23 December, 2019

During a merger and acquisition (M&A) transaction, the parties – particularly the acquiring party – must analyze a great deal of information. The timeframe allotted for completing this due diligence may often be short, relative to the amount of information to be reviewed and analyzed. This is a problem for companies with intricate, global supply chains and extensive foreign sales activities both because of the volume of information that must be examined and because country-specific insight is required to fully evaluate the target’s worldwide activities.

As M&A acquirers trend toward shorter due diligence periods in order to remain competitive during the bidding process, they must properly evaluate risk, considering the potential for successor liability and current enforcement posture of anti-corruption and bribery (ABC) laws.

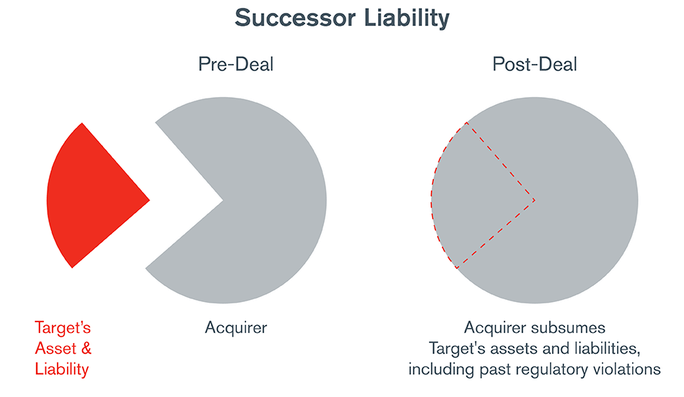

What is M&A Successor Liability?

In an M&A transaction, the acquiring company takes on more than the acquisition’s assets and operations—it also takes on its liabilities. If the acquisition target has a global footprint, then the acquirer must evaluate issues under the Foreign Corrupt Practices Act (FCPA), as it would absorb the target company’s ABC responsibilities and transgressions. This is true not only for ongoing anti-corruption violations, but also for violations that occurred prior to the M&A transaction. Violations can result in regulatory penalties, such as fines and imprisonment, which can lead to reputational fallout, brand damage and market value decline.

Although the U.S. government actively enforces criminal penalties for violations of the FCPA, it does not wish to impede companies undertaking M&A activity. Consequently, the U.S. Department of Justice (DOJ) has provided added clarity for the responsibilities of the acquirer. Generally, the earlier any FCPA issues are identified and disclosed to the DOJ, the more favorable the DOJ’s treatment will be to any misdeeds that were uncovered.

How to Identify and Handle Target FCPA Violations

In April 2016, the DOJ announced its pilot Corporate Enforcement Policy, with its most recent update announced in November. The policy provides incentives for companies that take certain actions after discovering an FCPA violation.

If disclosed, and the discloser fully cooperates with the DOJ, makes timely and appropriate remediation, and there are no aggravating circumstances present (for example, the nature and seriousness of the offense or whether the offender is a criminal recidivist), there is a presumption of declination of prosecution. If all factors are met, but there are aggravating circumstances, the reporting company is eligible for a 50% reduction in fines as per the sentencing guidelines. If there is no self-disclosure, but the company fully cooperates and engages in timely and appropriate remediation, then there is the potential for a 25% reduction in fines.

|

Credit for FCPA Violations |

||||

|

Full Cooperation |

Yes |

Yes |

Yes |

Yes |

|

Timely and Appropriate |

Yes |

Yes |

Yes |

|

|

Self-Disclosed |

Yes |

Yes |

|

|

|

No Aggravating Circumstances |

Yes |

|

|

|

|

DOJ Recommended Action |

Declination of Enforcement |

50% Reduction in Enforcement Fines |

25% Reduction in Enforcement Fines |

No Reduction in Enforcement Fines |

DOJ Recommended Action Declination of Enforcement 50% Reduction in Enforcement Fines 25% Reduction in Enforcement Fines No Reduction in Enforcement Fines

The most important factors are that the disclosure was voluntary (and not compelled by law, contract or court order), the discloser fully cooperates with the DOJ and that remediation was timely and appropriate. The DOJ’s most recent clarification of the Corporate Enforcement Policy incentivizes the acquirer to report all relevant facts known to at the time of disclosure, regardless of whether it has fully completed investigating the subject misconduct.

