12 February, 2020

Fundamental strengths to drive recovery from a short-term slowdown

Healthcare and life sciences is a robust market. Though it’s not immune to the economic and geopolitical headwinds affecting all industries, its underlying strength will continue to promote dealmaking.

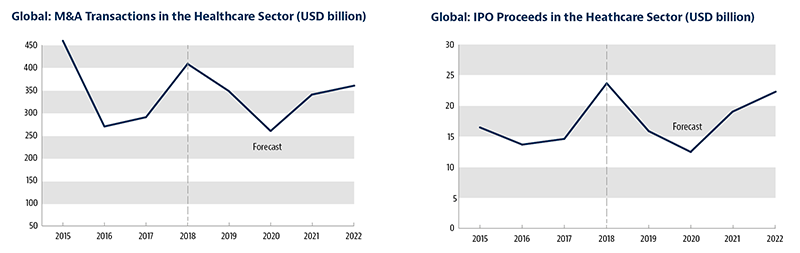

Following a robust 2018, dealmaking activity in the sector witnessed a modest rise in 2019.

Our Global Transactions Forecast, compiled in collaboration with Oxford Economics, reflects this. We expect healthcare M&A values to total USD 391 billion in 2019 – a rise from USD 366 billion the previous year.

Volatility returned to the equity markets, with IPO proceeds in this sector falling to USD 16 billion, from USD 23 billion last year.

“The global transactions boom is leveling out, and a cyclical downturn looms,” says Head of the International Capital Markets Practice in Asia Pacific, Ashok Lalwani.

The cautious mood that defined 2019 will sustain into 2020. Our forecast is for M&A values to slow in 2020, to USD 267 billion.

Ben McLaughlin, Chair of Baker McKenzie’s Global Healthcare & Life Sciences Group, says macro forces are driving this slowdown, not sector-specific causes:

“The US election, stock markets at an all-time high, trade tensions between the US and China, and ongoing Brexit uncertainty — these factors are holding investors back.”

The good news is that the deceleration should be more muted than in other industries. Then starting in 2021, we expect a recovery in M&A and IPO volumes, as the global economy stabilizes and investor confidence returns.

Please click on the image below to enlarge.

MEGADEALS PERSIST DESPITE THE SLOWDOWN

There were some eye-catching deals in 2019. For instance, Takeda, Japan’s largest pharmaceutical firm, bought Ireland- based Shire for USD 77 billion — by far the largest-ever foreign buyout by a Japanese company.

We’ve also seen megadeals in the medical devices space, says M&A Partner Jane Hobson, who sits on Baker McKenzie’s Global Healthcare & Life Sciences Steering Committee.

At the same time, a number of blockbuster mergers are pending. These include Bristol-Myers Squibb’s USD 93 billion bid for Celgene, and the transaction between GSK and Pfizer to form a new world-leading Consumer healthcare joint venture.

Of course, proposed megadeals like these must overcome stringent regulatory hurdles if they’re to go through. But their announcements highlight the strong structural drivers of the healthcare and life sciences M&A market.

MULTIPLE FACTORS DRIVING ACQUISITIONS

According to our experts, high costs and disruptive business models will bring about consolidation of core pharmaceutical products, and divestment of non-core offerings.

Companies are also looking to boost their oncology pipelines — in immuno-oncology in particular, according to Hobson.

She also points to the substantial liquidity available among private equity investors:

“PE funds are looking for buy- and-build targets in new sectors. Pharma players with established products will attract investment, as there’s no drug development risk. Plus, any uninvested products in their portfolios will represent growth opportunities as another factor driving acquisitions in this sector.”

A recent example of this can be seen in Platinum Equity’s USD 2.1 billion acquisition of leading diabetes specialist LifeScan from Johnson & Johnson.

Hobson highlights another growth area. Given the increase in successful drug development by biotechs, and the money available to fund smaller players’ development and commercialization activities, we’ll also see deals driven by the need to acquire those commercialization skills,” she suggests.

One interesting trend will be the growth of venture lending as an alternative to equity purchases. Low interest rates are expected to encourage venture lending to cross over from digital health and biotech into pharma and medical devices and potentially be used to help smaller firms through approval processes.

DATA AND BIOTECH WILL BE SECTOR HOTSPOTS

As deals pick up starting in 2021, digital health is likely to be the most active sector.

“The major players are all making tech bets,” says McLaughlin. “And they’re investing in a broad range of technologies:

not just digital propositions like aggregated data, AI and telemedicine, but also medical devices, pathology, radiology and medical imaging.”

Pharma firms and medical device manufacturers are acquiring data-led tech propositions — and vice versa. However, increasing data protection regulation around the world may be a barrier to some of these deals.

Meanwhile, biotech is set to be a growth area in China, says M&A Partner Tracy Wut:

“There’s a growing tendency to take risks on less developed products.”

It’s a move being driven by a number of factors: government policy, availability of domestic and international private capital, the return of Chinese talent to the Chinese market and increasing demand for better and more effective treatment.

