9 January, 2019

1. Introduction

Directors are elected by the shareholders to manage the company and are directly and collectively accountable to the shareholders of the corporations. Directors’ remuneration is taken as an incentive for the directors and usually attractive enough to influence the directors to come up with strategies and decisions which in turn have an impact on the performance and profitability of the company. Based on the study conducted by KPMG, non-executive directors’ remuneration in Malaysia has increased by 8% per annum from 2009 to 2017 i.

This begs the question whether director’s performance always measure up to their hefty remuneration and whether there is a link to the directors’ remuneration and the performance of the company. Earlier this year, a shocking announcement was made when the salary of the CEO and Chairman of GoPro Inc. was reduced to a minimal of $1 and no cash bonus for 2018 due to the poor performance of the company in 2017 ii.

2. Directors Remuneration in Malaysia

In Malaysia, the director remuneration is principally governed under Section 230 of Companies Act 2016 (“CA 2016”).

Any fees and benefits payable to the director of public listed companies (“PLCs”) must be approved by the shareholders while for the directors of private companies, subject to its constitution, it needs only to be approved by the Board iii. For PLCs, under the listing requirements of the Main Market of Bursa Malaysia Securities Berhad (“MMLR”), non-executive directors shall be paid by fixed fees and not by a commission on or percentage of profits or turnover whereas for executive directors, the salary may not include a commission on or percentage of turnover iv.

Under the Malaysian Code for Corporate Governance (“MCCG”), the Board must have a proper policies and procedures in determining the remuneration of directors, which considers, among others, the performance of the companyv and a remuneration committee consisting of independent directors is proposed for that purpose vi.

Please click on the tables to enlarge.

