11 May, 2018

On December 26, 2017, the National Development and Reform Commission (the “NDRC”) promulgated the Measures for the Administration of Overseas Investment of Enterprises (“Decree 11”), which came into force on March 1, 2018.

One month before Decree 11 became effect, the NDRC published the Ancillary Template Documents of Measures for the Administration of Overseas Investment of Enterprises (2018 Version), which, consisting of 15 documents1 in total, provided template documents/forms and detailed guidelines for NDRC formalities for overseas investment projects (collectively, the “Guidelines”).

This article aims to help enterprises prepare documents relevant to the formalities for overseas investment projects in a correct and efficient manner by analyzing and summarizing key points in the Guidelines and major differences among the documents subject to different formalities.

1. Key Information

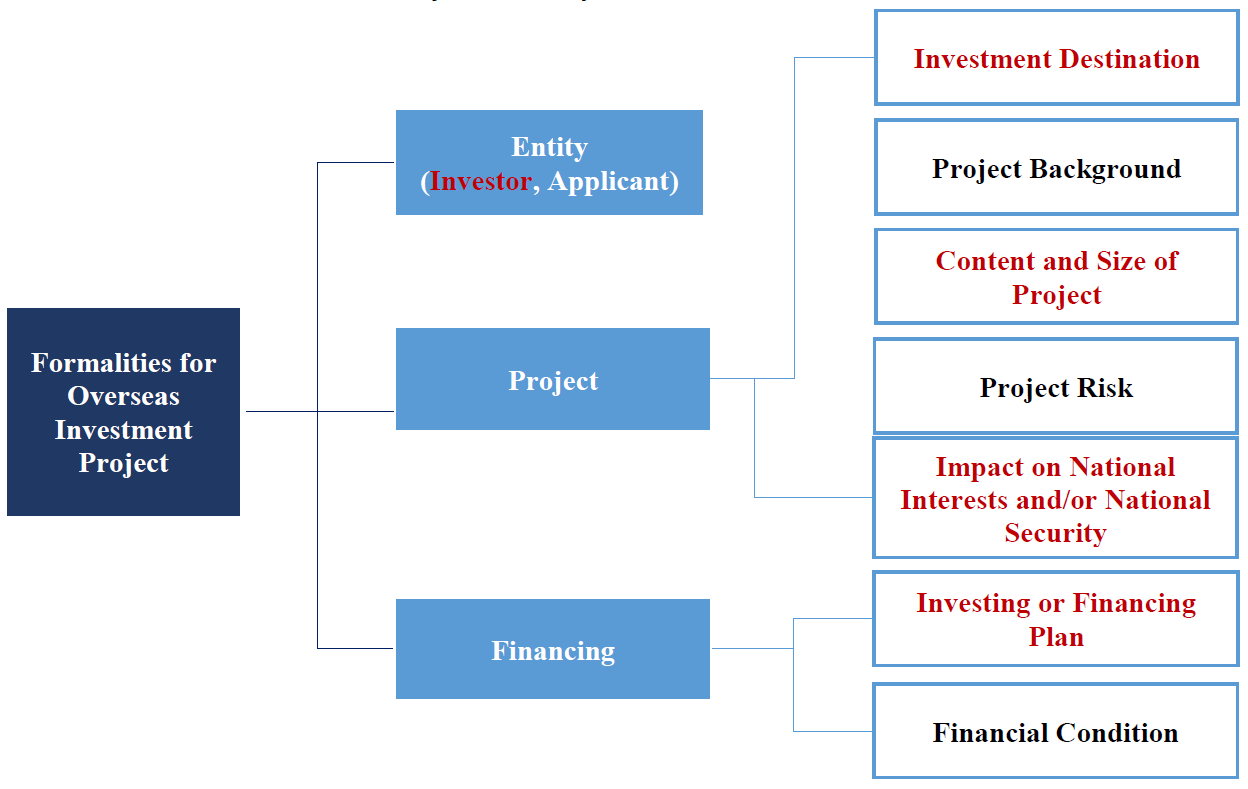

According to the Guidelines, the key information of the overseas investment formalities is about “Entity-Project-Financing” (see chart below).

