In General

Stapled securities are two or more classes of securities issued by the same or different entities that are attached together, hence the name given. For starters, stapled structures may be listed on the stock exchange or even be unlisted.

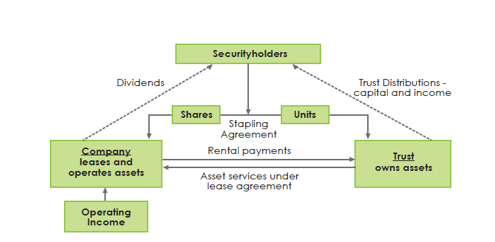

Though a common stapling arrangement consists of a unit in a trust being stapled to a share in a company, it is not prescriptive and the stapling structure can vary to suit the objectives of the management1.

The stapling itself is implemented by means of a contractual arrangement, usually in the form of a stapling deed which is the main instrument entered by both issuers of stapled securities2. Terms of stapling deeds may vary, but in essence, their effect is to prevent the securities of the entities subject to the stapling deed from being traded separately.

This is then reflected in the constituent documents of the underlying entities which are amended to provide that their securities shall not be traded or transferred separately3.

Stapled Instruments in Malaysia

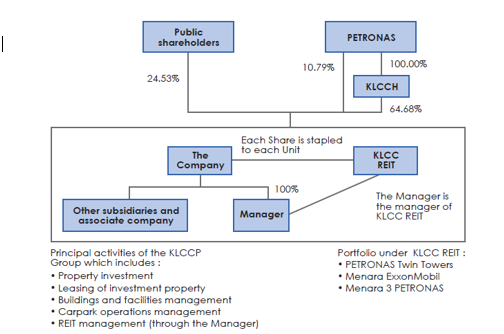

Presently in Malaysia KLCCP Stapled Group is the first and only stapled security listed on Bursa Malaysia since 2013. Initially, KLCC Property Holdings Berhad (“Company”) was listed in 2004 but had undergone a restructuring, where three of the main buildings owned by the Company were injected into the KLCC Real Estate Investment Trust (“KLCC REIT”) while the remainder of the assets remained in the Company.

The stapling resulted in an investor holding one unit of KLCCP Stapled Group owning both share in the Company share and unit in the KLCC REIT. It is important to note that the listing of such stapled securities was in fact not an offering – rather the prospectus was issued for information purposes only. The shareholders of the Company were not required to take any action nor make any direct payment to receive the Stapled Securities.

Figure 1: Stapled structure consisting of a company, a trust company which is similar to the structure of KLCC Stapled Group (see below Figure 2).

Figure 2: The chart above illustrates the structure of the KLCCP Stapled Group upon Listing

Source: KLCCP Prospectus dated 7 May 2013

Benefits of Stapled Instruments

In general, investors would prefer to have two securities which can be separately traded rather than stapled. This is unless the act of stapling increases the value of their investment. Hence, the question of how stapling might create value not only for issuers but also investors should be the consideration of top management when exploring the adoption of stapled structures4.

The structure of stapled securities which horizontally integrate several businesses into one structure via the contractual agreements between them, provides benefits from synergies (shared expertise and knowledge) between the issuers, “internalisation” of certain transactions, where transactions are kept within the company through transacting with the other stapled entity, its subsidiary companies or associates, rather than going out to the open market and increases certainty due to the long-term contracts involved5. Typically in the case of shares, investors do not necessarily receive dividends.

Whether there is any dividend and the amount of dividend received is subject to the dividend policy determined by the board of directors of the company. Conversely, for stapled securities consisting of both a company share and another security such as a unit in a trust, such stapled security will have an express distribution policy to investors, normally set out in the stapling deed and is disclosed in the prospectus6.

In the case of KLCCP Stapled Group, its stapled structure gives the tax incentive of being a REIT whilst maintaining the flexibility of being a company7. This is because a REIT can save on taxes if the operating income is distributed back to unitholders8. If the properties still remain under the Company, then the net property income generated would still be taxed based on the company’s corporate tax rate9.