3. Link between Directors’ Remuneration and Performance of the Company

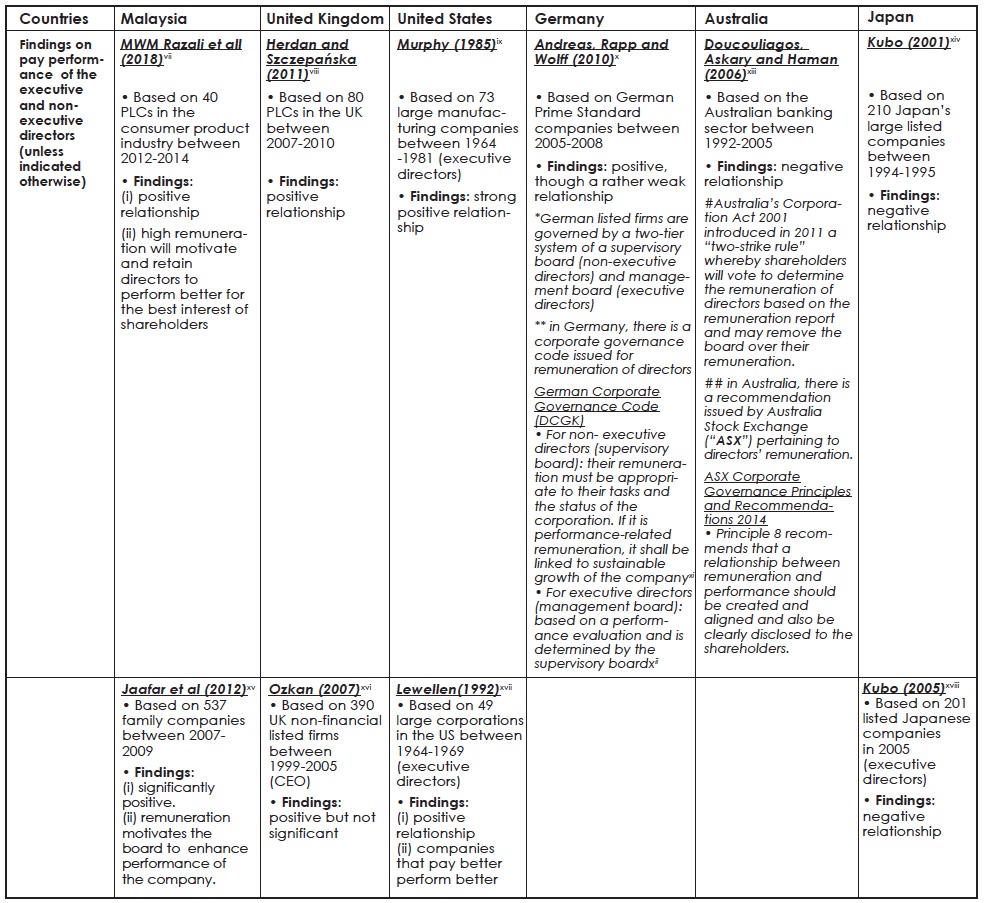

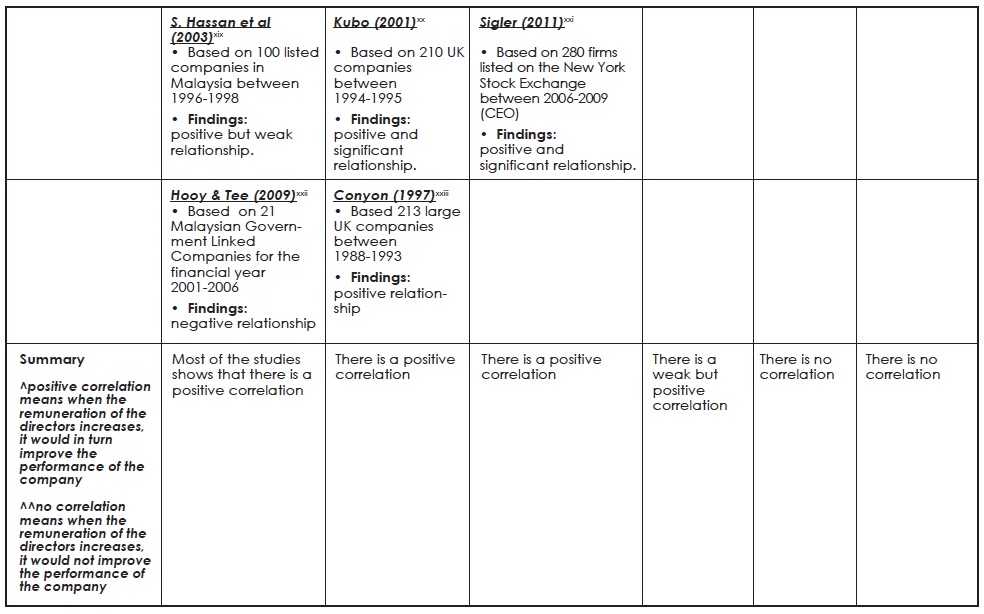

The table above seeks to compare selective empirical studies conducted in Malaysia, United Kingdom, United States, Germany, Australia and Japan on whether the directors’ remuneration affect the performance of the company and to find any link between the two, also known as “Pay-performance”.

It is not known whether the sample companies used in the studies below determined the remuneration based on past performance of the company or otherwise. The studies however, have simply compared the remuneration with the performance of the company for a prescribed period.

4. Conclusion

By and large, Boards can be said to be motivated to improve performance when the pay commensurate with their effort. However, it is interesting to note that in Japan, the correlation between pay and performance is negative. Likewise in Malaysia, one study found a negative relationship in GLCs. One could interpret it in many ways, including: in good or bad times, directors’ remuneration remain the same; or the directors remuneration is high regardless of performance; Noting the various commentaries in the news post-GE 14 on high remunerations enjoyed in some GLCs and the re-shuffling of others, it lends support such finding.

For further information, please contact:

Rosinah Mohd Salleh, Partner, Azmi & Associates

general@azmilaw.com

i KPMG Report on Non-Executive Directors’ Remuneration2017.

ii “GoPro CEO salary slashed to $1 after poor 2017” published on 27 April 2018 in Financial Times

https://www.ft.com/content/2c2de7f0-4972-11e8-8ee8-cae73aab7ccb

iii Section 230 CA 2016

iv Paragraph 7.23 of the MMLR

v Practice 6.1 MCCG

vi Practice 6.2 MCCG

vii MWM Razali, Ng S.Y., Yau T.H., AH Tak, N Kadri (2018) Directors’ Remuneration and Firm’s Performance A Study on Malaysian Listed Firm under Consumer Product Industry.

viii Herdan and Szczepańska (2011) Directors Remuneration And Companies’ Performance The Comparison Of Listed Companies In Poland And UK.

ix Murphy (1985) Corporate performance and managerial remuneration: An empirical analysis.

x Andreas, Rapp & Wolf (2010) Determinants of Director Compensation in Two-Tier Systems: Evidence from German Panel Data.

xi DCGK 5.4.6

xii DCGK 4.2.2

xiii Doucouliagos, Askary and Haman (2006) Directors’ Remuneration And Performance In Australian Banking.

xiv Kubo (2001) The Determinants of Executive Compensation in Japan and the UK: Agency Hypothesis or Joint Determination hypothesis?

xv SB Jaafar, EAA Wahab, K James (2012) Director Remuneration and Performance in Malaysia Family Firms: An Expropriation Matter?

xvi Ozkan (2007) CEO Compensation and Firm Performance: An Empirical Investigation of UK Panel Data.

xvii Lewellen, Loderer, Martin and Blum (1992) Executive Compensation and The Performance of the Firm.

xviii Kubo (2005) Executive Compensation Policy and Company Performance in Japan Corporate Governance: An International Review,

xix S Hassan, Christopher and Evans (2003) Directors' Remuneration and Firm Performance: Malaysian Evidence.

xx Kubo (2001) Supra Note 14

xxi Sigler (2011) CEO Compensation and Company

Performance.

xxii Hooy C. W. and Tee C. M. (2009) Directors’ Pay-Performance: A Study on Malaysian Government Linked Companies.

xxiii Conyon (1997) Corporate governance and executive compensation.