12 April 2021

The new investment list under Presidential Regulation No. 10 of 2021 regarding Investment Sectors (the New Investment List), which sets out new foreign investment restrictions for a raft of sectors in Indonesia, has replaced the former negative list under Presidential Regulation No. 44 of 2016 (the 2016 Negative List) since 4 March 2021. See our recent publication on the overall background and framework of the New Investment List here.

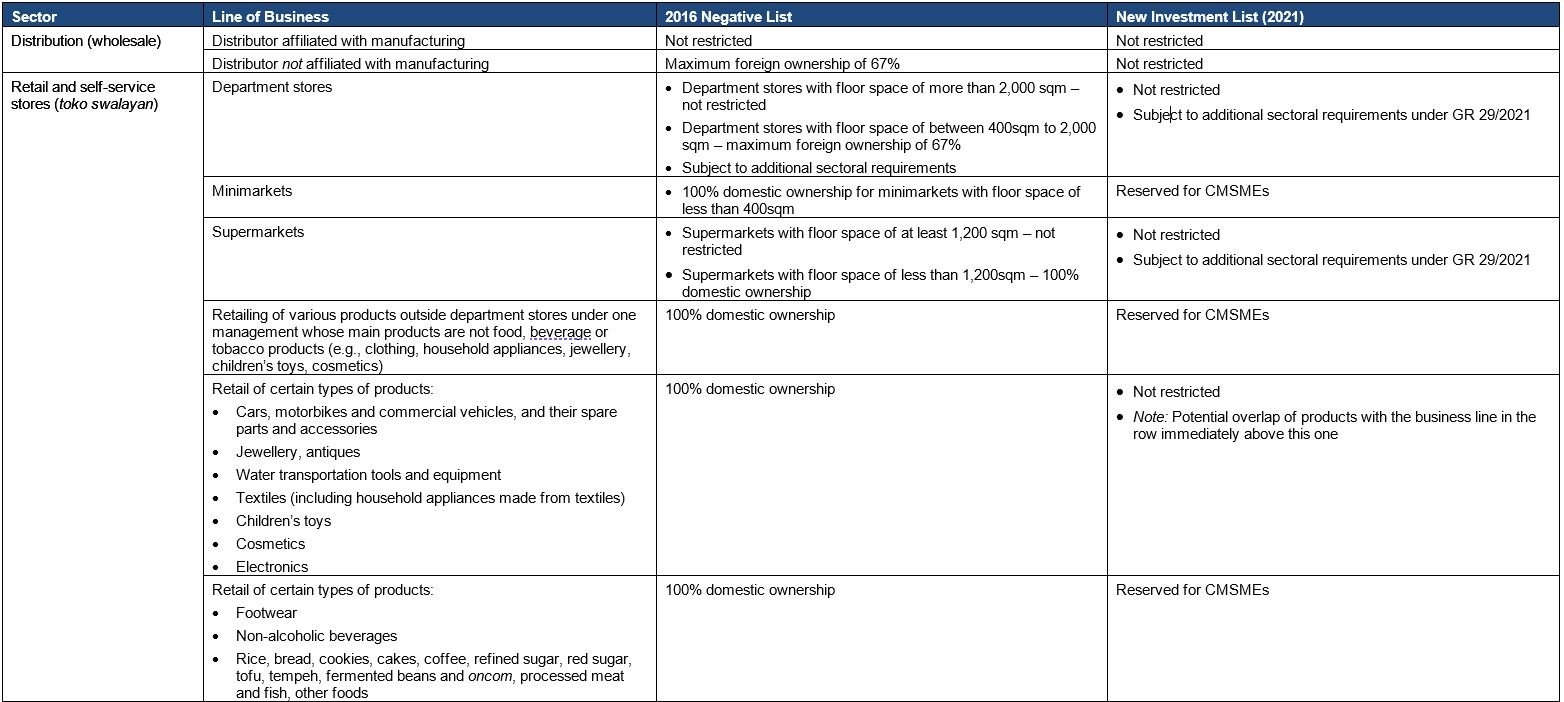

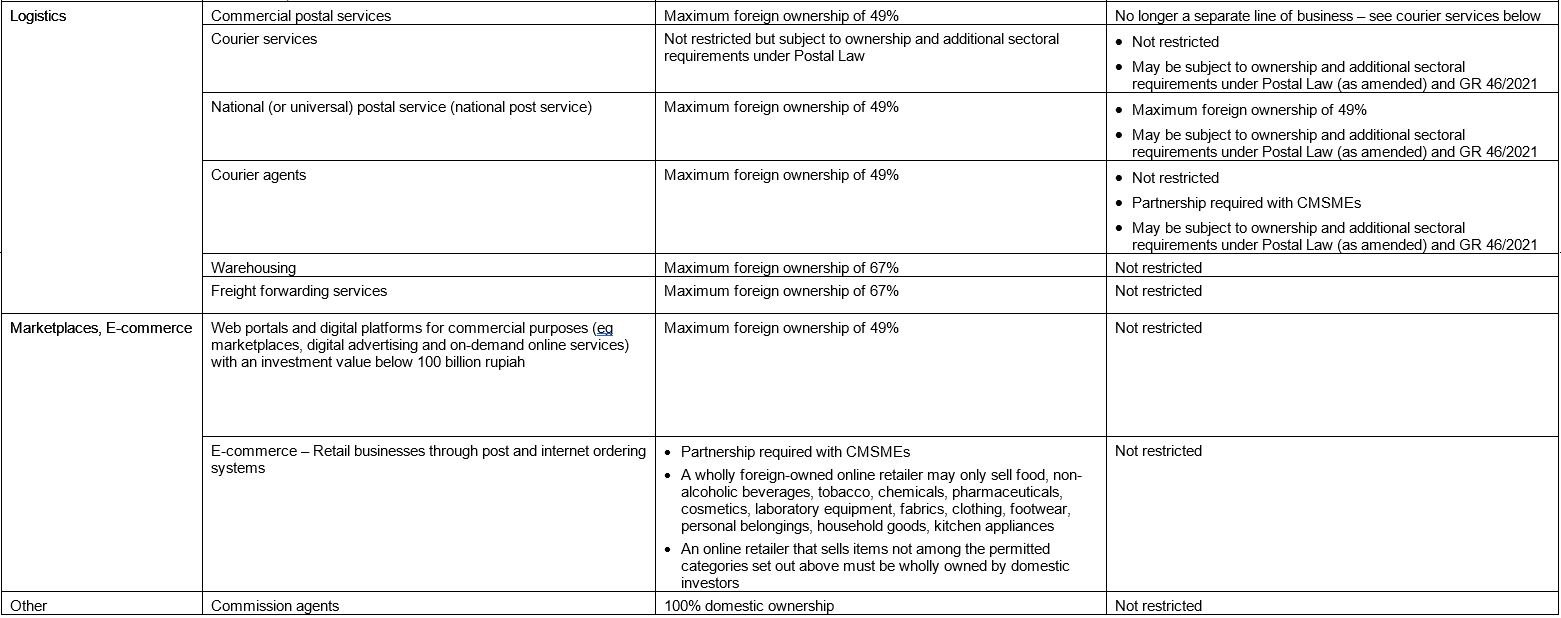

We set out below our key observations on important Foreign Direct Investment (FDI) changes under the New Investment List that are relevant to businesses operating in Indonesia’s consumer sector. We have also included a table comparing relevant foreign ownership rules under the 2016 Negative List and the New Investment List. We note that distribution of health supply products is not covered by this e-bulletin and will instead feature in an upcoming e-bulletin on the healthcare sector.

Background

Certain sector-specific laws and regulations of relevant technical ministries and regulators may continue to apply under the New Investment List regime, so long as those laws and regulations do not contradict the provisions under the New Investment List.

In the consumer sector, Government Regulation No. 29 of 2021 regarding Implementation of Trading Business Sector was recently issued, as one of the implementing regulations of the Omnibus Law (GR 29/2021). In addition, the Ministry of Trade may issue new implementing regulations amending existing trading regulations that govern distribution and retail trading in specific sectors. It may take some time to determine how the new regulations and policies of relevant regulators will interface with the new FDI rules in practice.