For similar reasons, single-purpose drugmakers will be an IPO hotspot, says McLaughlin. “This is the innovative end of the market as big pharma reduces R&D spend. Once niche producers develop a drug, they’ll need to raise funds to commercialize it, and to begin developing the next one.”

EMERGING MARKET TRENDS REFLECT LOCAL CONDITIONS

Lalwani underlines the growth potential for healthcare and life sciences across South Asia:

“The region has many emerging markets, with burgeoning middle classes who are demanding healthcare services, and can increasingly afford them.”

As an example, he points to “Modicare,” the Indian government’s introduction of health insurance for 500 million people in 2018.

A lack of infrastructure in these markets will focus investment on hospitals and clinics, telemedicine, and drone delivery of medicines, he forecasts.

On the downside, banking and corporate scandals in several Asian countries have damaged trust in the capital markets. These could hamper IPO activity in the region.

Hospitals and clinics are set to become a particular hotspot in China, and are attracting investment from hospital groups and private equity funds from across the world thanks to three key trends: urbanization, the rising middle class and an ageing population.

The trend for consolidation will be prevalent in the country. “The Chinese market is fragmented, with large numbers of domestic players. And the government is pushing them to be more efficient, to lower the price of healthcare, while increasing their regulatory burden. This will encourage restructuring and consolidation,” says Wut.

REGULATION PRESENTS THREATS AND OPPORTUNITIES

The regulatory landscape is a potential challenge to transaction volumes, with tightening foreign investment controls in a number of jurisdictions, making deal outcomes harder to predict.

“This will trigger caution from investors, particularly Chinese players, given the restrictions in their home jurisdiction.

And with ongoing trade tensions between China and the US, we expect low levels of Chinese investment in American healthcare and life sciences businesses,” Hobson says.

On a more positive note, Wut underlines two positive regulatory developments in China: the streamlining of the drug approval process, and the abolition of certain rules on joint ventures. “These won’t be transformative, but they should make the outlook rosier for healthcare and life sciences deals,” she says.

Meanwhile, the regulatory agenda for digital health IPOs will be dominated by data protection and cyber risk.

“Ask healthcare leaders what keeps them awake at night, and their top two answers are data privacy and cyber threats,” says McLaughlin. These concerns will dampen listings to an extent.

“Data aggregation and analytics have enormous potential to transform healthcare,” McLaughlin explains. “But governments are regulating on what can and can’t be done with personal data. It’s a tension that needs to play out.”

In this climate, however, there are opportunities for firms with data protection and cybersecurity offerings tailored to the needs of healthcare and life sciences businesses.

What’s more, new EU regulations on biosimilar drugs could encourage IPOs. Biosimilars are a new battleground for pharmaceutical companies.

“Europe is the first region to relax regulation around them, which could make European manufacturers attractive investment targets,” says McLaughlin

LICENSING TO REMAIN A CENTRAL GROWTH STRATEGY

In the healthcare and life sciences industry, licensing is a mainstay of businesses’ efforts to supplement their R&D, and extend the reach of their technologies.

According to Randall Sunberg, Head of Baker McKenzie’s

North America Healthcare & Life Sciences Group, licensing and collaboration arrangements will play a major role in the market over the next few years — particularly in the biotech space.

“Investors in many privately held and VC-backed biotech firms are looking for their exit moment. As M&A and IPO markets soften in 2020, that exit may not be so readily available. Licensing is a good way to move a company closer to that point, by making it a more attractive acquisition, or a more compelling IPO proposition,” says Sunberg

A further driver of licensing deals will be new and emerging technologies, such as gene therapy, gene editing and CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats). “Innovation in this area is so fast, and so powerful, pharma companies are desperate to be at the forefront,” says Sunberg. “Licensing is an effective way for them to stay at the cutting edge.”

“Another hot area is predictive medicine and companion diagnostics. This will lead to IP licensing and collaboration opportunities in arenas such as biomarkers, with companies looking to develop more targeted products, and needing to leverage licensing and collaboration arrangements to do so,” he adds.

Sunberg says it’s an area that faces regulatory barriers, however:

“Authorities in many jurisdictions are raising the bar for evidence of a product’s effectiveness in connection with decisions about pricing and reimbursement.”

These hurdles aside, we can expect licensing and collaboration to remain central to the healthcare and life sciences deals landscape in the coming years.

A recent example of this is Gilead’s USD 5 billion R&D pact with Galapagos, which allows them to gain access to a portfolio of compounds, including six molecules currently in clinical trials, more than 20 preclinical programs, and a drug- discovery platform.

As we head into 2020, healthcare and life sciences — like all industries — will see transactions cool. But as the winds of uncertainty die down, the sector’s deals market will prove a fertile hunting ground.

For further information, please contact:

Ben McLaughlin, Partner, Baker & McKenzie

Ben.McLaughlin@bakermckenzie.com