16 January, 2017

With the introduction of the Goods and Services Tax Act 2014 (GSTA) on 1 April 2015, a special sales tax refund was provided under section 190 and 191 of the GSTA to any person holding goods (subject to sales tax) in hand as at 31 March 2015, and who had to charge 6% GST on such goods after 1 April 2015.

(I) Conditions for Refund under the GSTA

Section 190 of the GSTA provides for refunds under 2 scenarios to any person showing they have held goods in hand as of the effective date.

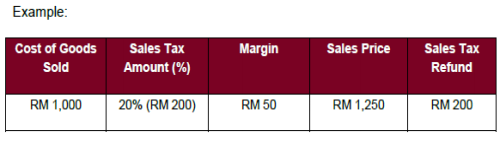

Scenario 1: 100% sales tax refund, subject to the following conditions:

(a) the claimant is a GST registered person as of 1 April 2015 (i.e. makes taxable supplies of RM500,000 and above);

(b) the claimant on 1 April 2015 holds goods for purposes of making a taxable supply;

(c) the goods are taxable under the Sales Tax Act 1972 and the sales tax has been charged to and paid by the claimant; and

(d) the claimant must hold the supplier's invoice proving that sales tax was charged (i.e. invoice from sales tax licensed manufacturer), or import documents proving that the claimant was the importer of record (i.e. the Customs K1 Form).

Please click on the image to enlarge.

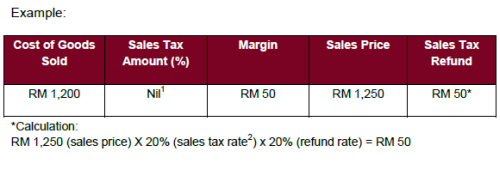

Scenario 2: 20% sales tax refund, subject to the following conditions:

(a) the claimant purchased taxable goods from suppliers other than a sales tax licensed manufacturer and is not the importer of record;

(b) the claimant is GST registered as of 1 April 2015;

(c) the claimant on 1 April 2015 holds goods for purposes of making a taxable supply;

(d) the claimant has paid the amount shown on the invoice.

Please click on the image to enlarge.

Other conditions for the refund are stated in section 190(4), which provides that the special refund does not apply to goods which have been capitalised under accepted accounting principles, goods which have been used partially or incorporated into some other goods, goods held for hire, goods held otherwise than for business use and goods not for sale or exchange, exported goods subject to sales tax drawback, and goods subject to deduction from sales tax under section 31A of the Sales Tax Act 1972 (i.e. the credit system).

A claimant may only claim once, using the prescribed form and submitted to a GST officer. An application must be submitted no later than 6 months from 1 April 2015, i.e. no later than 1 October 2015.

(II) Common Issues Arising from Refund Applications

Although not expressly stated within the GSTA itself or the Explanatory Statement to the GST Bill in 2009, Customs have said that the special refund is to enable traders who have paid sales tax on goods previously purchased, to price down the goods for taxable supplies after 1 April 2015, such that there is no 'double taxation' to consumers (i.e. a sales tax component, and an added GST component on the goods supplied).

Whilst this rationale may make sense, this condition is neither contained within the GSTA itself, nor any of the other guides issued by Customs to date. Businesses are also left in the dark as to whether it would need to price down its goods even though sales tax have not been refunded, as this would mean absorbing the cost of sales tax previously incurred, and either (i) waiting for up to 2 years for the full amount of sales tax to be refunded3, (ii) receiving only part of the amount claimed, or (iii) in the worst case scenario, having its application completely rejected by Customs.

Recently, there has been a slew of rejection notices issued by Customs to companies operating in various industries. These rejection notices are generally not accompanied by any supporting reasons, other than a statement that the Director General of Customs has rejected the refund application, and the reference to a DG Standing Order. It should be noted that this Standing Order is not a publicly available document.

Perintah Tetap Pematuhan Bilangan 7 (Standing Order No. 7)

The Standing Order No. 7 was issued on 31 May 2015 by Customs as a guide to its GST audit officers tasked to process special refund applications. There are various criteria laid down which are required to be adhered to by the audit officers when processing an application, and the relevant stages and responsible divisions within the GST department (at both the state and federal level) which would need to decide on whether an application is to be approved or rejected.

