14 January, 2019

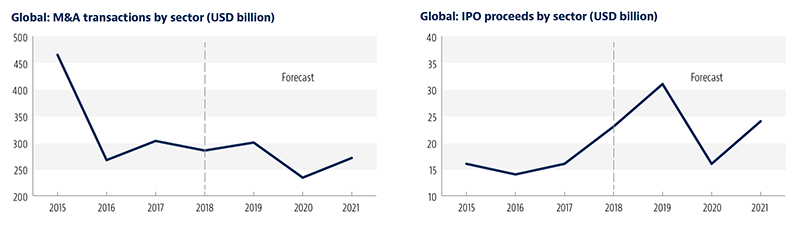

Dealmaking in the healthcare sector dropped 5% in 2018, to USD 308 billion, as political uncertainty and new regulations came into force.

However, 2019 has already started with a bang, following the announcement Bristol-Myers Squibb will acquire Celgene for USD 74 billion.

Our Global Transactions Forecast, issued with Oxford Economics, predicts a modest rise of 7% to USD 331 billion in 2019, as a number of cross-border and domestic megadeals are set to close. The figures do not account for the BMS-Celgene tie-up.

Key trends

Despite a lackluster performance in 2018, pharmaceutical companies are still shedding non-core assets as they aim to specialize and gain access to new technology.

Many of the industry’s biggest pharma companies conducted these transactions with one another in 2018, including Shire’s USD 2.4 billion sale of its oncology business to Servier, and Proctor & Gamble’s acquisition of Merck KGaA’s consumer health business for USD 4.2 billion.

Jane Hobson, Healthcare M&A Partner at Baker McKenzie, explains that as well as divesting, companies are also wanting to grow their product pipeline, as competition for the next innovative drug becomes fierce.

"As companies compete to add drugs to their portfolios, we’re seeing more early stage acquisitions and licensing, sometimes before proof of concept," Jane said.

"Also, a lot of the medical device companies are shifting their business models so that they don’t just offer a medical device. Instead, they offer a solution or patient support around it, or they offer to run a service for a hospital. Many manufacturers are having to buy in that expertise."

Meanwhile, the sector is also witnessing a continued rise in deal activity around healthcare technology, as Ben McLaughlin, Global Chair of Baker McKenzie’s Healthcare Industry Group, explains.

"For the past few years, we’ve seen healthcare companies increasingly seeking to meet the demands of this fast-changing healthcare market," he said.

"Pressure to lower costs and adjust to value-based care models, as well as meet the demands of technology-driven consumers and the rise in consumer healthcare devices, mean that buyers are looking to acquire companies capable of evolving within the landscape.”

US and Asia dominating deal activity

Our experts forecast that companies will be most active in the US and Asia. Thanks to populations with relatively disposable incomes, companies in both regions will try to attract new technologies.

According to Alan Zoccolillo, Healthcare M&A Partner, we’re seeing increased vertical integration where data, logistics and other potential areas for efficiencies can be found and help provide growth opportunities for companies where growth within their traditional sector is constrained.

"The long-term outlook for the sector is especially positive in mature economies with aging populations, like the US," he said.

Here, consolidation has come as new mergers between insurers and care delivery operators, to create more integrated full-service providers. In 2018, Cigna closed its USD 54 billion acquisition of Express Scripts, creating one of the biggest providers of pharmacy benefits and insurance plans in the country, a combination it says will help it improve healthcare coordination and cut costs.

IPO activity, particularly in the biotech sector, has been boosted by US FDA efforts to speed up approvals, along with the new rules on the Hong Kong Stock Exchange (HKSE), which have made it easier for biotechs to list.

As Ashok Lalwani, Healthcare IPO Partner explains, "The HKSE now allows biotech companies that aren’t yet profitable or without revenue to list, provided their expected market capitalization is more than HKD 1.5 billion. In comparison, those listed on China’s main exchanges – Shanghai and Shenzhen – must prove three consecutive years of profit and revenue before listing. The new rules mean in Hong Kong the number of biotech companies coming to the market in the early stages of research and development and with no profit or turnover is expected to grow."

Asia will play host to a number of megadeals in 2019, including Japan’s largest corporate takeover, Takeda’s acquisition of Irish pharmaceutical company Shire for USD 58 billion.

Challenges facing healthcare transactions

Deal activity is to reach its cyclical trough in the healthcare sector in 2020, as political uncertainty and regulations take their toll, as Hideo Norikoshi, Healthcare M&A Partner, explains.

"New investment and cross-border investment will be affected in the years to come, particularly between the US and China as tensions over trade continue. The UK’s withdrawal from the EU also leaves companies feeling uncertain, and this will further dampen deal activity in the UK and elsewhere.

"Political challenges aside, data protection may be a challenge for a lot of healthcare players thanks to GDPR and other similar measures. These regulations will force companies to protect patients’ data, but at the same time, they need to collect data for the development of new drugs. Whether regulators tend to enforce protection or make data available to responsible parties, M&A activities will be impacted."

Please click here for the full report.

For further information, please contact:

Ben McLaughlin, Partner, Baker & McKenzie

Ben.McLaughlin@bakermckenzie.com