23 June, 2017

When the Companies Act, 2013 (the “Act”) was notified, it did not specifically provide for any separate list of exemptions for certain categories of companies. Finally, the Ministry of Corporate Affairs (“MCA”), after taking cognizance of the demands made from various stakeholders, through its Notifications dated June 05, 20151, granted exemptions to Private Companies, Section 8 Companies and Government Companies from the applicability of certain provisions of the Act to such entities.

In furtherance to the said exemptions, the MCA, through its Notifications dated June 13, 2017 have granted further exemptions to Private Companies, Section 8 Companies and Government Companies.

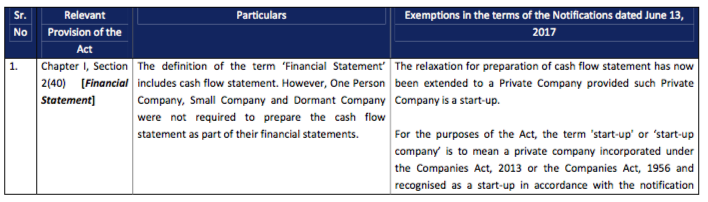

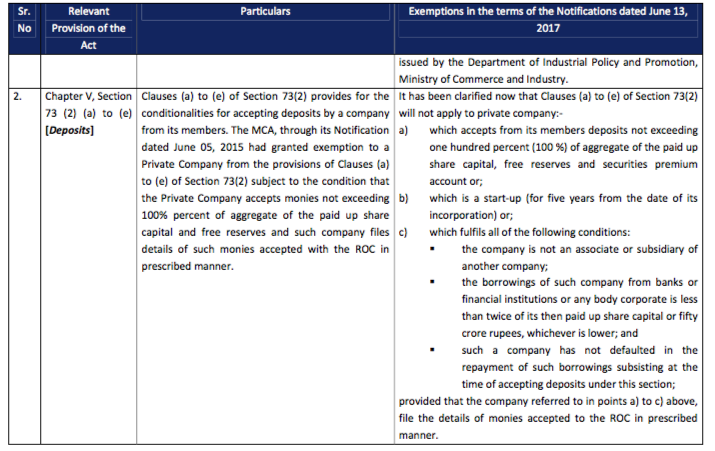

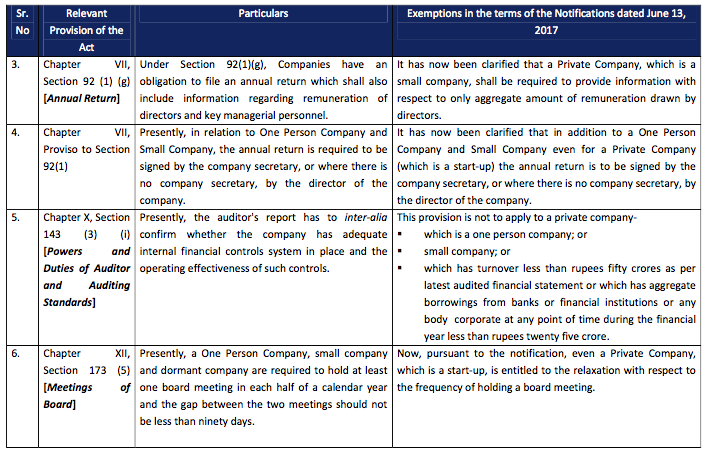

The analysis of exemptions granted to the Private Limited Companies are as follows:

It must be noted that exemptions with respect to the private company is to be applicable only where such private company has not committed a default in filing its financial statements under Section 137 of the Act or annual return under Section 92 of the Act with the ROC.

Please click on the tables to enlarge.

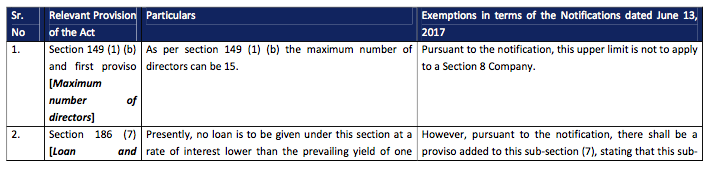

The analysis of exemptions granted to the Section 8 Companies are as follows:

The exemptions with respect to the Section 8 company are to be applicable only where such Section 8 company has not committed a default in filing its financial statements under Section 137 of the Act or annual return under Section 92 of the Act with the ROC.

Please click on the tables to enlarge.

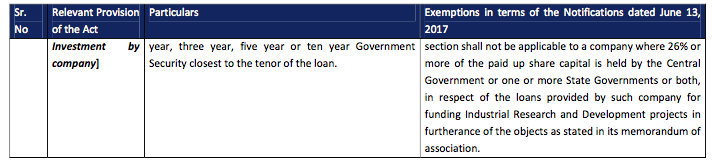

The analysis of exemptions granted to the Government Companies are as follows:

The exemptions with respect to the Government Company shall be applicable only where such Government company has not committed a default in filing its financial statements under Section 137 of the Act or annual return under Section 92 of the Act with the ROC.

Please click on the tables to enlarge.

Our Views

From the exemptions which have now been provided under the present notifications, especially with respect to private companies, one can understand that the Government is trying to provide further impetus to start‐ups by relaxing certain provisions of the Companies Act to the Private Companies which are start‐ups. This is in line with the various other relaxations and incentives provided by the Government of India to a start‐up entity under various other legislations. This seems to be in furtherance to the agenda of the Government of ‘ease of doing business’. More such steps and concessions are welcome as they provide requisite encouragement to the budding enterprises and thereby promote the spirit of entrepreneurship.

1 Notifications G.S.R. 464(E), G.S.R. 463(E) and G.S.R. 466(E)

Prem Rajani, Partner, Rajani Associates

prem@rajaniassociates.net

.jpg)