income under Section 4(aa) of the Income Tax Act (“ITA”) 1967. Consequently, such capital gains are subject to capital gains tax (“CGT”) under the ITA 1967.

By default, gains from the disposal of capital assets are considered non-business income. However, if the disposal occurs regularly within the ordinary course of business, these gains will be classified as business income under Section 4(a) of the ITA 1967. Capital assets qualify as business income if they are:[1]

(a) Stock-in-trade for the business, or

(b) Part of an adventure in the nature of trade

Scope of Capital Gains Tax

CGT applies to the disposal of the following:

(a) Shares of a company incorporated in Malaysia not quoted/listed on the stock exchange;[2]

(b) Shares of a foreign-controlled company that substantially owns real property in Malaysia or shares of another controlled company or both; and[3]

(c) All other capital assets situated outside Malaysia.[4]

It is pertinent to note that CGT is applicable only to companies, limited liability partnerships (“LLP”), trust bodies, or co-operative societies.[5] Individuals, i.e., natural persons, are not subjected to CGT.

How Much of Capital Gains Tax Do You Have to Pay?

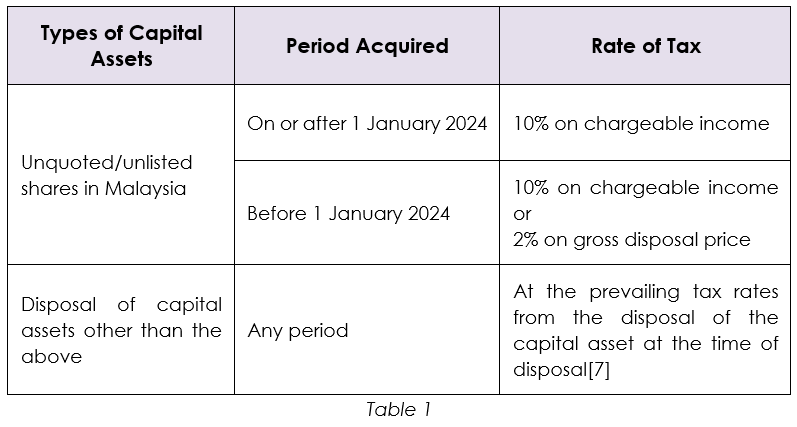

Table 1 illustrations the CGT rates on the chargeable income of a company, LLP, trust body, or co-operative society from the disposal of capital assets:[6]

It is pertinent to note that the disposal price of the capital asset must reflect its market value. The Director General of Inland Revenue (“DGIR”) is empowered to substitute the market value where he is of the opinion that the consideration is not at market value.[8]

Exemptions from Capital Gains Tax

A. Disposal of Foreign Capital Assets

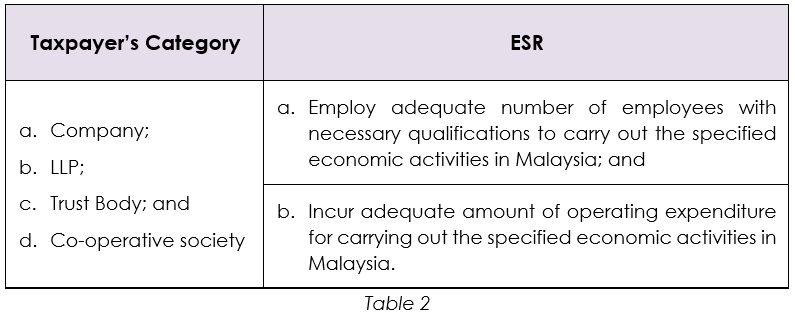

With the Income Tax (Exemption) (No. 3) Order 2024 [P.U.(A) 75/2024] gazetted on 4 March 2024, any gains or profits from the disposal of foreign capital assets received in Malaysia by companies, LLPs, trust bodies, and co-operative societies resident in Malaysia, which comply with the economic substance requirements (“ESR”), are exempted from CGT from 1 January 2024 to 31 December 2026.[9]

The ESR for the CGT exemption includes the following:[10]

Compliance to the ESR is subjective in nature. The Inland Revenue Board Malaysia (“IRB”) will examine and review the funds, management of the funds and its operation to ascertain its compliance.