Key observations

Distribution (Wholesale)

The foreign ownership level that applies to wholesale distribution business has been the subject of numerous changes over the past few decades, mainly because protectionist sentiment previously favoured reserving distribution in Indonesia for local companies generally. The 2016 Negative List provided that “distribution not affiliated to manufacturing” was subject to 67 percent maximum foreign ownership, implying that “distribution affiliated to manufacturing” was 100 percent open for foreign ownership. As there was no express regulatory guidance on the meaning of “affiliated to manufacturing”, in practice, this required a foreign investment manufacturing company to be the foreign investment distribution company’s parent, sister or subsidiary company.

Importantly, the New Investment List removes the distinction between “distribution affiliated to manufacturing” and “distribution not affiliated to manufacturing” and in general has now opened up the wholesale distribution business.

Retail

Previously, foreign investment restrictions applied to the retail business, with particular restrictions imposed on certain types of self-service stores (toko swalayan), including department stores, and differentiated based on retail business floor space and the types of products sold.

The New Investment List has further opened up the retail business to 100 percent foreign ownership for (i) most self-service stores with a floor space of more than 400 sqm and (ii) most non-F&B products.

Under the 2016 Negative List, supermarkets with a floor space below 1,200sqm, and department stores with a floor space of between 400 sqm and 2,000 sqm, were capped at 67 percent maximum foreign ownership. These restrictions are no longer contained in the New Investment List. However, under GR 29/2021, floor space requirements still apply to the different types of self-service stores.

Retail sales of products expressly closed to foreign investment under the 2016 Negative List included the retailing of cars and motorbikes, and their respective spare parts and accessories. Under the New Investment List, this type of retailing is no longer restricted. Retailing of certain other products, including products sold outside department stores, footwear and most F&B products (eg rice, bread, processed food) remains closed to foreign investors, having been expressly allocated for cooperatives and micro, small and medium enterprises (CMSMEs) under the New Investment List.

Logistics services

The New Investment List appears to have liberalised most logistics services, namely, commercial postal services, courier agent services, warehousing, and freight forwarding.

Under the 2016 Negative List, postal activities were divided into four categories: (i) national (or universal) postal services managed by the government, (ii) commercial postal services, (iii) courier agent services and (iv) courier services. The first three categories were subject to a maximum foreign ownership cap of 49 percent under the 2016 Negative List.

Under the New Investment List, commercial postal services are no longer considered a separate line of business and appear to be part of the courier services business. Foreign ownership in courier agent services is no longer restricted under the New Investment List but does require partnership with CMSMEs. National (or universal) postal services remain subject to a maximum foreign ownership cap of 49 percent.

As was the case previously, courier services are not subject to any foreign ownership cap under the New Investment List, but they are subject to additional sectoral requirements under Government Regulation No. 46 of 2021 on Post, Telecommunications and Broadcasting (GR 46/2021), which is the implementing regulation of Law No. 38 of 2009 on Post, as amended by the Omnibus Law (Postal Law).

Warehousing and freight forwarding services, covering delivery of goods and packaging services in large volumes by rail, land, sea or air are now also no longer restricted and should therefore be 100 percent open for foreign ownership. Under the 2016 Negative List, these business activities were previously subject to 67 percent maximum foreign ownership.

Commission agents

The fee-based commission agency business, which was historically always closed to foreign ownership, appears to no longer be subject to any foreign ownership restrictions under the New Investment List.

Conclusion

The changes introduced by the New Investment List to the general consumer sector are significant. While it remains to be seen how these changes will be implemented in practice, they are sure to have a material impact on the traditionally complex trading supply chain in Indonesia, which currently involves numerous intermediaries, leading to major inefficiencies of both cost and process, driving up prices for Indonesian consumers and businesses.

Comparison Table

Please click on the image to enlarge.

For further information, please contact:

David Dawborn, Partner, Herbert Smith Freehills

david.dawborn@hbtlaw.com