9 December, 2016

INTRODUCTION

SEBI has been expressing its concerns over certain agreements entered into between private equity funds ("PE investors") and employees of listed companies ("Listed Companies") for incentivizing/boosting the performance of the employee, including key managerial personnel (KMPs), director or promoter of the Listed Companies ("Recipient"), so as to enhance the overall performance of the Listed Companies.

Under such agreements, the PE investor assures the Recipient a certain share in profits generated by them out of the sale of shares held by them in such Listed Companies during exit from such Companies, by way of rewards for good performance. Though such agreements are personal in nature and has nothing to do with the public investments or the market equilibrium, SEBI considers such agreements to be unfair to the (public) shareholders.

SEBI, at its board meeting held on November 23, 2016 approved amendments to the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("Listing Regulations") requiring disclosures with the bourses and prior approval from SEBI and public shareholders with respect to such agreements. The revised norms provide that –

a. No employee including key managerial personnel, director or promoter of a listed entity shall enter into any agreement for himself or on behalf of any other person, with any shareholder or any other third party with regard to compensation or profit sharing unless prior approval has been obtained from the Board (SEBI) as well as public shareholders.

b. All such agreements entered during the past three years from the date of notification shall be informed to the stock exchanges for public dissemination including those which may not be currently valid.

c. Existing agreements entered into prior to the date of notification and which may continue to be valid beyond such date shall be informed to the stock exchanges and approval shall be obtained from public shareholders by way of an ordinary resolution in the forthcoming general meeting. The term 'public' shall carry the same meaning as defined under Rule 2 of Securities Contracts (Regulation) Rules, 1957.

d. Interested persons involved in the transactions shall abstain from voting on the said resolution.

Post the board meeting, SEBI issued a show-cause notice (SCN) to multiplex operator PVR Limited ("PVR") with respect to similar profit sharing agreements entered into by PVR with its PE investors alleging violation of Listing Regulations for non-disclosure of such agreements to the bourses. SEBI claims such agreements to be price sensitive information under the Listing Regulations as the same are linked to the performance of the Listed Companies.

While SEBI has been on one side proposing to allow disclosure of all existing as well as non -existing profit sharing agreements entered into during the three years preceding the amendments to the Listing Regulations, it is unclear as to why SEBI has been at this stage issuing SCNs to target entities even prior to such amendments coming into force?

VIEW ON SIMILAR AGREEMENTS IN THE PAST

The concept of rewarding Recipients by proposed investors by way of separate agreements has been in vogue since many years, and to an extent, also been acknowledged by SEBI with the introduction of the (erstwhile) SEBI Takeover Regulations 1997. Under this Regulation, payments by an acquirer to the selling shareholders by way of non-compete fees over and above the offer price was allowed.

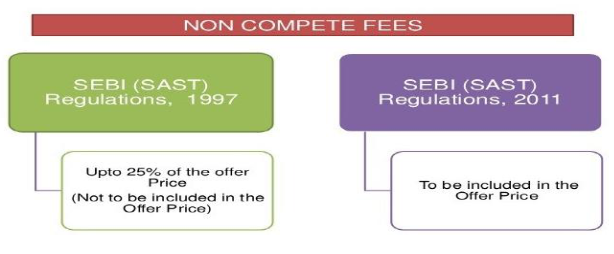

Such non-compete fees were paid to exiting promoters or founders of a company by the investor to ensure they do not compete with the Listed Companies for a certain period post acquisition by the investor. In 2002, the Bhagwati Committee, noting the possibility of a misuse of the non-compete fees, recommended a cap of 25% on such payments which would be exempted from being included in the offer price calculated under the erstwhile Takeover Regulations. The limit of 25% was brought in as a measure to curb the practice where the acquirer passes on a significantly large portion of the consideration to the outgoing promoter in the form of non-compete fee and only a token amount is shown as negotiated price for acquisition of shares under the agreement.

Please click on the image to enlarge.

Under the present SEBI Takeover Regulations, 2011,after much debate and discussion by Achuthan Committee, the limit of 25% on non-compete fees was done away with requiring the acquirer to include the entire payments made by way of non-compete fees or in any other manner, in the offer price, to other shareholders willing to exit from the company. Nevertheless, such agreements are not totally forbidden by SEBI.

SUPREME COURT ON PROFIT SHARING AGREEMENTS

The Supreme Court of India in a decision1 given on May 10, 2016 with respect to such non-compete agreements has acknowledged commercial wisdom and independence of parties entering into such agreements. The view of SEBI and SAT was that out of 20 promoters only 5 promoters were eligible to non-compete fees and there has been no rationale for payment of such non-compete fees to other promoters. The Supreme Court allowing the appeal and approving the non-compete fees concluded on the following propositions:

(a) commercial decisions of the parties should be respected, unless SEBI establishes with conclusive evidence that the decision had malafide intentions; and

(b) it is imperative to give sufficient elbow room to commercial entities for entering into a business transaction and host of considerations go into business relations.

OUR VIEW

SEBI now wants to prohibit employees, including KMPs, directors or promoters of Listed Companies from entering into any agreement with any shareholder(s) or any other third party.

Interestingly, SEBI’spress release seems to be rather overarching. On one hand it refers to "employee" (which is an inclusive term to cover KMPs, director or promoter), which raises a question whether the intention is to limit only to KMP, director and promoter OR even any other employee (even if not KMP)? On the other hand it extends to agreements with "any shareholder" or "any other third party", which once again covers virtually any person (not just restricted to PE funds or other investors. Hypothetically, a contract between an employee [who maybe holding 1,000 shares received by him pursuant to ESOP] with his friend or any lender (read, third party) to share profit could technically fall within the mischief of this Press Release and would need shareholders consent?

Certainly, if the intention is to only restrict the KMPs and promoters on one hand, and the PE Investor on the other hand, then the amendment to the SEBI LODR must be suitably worded.

From a practical viewpoint, the decision of SEBI in amending the Listing Regulations with respect to profit sharingagreements,which are personal in nature, seems to be rather overarching and seeking to control commercial democracy and negotiations between the investors and the Recipient.

Similar to non-compete agreements, compensation agreements also involve payments by the investors out of their own funds to the Recipient over and above their managerial remuneration.

While one may only see the profit share that the Recipient may be entitled to, one must also see the onerous obligations (sometimes giving of warranties and personal guarantees and put/ buy-back undertakings) undertaken by such Recipients. Further, payment of non-compete fees did not require any shareholder or SEBI approval either under the erstwhile Takeover Regulations or the Takeover Regulations, 2011 as they are paid based on private contracts entered between parties.

SEBI has not justified the rationale behind requiring Target Companies to incur expenditure in convening the general meetings for approval of such profit sharing agreements. While payments would be made out of the resources of the PE funds, the ap proval to such payments would be at a cost to the public shareholders.

SEBI may require public disclosure of such profit sharing agreements from the point of view of good governance practices and transparency. However by requiring Recipient to obtain prior approval from SEBI and public shareholders, SEBI seem s to be either unwilling to promote the growth of the target companies or save some funds to the private equity investors.

1I.P. Holding Asia Singapore Private Limited & Anr Versus SEBI – Civil Appeal No.7390 of 2012

Prem Rajani, Partner, Rajani Associates

prem@rajaniassociates.net

.jpg)