The Capital Gains Tax Return Form (“CGTRF”) submission guide notes in HASiL’s CGTRF Filing Programme[11] state that the exemption is applicable to disposals of shares in a foreign controlled company with a nexus to Malaysian real property and that taxpayers are not required to submit a CGTRF for the disposal of the relevant capital assets within the exemption period. Interestingly, the Income Tax (Exemption) (No. 3) Order 2024 [P.U.(A) 75/2024] does not specify such exemption.

Additionally, Section 65E(2) of the ITA 1967[12] sets out the method for calculating the adjusted income from the disposal of capital assets. This provision allows for the deduction of specific expenses incurred wholly and exclusively for the acquisition and disposal of such assets. Eligible deductible expenses include legal fees, appraiser fees, advertising costs, and expenses related to enhancing or maintaining the capital value of the assets. By permitting these deductions, the provision ensures that only the net gains or profits from such disposals are subject to taxation, providing a more accurate assessment of taxable income.[13]

Furthermore, gains from the disposal of foreign capital assets received in Malaysia may be subject to tax both locally and in the country where the asset was sold. To prevent double taxation, Sections 132 and 133 of the ITA 1967 allow taxpayers to claim a tax credit. Under Section 132, a bilateral tax credit applies if Malaysia has a Double Taxation Agreement with the foreign country while Section 133 provides a unilateral tax credit if no such agreement exists. These provisions ensure that taxpayers are not taxed twice on the same income, with the credit limited to the Malaysian tax payable on the gains.[14]

B. Exemptions for Unit Trusts

According to the Income Tax (Unit Trust) (Exemption) Order 2024 [P.U.(A) 249] gazetted on 20 September 2024, a qualifying unit trust resident in Malaysia (excluding a Real Estate Investment Trust or Property Trust Fund listed on Bursa Malaysia) is given an income tax exemption in respect of the gains or profits from the disposal of:[15]

(a) Shares of a Malaysian-incorporated company not listed on the stock exchange; and

(b) Shares of a foreign controlled company with a nexus to Malaysian real property.[16]

Despite this exemption, unit trusts must still file a CGT Return Form within 60 days of disposal. It is also pertinent to note that any losses from the disposal of shares above can be used to reduce the adjusted income on a subsequent disposal of capital assets, either in the same year as the loss-making disposal or in the next 10 consecutive years of assessment.

This Order is applicable to the disposal of shares made from 1 January 2024 to 31 December 2028.

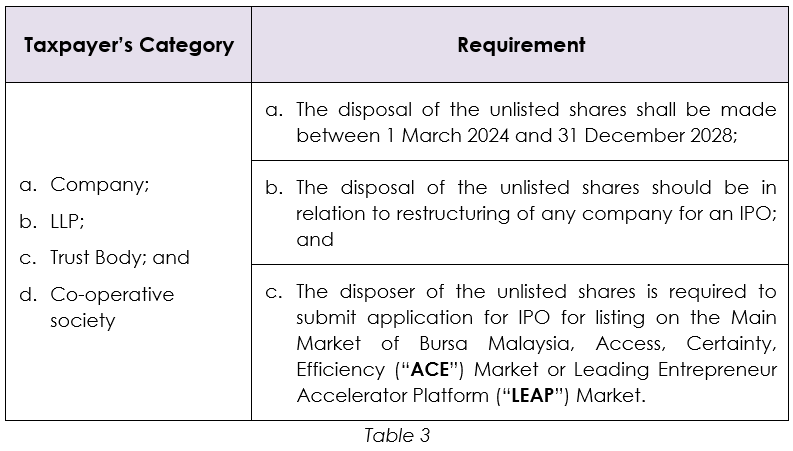

C. Exemptions for Initial Public Offerings (“IPOs”)

The Income Tax (Initial Public Offering) (Exemption) Order 2024 [P.U.(A) 290] gazetted on 8 October 2024 provides that CGT is exempted for shares disposals in connection with IPOs approved by Bursa Malaysia.

The Order is effective from 1 March 2024 to 31 December 2028.

To qualify, the disposal of shares must meet the following conditions:[17]

It shall be noted that the application for the exemption should be submitted to the IRB within one year after the date of the approval for the application of IPO. Hence, similar to the restructuring exemption, the disposer would need to first file CGT returns and pay CGT within 60 days from the date of the disposal, and then apply for an exemption and seek a refund.

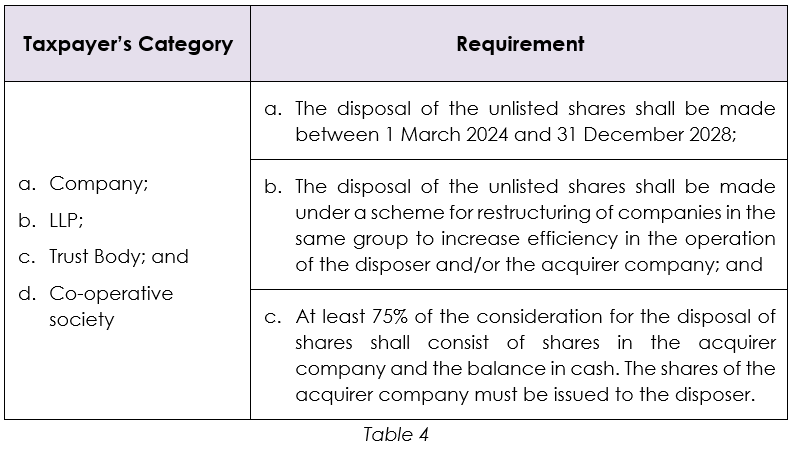

D. Exemptions for Group Restructuring

The Income Tax (Restructuring of Companies Scheme) (Exemption) Order 2024 [P.U.(A) 289] gazetted on 8 October 2024 provides that CGT is exempted for shares disposals in connection with internal group restructuring.

The Order is effective from 1 March 2024 to 31 December 2028.

The relevant Order exempts a company, LLP, trust body or co-operative society from income tax on gains or profits from the disposal of unlisted shares in a Malaysian-incorporated company, to an acquirer company which is tax-resident in Malaysia.

To qualify for the exemption:[18]

It is important to note that the application for the exemption should be submitted to the IRB three years after the date of the disposal of the unlisted shares. Hence, the disposer would need to first file the CGT returns and pay CGT within 60 days from the date of the disposal and then apply for an exemption and seek a refund three years after the disposal. The Order does not state a time limit for the exemption application to be made.

Conclusion

The implementation of CGT in Malaysia marks a shift in how share disposals are taxed. While the standard tax rate is 10%, there are several exemptions in place to ease the tax burden on businesses, including those for corporate restructuring and IPO related share disposals.

For businesses and investors, understanding these exemptions and compliance requirements is crucial. Foreign capital assets remain largely exempt, provided they meet the ESR, while unit trusts also benefit from targeted exemptions but must still fulfil reporting obligations. Additionally, as part of the measures to prevent tax avoidance, the DGIR is responsible for determining that the disposal of the capital asset is equal to its market value in certain circumstances (similar to the power granted to DGIR under the Real Property Gain Tax regime).

With these regulations in place, careful tax planning is essential. Staying informed and seeking professional tax advice can help your business navigate this evolving tax landscape effectively.

For further information, please contact:

Muhammad Inamul Hassan Shah Norman Dunsah, Partner, Azmi & Associates

hassanshah@azmilaw.com

- Section 2 of the Income Tax Act (“ITA”) 1967.

- Section 2 and Section 4(aa) of the ITA 1967.

- Section 15C of the ITA 1967.

- Section 2 of the ITA 1967.

- Q&A No. 9, Seminar Percukaian Kebangsaan 2023, Kompilasi 2.

- Part XXI, Schedule 1 of the ITA 1967.

- Section 65F of the ITA 1967.

- Section 65E(11) of the ITA 1967.

- Order 2 of the Income Tax (Exemption) (No. 3) Order 2024 [P.U.(A) 75/2024].

- Paragraph 8.1 of the Guidelines for the Tax Treatment on Gains from the Disposal of Foreign Capital Assets Received from Outside Malaysia.

- CGTRF Submission Guide Notes: https://www.hasil.gov.my/en/forms/cgt-return-form-filing-programme/.

- Section 65E(2) of the ITA 1967.

- Paragraph 6.4 of the Guidelines for the Tax Treatment on Gains from the Disposal of Foreign Capital Assets Received from Outside Malaysia.

- Paragraph 7.1 of the Guidelines for the Tax Treatment on Gains from the Disposal of Foreign Capital Assets Received from Outside Malaysia.

- Order 2 of the Income Tax (Unit Trust) (Exemption) Order 2024 [P.U.(A) 249].

- Section 15C of the ITA 1967.

- Order 3 of the Income Tax (Initial Public Offering) (Exemption) Order 2024 [P.U.(A) 290].

- Order 2 of the Income Tax (Restructuring of Companies Scheme) (Exemption) Order 2024 [P.U.(A) 289].