26 April, 2017

On 17 March 2017, the State Administration of Taxation (SAT) issued the Bulletin on the Administrative Measures for Special Tax Investigation and Adjustments and Mutual Agreement Procedures1 (Bulletin 6). Bulletin 6 is the third and final bulletin in a series through which the SAT has comprehensively revised the transfer pricing regime under the former Circular 22.

This process began in 2015 when the SAT prepared and circulated a draft Implementing Measures for Special Tax Adjustments (Draft Measures). After running into difficulty obtaining the consensus needed to promulgate the Draft Measures, the SAT decided to proceed with revising the transfer pricing regime by way of separate bulletins. The first two bulletins in the series were Bulletin 423 on transfer pricing documentation and Bulletin 644 on advance pricing arrangements (APAs). When Bulletin 6 takes effect on 1 May 2017, the revamping of China's transfer pricing regime will be complete.

Bulletin 6 represents, in the SAT's own words, an "active application of the Base Erosion and Profit Shifting (BEPS) action plans' outcomes". Nonetheless, the SAT has backed away in Bulletin 6 from some of the more controversial elements in the Draft Measures.

In this alert, we will first examine who is affected by Bulletin 6. We will then discuss the bulletin's key provisions and their implications for multinational companies (MNCs). Finally, we will provide recommendations to MNCs on how to develop appropriate transfer pricing strategies to safeguard their tax interests in China.

1. Who is Affected?

Any MNC that engages in a cross-border, related-party transaction involving China will be affected by Bulletin 6. However, transactions between domestic related parties that are part of an MNC group are in principle excluded from transfer pricing adjustments as long as such transactions do not decrease China's overall tax revenue.

While Bulletin 6 will take effect on 1 May 2017, it is not yet known whether it will also apply retroactively to transactions that occurred before 1 May 2017 for which the tax authorities have not yet determined the tax treatment. If Bulletin 6 has retroactive effect, it may apply during the 10-year statute of limitations period for any ongoing transfer pricing investigation that started before 1 May 2017, or it may extend back only to 1 January 2008, which is the effective date of the present Enterprise Income Tax Law.

2. What Does Bulletin 6 Say?

2.1 Entitlement to intangible-related return

Unlike the Draft Measures, Bulletin 6 does not refer to the concept of economic ownership of intangibles. However, it still requires value contribution analysis when determining the allocation of returns to intangibles. The key factors in the value contribution analysis include the functions of development, enhancement, maintenance, protection and exploitation (DEMPE) as proposed under the BEPS Actions 8-10 final report, but marketing/promotion is introduced as a new value-contributing factor. Bulletin 6 further provides that a legal owner which does not contribute to value creation should not receive any intangible-related return. More specifically, it states that a capital-rich company which merely provides funds without actually performing relevant functions or assuming relevant risks is not entitled to intangible-related returns.

2.2 Outbound payments

Bulletin 6 replaces the controversial Bulletin 165 regarding the deductibility of the outbound payment of service fees and royalties to related parties. It is an improvement on Bulletin 16 in two respects:

- it removes the confusion about whether the rules in Bulletin 16 were based on transfer pricing or on the deductibility of expense, which had implications for interest, penalties and the statute of limitations, among other things, by providing that they are part of the transfer pricing regime;

- it strengthens the applicability of the arm's length principle for all of the various types of outbound payments to related parties, not only for royalties.

Bulletin 6 specifically provides that the tax authorities may make a transfer pricing adjustment on two types of outbound royalty payments if the payment does not comply with the arm's length principle. The first is a royalty paid for an intangible that does not benefit the payer of the royalty. The second is a royalty paid to a legal owner that does not contribute to the value creation of the intangible.

In other respects, the Bulletin 6 rules on outbound payments are similar to those in Bulletin 16.

2.3 Comparability analysis

As compared to Circular 2, Bulletin 6 requires comparability analysis to consider two additional factors:

- the enterprise’s ability to perform the contracts, its actual conduct of performing the contracts, and the degree of "credibility" of the related parties entering into the contract provisions

Although Bulletin 6 does not formally introduce the risk allocation principles proposed under the BEPS Actions 8-10 final report, the PRC tax authorities may use this newly-added factor to challenge the contractual allocation of risks between related parties. The "credibility" factor, in addition to being vague, seems to go beyond what is contemplated in the BEPS Actions on contractual risk allocation.

- location specific advantages (LSAs) such as location saving and market premium

The Chinese tax authorities have applied the LSA concept as a bargaining chip in transfer pricing negotiations for a number of years. More recently, the SAT formally introduced the LSA concept for transfer pricing documentation and APA negotiation under Bulletin 42 and Bulletin 64. With Bulletin 6 now requiring LSA analysis in comparability analysis, MNCs may face an increasing number of cases where the tax authorities make transfer pricing adjustments based on LSAs.

2.4 Transfer pricing methods

In addition to the five traditional transfer pricing methods6 listed in Circular 2, Bulletin 6 introduces the asset valuation method and a catchall "other methods that can align profits with economic activities and value creation". Both methods must be applied consistently with the arm's length principle.

