6 October 2020

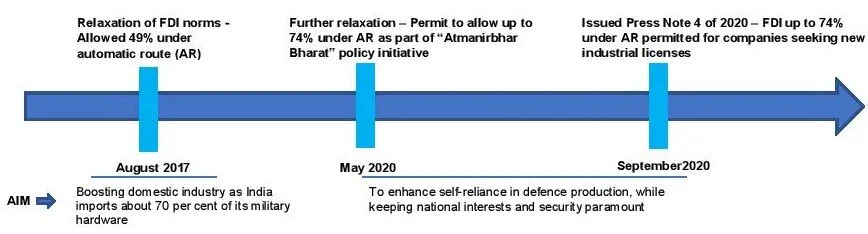

The Indian defence sector has been the third least popular sector for foreign direct investment (FDI). The Indian foreign direct investment policy has been revised with a view to increasing the inflow of foreign direct investment in the defence sector. The Department for Promotion of Industry and Internal Trade (DPIIT) has issued a press note to announce an increase of foreign direct investment limit in defence sector under the automatic route (that is without governmental approval) from 49% to 74%. In this update, we will briefly highlight the key changes proposed in relation to the increase of the FDI limit for the defence sector and potential issues. The policy change will come into effect upon notification of the press note no. 4 of 2020 under the Foreign Exchange Management Act (FEMA).

Click here to enlarge the image.

The key conditions for foreign direct investment in the defence sector as per the revised policy will be:

(a) For companies seeking new industrial licenses –

i. FDI will be permitted under the automatic route up to 74%

ii. Above 74%, fresh FDI will be permitted further to government approval and such fresh FDI should result in access to modern technology or provide other reasons for investment above the 74% limit.

(b) For existing investments, where the investee company has already obtained industrial license or governmental approval for FDI –

i. infusion of fresh FDI up to 49% by way of a change in the shareholding of the company or by transfer of capital to a new investor, such company shall be required to disclose such fresh foreign investment to the Ministry of Defence within 30 days of such infusion of foreign investment

ii. any transaction that would increase the FDI in the company to beyond 49% will require prior government approval

Therefore, Indian defence sector companies which already have FDI will continue to be bound by the existing provisions and the expansion of FDI permitted under the automatic route up to 74% is only to encourage the entry of entities seeking new industrial licenses in the sector. Another significant change is that the government may review or reject any FDI in any Indian defence company on grounds of national security even if such investment is below the varying thresholds as discussed above.

Challenges for existing investments – Additional reporting requirements to the Ministry of Defence are cast on Indian company in cases where FDI is less than 49% and is being increased to 49% thereby leading to a change in shareholding of the Indian company. In such cases, secondary transfer to new foreign investors is specifically required to be reported. However, the term “change in shareholding” may also suggest that even existing foreign investors increasing his own stake post-primary infusion in an Indian company (up to 49%) would also require reporting to the Ministry of Defence. Further, government approval would be required in such cases where such FDI is proposed to be increased beyond 49% up to the prescribed a new limit of 74%. Accordingly, the FDI amendment would not incentivize existing FDI in defence sector in terms of automatic investments.

At a conceptual level, FDI in the Indian defence sector is still fraught with some core legacy issues which would also need to be tackled head-on to make the FDI policy fruitful.

Hindsight wisdom would dictate that the notion that defence manufacturing is strategic and must be limited to Indian PSUs, Indian companies, or JVs with Indian companies holding the majority stake has not yet generated any significant economic or national security benefit. Foreign players are generally uncomfortable sharing their technology, especially in advanced defence systems, without having the majority stake in the Indian JV company and the amendment seeks to redress this grievance. However, this approach may not be effective across the entire spectrum of defence manufacturing given the heterogenous nature of the industry.

A differential treatment – Currently, FDI rules tend to treat the sector as homogeneous. The range of defence manufacturing is varied and complex – ranging from ancillary components, defence equipment components, software, fuselage, missiles to aerospace technology. Hiking FDI limits across all types of defence manufacturing may not adequately address this complexity. For instance, developing advanced defence aerospace technologies is an expensive and a very complex process involving enormous entry barriers and vast R&D. It would be advisable to look at 100% FDI under automatic route in aerospace defence to incentivize global aerospace defence players to part with their proprietary technology. Boeings investment in a 100% subsidiary in Australia is a case in point. The current 74% FDI under automatic route may be welcome for other types of defence manufacturing such as missiles, ancillary components, etc. Existing FDI investments should also get the benefit.

Being a historically sensitive sector, the efforts of the government to liberalize the sector are commendable. The intention of the proposed amendments is to encourage foreign investment in the defence sector and to facilitate the entry of new players at an industrial level while maintaining the indigenous nature of the final product.

For further information, please contact:

Souvik Ganguly, Partner, Acuity Law

al@acuitylaw.co.in

.jpg)