6 July, 2017

Introduction

The Bond Connect programme launched today1 marked yet another major milestone in mutual market access between Mainland China and the outside world following the hugely successful and innovative China-Hong Kong Stock Connect (Stock Connect). Bond Connect adds to the current modes of access to the China Interbank Bond Market (CIBM), such as the Qualified Foreign Institutional Investors (QFII) scheme, the RMB Qualified Foreign Institutional Investor (RQFII) scheme and the direct access scheme for foreign institutional investors (FII),2 by introducing a more streamlined way to trade and hold onshore bonds in the CIBM for foreign investors.

We discuss in this bulletin the features of Bond Connect and some of the legal and regulatory issues which market participants and prospective investors should be aware of.

What is Bond Connect?

Bond Connect is a new mutual market access scheme that will allow Mainland China and overseas investors to trade in each other's bond markets through a linkage between the Mainland China and Hong Kong market infrastructures. Northbound trading (that is, foreign investors accessing the CIBM) will begin first, while Southbound trading will be explored at a later stage.

Bond Connect was established further to a joint announcement by the People’s Bank of China (PBOC) and the Hong Kong Monetary Authority (HKMA)3 on 16 May 2017. Since then, various rules and regulatory guidance specific to Bond Connect have been published which (together with their English translation) are included in Appendix A for your reference.

Trading link

The Bond Connect Northbound trading link refers to the link between China Foreign Exchange Trade System & National Interbank Funding Centre (CFETS), the operator of the CIBM trading system, and offshore electronic trading platforms4 recognised by the PBOC. Through the Northbound trading link, eligible foreign investors will be able to directly submit their request for quotes (RFQ) through these recognised offshore electronic trading platforms and execute trades with onshore dealers on the CIBM. The use of offshore electronic trading platforms by foreign investors to execute trades on the CIBM is a feature of Bond Connect which makes trading simpler as foreign investors are no longer required to trade through onshore settlement agents as is the case under some of the existing access schemes. CFETS and the Hong Kong and Exchanges Clearing Limited (HKEx) have established a joint venture company, Bond Connect Company Limited (BCCL),5 to coordinate with the offshore electronic trading platforms and to set the detailed terms on which the Northbound trading link is available to offshore electronic trading platforms and overseas investors.

Settlement and Custody Link

Bond settlement and custody for Northbound trades under Bond Connect will be done under the settlement and custody link between the Central Moneymarkets Unit (CMU) operated by the HKMA and the two Mainland bond settlement systems, namely, China Central Depository & Clearing Co., Ltd. (CCDC) and Shanghai Clearing House (SHCH). Under the settlement and custody link, CMU will open a nominee account with each of CCDC and SHCH. The CMU will settle Northbound trades and hold the CIBM bonds in these nominee accounts on behalf of CMU members, who in turn will provide services directly or indirectly to foreign investors using Bond Connect.

Once a Northbound trade is executed under Bond Connect, the CMU will match the trade details sent to CMU by CCDC/SHCH with those submitted to CMU by CMU members. Under the settlement link, CCDC/SHCH will effect gross settlement of confirmed trades onshore and CMU will process the bond settlement instructions from CMU members in accordance with CMU rules. Unlike the clearing link arrangement in Stock Connect, neither CMU nor the CCDC/SHCH performs the function of a central counterparty in the settlement of Bond Connect transactions.

Under the custody link, CIBM bonds held by eligible foreign investors will be recorded in the omnibus nominee account in the name of CMU at each of CCDC and SHCH. CMU will in turn record the CIBM bonds in segregated sub-accounts of the relevant CMU members, who may hold the bonds for itself or on behalf of other custodians or investors. Eligible foreign investors will therefore be able to hold their onshore bonds through their global or local custodian in a segregated sub-account opened in their name at CMU.

Key Features of Bond Connect

Eligible Investors

The following investors are eligible to trade under the Northbound leg of Bond Connect:

- QFIIs;

- RQFIIs;

- Central banks, international financial organisations and sovereign wealth funds; and

- FIIs (i.e. banks, securities companies, insurance companies, and medium to long term institutional investors) and products issued by FIIs.

The investor scope is therefore no different from the types of foreign investors that can currently access the CIBM.