The NDRC and its local agencies review the overseas investment projects from the following seven aspects: information on the investor, investment destination, background of the project, main content and size of the project, investing and financing plan of the project, major risks and relevant precautions, and the impacts of the project on the national interests and national security of China.

Among the above aspects, for projects subject to approval, information on the investor, investment destination, main content and size of the project, investing and financing plan of the project and the impacts of the project on the national interests and national security of China are the main concerns of the NDRC when it decides whether a project fulfils the approval requirements.

The other factors — project background, the implementation of supporting conditions, financial condition, major risk analysis, etc. — are only for NDRC’s reference, and are not considered as major concerns from the NDRC’s perspective2.

2. Investor

In the event where only one investor is involved, such investor shall be the applicant. Where a project is jointly conducted by two or more investors, according to the Decree 11, the investor with the larger or largest investment shall submit an application for approval or filing after obtaining the written consent of the other investor or investors.

If each investor makes the same amount of investment, one of the investors shall submit the application after they reach an agreement through consultation. Such condition shall be clarified in the application document, such as “Investor A, B, and C have reached an agreement through consultation that A shall be the applicant”.

If a parent company (company A) submits an application for its subsidiary (company B), the application document shall contain a statement to the effect of “the applicant is A, the parent company of investor B”.

3. Application Requirements

1) Application Categories

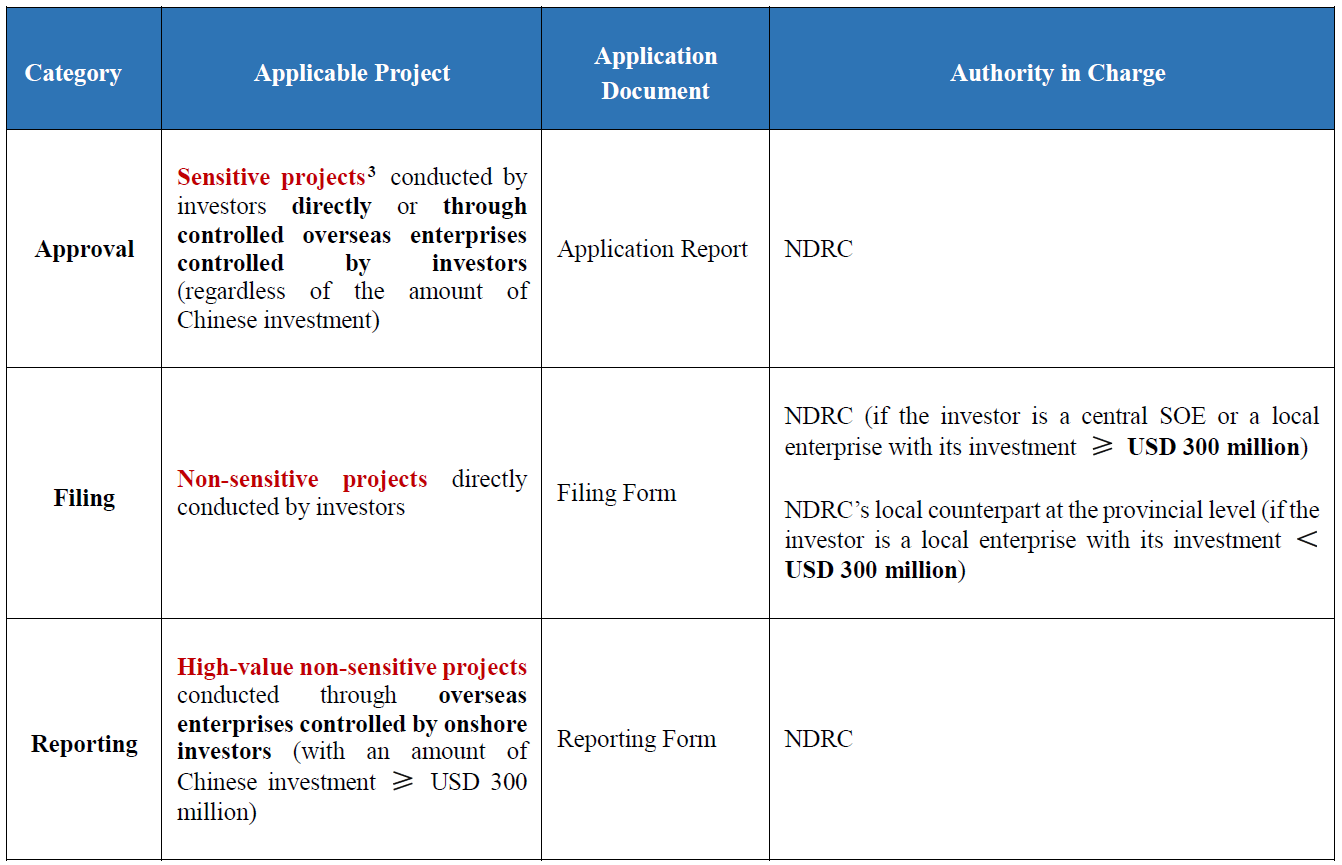

According to Decree 11, depending on the nature of the projects, the project formalities may be subject to three different administration categories: approval, filing or reporting.

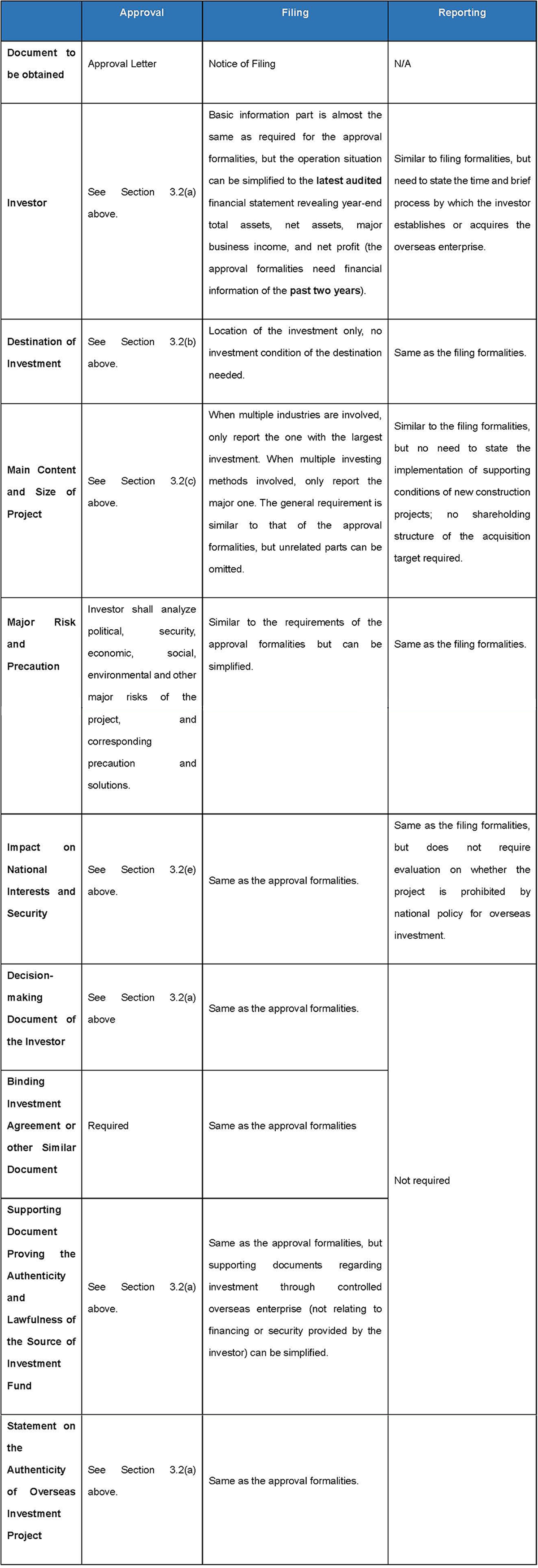

Among the above three administration regimes, approval is the most demanding way of administration. The application for the projects subject to approval need to be conducted through the submission of an application report to NDRC, while the application for the projects subject to filing and reporting only require the submission of a filing form. Hence, this article mainly focuses on the requirements for the approval formalities, and also briefly compares the difference of the requirements for application documents under the three formalities.