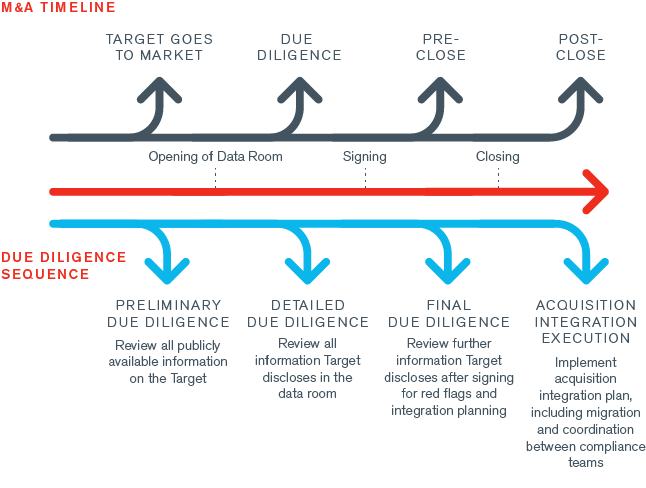

Disclosing material FCPA issues in a timely manner requires acquirers to review target company information. Specific information will become available as the M&A transaction progresses. Prior to the target’s data room opening, the acquirer will only be able to evaluate publicly available information. As the data room opens, the target should disclose material relationships with key suppliers, customer and distributors, as well as materials on its compliance program and any known material issues. If the acquirer favorably reviews this information and its offer to purchase the target is accepted, the companies will sign a purchase agreement. After signing of this purchase agreement, but before closing of the transaction, the acquirer should receive additional information about other international contractual relationships and its compliance program.

Standard M&A Transaction Sequence and Information Availability

Based upon the standard deal sequence and how information access increases incrementally throughout this deal process, it is paramount to have a focused, comprehensive due diligence plan. This will identify issues quickly, escalate any issues found to acquirer’s leadership, and allow the best opportunity to mitigate the risk of prolonged and often messy FCPA enforcement actions.

Proposed Developments to the FCPA

In July 2019, several U.S. congressional representatives proposed legislation that, if passed, would be known as the Foreign Extortion Prevention Act (FEPA). The FEPA would essentially expand the bribery-related prohibitions of the FCPA by penalizing any foreign official who demands or accepts a bribe. As it currently stands, the FCPA targets only the individual or corporation offering a bribe to a foreign official.

Should the FEPA pass, it would not functionally increase the scope of due diligence, but companies doing business outside of the U.S. need to be aware of the additional category of individuals who are subject to fines and imprisonment.

Additionally, under the FCPA Corporate Enforcement Policy, one of the aggravating circumstances that would undercut the impact of a voluntary disclosure is recidivism. Because the FEPA criminalizes bribe taking, if a target contracts with a foreign distributor that is working with a government official who is known to have taken bribes, the target could potentially be considered a recidivist under the FCPA. This would increase the footprint of accountability for acquirers by extending it beyond the employees or agents of the target to individuals with whom these employees or agents conduct business.

Given the increased focus on successor liability and potentially expanded scope of who may be liable, acquiring companies need to ensure that their due diligence process for M&A transactions is sufficient. Acquirers need to develop strategies and techniques fully and efficiently in light of how the FCPA is being enforced.

Kroll, a division of Duff & Phelps, and Duff & Phelps have a streamlined approach to M&A due diligence that combines contract review with regulatory due diligence. By marrying the two, we provide a dynamic report showing an acquisition’s cross-border value at risk. The result is a deal team equipped with actionable information about a target’s contract and international anti-corruption posture.

For further information, please contact:

Richard Dailly, Managing Director, Investigations And Disputes, Kroll Associates (S) Pte

rdailly@kroll.com