Malaysia – Recent Developments On The Implementation Of ESG.

ESG in Malaysia is in different phases for different entities. For the larger public listed companies, the levels of awareness and implementation are relatively high compared to the smaller companies especially the Small and Medium Enterprises (“SMEs”).

In fact, there are SMEs that consider the whole ESG arena as being something they need not know about. They feel ESG has nothing to do with them at all and is the concern of large companies. Those SMEs that are aware of ESG appear to feel that this just adds additional costs to their operations which they are not willing to bear. Lack of awareness, capacity constraints and implementation difficulties appear to be the major stumbling blocks.

However, companies whatever size they may be, cannot continue to believe that they are exempt from ESG requirements especially if they are part of international supply chains. Developments in the global arena can and do affect them, more so if they export to Europe with its various rules on ESG compliance and ratings.

Having said that, the ESG momentum today is such that it appears inexorable. In order to assist companies in addressing the various constraints faced, the authorities have prepared guidance and templates to assist these entities in beginning their ESG journey. Various government agencies in Malaysia have focused not only on awareness raising but have also extended help and guidance to SMEs to add to their understanding of ESG principles as well as its implementation and reporting.

Ministry of Investment, Trade and Industry (“MITI”) Issues Guidance

In October 2023, MITI launched the National Industry Environmental, Social, and Governance Framework (“i-ESG Framework”). The framework introduced a phased approach with Phase 1, named “Just Transition”, envisaged to take place between 2024 and 2026. Phase 2 is scheduled for 2027 to 2030 when ESG practices would be more mature and will be focused on aligning with national and global developments.

MITI has therefore issued the i-ESG Starter Kit (“i-ESGStart”) as an aid for micro, small and medium enterprises (“MSMEs”), focusing on manufacturing companies. The i-ESGStart includes templates and tools to enable MSMEs to begin their ESG journey.

There are chapters on basic matters such as establishing baselines, stakeholder engagement processes and how to determine materiality — all matters that need to be considered before deciding on priorities and targets. Thereafter, the types and nature of disclosures to be made are set out in a fairly comprehensive manner covering Environmental disclosures, Social disclosures and Governance disclosures.

Environmental disclosures include energy and emission, water and waste management. Social disclosures include labour practices, occupational safety and health and community-related matters. Governance disclosures include anti-corruption activities, supply chain management and data privacy and security.

The examples and templates given are useful and provide reasonable guidance. However, staff training and commitment by management are prerequisites for successful implementation.

Capital Markets Malaysia (“CMM”) and the Simplified ESG Disclosure Guide (“SEDG”)

The CMM is an affiliate of the Securities Commission Malaysia (“SC Malaysia”). It has developed the SEDG for SMEs in Supply Chains after taking into consideration feedback obtained from a public consultation. The SEDG was published to assist and provide guidance to SMEs in preparing to disclose ESG data to their stakeholders, aligned with international standards. Among the standards that have been used as a reference point are Bursa Malaysia’s Listing Requirements and Sustainability Reporting Guide, FTSE4Good[1], GRI[2], IFRS S1 and S2[3], TCFD[4] and CDP[5].

The SEDG framework is based on the frequently referred to standards but in a simplified manner. It comprises a series of checklists and templates that set out the essential information to be disclosed, thereby indicating the data to be collected and analysed. Disclosures cover five (5) topics for each of the three (3) pillars: Environment, Social and Governance.

The disclosures for Environment cover Emissions, Energy, Water, Waste and Materials. The disclosures under Social cover Human Rights and Labour Standards, Employee Management, Diversity, Equity and Inclusion, Occupational Health and Safety and Community Engagement. The disclosures under Governance cover Governance Structure, Policy Commitments, Risk Management and Reporting, Anti-Corruption and Customer Privacy.