2) Key Points of the Application for Projects Subject to Approval

This section summarizes the key points of the application for projects subject to the approval formalities from the following five aspects: (a) investor, (b) investment destination, (c) main content and size of project, (d) investing and financing plan and (e) impacts of the project on the national interests and national security of China.

(a) Investor

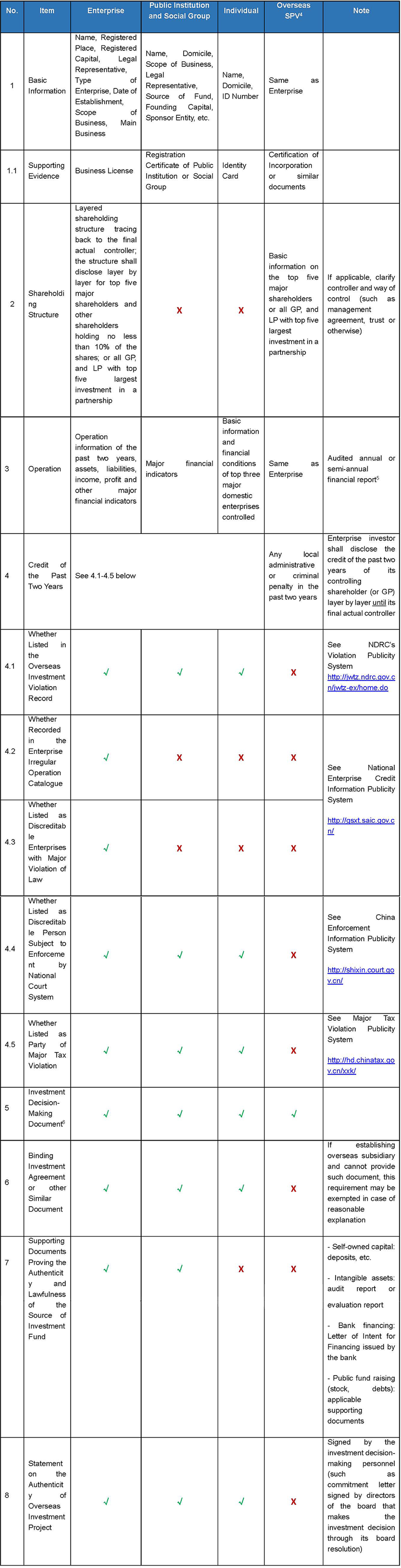

The NDRC requires different application documents for different types of investors, details of which can be found in the table below. (Note: documents needed are marked as “√” and documents not needed are marked as “X”):

(b) Investment Destination

Please note that there are three kinds of destinations in the application report:

(i)Direct destination

(ii)Final destination

(iii)Other relevant country and region

Below is an example7

A domestic enterprise A forms an enterprise B in Country X, and enterprise B forms an enterprise C in Country Y, and enterprise C enters into an agreement to purchase shares of an enterprise in Country Z. In this case, the investor shall clarify the entire path of investment, and the direct destination of this project is Country X, the final destination is Country Z while Country Y is a relevant country and region.

If multiple countries and regions are involved in an investment, investors are required to clarify the investment condition of each country and region along the path of investment in the following aspects:

(i)Whether the political and security conditions of the destination are suitable for the investment. (NB: This is the NDRC’s main concern which needs to be elaborated in great detail)

(ii)Any prohibition or restriction in the laws, regulations and access and regulatory policies of the destination. (NB: This is NDRC’s main concern which needs to be elaborated in great detail.)

(iii)Natural resources, infrastructure, economic and financial situation, social and cultural environment.

