11 June, 2015

The Monetary Authority of Singapore (“MAS”) has issued a Policy Consultation on Regulatory Framework for Intermediaries Dealing in OTC Derivative Contracts, ExecutionRelated Advice, and Marketing of Collective Investment Scheme (“Consultation”). The Consultation proposes the detailed licensing and regulatory framework for intermediaries dealing in OTC derivative contracts (“OTC Intermediaries”).

Most of the framework proposed in this Consultation essentially brings OTC Intermediaries within the fold of the existing framework for holders of Capital Market Services (“CMS”) licences. For OTC Intermediaries dealing in non-centrally cleared OTC derivatives, the MAS is proposing an additional set of risk mitigating requirements. These are based on standards recommended by IOSCO and cover trading relationship documentation, trade confirmation, and portfolio reconciliation and compression.

Finally, the Consultation also deals with proposals in relation to the provision of execution-related advice in respect of listed Excluded Investment Products and the regulation of the marketing of collective investment schemes under the Financial Advisers Act (“FAA”). This Update takes a look at this Consultation. We would be pleased to assist with any feedback that our clients would like to make to the MAS on the Consultation.

Admission And Licensing

The proposed licensing framework will likely have the most impact on OTC Intermediaries that deal in derivative contracts other than securities-based derivatives or futures contracts, as the latter group would already require a CMS licence for “dealing in securities” or “trading in futures contracts” under the current regulatory regime. In this regard, the MAS has also proposed that, given the futurisation of OTC derivative contracts, the admission criteria proposed for OTC Intermediaries that deal in OTC derivative contracts should also apply to intermediaries that deal in exchange-traded derivative contracts such as futures contracts. It was explained that this will allow OTC Intermediaries to apply for the necessary licence to continue to deal in these contracts should they be converted to exchange-traded or futures contracts.

For OTC Intermediaries

The MAS proposes to apply the admission criteria set out in MAS’ Guidelines on Criteria for the Grant of a Capital Markets Services Licence other than for Fund Management to OTC Intermediaries. However, OTC Intermediaries will not be required to meet the minimum five-year track record requirement if they do not serve retail investors (i.e., only accredited, institutional, and / or expert investors are targeted). If they do, the five-year track record requirement will apply.

With respect to base capital requirements, the following have been proposed:

- An OTC Intermediary that is a member of a designated clearing house must have a minimum base capital of SGD 5m; and

- An OTC Intermediary that is not a member of a designated clearing house must have a minimum base capital of SGD 1m.

The MAS also proposes to require CMS licensees dealing in OTC derivative contracts (other than those dealing only with non-retail investors) to comply with the risk-based capital requirements under the Securities and Futures (Financial and Margin Requirements) Regulations. As for CMS licensees dealing in OTC derivative contracts only with non-retail investors, the MAS has stated that it will continue to monitor international developments before finalising the risk-based capital requirements for such licensees.

For Representatives

The MAS proposes to extend the existing representative notification requirement in respect of regulated activities under the Securities and Futures Act (“SFA”) and FAA to persons who act as representatives in respect of dealing in or advising on OTC derivative contracts.

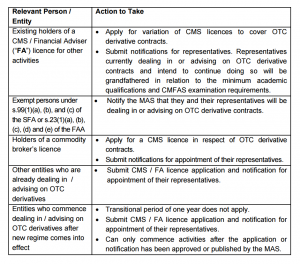

Transitional Arrangements

The table below sets out the actions that will need to be taken by the relevant persons referred to based on the proposals set out in the Consultation. There will be a one-year transitional period from the date that the new regime is effected to submit the relevant applications or notifications. Entities which submit the requisite applications or notifications within the transitional period will be allowed to continue with their OTC derivative activities until such time that the MAS decides on the application or notification.

(Click to enlarge)

Business Conduct Requirements

As noted above, the Consultation proposes bringing OTC Intermediaries within the fold of the existing framework for holders of CMS licences. As regards business conduct rules, the rules that the MAS proposes to apply to OTC Intermediaries and how they should be adapted to OTC Intermediaries are set out below:

(Click to enlarge)

Risk Mitigating Requirements for Non-Centrally Cleared Derivatives

The MAS has proposed requirements on trading relationship documentation, trade confirmation, portfolio reconciliation and dispute reporting, and portfolio compression on CMS licensees dealing in non-centrally cleared OTC derivatives. The table below summarises the requirements proposed.

(Click to enlarge)

Para 9 And Para 11 Arrangements

The Consultation proposes to extend the application of the exemptions under Paragraph 9 of the Third Schedule to the SFA (“Para 9”) and Paragraph 11 of the First Schedule to the FAA (“Para 11”) to dealing in and advising on OTC derivative contracts respectively. Under Para 9 and Para 11, a foreign company is exempted from the requirement to hold a CMS licence or a financial adviser licence (as the case may be), if it is doing so under an arrangement between it and its related corporation which is licensed or belongs to certain categories of exempt persons under the SFA or FAA, where such arrangement is approved by the MAS.

The MAS has stated that existing approvals granted by it under Para 9 and Para 11 in respect of current regulated activities will not be affected by the new proposals. As no grandfathering has been proposed for Para 9 and Para 11 arrangements, it would appear that an application for the MAS’ approval under Para 9 and/or Para 11 will be required for any such arrangements in respect of dealing in or advising on OTC derivative contracts, whether or not such arrangements are already in place before the new regime comes into effect.

Other Miscellaneous Proposals

The MAS has included two additional proposals in this Consultation which are not related to the licensing and regulatory framework for OTC Intermediaries:

- It proposes to exempt the provision of execution-related advice in respect of listed Excluded Investment Products from the FAA, subject to the following safeguards:

- The dealer must provide the customer with a written warning at account opening that the advice does not take into account the customer’s investment objectives, financial situation, and particular needs, and highlight to the customer that it is his responsibility to ensure the suitability of the product recommended; and

- The dealer must state the rationale for the advice provided to the customer so that the customer can make an informed assessment on whether to act on the dealer’s advice.

- The regulated activity of marketing of collective investment schemes will be removed from the FAA and be regulated only under the SFA. The exemptions in the SFA will be expanded to allow financial advisers to help customers transact in both listed and unlisted collective investment schemes if such dealing in incidental to their advisory activities. The amendment is intended to be cosmetic and not substantive, and the necessary drafting changes are proposed to be made to ensure that this is the case. While this has not been expressly raised in the Consultation, presumably existing exemptions currently relied upon by financial institutions under the FAA will be similarly ported over as well.

For further information, please contact:

Elaine Chan, Partner, WongPartnership

elaine.chan@wongpartnership.com

Rosabel Ng, Partner, WongPartnership

rosabel.ng@wongpartnership.com

Kah Keong Low, Partner, WongPartnership

kahkeong.low@wongpartnership.com