30 November, 2016

The Herbert Smith Freehills 2016 Australian Public M&A Report was released on 10 November 2016. The Report examines the 50 public takeovers and schemes involving ASX-listed targets that were announced in FY16.

Now in its eighth year, the Report gives readers a detailed insight into how market conditions have evolved in recent years and provides an indication of where M&A activity may be heading in years to come.

ACTIVITY LEVELS

Please click the image to enlarge.

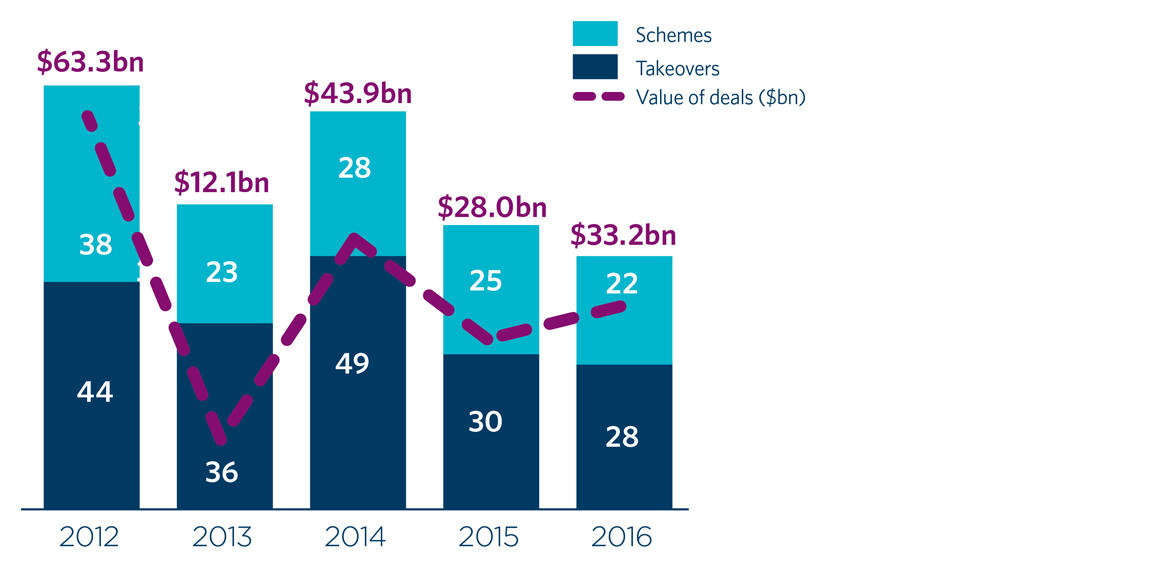

There were 50 deals announced in FY16, down from 55 deals announced in FY15. This contraction of public M&A activity is consistent with a significant reduction in deal volume experienced over the last 4 years. However, despite the lower numbers of deals, at $33.2 billion total deal value was higher than FY15 (largely due to the competing Brookfield and Qube proposals for Asciano, which alone contributed approximately $18 billion).

KEY FINDINGS

The Report’s key findings include the following:

FY16 saw a significant rebound in the level of competition in Australian public

M&A with 7 of 43 targets attracting multiple bidders (compared with only 2 targets attracting multiple bidders in FY15).

The industrials and utilities sectors featured strongly in FY16, contributing $23.3 billion to overall deal value. In contrast, FY16 proved a challenging year for the energy and resources sectors, with these sectors contributing only $1.1 billion to total deal value, the lowest value since the Report commenced in FY09.

North American bidders were more prominent in FY16 than in previous years,

with 27% of bidders coming from North America (in contrast to only 15% in FY15, 19% in FY14 and 11% in FY13). North American bidders were also active in the mega deal space (i.e. deals valuing the target in excess of $1 billion), with 3 of the 7 mega deals involving North American bidders.

Schemes of arrangement continued to feature prominently in FY16, with 44% of all deals and 6 out of the 7 mega deals structured as schemes of arrangement.

Cash consideration featured prominently in FY16. It was the sole form of consideration in 62% of transactions.

Private equity activity remained robust, with 18% of deals launched by private equity bidders (the same as in FY15).

Target shareholders were particularly receptive to scrip only consideration in FY16. It was the most successful form of consideration in FY16, with 83% of completed transactions offering scrip only consideration being successful, which is noticeably higher than the success rates of scrip only consideration in previous years.

Some of the Report’s findings relating to competition in FY16 and hostile deals are explored in more detail below:

COMPETITION

FY16 was a competitive year by historic standards, with 16% of targets attracting multiple bidders. Despite the high levels of competition, success rates remained high, with 73% of completed deals being successful (compared to 73% in FY15, 60% in FY14 and 64% in FY13).

Please click the image to enlarge.

Targets attracting multiple bidders in FY16 included:

- Affinity Education Group (consumer discretionary).

- Armour Energy (energy).

- Asciano (industrials).

- Devine (real estate).

- GPT Metro Office Fund (diversified financials).

- Phoenix Gold (mining).

- Vision Eye Institute (health care).

Competitive deals predominantly involved targets valued at between $100m to $500m (62%). Only one target in the mega deal space (Asciano) attracted multiple bidders.

Target shareholders in competitive scenarios often received significant premia from successful bidders, this year averaging 97%.

HOSTILE DEALS

The proportion of deals launched without support from the target board in FY16 (and therefore categorised as hostile) was consistent with previous years.

Please click the image to enlarge.

However, the trend for mega deals to be announced on a friendly basis continued in FY16, with only 1 of the 7 mega deals being announced without target board support. This was Equifax’s initial proposal to acquire Veda by scheme of arrangement (presented as a non-binding expression of interest).

Veda’s board later recommended an improved proposal from Equifax.

Cash only consideration was the most prominent form of consideration offered in hostile deals, with 70% of bidders offering cash only (as opposed to 56% of bidders offering cash only in friendly deals).

Please click the image to enlarge.

Of the hostile bids in FY16, for 65% the first substantive response (ie. other than a take no action type of response) was to recommend the shareholders reject the offer.

For those target boards that recommended that shareholders reject the offer, defence tactics varied and included:

- commissioning an independent expert report – in 7 cases;

- attracting a rival bidder – in 3 cases;

- using the board recommendation to secure an increase in consideration for target shareholders – in 8 cases; and

- commencing action in the Takeovers Panel – in 1 case.

61% of hostile bids were ultimately successful, with the target board eventually recommending acceptance in all of those bids. No hostile bids were successful where the target directors retained their reject recommendation for the full duration of the bid.

In the 8 cases where target boards used their recommendation to secure an increase in consideration for target shareholders, the increases ranged from 9.5% to as high as 92.3% (averaging 24.7%) on the initial consideration. In more than half of those cases (5/8), the target board had commissioned an independent expert report.

In 3 hostile bids a rival bidder emerged following a recommendation that shareholders reject the initial offer. The rival bidder was ultimately successful in each of those cases, with shareholders receiving an average increase on the value of the initial proposal of 54.9%.

For further information, please contact:

Paul Branston, Partner, Herbert Smith Freehills

paul.branston@hsf.com

.jpg)