27 July, 2017

Introduction

The Malaysian Inland Revenue Board (IRB) has announced that the Malaysian Transfer Pricing Guidelines 2012 (TP Guidelines 2012) will be updated, by making amendments to the chapters of the TP Guidelines 2012 on a gradual basis. The key aim of the updates is to ensure Malaysia's TP rules are aligned with global developments; however, it is also the intention to reinforce the enforcement of the arm's length principle and clarify the IRB's interpretations of the arm's length principle.

The first set of chapter updates have been released by the IRB. A new chapter has also been added. The chapters are:

- The arm's length principle – which has been updated from the TP Guidelines 2012;

- Intangibles – which has been updated from the TP Guidelines 2012;

- Documentation – which has been updated from the TP Guidelines 2012; and

- Commodity transactions – which is a new chapter.

Notably, there has also been a change to the penalty regime. The amendments and updates are reflective of the IRB's specific focus on transfer pricing matters in Malaysia.

Key Implications

Malaysia is not a member of the Organization Economic Co-operation and Development (OECD). However as of January 2017, Malaysia is a member of the inclusive framework on BEPS (Base Erosion and Profit Shifting). The present changes to the TP Guidelines 2012 appear to be an attempt on the part of the IRB to align its local transfer pricing rules and requirements to the standards suggested by the OECD.

From a practical perspective, Malaysia has historically adopted a broad interpretation of the OECD standards and at times its interpretation of the OECD standards has differed from its counterparties. It therefore remains uncertain as to how implementation of the guidance in the updated and new chapters will be effected in practice, and how this will translate to both the focus and outcomes of transfer pricing audits and dispute resolution. In many cases, it is anticipated that the application of differing standards may result in one-sided challenges in Malaysia (or elsewhere), thus making the development of a suitable transfer pricing risk management framework that takes into account such issues highly important.

The change to the penalty on adjustments will have significant implications. With this change, it is important for taxpayers to take planning measures in preparing transfer pricing documentation carefully so as to avoid adjustments where it is practically possible. There is also a need to prepare for adequate financial reserves in the event of a transfer pricing audit resulting in potential adjustments in view of the potential three-fold increase in penalty rates. This is because in the event of a dispute, taxpayers will be required to pay the amount, including the penalty, up front under protest.

Summary of Significant Amendments

The key changes are summarised in this alert as follows:

(a) Increase in Penalty Rates

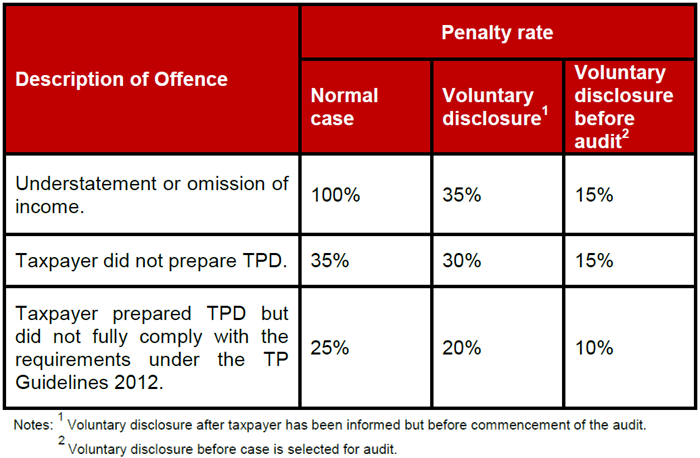

The amended chapter on documentation appears to have removed the previous penalty rates stipulated under the TP Guidelines 2012. Prior to the updates, taxpayers could rely on the TP Guidelines 2012 to appeal to the IRB to apply a maximum penalty rate of 35%.

At present, the IRB appears to have the discretion to apply a maximum penalty rate of 100% on a taxpayer if it is discovered during a transfer pricing audit that there has been an understatement or omission of income. While it remains to be seen how the IRB will apply such discretion, taxpayers are advised to prepare for the worst.

The new penalty rates as observed in the Transfer Pricing Audit Framework 2013 are summarised as follows:

Please click on the table to enlarge.

(b) New Master File Requirements

Taxpayers which are obliged to prepare Country-by-Country (CbC) Reports under the Income Tax (Country-by-Country) Rules 2016 are now also required to prepare a Master File, to be submitted together with transfer pricing documentation (TPD) upon the IRB's request.

(c) Adoption of the DEMPE Approach for Intangibles

The IRB has provided new guidelines to provide that taxpayers entering into controlled transactions involving intangibles must now consider the performance of development, enhancement, maintenance, protection and exploitation (DEMPE) functions in allocating profits according to the guidance provided by the IRB.

In practice, it is likely that the IRB will use this provision to assert that the local taxpayer performs some element of DEMPE functions that generate value greater than provided to it under its TP policies. Examples may be restricting outbound royalty payments, increasing R&D service fees or attempting in more extreme cases to assert the characterisation of the entity is incorrect (i.e. a routine entity should be considered an entrepreneur). In considering the functional roles of certain companies in a multinational group setting with respect to intangibles, companies performing DEMPE functions will likely be considered more significant and should be compensated accordingly. In short, companies performing more DEMPE functions in Malaysia should proportionally be compensated more.

(d) Commodity Transactions

There is also new guidance to specifically address commodity transactions between related parties. The new guidance stipulates the appropriate method to test such transactions. In particular, it is noteworthy that the IRB has emphasised the use of "quoted prices" and the comparable uncontrolled price (CUP) method to test commodity transactions between related parties.

What This Means for You

In the past year, the IRB's has increased its enforcement efforts in tax collection practices tremendously. The IRB continues to have broad powers and high tax collection targets to fulfill, and transfer pricing is an area of importance for tax collection.

In this climate, it is recommended that taxpayers exercise caution and prepare their transfer pricing policies and documentation carefully, to ensure defensibility in the event of an audit.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com