26 April, 2019

With the objective of promoting ease of doing business in India, the Reserve Bank of India ("RBI") has simplified and liberalised the erstwhile framework on external commercial borrowings/foreign currency denominated loans ("ECB") and the rupee denominated loans by notifying the Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 ("ECB Regulations"), on December 17, 2018. The ECB Regulations have repealed the Foreign Exchange Management (Borrowing or Lending in Foreign Exchange) Regulations, 2000, and the Foreign Exchange Management (Borrowing or Lending in Rupees) Regulations, 2000 (collectively the "Erstwhile Framework").

The ECB Regulations together with the RBI circulars dated January 16, 2019 and February 7, 2019, and the Master Directions on External Commercial Borrowings, Trade Credits and Structured Obligations dated March 26, 2019, issued by RBI constitute the new framework on ECBs and the rupee denominated loans ("New ECB Framework") and has been made effective from January 16, 2019.

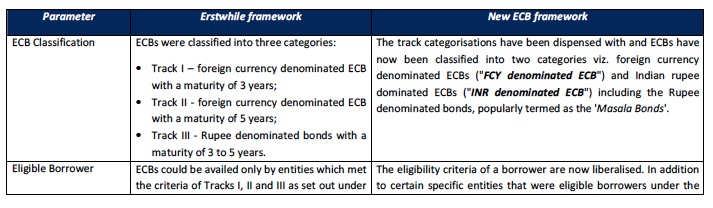

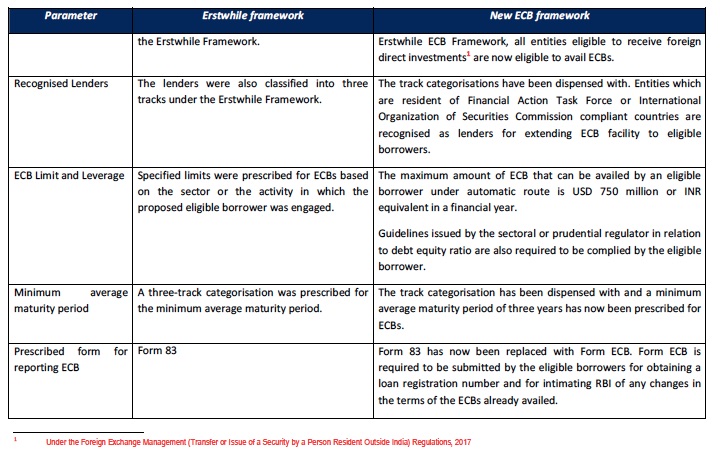

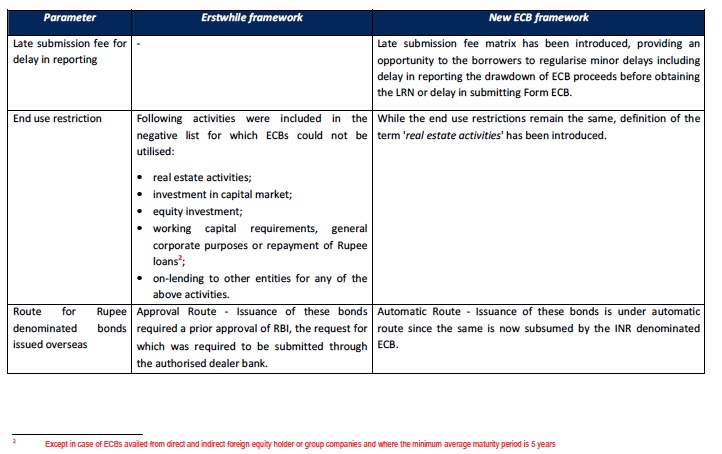

Tabulated below is a comparative analysis of certain ECB parameters under the Erstwhile Framework vis-à-vis the New ECB Framework:

Please click on the table to enlarge.

OUR VIEW

Dispensation of the track categorisation is a welcome change and should significantly simplify the process of ascertaining the criteria for availing ECBs, thereby providing an impetus to the debt funding route through ECBs for the Indian industry. Further, considering that the ECB facility can be availed by all entities who are eligible to receive FDI, certain entities which could not have otherwise availed ECBs under the Erstwhile Framework have now become eligible to avail ECBs.

Nishtha Mehta, Rajani Associates

nmehta@rajaniassociates.net