Despite earlier speculation that “parallel trading” may not be permitted under Bond Connect, meaning that foreign investors that are already accessing the onshore bond market through the QFII, RQFII and/or FII routes may not be able to trade under Bond Connect, it is now clear that this is not the case. The PBOC Interim Measures and CFETS Rules do not impose any prohibition against such investors accessing the onshore market through Bond Connect. However, such investors will still need to go through separate registration with the PBOC Shanghai Head Office to use Bond Connect.

Eligible Products

At the initial stage, foreign investors can conduct cash trading over the whole range of instruments traded on the CIBM under the Northbound leg of Bond Connect. The PBOC Q&As mentioned that in the future, the product scope will gradually expand to include bond repurchases, bond lending, bond forwards, interest rate swaps and interest rate forwards.

Significantly, in additional to secondary market trading, foreign investors can subscribe for eligible products in the primary market under Bond Connect. Bond Connect is therefore broader than the existing access schemes (or even Stock Connect) by giving foreign investors direct access to the primary issuances in the CIBM.

RMB settlement and foreign currency conversions

Eligible investors may use their own sources of RMB in the offshore market (i.e. CNH) or to convert foreign currencies into RMB in the onshore market to invest in CIBM bonds under Bond Connect. If an eligible investor wishes to use foreign currencies, its CMU member shall engage an RMB settlement bank in Hong Kong on behalf of the investor for foreign exchange conversions services in the onshore market. If CIBM bonds are purchased using foreign currency converted into onshore RMB, then upon a sale of the relevant CIBM bonds, the proceeds of sale remitted out of Mainland China are to be converted back into the relevant foreign currency.

Filing requirements

In order to trade under Bond Connect, foreign investors must be registered with the PBOC Shanghai Head Office. Registration for Bond Connect may be done through BCCL or other registration agents recognised by the PBOC, such as onshore settlement agents. Bond Connect appears to provide a more streamlined access to foreign investors due to a shorter proposed application timeframe.

Unlike Stock Connect, no investment quotas are imposed under Bond Connect.

Trading and settlement days

Bond Connect is open for trading on CIBM trading days, while settlement can occur on a day which is a CIBM settlement and RMB settlement day, notwithstanding that it is not a Hong Kong business day.

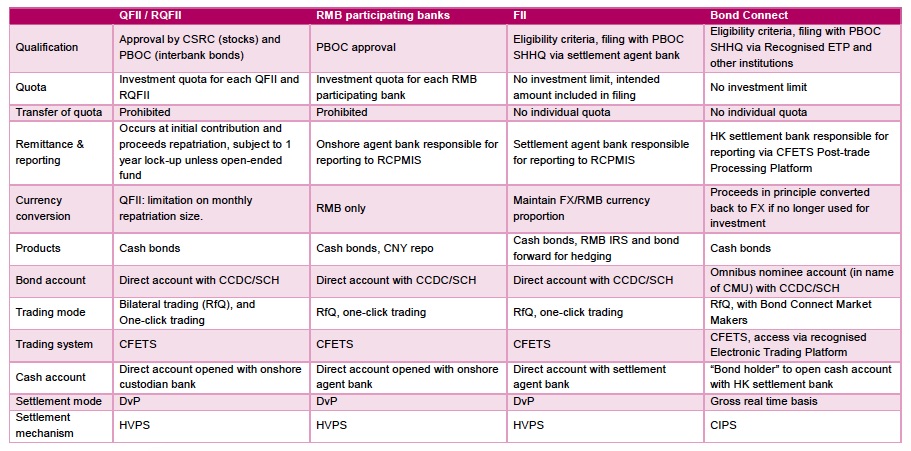

Comparisons with existing access routes to CIBM and Stock Connect

A comparison between Bond Connect and the existing access routes for the CIBM is included as Appendix B while a comparison with Stock Connect is included as Appendix C.

Legal and Regulatory Issues

Beneficial Ownership

From our experience in setting up Stock Connect, the issue of beneficial ownership will likely be one of the key considerations of foreign investors hoping to use Bond Connect.

