16 January, 2017

The Stamp (Amendment) Bill 2016 (Stamp Bill) was recently introduced and tabled for its first reading in the Lower House of the Malaysian Parliament (i.e. Dewan Rakyat). The provisions in the Stamp Bill will result in significant amendments to the current Stamp Act 1949 (Stamp Act). While the date for the second reading of the Stamp Bill has yet to be confirmed at the date of writing, it is expected that the Stamp Bill will be enacted into law this year.

Key Changes under the Stamp Bill

Changes from Official Assessment to Self Assessment System

a) Under the Stamp Bill, a self assessment system has been proposed. The self assessment system will replace the current official assessment system. With the change, a payer may opt for self-assessment of stamp duty payable if the return is submitted by an electronic medium based on information furnished in the return. Where self-assessment is preferred, the duty will be due and payable within 14 days of submission.

b) There is also a new requirement to furnish a return together with any instrument which is executed and chargeable with duty as well as a new obligation to retain and maintain instruments and all relevant documents for a period of 7 years. Failure to comply is an offence and, on conviction is subject to the imposition of a fine of up to RM10,000.

c) The current powers of the Collector will also be broadened to encompass audit rights and rights to search any buildings or premises as well as access to instruments, books, accounts, records and other documents considered necessary in the execution of its duties.

d) The Collector will also be empowered to appoint agents to be responsible for the payment of any duty or penalty due under the Stamp Act.

The Instrument on which ad valorem Stamp Duty is Paid

a) Ad valorem stamp duty will be payable on the agreement for conveyance upon execution and nominal stamp duty be imposed on the instrument of conveyance. This is in contrast to the current position where ad valorem duty is paid on the instrument of conveyance and the agreement is charged with nominal stamp duty.

b) The proposed change is expected to create challenging implications in the context of multiple transfer type transactions which are common in the context of global restructuring exercises.

c) It is foreseeable that there would be practical implications arising from the proposed amendments, one of which being the large number of refund applications for cancelled agreements and the other being agreements with post-completion adjustment clauses for the purchase price.

d) In the context of property acquisition, where a purchaser has paid the ad valorem duty on a conveyance and prior to obtaining conveyance of the property, enters into another agreement to transfer the same property, the subsequent agreement shall also be charged with the full ad valorem duty.

Changes to Stamp Duty Relief Requirements

a) The period in which the companies have to remain as the beneficial owner of the shares will be extended from two years to three years following the date of registration.

b) For transfers of property between related parties:

the asset acquired must remain with the transferee for a period of 3 years; and

it is intended that the transferor and transferee must remain associated for a period of 3 years from the date of conveyance or transfer.

c) The proposed amendments will impact intercompany restructuring and reorganisation exercises as the conditions are more stringent than the present conditions.

d) If a declaration for relief or evidence presented for the relief is untrue, the Stamp Bill seeks to impose stamp duty and interest of 6% per annum.

e) All parties to the instrument are required to notify the Collector of any change in the circumstances within 30 days of its occurrence. Failure to provide the requisite notice is commission of an offence and on conviction, a fine of up to RM10,000 can be imposed.

Revision to Schedules

The First, Second, Third, and Fifth Schedules to the Stamp Act are substituted with new schedules.

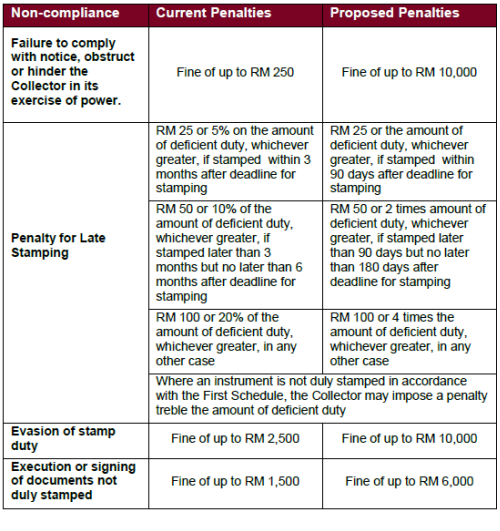

Increased Penalties

A summary of some of the increased penalties is set out below:

Please click on the table to enlarge.

Commentary and Observations

The above summary is not intended to be exhaustive of all the amendments and only serves to highlight the key amendments of which the Stamp Bill seeks to introduce. At this stage, the amendments are merely proposals until the Stamp Bill is passed into law.

The contents of the Stamp Bill are generally viewed as being aligned with the Malaysian government's recent efforts to widen the tax base and increase its tax revenue and collection.

It is important for businesses to review their documentation to ensure compliance in view of the proposed self assessment system, the introduction of audits and the substantial increase in penalties for late stamping.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com