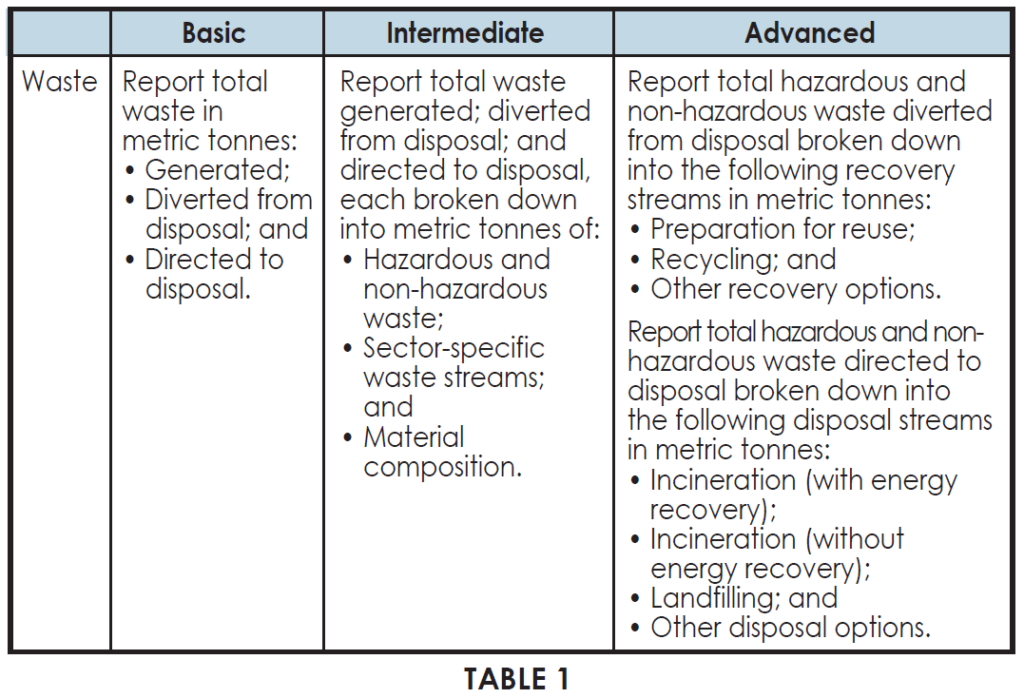

There are different stages for such disclosures namely basic, intermediate and advanced. Thus, as an example, under Waste the following disclosures are required. (Refer Table 1)

The SEDG is a good introduction to basic ESG and assists in the start of a full-blown ESG strategy and implementation as it introduces the concepts that need to be understood and the data that needs to be collected for appropriate reporting.

The National Sustainable Reporting Framework

The Advisory Committee on Sustainability Reporting (“ACSR”), chaired by SC Malaysia, has been consulting on the Proposed National Sustainability Reporting Framework (“NSRF”). The ACSR was formed in May 2023, with the endorsement of the Ministry of Finance to assess the use and application of the standards issued by the International Sustainability Standards Board (“ISSB”), specifically International Financial Reporting Standards (“IFRS”) on the General Requirements for Disclosure of Sustainability-related Financial Information (“IFRS S1”), and Climate-Related Disclosures (“IFRS S2”), collectively referred to as the ISSB Standards. The consultation also includes the basic requirements for assurance of ESG reports and considers the inclusions required in a sustainability assurance framework for Malaysia. The consultation paper was issued on 15 February 2024 with responses to be sent in by 29 March 2024.

Essentially the consultation paper aims to seek feedback on the following to inform the NSRF:

(a) the use and application of IFRS S1 and IFRS S2, including the required transition reliefs;

(b) the approach in relation to a sustainability assurance framework; and

(c) enablers and/or support required for (a) and (b).

The background to this consultation is the fact that there are multiple sustainability reporting frameworks and standards in the market. This results in difficulties in comparing data across different entities and different geographies. The purpose of proposing a national sustainability framework is, amongst others, to reduce this fragmentation and the risk of inconsistent disclosure.

To address the need and demand for comparable and reliable sustainability-related information, the ISSB Standards were developed and issued to provide a global baseline standard. As noted in the consultation paper, ‘the ISSB builds on the work of market-led investor-focused reporting initiatives, including the Climate Disclosure Standards Board (“CDSB”), Task Force on Climate-Related Financial Disclosures (“TCFD”), Value Reporting Foundation’s Integrated Reporting Framework and industry-based SASB Standards, as well as World Economic Forum’s Stakeholder Capitalism Metrics’.

At the time of issuance of this newsletter, the results of the public consultation have not been published. This framework will be a good step forward in giving some level of certainty to companies complying with ESG reporting requirements. In particular, the conditions for third-party assurance will be of interest as currently no pre-conditions are specified by Bursa Malaysia. An objective and affordable assurance process will be of definite value to the companies involved. While these are developments that may appear to be a duplication of resources, the many and varied targets of ESG implementation are such that all efforts by various authorities whose individual reach may differ, are to be seen as a joint effort to encourage ESG compliance for the betterment of our businesses, especially in terms of attracting investment and the essential role they play in the local and global economy.

For further information, please contact:

Pushpa SK Nair , Azmi & Associates

pushpanair@azmilaw.com

- The FTSE4Good Bursa Malaysia Index (FGBM) was launched in 2014.

- The Global Reporting Initiative – one of the older standards used for ESG especially for non-financial reports.

- Standards issued by the International Sustainability Standards Board.

- Task Force on Climate Related Financial Disclosures. The task force has been disbanded and its work subsumed by the International Financial Reporting Standards (IFRS) Foundation.

- Carbon Disclosure Project which assists companies and cities to disclose their environmental impact and climate change-related information.