In the PBOC Interim Measures, the PBOC made a clear distinction between the concepts of “nominee holder” and “foreign investors who purchased the bonds.” The PBOC stated that the offshore depositary recognised by the HKMA (i.e. CMU) shall open a nominee account with an onshore depositary (i.e. CCDC/SHCH) as nominee holder of the bonds purchased by foreign investors through Bond Connect while foreign investors are entitled to “enjoy the rights and interests of the bonds according to law.”

The PBOC Q&As made it clear that Bond Connect will use the “internationally-adopted” multi-tiered custody structure. It confirmed that the ultimate investors are the beneficial owners of the relevant bonds and shall exercise their rights against the bond issuer through (CMU as) the nominee holder. In terms of enforcement of bondholder rights in the Chinese courts, the Q&As clarified that the nominee holder may exercise its creditor rights and bring actions against bond issuers in Chinese courts. In addition, ultimate investors who can prove that they are the beneficial owners of the bonds with a direct interest in the case may also bring actions against bond issuers in Chinese courts directly in their own names. Chinese courts will respect arrangements under Hong Kong law on how beneficial ownership is to be evidenced. The PBOC Q&As also made various references to Stock Connect and indicated that the position is essentially the same. Therefore, it appears

that foreign investors’ beneficial ownership in bonds held through Bond Connect would likely be respected by regulators and Chinese courts.

Non-Trade Transfer

In Mainland China, there are rules governing the CIBM which specifically prohibit non-trade transfers (that is, no transfer of bonds other than through a trade executed on the CIBM). The rules however provide for certain limited exceptions such as succession, mergers, debt repayments and gift under which non-trade transfers are permitted.

Trading in CIBM bonds through Bond Connect is subject to these onshore rules. To this end, the CMU has further provided in its rules that transfers of CIBM bonds between two CMU members and between two CMU sub-accounts of the same CMU member are not allowed. These restrictions appear to be more restrictive than the onshore CIBM rules since specific exceptions allowed in the onshore CIBM have not been carried over to the CMU rules.

It is interesting to note that exceptions were specifically made in Stock Connect for non-trade transfers to allow for post-trade allocation in respect of funds and transfers to rectify error trades. However, none of these exceptions are available in Bond Connect.

Taking Security

Another issue is whether foreign investors may create security interest over CIBM bonds held through Bond Connect, and if so, how such security would be enforced.

Any such security arrangement must be created in a way not to trigger a transfer so that it would not be a non-trade transfer (as described earlier). On the other hand, any transfer following enforcement of the security arrangement shall be conducted through a trade on the CIBM.

In the onshore CIBM, it is not uncommon for investors (including foreign investors) to grant security by way of pledge over bonds they hold directly as accountholders on the CIBM. To this end, both CCDC/SHCH have prescribed detailed procedures governing the registration and administration of these pledges created by their accountholders. However, these procedures do not apply to Bond Connect given that foreign investors who grant the security are not accountholders at CCDC/SHCH (and CMU as the accountholder of CCDC/SHCH does not grant the security). In any event, as Bond Connect adopts a multi-tiered holding structure, any security would be granted by foreign investors at the level of CMU (as holder of account or sub-account at CMU) subject to relevant requirements in Hong Kong and elsewhere.

In principle, the position is similar to Stock Connect where it is increasingly common for financing to be obtained and security arrangement to be entered into in respect of China “A” shares held through Stock Connect.

Mainland China Regulatory Issues

The regulator of the CIBM is the PBOC rather than the China Securities Regulatory Commission (CSRC). As provided by the PBOC in the PBOC Interim Measures, participants of the Northbound link under Bond Connect shall abide by the laws and regulations in Mainland China and Hong Kong. In addition, the regulations and business rules of the place where the trading and settlement activities takes place shall govern the trading and settlement activities under the Northbound link of Bond Connect. The PBOC will also supervise and regulate the Northbound link in areas such as anti-money laundering, RMB purchase and sale, outbound and inbound remittance of funds and FX risk hedging in accordance with Chinese law. In addition to the new rules and regulations governing Bond Connect, existing “home-market rules” for the CIBM therefore continue to apply6.

As an OTC interbank market for the trading of bonds, the Mainland China Securities Laws do not apply to the CIBM. Instead, trading on the CIBM is subject to PBOC regulations and CIBM trading rules, which contain prohibitions on market manipulation activities on the CIBM. Given that the CIBM is essentially an institutional rather than a retail market, understandably, the CIBM is subject to far fewer restrictions compared to the trading of shares and futures on a stock market or futures exchange. For example, insider dealing regulations, disclosure of interests and short swing rules which applies to the trading of shares do not apply to the trading of bonds on the CIBM.

