10 August, 2017

On 21 June 2017, the Treasury Laws Amendment (GST Low Value Goods) Bill 2017, which applies Australian Goods and Services Tax (GST) to supplies of low value goods purchased by consumers and imported into Australia, was passed with the following amendments:

- a delay in the start date to 1 July 2018 (instead of 1 July 2017); and

- a requirement for the Productivity Commission (the Commission) to conduct an inquiry into collection methods.

- Specifically, the Commission has been tasked to undertake a four month inquiry into:

- the effectiveness of the GST on low value good amendments;

- whether models other than the proposed 'vendor collection' model might be suitable; and

- any other aspects considered relevant by the Commission.

The Commission's Terms of Reference are available here. The Commission's report is not limited to only reviewing the current vendor collection model, it will extend to a variety of alternative models. Parties affected and not affected by the current proposal may therefore consider engaging in the review process. In our view, parties that should consider involvement in the review process include:

- overseas vendors of goods valued at under AUD 1,000;

- operators of electronic distribution platforms (EDPs) that involve supplies of low value goods being made to Australian consumers;

- 'redeliverers' and package forwarders who provide the use of an address outside Australia, purchase the low value goods, or arrange or facilitate the purchase of the low value goods;

- logistics and freight providers; and

- financial intermediaries, such as payment processors.

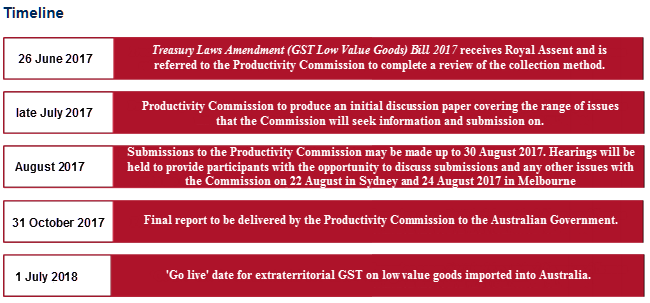

Parties will have an opportunity for engagement following the release of the Discussion Paper in late July 2017, when the Commission will open a formal submission process running until 31 August 2017, as well as holding public hearings into the matter (Sydney on 22 August 2017; and Melbourne on 24 August 2017).

Please click on the timeline to enlarge.

In addition to the above, the Australian Taxation Office (ATO) has released two new draft law companion guides LCG 2017/D4 – GST on supplies made through electronic distribution platforms and LCG 2017/D5 – when is a redeliverer responsible for GST on a supply of low value imported goods? to assist taxpayers with understanding their obligations under the law. These are to be read in addition to the ATO's earlier draft law companion guide LCG 2017/D2 – GST on low value imported goods.

For further information, please contact:

Amrit MacIntyre, Partner, Baker & McKenzie

amrit.macintyre@bakermckenzie.com