23 November, 2018

The announcement from the Australian Government that the Open Banking Review recommendations will be implemented will rigorously transform the financial services and banking industries by driving competition between banks to provide quality customer services and outcomes.

Open Banking is only the first part of the Consumer Data Right framework in Australia with the Treasury and the Australian Competition and Consumer Commission (ACCC) already proposing to extend the framework to cover the energy and telecommunications sectors. So it is important for other sectors of the Australian economy to view the Open Banking recommendations as a guide on how the Consumer Data Right framework will effect their sectors.

What exactly is Open Banking?

At a high level, Open Banking provides a banking customer the right to direct their current bank to provide personal information about the customer with other banks. This places customers in a new playing field where they have control over their banking information, which will allow them to have more choices when managing their finances. The Australian Government has adopted the four main principles recommended by the Open Banking Review. That is, the Consumer Data Right should be consumer focused, encourage competition, create opportunities and be efficient and fair.

When is this going to start?

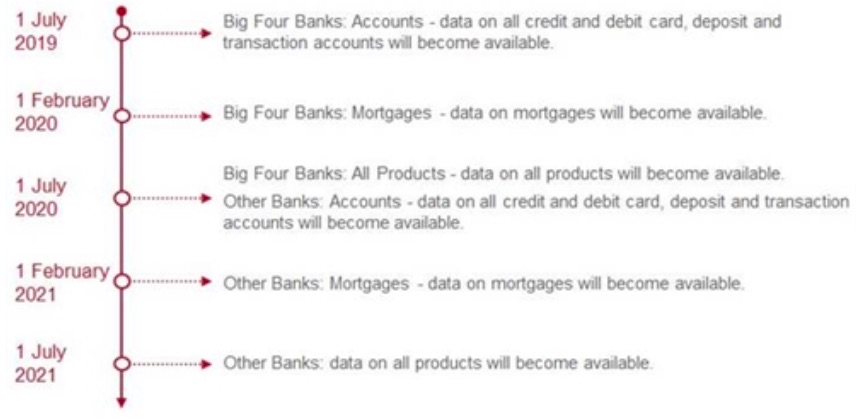

Open Banking will commence on 1 July 2019 starting with the largest four Australian Banks (i.e. Commonwealth Bank of Australia, Westpac, Australia and New Zealand Banking Group and National Australia Bank), before phasing into the other small to medium-sized banks. The implementation of Open Banking is summarised in the following diagram, subject to any amendments by the ACCC.

Please click on the image to enlarge.

What has happened so far?

On 15 August 2018, the Treasury released the exposure draft legislation, which legislates a Consumer Data Right to allow consumers to obtain control over their data. The Treasury Laws Amendment (Consumer Data Right) Bill 2018 (Bill) seeks to amend the Competition Act 2010, the Privacy Act 1988 and the Australian Information Commissioner Act 2010.

In our review of the Bill, we note the following key areas:

The ACCC will be responsible for drawing up the consumer data rules in relation to the accreditation, consent requirements and security on a sector-by sector basis. Public consultation is required before the 'consumer data rules' are made for a sector. We expect the public consultation for Open Banking to commence soon.

The definition of 'Consumer Data Right data' is broadly framed, which will capture a broad range of value-added date sets within an organisation. We are expecting a subsequent narrowing of the definition for different sectors through the consumer data rules.

On 24 September 2018, the Australian Government released for public consultation the second stage of exposure draft legislation and explanatory material giving effect to the announced measures and the designation instrument for the application of the Consumer Data Right to the banking sector. Any amendments that may come out of this further consultation process will be expected to be introduced into legislation before the end of 2018.

How is this going to affect you?

Banks and regulators should be preparing themselves in the coming months to ensure compliance before the Consumer Data Right regime commences in 1 July 2019.

Further, companies in the banking, energy and telecommunications industries will need to develop new competitive offerings for their customers, as well as the customers of the competitors. Companies that don't act now run the risk of getting left behind by their customers.

Looking to the United Kingdom for guidance

Leading the move into Open Banking, the United Kingdom's Competition and Markets Authority (CMA) implemented the first stage of Open Banking following a report in 2016 on the lack of competition in the banking sector.

The CMA Open Banking requirements apply only to the largest 9 UK banks (the CMA 9) and require the CMA 9 to open up their data via a set of secure and standardised application programming interfaces (APIs). The CMA Open Banking requirements are supplemented and extended by open banking requirements relating to account information and payment initiation which are set out in the Second Payments Services Directive (PSD2) and apply to all European Payment Institutions.

Under the CMA Open Banking requirements, the CMA 9 were originally set a deadline of 13 January 2018 for implementation but five of the UK's biggest banks were granted more time to comply following delays. The managed roll out of the data sharing aspect of Open Banking was officially completed on 17 April 2018, with payments and transaction functionality to follow.

Some of the challenges to the effective implementation of Open Banking in the UK include:

- difficulties in upgrading legacy IT systems and creating the required APIs;

- concerns over customer data and increasing data protection obligations; and

- low consumer engagement and awareness of change.

When looking to implement Open Banking, many institutions have found that the organisational impacts of Open Banking and PSD2 access requirements are greatly increased where providers aim to compete, rather than simply comply. Six months on from the official roll-out of Open Banking to the CMA 9, the first banks are starting to launch their own products leveraging Open Banking access.

The next stage of Open Banking access will come in 2019 with the implementations of PSD2 requirements around account aggregation and payment initiation. It is, therefore, yet to be seen what impact Open Banking (including PSD2) will have in the UK and whether the level of consumer engagement will increase.

Banks to be more 'forward looking'

It is essential for banks to become more 'forward-looking' and confront this challenge with a positive attitude. This may require adapting existing platforms in a way that can easily aggregate data from external sources, establish distribution partners with third-party platforms and invest in new data and service providers to move further up the value chain. Banks that are 'change-ready' are also simplifying and automating their back-end processes, removing legal costs and eliminating options that do not derive customer value or deliver quality experiences that are 100% digital.

We urge for all banks and companies in the telecommunications and energy sectors to be in the 'forward- looking' category and embrace this change. However, as proven in the UK, progress can be challenging and the impact of Open Banking can take some time to materialise.

For further information, please contact:

Bill Fuggle, Partner, Baker & McKenzie

bill.fuggle@bakermckenzie.com