This guide is designed to compare some of the key public takeover rules in Hong Kong (HK), Singapore (SG), the United Kingdom (UK) and the United States of America (US or USA). However, each transaction is case specific and our market-leading global corporate team can advise you on public takeovers and other M&A transactions throughout the world. It is important to seek advice from legal advisers in the early stages of a public takeover where possible and we would welcome the opportunity to discuss your individual objectives. Should you require any further information please contact any of the Hogan Lovells corporate partners listed on the following page.

Public Takeover Framework At A Glance

Takeover Rules

Hong Kong, Singapore and the UK are based on common law systems. The US, by comparison, is based on the civil law system. The focus of this guide is on the takeovers regimes in Hong Kong, Singapore, the UK and USA. However, the local securities laws in the jurisdictions of incorporation of the relevant target companies are also relevant.

For the US, this guide is based on Delaware law, being the most important and influential state corporate law from an M&A perspective.

HK: Codes on Takeovers and Mergers and Share Buy-backs (HK Code)

SG: The Singapore Code on Take-overs and Mergers (SG Code)

UK: The City Code on Takeovers and Mergers (UK Code)

US: The federal and state corporate laws of the US, with Delaware law being the most common jurisdiction of incorporation for public companies in the US

Regulators

HK: Hong Kong Securities and Futures Commission (SFC) SG: Securities Industry Council (SIC) UK: Panel on Takeovers and Mergers (Panel) US: Securities and Exchange Commission (SEC)

Stock Exchanges

Listed companies are also regulated by their respective stock exchanges. In addition to the constitutional documents, the listing rules on which the target’s securities are listed may apply.

HK: Hong Kong Stock Exchange (HKEx)

SG: Singapore Stock Exchange (SGX)

UK: London Stock Exchange (LSE)

US: New York Stock Exchange (NYSE) or Nasdaq

Courts

Jurisdiction of the courts of a company’s country of incorporation may also apply.

In particular, in the US, public company M&A transactions often become the subject of shareholder litigation, irrespective of whether any such claims are meritorious. Generally, these claims are based on allegations of breach of fiduciary duty by the target’s board and/or of failure to make all required disclosures. In most cases, these claims can be settled for nominal amounts and possibly some added disclosures.

Competition Laws And Other Industry-Specific Restrictions

Competition laws and other restrictions contained in local laws may restrict takeovers in certain industries and/or require prior approval by the relevant regulator.

Obtaining Control of publicly listed companies at a glance

Hong Kong, Singapore And The UK

In Hong Kong, Singapore and the UK, takeovers and schemes of arrangement are the main methods by which acquisition of control of a publicly listed company is affected. It is important for an offeror to consider at the outset the shareholder base of the target to determine whether to proceed with the offer or scheme of arrangement route, and to build in flexibility to switch between the different routes, if necessary, to maximise the chances of gaining overall control of the target.

Schemes Of Arrangement

A scheme of arrangement is a court sanctioned procedure that is also required to be approved by the target’s shareholders. Minimum shareholder approval thresholds in each jurisdiction apply. A takeover conducted by way of a scheme of arrangement will bind all of the target shareholders if the approval thresholds are met (see the summary in section 17 of this guide).

A scheme usually involves the cancellation of all the issued shares of the target (other than those shares held by its controlling shareholder(s)) and the issue of new shares to the offeror. In return, the offeror will pay the consideration to the target’s former shareholders.

Takeovers

A takeover involves an offeror making an offer to all target shareholders in a particular class to acquire their shares. Takeovers are either mandatory (i.e. an offeror is required to make a takeover offer once specified events have occurred) or voluntary. The rules set out in the takeover regulations in each jurisdiction apply as summarised in this guide.

Takeovers can either be hostile or negotiated. However, in Hong Kong for example, hostile takeovers are not as commonly seen due to the prevalence of companies listed on the HKEx having significant or controlling shareholders and consequently the co-operation of the offeree is often required.

Compulsory acquisition is another method that can be used to acquire complete control of a publicly listed company as part of a takeover.

Compulsory Acquisition

Compulsory acquisition requires that the offeror has already acquired an interest in a minimum number of shares in the target. It is a method that can be used to “squeeze out” minority shareholders (see the summary in section 18 of this guide).

USA

In the US, the acquisition of a publicly traded company may be effected mainly through a tender offer or merger.

Tender Offer

In a tender offer, the offeror makes an offer directly to the target’s shareholders to acquire their shares on specified terms and conditions.

A tender offer may be either hostile or negotiated. Tender offers are regulated by the US federal securities laws which provide both substantive regulation and specify required disclosures. The actions of the target and its board of directors in connection with a tender offer are also subject to the corporate laws of the state in which the target is incorporated, including, most importantly, whether such actions are consistent with the board’s fiduciary duties under such laws.