On the other hand, if a single investor holds more than 30% of the principal amount of a single series of bonds, CCDC or SHCH shall notify CFETS and CFETS shall disclose such information to the market. Despite the nominee account holding structure for Bond Connect, this 30% threshold should apply to each eligible foreign investor rather than to CMU as nominee holder. Investors are also required to disclose to CFETS bond transactions with certain types of connected parties.

Documentation and next steps

Eligible foreign investors wishing to take advantage of the opportunities available under Bond Connect would need to conduct due diligence over Mainland China specific issues, prepare for on-boarding with the various Bond Connect entities such as the offshore electronic trading platforms, CMU or a CMU member as its custodian, and consider potential changes to their client terms and/or CIBM access documentation.

Other participants in the offshore markets have also started to explore ways to capitalise on Bond Connect, including arranging for foreign investors to buy into primary issuances of bonds through Bond Connect, establishing products (in the form of funds or repackaging SPV) for accessing the CIBM, structuring derivatives and total return swaps over bonds held in Bond Connect and providing hedging arrangements and related services.

Appendix A

Bond Connect Rules and Regulations

PBOC Interim Measures for the Administration of the Mutual Bond Access between Hong Kong and Mainland China (the “PBOC Interim Measures”) promulgated by the PBOC on 21 June 2017 (Chinese and our English translation).

Question and answers from the PBOC dated 22 June 2017 (the “PBOC Q&As”) (Chinese).

Guide on Registration of Overseas Investors for Northbound Trading in Bond Connect promulgated by the PBOC Shanghai Head Office on 22 June 2017 (Chinese and English).

National Interbank Funding Centre “Bond Connect” Trading Rules (the “CFETS Rules”) dated 22 June 2017 (Chinese and our English translation).

Shanghai Clearing House Detailed Operation Rules for Registration, Custody, Clearing and Settlement of Bond Connect Cooperation between the Mainland and Hong Kong (the “SHCH Rules”) dated 23 June 2017 (Chinese and English).

China Central Depository & Clearing Co., Ltd. “Bond Connect” Northbound Link Registration, Depository and Settlement Business Rules dated 26 June 2017 (the “CCDC Rules”) (Chinese and our English translation).

CMU Bond Connect Linkage Service Operational Information for CMU Members issued by the HKMA.

China Bond Connect Company Limited Access Rule Book dated 30 June 2017.

In addition to the above Bond Connect rules and regulations, the following existing rules and regulations applicable to the CIBM continue to apply to trading under Bond Connect:

- CIBM Registration, Depository and Settlement Measures promulgated by the PBOC;

- the PBOC circulars on CIBM trading, DVP settlement, non-trade transfer and disclosure;

- CFETS bond trading rules and bond circulation rules;

- CCDC bond settlement rules, DVP rules and settlement agreements; and

- SHCH bond registration, depository, clearing and settlement rules.

Appendix B

Comparison between current CIBM access routes and Bond Connect

Please click on the table to enlarge.

Appendix C

Comparison between Stock Connect and Bond Connect

Please click on the table to enlarge.

1 The joint announcement published by the PBOC and the HKMA on 2 July 2017 announcing the launch of the Bond Connect can be found here: Chinese and English.

2 Our client bulletins can be found via the following links: The Expanding RQFII Regime: Key Legal Issues for Offshore Investors (June 2015); China Interbank Market Widens Access to Overseas Participants (August 2015) and China opens up interbank bond market to foreign institutional investors (June 2016)

3 The link to the Chinese version of the joint announcement published on the PBOC website can be found here. The link to the English version of the joint announcement published on the HKMA website can be found here.

4 Such as Tradeweb Markets and Bloomberg.

5 BCCL is licensed as a provider of automated trading services (ATS) in Hong Kong.

6 These existing rules and regulations are included in Appendix A for reference.

For further information, please contact:

Chin-Chong Liew, Partner, Linklaters

chin-chong.liew@linklaters.com

.jpg)

.jpg)