11 August 2021

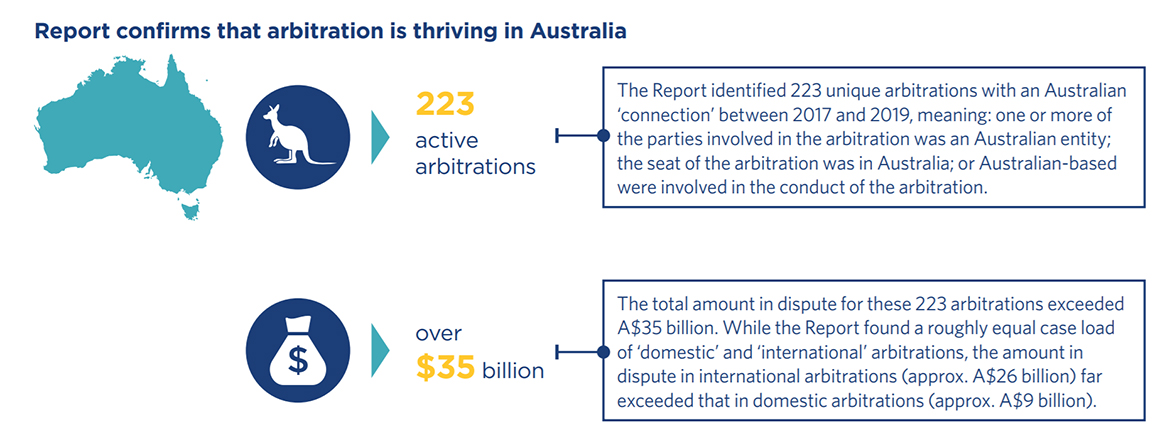

The arbitration industry is booming in Australia. Between 2017 and 2019, the total amount in dispute in arbitrations with an Australian connection exceeded A$35 billion. Like any successful industry, success does not happen in a vacuum.

In the car industry, the location of a factory in a particular country is a multifaceted decision involving a range of financial and commercial considerations. It is a very competitive process in which factors such as the strength of domestic car sales, a business-friendly legal framework, the productivity and competitiveness of the labour force, and the technological know-how of supply-chains all play a role. In a similar way, the rise of the arbitration industry in Australia arises out of a confluence of factors. In this article we cover the following three:

-

First, corporates increasingly see arbitration as their go-to-method of dispute resolution, particularly when there is a cross-border component to the dispute. On this, the numbers are telling. As shown in the inaugural Australian Arbitration Report by the Australian Centre for International Commercial Arbitration (ACICA) and FTI Consulting (the Report), the use of arbitration is booming in Australia because of increased domestic and cross-border investment and trade in sectors and industries such as construction, engineering, mining, infrastructure and renewables.

-

Second, Australia’s arbitration-friendly legal framework continues to be reinforced by the support of the Australian courts and by their sophisticated consideration of international arbitration issues. Over the past decade, the Australian courts have increasingly provided users with certainty and confidence around the judiciary’s support for a robust international arbitration framework.

-

Third, the preeminent arbitral institution in Australia is at the fore-front of arbitral best-practice and innovation. The recently unveiled ACICA 2021 Rules modernise the rules by codifying recent practices in relation to technology, virtual and hybrid hearings, and anticipating the needs of the arbitration community in key areas such as consolidation and multi-contract arbitrations, effective case management and costs.

Click on the image to enlarge the image.

For international arbitrations, the Report indicated that the most favoured arbitration rules were those of the Singapore International Arbitration Centre (SIAC) and the International Chamber of Commerce (ICC), and Singapore was the most popular arbitration seat. There was indication of a growing inclusion of ACICA arbitration clauses (now almost equal to the use of SIAC/ICC rules) in cross-border contracts, which we would expect to translate into a greater proportion of Australian-seated ACICA arbitrations in the future.

BROAD INDUSTRY USE

The Report highlights that arbitration is experiencing significant growth in sectors other than the traditional core sectors for arbitration in Australia, ie construction, infrastructure, mining and resources.

Although the bulk of the 223 arbitrations referenced occurred in relation to construction, engineering and infrastructure (about 43%), oil and gas (about 20%), mining and resources (about 13%), and transport (about 4%), there was also a significant use by ‘other’ industries (about 20%), including property, banking, agriculture and others.

We expect to see an increase in arbitration use by the technology, consumer products, banking and finance sectors as these sectors benefit from key features of the arbitral process such as confidentiality and cross-border enforceability.

CHASING EFFICIENCY

While 80% of respondents indicated that they were satisfied with arbitration, for some respondents costs and time were two key perceived weaknesses of the arbitration process.