The mandate of the GST audit officers include obtaining and testing a sample of at least 10 SKUs or 1% of the total SKUs submitted by an applicant of a sales tax refund, whichever is the higher. Where a field audit is carried out, all of the chosen SKUs must be analysed. For claims under RM20,000 a desk audit is preferred, compared to a field audit.

There are also other audit recommendations in the Standing Order No. 7, such as the use of the "Roll Forward Method" or the "Roll Back Method" to verify the inventory of goods held on hand as of 1 April 2015, to confirm the amount of sales tax that is required to be refunded. If there is a discrepancy in the inventory, the audit officer is required to dismiss the claim. However, an example is given of a claim worth RM 25 million, where upon audit, 40% of the SKU submitted is found to be incorrect, and the remaining 60% correct. In such cases, 60% of the value claimed is to be refunded.

There are also other recommendations relating to the percentage of price increase allowed for SKUs depending on the amount of sales tax previously paid on such goods. For example, where the sales tax paid previously is higher than the existing GST rate of 6% (e.g. sales tax of 10% to 20%), a price reduction is required. For items subject to 5% sales tax, and items qualifying under the 20% refund method (i.e. Scenario 2), a price increase is allowed, up to a specified percentage.

Besides Standing Order No. 7, there are also other circulars issued by Customs to its audit officers, including one stating that a sales tax refund claim may be rejected if the profit margin on goods not subject to sales tax is unreasonably high, to address instances where businesses artificially shift profit margins from goods subject to the sales tax refund, to goods not subject to the sales tax refund.

One observation from the various criteria laid down in Standing Order No. 7 and the other circulars are that they are either too simplistic, or too subjective, and does not take into account business exigencies including increases in the cost of doing business and foreign currency fluctuations. Businesses ought to be given the opportunity to explain any price increases which are not in accordance with the pre-determined formulas adhered to by the GST audit officers, especially when Standing Order No. 7 and the other circulars are not public documents.

In any case, such documents issued by Customs internally do not have the force of law, and in any legal dispute with the Royal Malaysian Customs Department brought before the Malaysian courts, the GSTA and its subsidiary legislation shall prevail.

Under such circumstances, any person who is aggrieved by a notice of rejection of its sales tax refund ought to consider the avenues of appeal available to it.

(III) Avenues of Appeal For Rejected Sales Tax Refund Application

Review by Director General of Customs

Section 124 of the GSTA provides that any person may apply to the Director General of Customs within 30 days of being notified of a decision made by a GST officer for the review of the decision, and provided no appeal has been made on the same matter to the GST Tribunal4 or the courts.

Application for Judicial Review

Order 53 of the Rules of Court 2012 provide a 3 month time frame from the date the grounds of application first arose, or the decision was first communicated to the applicant, to bring a judicial review action.

In the context of challenging a special sales tax refund rejection, a judicial review action would be appropriate if the reasons for rejecting the sales tax refund is arbitrary, illegal, or Customs have acted in excess of their powers when making the decision (or that such decision was so unreasonable that no other reasonable person exercising that authority would have arrived at the same decision). The applicant must also show that the exercise of power was in breach of the

principles of natural justice.

There are currently ongoing cases where taxpayers have successfully obtained leave to commence judicial review proceedings against the Royal Malaysian Customs Department for rejecting their applications, based on the reasons above. This shows willingness on the part of Malaysian courts to allow such applications as long as illegality or abuse of process can be shown.

(IV) Conclusion

In light of our current economic climate both domestically and globally, where the saying 'every penny counts' certainly rings true during this uncertain times, companies who have been unfairly denied their refund applications are advised to consider judicial review as a means to obtain their rightful sums owed.

In view of the limited time available to commence a judicial review action, companies who are currently waiting to hear on their application are also advised to start considering their strategy to adopt in the event of receiving a notice of rejection of their special refund application.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com