The Figures

What the latest figures show — this edition combines two months of data, which was released within a week by ASIC

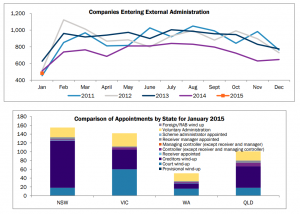

- During calendar year 2014, a total of 8,794 companies entered external administration across Australia, an 18.7% fall on the 10,821 companies that entered external administration in 2013.

- External administration appointments fell in every state in 2014, except in Western Australia, which recorded a 3.6% rise (to 729 from 704). Of note, there were 941 fewer insolvencies in New South Wales during 2014.

- An analysis of the most common types of external administration for 2014 showed there were 960 fewer court wind-ups, 530 fewer creditor wind-ups, and 329 fewer voluntary administrations than in 2013. However, there were 499 more controllers (except receiver or managing controller) appointed than in 2013.

- In January 2015, 484 companies entered external administration, a significant fall from the 648 in December 2014. While there is a seasonal drop in January, this is the lowest level seen for the month since January 2011.

- Compared to the previous month, external administration appointments fell across the country in January, bar a small rise in South Australia (23 in January from 19 in December). Sharp month-on-month falls were seen in New South Wales (155 vs. 260) and Queensland (101 vs. 142). Court and creditor wind ups fell significantly but voluntary administrations were flat.

(Click to enlarge)

Economic Influences

The broader market and its potential impacts on insolvency levels

- Prior to the Reserve Bank of Australia (RBA) lowering rates to 2.25% in February 2015, it had left cash rates unchanged at 2.5% at its December meeting, referring once again to a period of interest rate stability.

- New buildings approved for construction dipped by 3.3% month-on-month (seasonally adjusted) in December to 17,753, according to Australian Bureau of Statistics (ABS) figures. The figures showed a rise in new building approvals of 8.8% year-on-year.

- The Westpac Melbourne Institute Index of Consumer Sentiment plunged 5.7% in December to 91.1, which is the lowest level recorded since August 2011. Respondents to the survey reflected worries about economic outlook and job security.

- NAB’s Monthly Business Survey showed business conditions fell by one point in December to +4 points. It was the second month of an easing in conditions, with deterioration in the construction and mining sectors in particular. Business confidence marginally improved in the month but remained well below long run averages.

- Labour demand in Australia further firmed in December, with unemployment rates recording a surprise fall of 0.1% to 6.1%. Meanwhile, job advertisements recorded the seventh consecutive monthly rise, up 1.8% monthon-month. Job ads had trended higher for 14 months and were up 11.4% in the year to December.

- Australian manufacturing conditions swung to a contraction in December, with the Australian Industry Group’s Performance of Manufacturing Index (PMI) falling by 3.2 points to 46.9 points, seasonally adjusted. The services sector also recorded another weak month, albeit at a slower place, up 3.7 points to 47.5 points. It was also a subdued end to the year for construction, with the Index falling by 1.0 point to 44.4 points. It was the second month the Performance of Construction Index (PCI) had been below the 50 point level, which indicates contraction.

- New car sales in December rose 2.6% month-on-month to (a revised) 94,501, according to figures from the ABS.

- December’s retail trade figures recorded at AUD 23.81bn (seasonally adjusted) reflected soft sales over Christmas, with only a slight 0.2% increase in sales from November. This followed a 0.1% monthly rise in November.

Special Focus: Residential Property

Australia’s residential property market has been in focus recently, with strong house prices cited by the RBA as a reason why the bank declined to further cut interest rates. Given the weak economy, RBA’s decision to leave rates at 2.25% at its March meeting surprised the market, with many instead expecting further easing to be applied by the Bank. However, the RBA said that house prices continued to rise strongly in Sydney and, while there were varied trends across other cities, it was “working with other regulators to assess and contain risks that may arise from the housing market.”

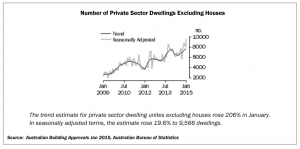

The latest ABS figures show national housing approvals grew by 7.9% in January from December (seasonally adjusted) and 9.1% in the 12 months to January. The result beat market expectations and were fuelled by a strong 19.6% increase in apartments and townhouses in January versus December. Approvals for private sector houses rose 0.4% in the month and fell by 2.9% year-on-year.

(Click to enlarge)

In Australia, the rate of apartment building is now outpacing private sector housing. In Perth, there are currently 121 apartment buildings either approved or under construction within 5km of the CBD. Apartments are accounting for 20% of new dwelling approvals in WA. A recent report from Master Builders and Y Research showed this could add almost 11,000 apartments within that district by 2020. There is, however, some concern that the apartment market could become oversupplied as a result of such a fast rate of growth.