On the flip side, because a REIT would need to pay out most of its earnings, there will be little buffer cash left for reinvestment for growth. This is why having the Company included in the stapled group is an advantage where the reinvestment and growth capital expenditure can continue to be undertaken by the Company without affecting the tax benefit of KLCC REIT10.

Notwithstanding both a company and a REIT are able to hold assets and operate business, active business such as asset management and development are typically managed by the company while passive investments in property or funds are undertaken by REIT. In practice, the trust and the company effectively operate as one entity although the company continues to be a separate legal entity from the trust11.

For both legal and tax purposes, separate securities forming part of a stapled security continue to retain they individual legal character and are treated separately for income tax purposes.

Accordingly, for example, if a stapled security consists of shares in a company and units in a REIT, then the rights and obligations of the security holder as a shareholder in the company continue and similarly the rights and obligations as a unit-holder and hence beneficiary of the REITS continue12.

Other jurisdictions

Stapled securities in the Australian jurisdiction have been formed substantially, particularly in the property and infrastructure sector due to the country’s tax structure and settings pose to attract global capital13.

There are also a number of major banks that have issued stapled hybrids involving stapling of a “loan note” issued by an offshore branch of the bank to a preference share issued by the parent14. A number of Malaysian banks have issued unlisted stapled securities similar to those used by Australian banks. The first was Maybank15, which issued RM3.5b of stapled securities in June 200816, involving a non-cumulative preference share and a subordinated note, which qualified as non-innovative tier 1 hybrid capital. Other subsequent issuers include Ambank (2008), Public Bank (March 2009), and Hong Leong Bank (2011).

Whilst in Singapore, the gradual increase of interest towards stapled instruments is evident as stapled instruments, in particular the stapling of REIT to business trust, had been listed on the Singapore Stock Exchange. As at July 2019, there are a total of 7 stapled structures listed on the Singapore Stock Exchange17.

Hong Kong is another renowned economic hub with growing interest in the use of stapling instruments. It had started to gain traction since the announcement in 2011, by telecoms carrier giant PCCW Limited, of its plans to spin-off its telecommunications business marking the first business trust listing with stapling on the Hong Kong Stock Exchange (HKEx)18. As of 2022, there are currently four stapled securities listed on the HKEx19.

With the exception of a few listed staples in Singapore and Hong Kong, the use of stapled structures outside of Australia is uncommon. Several jurisdictions have rules that remove the tax advantages arising from stapled structures20.

Concluding remarks

To summarize, to date, Malaysian stock market has only seen the listing of the stapled securities of KLCC Stapled Group and only a handful of jurisdictions proceed to adopt them due to its strong merits and alignment with the issuing entity’s corporate objectives and tax advantages. Potential issuers should note that the main consideration of adopting a stapling arrangement is very much dependent on the objectives of the potential issuing entity, whether there are attractive incentives to be derived from adopting stapled securities structure including the tax structure in the country where the stapled securities are seeking to be listed in and of the associated risks that comes with it.

The Education Network, ‘Stapled Securities, the Division 6C Review and Issues in Property & Infrastructure Vehicles’ <https://www.tved.net.au/index.cfm?SimpleDisplay=PaperDisplay.cfm&PaperDisplay=https://www.tved.net.au/PublicPapers/May_2009,_Sound_Education_in_Corporate_Tax,_Stapled_Securities__the_Division_6C_Review_and_Issues_in_Property___Infrastructure_Vehicles.html>(May 2009).

For further information, please contact:

Serina Abdul Samad, Partner, Azmi & Associates

serina@azmilaw.com

- The Education Network, ‘Stapled Securities, the Division 6C Review and Issues in Property & Infrastructure Vehicles’ <(May 2009″ target=”_blank” rel=”noreferrer noopener”>https://www.tved.net.au/index.cfm?SimpleDisplay=PaperDisplay.cfm&PaperDisplay=https://www.tved.net.au/PublicPapers/May_2009,_Sound_Education_in_Corporate_Tax,_Stapled_Securities__the_Division_6C_Review_and_Issues_in_Property___Infrastructure_Vehicles.html>(May 2009).