(c) Main Content and Size of a Project

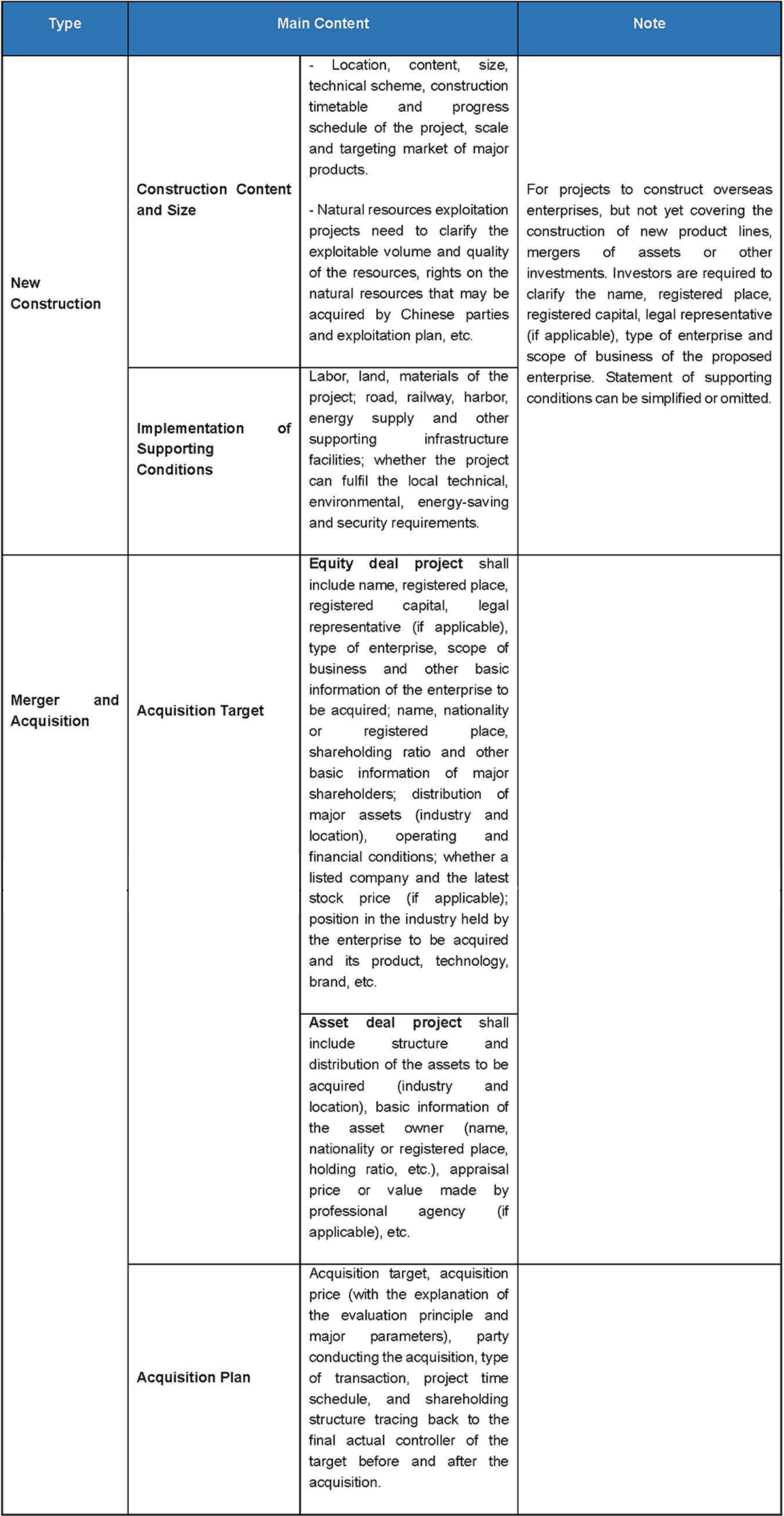

According to the Guidelines, the main content and size of a project is divided into two types: new construction and merger and acquisition.

(d) Investing and Financing Plan of the Project

The amount of intermediate financing and security in complex investing and financing plans shall be calculated based on the principle of “substance over form” and the characteristics of the project, to avoid repetitive computation.

Below is an example8

A Chinese investor A plans to acquire certain assets with a value of USD 2 billion (which is also the final acquisition price). Investor A is a domestic enterprise, B is A’s controlled overseas enterprise. Apparently A has invested (deemed as A’s direct investment): ① USD 500 million self-owned capital, ② USD 500 million provided to B as shareholder loan, ③ USD 500 million provided to B as security; B has invested (deemed as A invests through B):④ USD 500 million self-owned capital; ⑤ USD 500 million borrowed capital (shareholder loan provided by A); ⑥ USD 500 million borrowed capital (bank loan, secured by A). Substantially, ② and ⑤ refer to the same sum of fund, and ③ and ⑥ refer to the same sum of fund. Therefore, when applying the “substance over form” principle, the amount of Chinse investment is ①+②+③+④=USD 2 billion, not a simple accumulation of the above amount ( ①+②+③+④+⑤+⑥=USD 3 billion). The direct investment of the investor is ①+②+③= USD 1.5 billion.