If the offeror is an affiliate or controlling shareholder of the target, a tender offer would also be subject to enhanced disclosure obligations under the US federal securities laws, and the actions of the target and the offeror in a negotiated transaction would be subject to enhanced scrutiny under the applicable state corporate law.

Merger

In a merger, the target is merged either with the offeror or a subsidiary of the offeror and the shares of the target are converted into merger consideration, which can be either cash or shares.

A merger must be completed on a negotiated basis, as it requires the approval of the board of the target, among others. A merger is primarily governed, on a substantive basis, by state corporate law, though the US federal securities laws specify the disclosures that must be made to shareholders and provide some substantive rules relating to the manner in which a shareholder vote may be solicited.

Trigger Thresholds At A Glance

In planning a takeover or scheme of arrangement, there are a number of key shareholding acquisition thresholds that are important in one or more of the takeover regimes in Hong Kong, Singapore, the UK and the US. These are broadly summarised below and set out in more detail in this guide,

| 1% / 5% | Shareholding disclosure requiredPotential offeror must disclose level of shareholding (see section 6 of this guide) |

| 10% | Cash offer required Potential offeror must make a cash offer if it has acquired more than 10% of voting rights in the specified periods (see section 8 of this guide) |

| 30% | Mandatory takeover offer requirement triggeredPotential offeror must make a mandatory takeover offer (see section 7 of this guide) |

| 50% | Effective control obtained Potential offeror will obtain effective control and be able to pass ordinary resolutions if there are no other significant shareholders |

| 75% | Scheme of arrangement approval acquired This is conditional upon the relevant scheme tests being met (see section 17 of this guide) |

| 90% | Compulsory acquisition of minority shareholders |

| 100% | Wholly-owned company acquired |

Takeover Rules

1. “Acting In Concert” Definition

“Acting in concert” is a complex but key takeovers concept that is used in various rules in the HK Code, SG Code and UK Code. If in any doubt as to whether a person or an entity is a concert party, you should always consult the Takeovers Executive (in HK), Securities Industry Council (in SG) or Takeovers Panel (in UK), as applicable, in advance of any action. The US uses a similar concept called acting “as a group”.

| Hong Kong | Singapore | UK | USA |

| “Acting in concert” comprises persons who, pursuant to an agreement or understanding (whether formal or informal), actively co-operate to obtain or consolidate control (i.e. a holding of 30% or more of the voting rights) of a company.Persons who fall within certain prescribed classes are presumed to be acting in concert with each other unless the contrary is established. These classes include, broadly:

(a) companies within the same corporate group,

(b) companies with their directors (or the directors of their parent company) and pension funds, provident funds, and employee share schemes,

(c) fund managers with any funds that they manage on a discretionary basis,

(d) financial/professional advisers and brokers with its client,

(e) directors of a company which is subject to an offer or where they believe an offer is imminent, (f) partners, (g) an individual with his close relatives, related trusts and companies controlled by him together with companies that they control, and (h) a person lending money in the ordinary course of business, providing finance or financial assistance. |

“Acting in concert” comprises individuals or companies who, pursuant to an agreement or understanding (whether formal or informal), cooperate, through the acquisition by any of them of shares in a company, to obtain or consolidate effective control of that company.Without prejudice to the general definition above, certain categories of individuals and companies will be presumed to be persons acting in concert with each other unless the contrary is established. These categories include, broadly:

(a) companies within the same corporate group,

(b) companies with their directors and pension funds, fund managers with any funds that they manage on a discretionary basis, and

(c) a company or individual with any person who has provided financial assistance (other than a bank in the ordinary course of business). |

“Acting in concert” comprises persons who, pursuant to an agreement or understanding (whether formal or informal), cooperate to obtain or consolidate control of a company or to frustrate the successful outcome of an offer for a company. Without prejudice to the general application of this definition, persons who fall within certain prescribed categories are presumed to be acting in concert with each other unless the contrary is established. These categories include, broadly: (a) companies within the same corporate group, (b) companies with their directors and pension funds, (c) fund managers with any funds that they manage on a discretionary basis, and (d) financial advisers and corporate brokers with any parties to an offer that they are advising in relation to the offer. The concert party of a sovereign wealth fund or government owned entity offeror could encompass a wide range of entities – we are familiar with the approach taken by the Takeovers Panel and would be happy to discuss specifically with a view to obtaining appropriate exemptions. | Parties acting “as a group” must make the disclosures described under “Disclosure of dealings and positions” below, and must make such disclosures when the holdings of the group pass the relevant thresholds.The law is somewhat vague in determining whether parties are acting as a group in the absence of an express agreement. Groups of hedge funds (“wolf packs”) acting with respect to a single target tend to avoid such express agreements and disclaim acting as a group. |

2. When An Announcement Is Required

| Hong Kong | Singapore | UK | USA |

| Rules 3.1 – 3.3: (a) When a firm intention to make an offer is notified to the target board.