Further, users remarked that, particularly in the domestic arbitration context, there was a “tendency for arbitration to resemble litigation” and “not always follow international best practice" which can prevent arbitration users from maximising the time and cost efficiencies of the process. However our experience suggests, and the Report’s data seems to confirm, that the Australian market is making significant steps forward in consolidating international best practices to maximise the benefits of arbitration for its users.

Click on the image to enlarge the image.

Some decades ago, a number of arbitration-related decisions were issued by the Australian courts that were perceived as parochial in international arbitration circles. Indeed, it was only in 2006 that the Full Court of the Federal Court of Australia resolved diverging lines of authorities on whether statutory claims for misleading and deceptive conduct were arbitrable.1

The situation is very different now. In harmony with international best practice, Australian courts consider it essential to pay due regard to international jurisprudence when construing international instruments such as the New York Convention and the UNCITRAL Model Law,2 and give consideration to international principles when dealing with the construction of international arbitration agreements and the relationship between national courts and arbitral tribunals.3 The Australian judiciary is now unabashedly “pro-enforcement”.4

More recently, Australian courts have demonstrated their ability to adeptly tackle complex arbitration-related questions in a nuanced and thoughtful way. In two recent examples, the Federal Court of Australia:

-

ordered a stay of litigation proceedings concerning non-arbitrable matters relating to arbitral proceedings on the basis that the non-arbitrable matters were ancillary to and dependent on the outcome of the arbitral proceedings. To allow litigation proceedings to continue would be contrary to the resolution of disputes in a cost-efficient manner and create a real risk of inconsistent findings;5 and

-

has engaged on nuanced issues regarding the applicable law for determining whether an arbitration agreement was formed (deciding to apply the law of the forum), and the applicable law to determine whether a party has waived its rights to enforce an arbitration agreement (deciding to apply the law governing validity, ie the law governing the arbitration agreement or where no choice has been made, the laws that have the closest and most real connection).

BEST PRACTICE – ACICA 2021 ARBITRATION RULES

The ACICA 2021 Arbitration Rules (the 2021 Rules) further strengthen ACICA’s status as the preeminent arbitral institution in Australia. We set out below a selection of salient features of the updated rules.

|

New provisions embracing the digitalisation of arbitration: Virtual hearings and paperless filing The 2021 Rules expressly permit Tribunals to hold conferences and hearings virtually or in a combined (or ‘hybrid’) form. Under the new rules, if a hearing is held virtually it will be deemed to be held at the seat. ACICA has also moved to default electronic filing by requiring both the Notice of Arbitration and Answer to be filed by email or through its dedicated online portal. Unless the parties agree otherwise, or the Tribunal or ACICA directs otherwise, any award may be signed electronically and/or in counterparts and assembled into a single instrument.

|

|

|

Extended scope for consolidation and multi-contract arbitrations The 2021 Rules adopt a more liberal approach to consolidation, broadly consistent with the SIAC and HKIAC rules. ACICA may consolidate two or more arbitrations into a single arbitration, if:

The 2021 Rules also present a streamlined approach for multi-contract arbitration. In a multi-contract setting, the Notice of Arbitration should include an application to ACICA addressing the threshold issues for consolidation.

|

|

|

Early dismissal procedure The 2021 Rules expressly empower the Tribunal to make an award granting early dismissal or determination of any claim, defence or counterclaim. Consistent with other developments, this provision enhances the Tribunal’s powers under the ACICA Rules, now expressly including summary dismissal and early determination.

|

|

|

|

Time limit for rendering awards The Tribunal is required, unless a shorter period being required by law or by parties' agreement, to render an award no later than the earlier of 9 months from the date the file is transmitted to the Tribunal, or 3 months from the date the Tribunal declares the proceedings closed. ACICA may extend these time frames following a reasoned request from the Tribunal, or if ACICA otherwise deems it necessary |

READ AND DOWNLOAD THE FULL PUBLICATION

For further information, please contact:

Chad Catterwell, Partner, Herbert Smith Freehills

chad.catterwell@hsf.com

-

Comandate Marine Corp v Pan Australia Shipping Pty Ltd (2006) 157 FCR 45.

-

TCL Air Conditioner (Zhongshan) Co Ltd v Castel Electronics Pty Ltd (2014) 232 FCR 361 at [75].

-

Cape Lambert Resources Ltd v Mcc Australia Sanjin Mining Pty Ltd (2013) 298 ALR 666 at [55].

-

Castel Electronics Pty Ltd v TCL Air Conditioner (Zhongshan) Co Ltd (No 2) [2012] FCA 1214 at [50]; IMC Aviation Solutions Pty Ltd v Altain Khuder LLC (2011) 38 VR 303 at [128].

-

First Solar (Australia) Pty Ltd, in the matter of Lyon Infrastructure Investments Pty Ltd v Lyon Infrastructure Investments Pty Ltd [2018] FCA 1666 at [58]-[73].

.jpg)