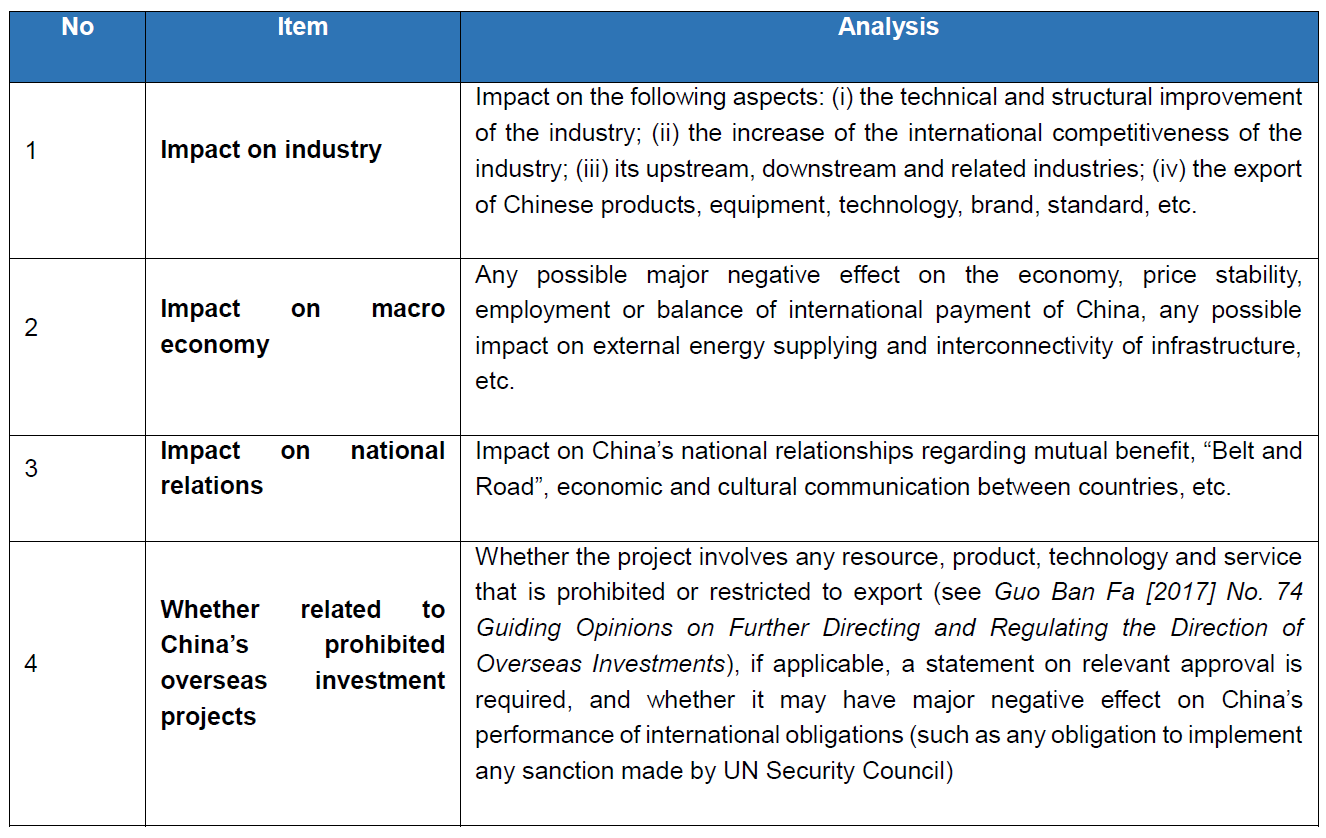

(e) Impacts on National Interests and Security

5. JunHe Comments

In general, the Guidelines issued by the NDRC provide quite clear and detailed instructions on the required information and procedures for the application for overseas investment projects.