In Sydney and Melbourne, growth in this market is still occurring, but at reduced rates. One of the larger upcoming residential projects in Sydney is the three high-rise apartment buildings (750 high end apartments) in the Barangaroo precinct of the CBD. Despite growth in the Sydney residential market, first home buyer activity in NSW has reached a 10-year low, suggesting that growing investor demand is responsible for pushing first home buyers out of the residential market. Some commentators point to international investors contributing to the overheated residential market in Sydney and that a correction could be seen within the next two years. In the meantime though, auction clearance rates in Sydney remain historically high, averaging above 80% in early 2015, 81% in February 2015 and 83% in March 2015.

With residential development approvals up 20% year-on-year in Brisbane, the market there has had a very strong uplift in new residential development approvals (notably apartments, which account for 53% of all new approvals) to meet rising demand in the inner city ring (CBD and 3km ring). Prices have lifted in the year, although these rises are still modest relative to the Sydney and Melbourne markets. The outlook for this market is unclear though; the local economy is soft, characterised by Queensland having the second highest level of unemployment in Australia (at 6.6%). There is also some uncertainty in the policy approaches of the new Government, with it recently announcing it will withdraw from sale a major (8,900sqm) CBD development site.

More broadly, the latest housing data largely bodes well for the residential construction sector, which now has a pipeline of work from housing investment until at least the first half of 2016.

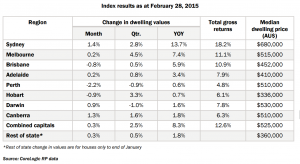

Property prices also continue to rise, showing that demand is still outstripping supply. The latest data from CoreLogic RP show Sydney house prices rose 1.4% in February but are up 13.7% in the last 12 months, well ahead of year-onyear increases in Melbourne (7.4%), Brisbane (5.9%), Adelaide (3.4%), and Perth (0.6%).

(Click to enlarge)

Outlook

The broader market and its potential impacts on insolvency levels

- Last month (February 2015), in one of the biggest economic moves for some time, the RBA lowered the interest rate to a new record low of 2.25%, a 25 basis point cut. It was the first time the RBA had cut rates since August 2013. The RBA continued to hold rates at 2.25% at its March meeting, another surprise move, given that the market had expected another rate cut to ease conditions in a strong property market, which Sydney has been particularly subject to. The purpose of the cut was to spur business activity and household spending during a period of below-trend economic growth in Australia. Of the rate cut, RBA Governor Glenn Stevens said: “This action is expected to add some further support to demand, so as to foster sustainable growth and inflation outcomes consistent with the target.”

- New homes approved for construction jumped 7.9% (seasonally adjusted) in January from December — the largest monthly gain in three months. An increase in apartments was behind the jump in approvals, which were up 9.1% year-on-year.

- The RBA’s concerns about a weaker jobs market following the rate cut were reflected in a surge in the unemployment rate in January to 6.4%, following December’s unexpected fall in unemployment to 6.1%.

- Job advertisements, meanwhile, rose for the eighth month in a row, increasing 1.3% month-on-month in January, according to ANZ’s monthly job data.

- The cut in rates has led to a strong lift in consumer sentiment. The Westpac Melbourne Institute Index of Consumer Sentiment recorded an 8% increase month-on-month in February to 100.7. Westpac’s Chief Economist, Bill Evans noted that it was the first time since February 2014 that the Institute had seen a majority (albeit slight) of optimists over pessimists. Lower petrol prices were also a contributor to the boost in consumer confidence, which had recorded small monthly rise of 2.4% in January to 93.2.

- The Australian Industry Groups Indexes of manufacturing, services and construction showed contraction (below 50 points) in manufacturing, but a swing to expansion (above 50 points) in the services sector in February. The services sector PSI improved by 1.8 points to 51.7 points in February, after having spent most of 2014 in negative territory. After an increase in January, weak domestic demand pushed the PMI down 3.6 points to 45.4 in February for the third month of contracting conditions, with the lower dollar increasing import prices and pressuring manufacturer’s margins. The construction sector recorded its fourth consecutive month of contraction, with the PCI decreasing 2.0 points in February to 43.9 in response to a further weakening in new orders.

- Business conditions fell again in January (third consecutive month), with the index dropping 0.5 points to +2, according to NAB’s monthly business survey. The survey showed a difference in conditions between sectors with weakness in mining, construction and manufacturing, while retail and services showed small improvements. Business confidence increased slightly in January, but remained below long run averages, with particular weakness in mining, alongside soft commodity prices. The greatest falls in confidence were seen in transport/utilities, wholesale and manufacturing.

- New car sales had a poor start to the year, falling in January by a seasonally adjusted 1.5% to 93,104. Sales are 0.2% higher year-on-year, seasonally adjusted.

For further information, please contact:

Quentin Olde, Director, FTI Consulting

quentin.olde@fticonsulting.com

Ross Blakeley, Director, FTI Consulting

ross.blakeley@fticonsulting.com

Michael Ryan, Director, FTI Consulting

michael.ryan@fticonsulting.com

Stefan Dopking, Director, FTI Consulting

stefan.dopking@fticonsulting.com