27 February, 2017

On 22 February 2017, the Financial Secretary announced the 2017-18 Budget, proposing to set up a new tax policy unit within the Financial Services and the Treasury Bureau to review Hong Kong's tax regime and narrow tax base.

Citing increasing government expenditure, concentration of revenue from a few industries and volatility of the global economy, the Financial Secretary seeks to address these issues from a macro perspective through the proposed tax policy unit. More specifically, the focus will be on aligning Hong Kong's tax practices with international standards, developing key industries to boost Hong Kong's competitiveness and exploring broadening the tax base.

In addition, the 2017-18 Budget puts forward a number of tax relief measures. The changes in substance will have relatively limited impact on corporate taxpayers in Hong Kong with the majority of the relief being focused on individual taxpayers and in particular, individual taxpayers at lower levels of taxable income. These taxpayers will see a significant reduction in tax as a result of the measures announced due to the one-off tax reduction as well as the widening of the bands and the increase in allowances.

1. One-off reduction of profits tax, salaries tax and tax under personal assessment

Similar to the previous two years, the Financial Secretary has again proposed a one-off 75% reduction of profits tax, salaries tax and tax under personal assessment for the year of assessment 2016/17, capped at $20,000 per case.

The Inland Revenue Department will automatically effect the reduction for any final assessment and as such, there is no need to make a separate application. The proposed reduction does not apply to property tax. However, individuals receiving rental income who are eligible for personal assessment can still enjoy the relief.

2. Widening the marginal tax bands for salaries tax

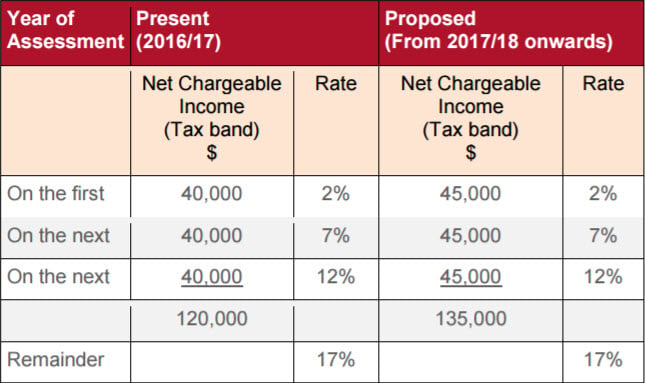

Marginal tax bands are proposed to increase from USD 40,000 to USD 45,000. As a result, the top rate of 17% now applies to income in excessive of USD 135,000 instead of the previous USD 120,000. The table below illustrates the change in detail.

Please click on the table to enlarge.

3. Extending the entitlement period for home loan interest deduction

Entitlement to deduction for home loan interest is proposed to be extended from 15 to 20 years. The cap remains unchanged at USD 100,000 per year.

4. Raising the deduction ceiling for self-education expenses

The cap for deduction for self-education expenses will be raised from USD 80,000 to USD 100,000. Rules governing claims of deduction for self education expenses remain unchanged.

5. Increasing the disabled dependent allowance and dependent brother/sister allowance

Disabled dependent allowance is proposed to increase from USD 66,000 to USD 75,000, and dependent brother/sister allowance from USD 33,000 to USD 37,500. These changes are expected to benefit 35,000 and 23,800 taxpayers respectively.

As these measures require legislative approval before they can be implemented, we expect the Hong Kong Legislative Council to pass amendments to the Inland Revenue Ordinance around mid-year 2017 to give effect to the proposed measures. The changes will be effective from the year of assessment 2017/18.

For further information, please contact:

Steven R. Sieker Partner, Baker & McKenzie

steven.sieker@bakermckenzie.com