Meanwhile, the NDRC also specifies in the Guidelines the key points that are subject to its review, which are the five aspects mentioned in this article, and make it easier for investors to prepare the application accordingly.

It can be seen from the Guidelines that the NDRC’s requirements on the application for projects subject to approval, filing and reporting are different.

As such, based on the understanding of different application requirements under different administration regimes, an enterprise may focus on preparing the necessary information and materials, so as to improve the efficiency of its application for overseas investment projects.

ZHENG, Yu, Partner, Jun He

zhengy@junhe.com

1. The ancillary template documents for the Measures for the Administration of Overseas Investment of Enterprises include the following 15 documents: (1) Standard Text of Overseas Investment Project Application for Approval or Filing, (2) Model Text of Overseas Investment Project Application Report, (3) Standard Text of Overseas Investment Project Approval, (4) Standard Text of Overseas Investment Project Filing Form, (5) Standard Text of Overseas Investment Project Filing Notice, (6) Standard Text of Overseas Investment Project Modification Filing, (7) Standard Text of Overseas Investment Project Modification Approval or Notice, (8) Standard Text of Overseas Investment Project Extension Filing, (9) Standard Text of Overseas Investment Project Extension Approval or Notice, (10) Standard Text of Overseas Investment Project Relevant Information Filing, (11) Standard Text of High-value Non-sensitive Overseas Investment Project Report Form, (12) Standard Text of Major Adverse Event Reporting Form of Overseas Investment Project, (13) Standard Text of Completion Report Form of Overseas Investment Project, (14) Sample Shareholding Structure Tracing Back to the Final Actual Controller of an Investor and (15) Standard Text of Statement on Authenticity of Overseas Investment Project.

2. See “Model Text of Overseas Investment Project Application Report” Page 10.

3. “Sensitive project” under Decree 11 means a project involving a sensitive country or region; or a sensitive industry. “Sensitive country or region” means:

(1) a country or region without diplomatic relations with China;

(2) a country or region in war or civil disturbance;

(3) a country or region in which enterprises are restricted from investment under any international treaty or agreement, among others, concluded or acceded to by China; or

(4) any other sensitive country or region.

According to the NDRC’s “Catalogue of Sensitive Industries of Overseas Investment” (Fa Gai Wai Zi [2018] No. 251) which came into effect on March 1, 2018), “Sensitive industry” means:

(1) research, production or maintenance of weapons;

(2) exploitation or utilization of cross-border water resources;

(3) news media; or

(4) other industries in which enterprises are restricted from investment according to Notice of the General Office of the State Council on Forwarding the Guiding Opinions of the National Development and Reform Commission, the Ministry of Commerce, the People’s Bank of China and the Ministry of Foreign Affairs on Further Directing and Regulating the Direction of Overseas Investments (Guo Ban Fa [2017] No. 74): real estate, hotels, cinemas, entertainment, sports clubs, and equity investment funds or investment platforms set up overseas without any specific industrial project.

4. For projects conducted through an overseas enterprise controlled by the investor, the application documents shall clarify the information of such overseas enterprise. Where more than one controlled overseas enterprise is involved, the documents shall clarify the information of the enterprises one by one through the controlling chain.

5. In case the investor is a newly formed enterprise, the investor shall provide the latest audited financial statement of the controlling shareholder, general partners or actual controller.

6. As required in the Model Text of Overseas Investment Project Application Report, the “Investment Decision-Making Document” means:

(1) For domestic enterprises, relevant decision-making document based on the actual situation of the enterprise (Article of Association, management policy, etc.), such as board resolution, investment committee resolutions. If part of the decision-making authority is at the hand of the controlling shareholder or actual controller of the investor, then provide applicable document based on which the controlling shareholder or actual controller make such decision.

(2) For domestic public institutions or social groups, relevant decision-making document based on the actual situation of the entities.

(3) For domestic individuals, relevant decision-making document or written statement.

(4) For projects conducted through overseas enterprise controlled by investors, also provide board resolution or other similar document of the overseas enterprise.

7. See “Model Text of Overseas Investment Project Application Report”

8. See “Model Text of Overseas Investment Project Application Report”

.jpg)