11 March, 2018

On 30 January 2018 , the Cabinet approved new nationwide minimum wages as proposed by the Ministry of Labour. Effective from 1 April 2018 onwards, the new minimum daily wage rates will increase to a range of Baht 308 to Baht 330 varying from province to province.

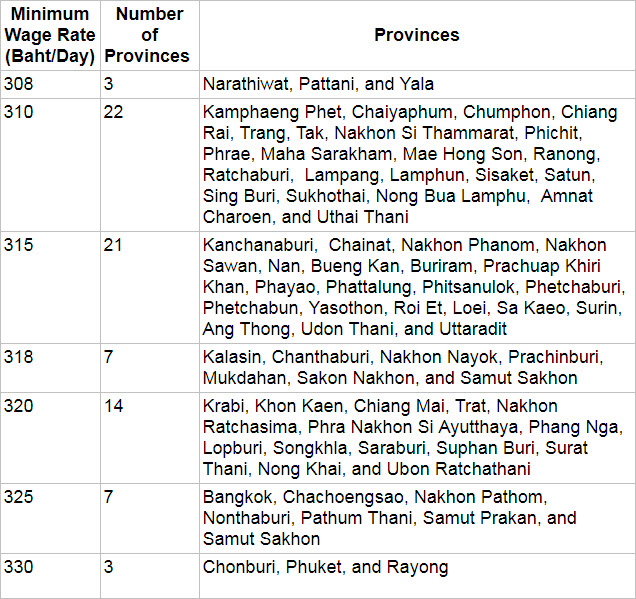

The new minimum wage rates for 2018 are as follows:

Please click on the table to enlarge.

In determining the new minimum wage rates for each province, consideration was given to provincial economic indicators, such as GDP, labor demand in each province, as well as wages in neighboring countries. However, it is interesting to note that the minimum wage rate in Rayong is surprisingly higher than the rate in Bangkok, despite Bangkok's higher cost of living.

In addition to the new minimum wage rates, certain relief measures have been introduced to alleviate the pressure that some employers may face implementing the new wage rates. The Ministry of Finance proposed a draft Royal Decree on corporate tax deduction concession from 1 April 2018 to 31 December 2018, which was approved by the Cabinet on 30 January 2018. According to the Royal Decree, in case it is a legal entity, an employer will be exempted from corporate income tax equivalent to 15 percent of the minimum daily wage expenses, excluding overtime payment, allowances and any tax paid by an employer on behalf of employees. To be eligible for the tax exemption, the employer must satisfy the following conditions:

- The employer must have revenues from the sales of goods or services during the fiscal year of not more than Baht 100 million, and must have fewer than 200 employees;

- Minimum daily wages paid to employees from 1 April 2018 to 31 December 2018 must be higher than the wages paid to the employees before 1 April 2018; and

- The employer must not already be entitled to any other tax benefits for its wage expenses.

There are other future measures in the pipeline that the government is proposing to help small and medium-sized enterprises (SMEs) and industry operators cope with the new wage rates. One measure proposed by the Ministry of Industry involves allocating Baht 5 billion to increase the productivity of SMEs to help them reduce costs and enhance the potentials of entrepreneurs and personnel over the next three years. Another measure suggested by the Board of Investment consists of two approaches.

Firstly, there will be a maximum 50 percent corporate income tax reduction for three years for entrepreneurs that have modernized their machinery and applied digital and internet-based services to their production and management of their business. Secondly, SMEs that have human resources-related expenses, such as improving technology skills budgets, will be entitled to a reduction from taxable income of 200 percent on the expenses incurred. Note that these proposals have not yet been approved and may be subject to further changes.

Additional future proposals include a requirement that an employer having 50 or more employees must prepare a wage structure for employees to see as reference and as a guarantee that the wages will be increased every year. Another is the application of floating wage rates in provinces located in Eastern Economic Corridor (EEC) such as Rayong, Chonburi and Chachoengsao in order to ensure that skilled workers are available in those locations to serve the needs of employers in the EEC. Similarly, this proposal has not yet been approved and may be subject to further changes.

For further information, please contact: