This is the second part of our two-part series covering the recent developments in Hong Kong’s tokenization regulatory landscape. Part one can be found here.

Following our previous article on the tokenisation of SFC investment products, we turn to the second circular issued by the Securities and Futures Commission (“SFC”) on 2 November 2023 – the SFC’s guidance to intermediaries engaging in tokenised securities-related activities (“Tokenised Securities Circular”).

The Tokenised Securities Circular provides specific guidelines for intermediaries engaging in tokenised securities-related activities, which we have broken down for you below.

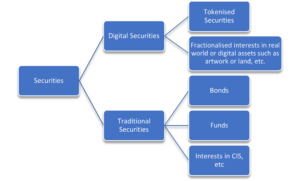

A. Tokenised Securities vs Digital Securities

For the purpose of the Tokenised Securities Circular, tokenised securities are:-

- Traditional financial instruments that are “securities” in section 1 of Part 1 of Schedule 1 to the Securities and Futures Ordinance (Cap. 571) (“SFO”) that utilise distributed ledger technology (“DLT”) (such as blockchain technology), or similar technology in their lifecycle (“Tokenised Securities”).

- Fundamentally traditional securities with a tokenisation wrapper.

- A subset of a broader set of digital securities, the latter of which in the Tokenised Securities Circular are “securities” under the SFO that utilise DLT or similar technology in their lifecycle (“Digital Securities”).

Conversely, Digital Securities which are not Tokenised Securities may be structured in more bespoke, novel or complex forms, with some existing exclusively on a DLT-based network without legally enforceable links to extrinsic rights or underlying assets, and without controls to mitigate risks that ownership rights may not be accurately recorded. Some of them may constitute interests in a collective investment scheme (“CIS”). Examples include (i) tokenisation of fractionalised interests in real world or digital assets, such as artwork, in a manner different from a traditional fund but such that the arrangement would amount to a CIS, or (ii) tokenisation of a profit-sharing arrangement which is not in the form of traditional securities.

B. New risks from Tokenised Securities

Given that Tokenised Securities are traditional securities with a tokenisation wrapper, all existing legal and regulatory requirements governing the traditional securities market still apply.

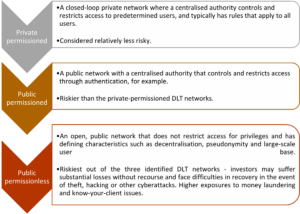

Additionally, Tokenised Securities bring new risks that intermediaries must manage, particularly ownership risks and technology risks. The risks involved in Tokenised Securities would depend, for instance, on the type of DLT network adopted, and intermediaries should address such risks accordingly. The SFC has identified several common archetypes of DLT networks:

C. Considerations for engaging in Tokenised Securities-related activities

In general, intermediaries engaging in Tokenised Securities-related activities should:

- Ensure their personnel have the necessary expertise to understand the nature of Tokenised Securities-related businesses.

- Recognise and effectively manage the new risks associated with ownership and technology.

- Act with due skill, care, and diligence when dealing with Tokenised Securities.

- Perform thorough due diligence by considering all available information on the Tokenised Securities, including the underlying product (such as the bond or fund being tokenised) as well as the technology aspects related to tokenisation.

Intermediaries, when issuing or when substantially involved in the issuance of Tokenised Securities, should:-

- Remain responsible for the overall operation of the tokenisation arrangement regardless of any outsourcing to third-party vendors/service providers.

- Take into account the list of non-exhaustive factors set out in Part A of the Appendix to the Tokenised Securities Circular.

- Take into account the features and risks (e.g. ownership and technology risks) of the Tokenised Securities when considering the most appropriate custodial arrangement (if any) for the Tokenised Securities. Additional considerations for the custodial arrangement for bearer form Tokenised Securities which use permissionless tokens on public-permissionless networks are set out in Part B of the Appendix to the Tokenised Securities Circular.

- Refer to the circular on tokenisation of SFC-authorised investment products issued by the SFC, which we have covered previously.

Intermediaries, when dealing in, advising on, or managing portfolios investing in Tokenised Securities, should:-

- Conduct due diligence on the issuers, their third-party vendors/service providers involved in the tokenisation arrangement, and the features and risks arising from the tokenisation arrangement.

- Understand and be satisfied with the controls implemented by the issuers and their third-party vendors/service providers to manage ownership and technology risks of the Tokenised Securities before they engage in related activities. Parts A and B of the Appendix to the Tokenised Securities Circular contain a non-exhaustive list of factors for consideration.

D. Information for Clients

Intermediaries should also bear in mind the importance of adequately disclosing relevant material information specific to Tokenised Securities (e.g. information material to the tokenisation arrangement) in a clear and easily comprehensible manner.

Examples include: (a) whether off-chain or on-chain settlement is final; (b) the limitations imposed on transfers of the Tokenised Securities (if any); (c) whether a smart contract audit has been conducted before deployment of the smart contract (if any); (d) key administrative controls and business continuity planning for DLT-related events; and (e) the custodial arrangement (if applicable).

E. Clarifications by the SFC

The Tokenised Securities Circular also clarified four points:

In respect of items (1) and (2), the Tokenised Securities Circular supersedes the SFC’s previous statement on Security Token Offerings of 29 March 2019 (“2019 Statement”). The following table illustrates the updates in the SFC’s position on complex product categorisation and the professional investors (“PI”)-only restriction.

| 2019 Statement | Tokenised Securities Circular | |

| (1) Complex product categorisation | SFC took the stance that security tokens would be regarded as “complex products” and therefore additional investor protection measures would apply. | Whether a Tokenised Security is a complex product or not is determined by a see-through approach based on an assessment of the complexity of its underlying traditional security.In conducting such assessments, an intermediary should consider the factors set out in Chapter 6 of the Guidelines on Online Distribution and Advisory Platforms, paragraph 5.5 of the Code of Conduct for Persons Licensed by or Registered with the SFC, and guidance issued by the SFC from time to time.An intermediary distributing a Tokenised Security which is a complex product should comply with requirements governing the sale of complex products, including ensuring suitability irrespective of whether there has been any solicitation or recommendation. |

| (2) PI-only restriction | SFC imposed a PI-only restriction on the distribution and marketing of security tokens. | There is no need to impose a mandatory PI-only restriction.However, the requirements of the prospectus regime under Cap. 32 and the offers of investments regime under Part IV of the SFO would apply to the offering of Tokenised Securities to the public of Hong Kong (Public Offering Regimes). An offer of Tokenised Securities not authorised under Part IV of the SFO or which has not complied with the prospectus regime could only be made to PIs or pursuant to any other applicable exemption under the public offering regimes. |

The following table illustrates the further clarifications of the SFC’s position on fund managers managing portfolios with Tokenised Securities, and on licensed virtual asset trading platform operators (“VATPs”) (i.e. items (3) and (4)), compared with the pre-existing positions:

| Existing requirements | SFC’s clarification | |

| (3) Fund managers managing portfolios which may invest in Tokenised Securities | In the joint circular on intermediaries’ virtual asset-related activities, the SFC stated that the “de minimis threshold” under the Terms and Conditions only applies to virtual assets as defined in section 53ZRA of the AMLO. | The SFC will not impose the Terms and Conditions on fund managers managing portfolios investing in Tokenised Securities meeting the “de minimis threshold” unless the portfolios also invest in virtual assets meeting the “de minimis threshold”.Fund managers managing portfolios which may invest in Tokenised Securities should comply with the requirements set out in the Tokenized Securities Circular when the portfolios they manage invest in Tokenised Securities, especially the requirements in section C paragraph 3 above. |

| (4) VATPs licenced by the SFC and the applicable insurance/compensation arrangement | VATPs are required to put in place a compensation arrangement approved by the SFC to cover the potential loss of security tokens in compliance with paragraph 10.22 of the Guidelines for Virtual Asset Trading Platform Operators. | VATPs may consider applying to exclude certain Tokenised Securities from the required coverage.The VATP will need to demonstrate to the SFC’s satisfaction that the risk of financial loss to its clients holding those Tokenised Securities can be effectively mitigated if the Tokenised Securities become lost. For example, the VATP may demonstrate that administrative controls (e.g. transfer restrictions or whitelisting) have been implemented by the issuer to protect the holders of Tokenised Securities which use public-permissionless networks against the risks of theft and hacking. |

F. Considerations for engaging in Digital Securities-related activities

Intermediaries should be aware that:-

- Offering Digital Securities to retail investors in violation of public offering regimes is prohibited.

- If Digital Securities are distributed on an online platform, the platform must be appropriately designed with suitable access rights and controls to ensure compliance with any selling restrictions that may apply to those Digital Securities.

- Digital Securities (that are not Tokenised Securities) are likely to be considered “complex products” as they may not be easily understood by retail investors. Intermediaries involved in distributing such Digital Securities must adhere to requirements governing the sale of complex products as explained above.

- It is important to establish adequate systems and controls to ensure compliance with relevant legal and regulatory requirements before engaging in activities involving Digital Securities. In addition to the requirements outlined in the Tokenised Securities Circular, intermediaries should exercise their professional judgment to evaluate each Digital Security they deal with that is not a Tokenised Security, and implement appropriate internal controls to address the specific risks in order to protect the interests of their clients.

G. Notification to the SFC

Lastly, intermediaries who have an interest in participating in activities related to Digital Securities, including Tokenised Securities, are required to inform and consult their designated officer at the SFC prior to engaging in such activities. They should also be prepared to provide information regarding the services that they intend to offer as requested by the SFC periodically.

H. Conclusion

Overall, the Tokenized Securities Circular reflects the SFC’s pragmatic, sensible and quickly-maturing regulatory approach to tokenization in Hong Kong. The updates and clarifications in the Tokenized Securities Circular are a welcome move in the development of Hong Kong’s fast-growing Web 3 markets and further demonstrate Hong Kong’s leading role in measured regulation of the industry.

If you would like to learn more about tokenisation of products or RWA tokenization, please contact us today.