- Bursa Malaysia, ‘FAQs on Stapled Securities’ < (accessed 27 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://www.bursamalaysia.com/trade/our_products_services/equities/stapled_securities> (accessed 27 October 2022).

- Ibid at [i].

- Stapled Secusrities: Antipodean Anomaly or Adaptable Innovation <delivery.php (ssrn.com)> (accessed 27 October 2022).

- Ibid at [iv].

- Securities Commission, ‘Guidelines on Listed Real Estate Investment Trust’ < (accessed 9 November 2022)” target=”_blank” rel=”noreferrer noopener”>https://www.sc.com.my/api/documentms/download.ashx?id=afacc30c-060e-4cc0-b40f-d4546db74724> (accessed 9 November 2022).

- For other advantages for adopting stapled securities structure KLCC Stapled Group, see page 3 of its prospectus at <https://klccp.listedcompany.com/misc/prospectus.pdf>

- hasilnet.org.my, ‘Tax on REIT (Real Estate Investment Trusts) Investment’ < (accessed 9 November 2022).” target=”_blank” rel=”noreferrer noopener”>https://www.hasilnet.org.my/taxon-reit-investment/> (accessed 9 November 2022).

- Value Invest Asia, ‘Top 7 Things to Know About KLCCP Stapled Group Now’ < (accessed 27 October 2022).” target=”_blank” rel=”noreferrer noopener”>https://valueinvestasia.com/top-7-things-know-klcc-reit-klccp-stapledgroup-now/> (accessed 27 October 2022).

- Ibid at [ix].

- Stapled securities – Listing a business enterprise involving a trust structure < (accessed 29 October 2022)” target=”_blank” rel=”noreferrer noopener”>https://www.ifec.org.hk/web/en/investment/investment-products/stock/listing-formats/stapled-securities.page> (accessed 29 October 2022).

- Ibid at [i].

- Transurban Submission, ‘Treasury Consultation Paper: Stapled Structures’ https://treasury.gov.au/sites/default/files/2019-03/c2017-t240634-Transurban.pdf (accessed 9 November 2022).

- Ibid at [iv].

- Aseambankers Malaysia Berhad, Annual Report Year 2008 < (accessed 9 November 2022)” target=”_blank” rel=”noreferrer noopener”>https://www.maybank2u.com.my/iwovresources/investment-bank/document/my/en/aboutus/annual-reports-financials/annual-reports/AnnualReport2008.pdf> (accessed 9 November 2022).

- <https://maybank.listedcompany.com/news.html/id/337059> (accessed 29 October 2022).

- Singapore Exchange (SGX), “Highlights of SGX’s Four US-Focused REITs & Stapled Trusts” <Highlights of SGX’s Four US-Focused REITs & Stapled Trusts – Singapore Exchange (SGX)> (accessed 9 November 2022).

- Details, including the regulatory arrangements, are provided in S Denton (2011), “Hong Kong – introducing business trusts and stapled securities”, Martindale.com Legal Library, https://www.martindale.com/legalnews/article_dentons-us-llp_1382802.htm (accessed 29 October 2022).

- HKEX, List of Stapled Securities < (accessed 29 October 2022)” target=”_blank” rel=”noreferrer noopener”>https://www.hkex.com.hk/Products/Securities/Equities/List-of-Stapled-Securities?sc_lang=en> (accessed 29 October 2022).

- Australian Government, ‘Consultation Paper March 2017: Stapled Structures’ < (accessed 9 November 2022)” target=”_blank” rel=”noreferrer noopener”>https://treasury.gov.au/sites/default/files/2019-03/C2017-009_Stapled_Structures.pdf> (accessed 9 November 2022).