The asset valuation method comprises the cost method, the market method and the income method (i.e., a discounted cash flow method), which are typical valuation techniques used by appraisal firms. Although Bulletin 6 does not expressly say so, we expect that the asset valuation method will typically be used to determine the arm's length price of related-party equity/asset transfers, as is already common practice in China today.

MNCs will be heartened to see that the controversial value contribution allocation method (which was similar to global formulary apportionment) proposed under the Draft Measures has not been included in Bulletin 6. However, traces of the value contribution allocation method can still be found in the Bulletin 6 provisions on the profit split method. When the tax authorities apply the profit split method, Bulletin 6 allows them to allocate the consolidated profits among related parties based on each party's value contribution7 if the tax authorities find it difficult to obtain comparable data and they can reasonably determine the consolidated profit. Still, as the value contribution allocation method would have allocated the group's consolidated profits among all member entities, the SAT has backed down significantly on this issue in Bulletin 6.

Bulletin 6 also expressly provides that the transactional net margin method (TNMM) generally should not be used to determine the arm's length profit of an enterprise with valuable intangibles. This may limit the ability of a high and new technology enterprise (HNTE) to apply TNMM. As a qualification requirement, an HNTE must own the core IP of its main products or services. As Bulletin 6 does not define the term "valuable intangible", the tax authorities may assert that this core IP constitutes a valuable intangible and thus not allow an HNTE to use TNMM. Moreover, the tax authorities may assert that an HNTE should apply the profit split method so that a higher portion of profit will be allocated to the HNTE.

2.5 Transfer pricing audits

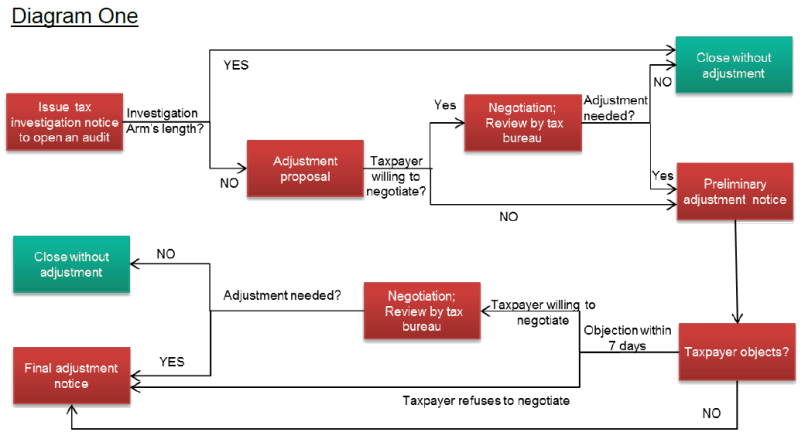

The transfer pricing audit procedures under Bulletin 6 are set out below in Diagram One:

These transfer pricing audit procedures are mostly the same as under Circular 2, with some clarifications to make the procedures more practical. Other notable Bulletin 6 directives on transfer pricing audits include:

- The tax authorities are expressly authorized to investigate a foreign enterprise and request information from the foreign enterprise.

- The tax authorities should choose the party with the simpler function to be the tested party. They may use this provision as a basis to choose the foreign transactional party of China's full risk manufacturers as the tested party. Once the overseas party is selected as the tested party, the MNC will have to disclose detailed information on the overseas party. In addition, by remunerating the overseas party based on one-sided methods such as TNMM or cost-plus, the tax authorities will be able to attribute all the residual profits to the Chinese full risk manufacturer.

- A long-standing practice on transfer pricing adjustments has been reaffirmed, i.e., that transfer pricing adjustments should be made on a yearly basis. This means that no credit can be given to tax years with high profits.

- Two other long-standing positions have been reaffirmed. First, in principle, single-function entities in China must be profitable. Second, the tax authority may determine a toll manufacturer's profits by selecting enterprises engaged in a different business model (typically buy-sell contract manufacturers) as the comparable enterprises; and the cost of the raw materials and equipment should be included into the toll manufacturer's total cost base.

2.6 Mutual agreement procedure (MAP)

Bulletin 6 governs MAP in relation to bilateral/multilateral APAs and special tax adjustments in one jurisdiction which would result in corresponding adjustment in another jurisdiction. Special tax adjustments include adjustments in relation to transfer pricing, controlled foreign corporation, thin capitalization and the general anti-avoidance rule. However, not all special tax adjustments will result in corresponding adjustments, and we would expect some would fall into the MAP for general treaty purposes rather than the MAP under Bulletin 6.

According to Bulletin 6, the SAT may initiate a MAP upon the request of an enterprise or the competent authority of the other contracting state. Prior to Bulletin 6, China did not have domestic rules governing the launching of a MAP upon request by a treaty partner country's competent authority in relation to a transfer pricing adjustment. This expansion under Bulletin 6 shows the SAT's increasing support for the MAP program.

For further information, please contact:

Jon Eichelberger, Partner, Baker & McKenzie

jon.eichelberger@bakermckenzie.com

.jpg)