(b) When an obligation to make a mandatory offer arises (see section 7 below for details).

(c) When, following an approach, the target is the subject of rumour or speculation or there is undue movement in its share price or share volume.

(d) When, before an approach, the target is the subject of rumour or speculation or there is undue movement in its share price or share volume and there are reasonable grounds for concluding that this has been caused by the offeror’s actions or those acting in concert with it.

(e) When negotiations or discussions are about to be extended beyond a very restricted number of people. |

Rule 3:(a) When there is a firm intention to make an offer.

(b) Upon an acquisition of shares which give rise to an obligation to make a mandatory offer (see section 7 below for details).

(c) When, following an approach, the target is the subject of rumour and speculation or there is an untoward movement in its share price and there are reasonable grounds for concluding that this is caused by the offeror’s action.

(d) When negotiations or discussions between the offeror and the offeree company are about to be extended to include more than a very restricted number of people. |

Rule 2.2: (a) When a firm intention to make an offer is notified to the target board.

(b) When an obligation to make a mandatory offer arises (see section 7 below for details).

(c) When, following an approach, the target is the subject of rumour and speculation or there is an untoward movement in its share price.

(d) When, before an approach, the target is the subject of rumour and speculation or there is an untoward movement in its share price and there are reasonable grounds for concluding that this has been caused by the offeror’s actions.

(e) When negotiations or discussions are about to be extended beyond a very restricted number of people. |

An offeror may make an announcement whenever it decides to make the offer.The offeror must, however, have an actual intention to commence and complete the offer within a reasonable period of time. The offeror may not afford shareholders of the target an ability to tender their shares (“commence” the offer) without filing the appropriate disclosure documents.

Upon any change to the terms of the offer, the offeror is also required to file amended disclosure documents, and if such change is material, extend the period during which the offer is open (which must generally be 20 business days). The target must provide shareholders with a disclosure document stating the target board’s position on the offer (i.e. recommend acceptance or rejection, remain neutral or state that it is unable to take a position).

In a merger context, announcement is generally required upon execution of the merger agreement. Preagreement discussions are generally viewed as nondisclosable on the basis that they may not result in an agreement. Under certain circumstances, disclosure of pre-agreement discussions may be required in response to a leak or in response to a request by the US national securities exchange on which the relevant shares are listed. |

3. Distribution Of Announcements To Shareholders, Employees And Pension Scheme Trustees

| Hong Kong | Singapore | UK | USA |

| Rule 8.1:Information about companies involved in an offer must be made equally available to all shareholders as nearly as possible at the same time and in the same manner.

There is no requirement to distribute announcements to employees who are not shareholders although the offer document must contain information regarding the target and its employees, and the target’s board circular should also include the views of the board on the offeror’s plans for the target and its employees. There is no requirement to distribute announcements to pension scheme trustees. |

Rule 9.1:Information about companies involved in an offer must be made equally available to all shareholders as far as possible at the same time and in the same manner.

There is no requirement to distribute announcements to employees who are not shareholders although the offer document must contain information regarding the target and its employees, and the target’s board circular should also include the views of the board on the offeror’s plans for the target and its employees. There is no requirement to distribute announcements to pension scheme trustees. |

Rule 2.12: Employees of both the offeror and the target company and the trustees of the target company’s pension scheme must be informed about an offer. In addition, the target company’s employee representatives and pension scheme trustees have the right to have a separate opinion appended to the target board’s circular or published on a website.

The target must pay for the costs of the publication of any opinion received from employee representatives and for the costs reasonably incurred in obtaining advice required for the verification of the information contained therein, and the costs of the publication of any opinion received from trustees of its pension scheme(s). |

All disclosure documents relating to an offer or to a merger must be provided to the target and to all of its shareholders (including trustees of benefit plans, if applicable). There is no requirement to provide such materials to employees who are not otherwise shareholders. |

4. Independent Advice

| Hong Kong | Singapore | UK | USA |

| Rule 2: The target company must retain a competent independent financial adviser whose advice must be made known to all the shareholders by including it in the target’s board circular together with the recommendations of the “independent” members of the board regarding the offer. | Rule 7:The target company must appoint a competent independent adviser whose advice on the offer must be made known to all the shareholders, together with the opinion of the “independent” members of the board. | Rule 3:The target company must appoint a competent independent adviser whose advice on the offer must be made known to all the shareholders, together with the opinion of the “independent” members of the board. | While there is no US law requiring that a target receive independent financial advice, in order for the board of directors to satisfy their fiduciary duties under the applicable state corporate laws and in particular, the duty of care, such independent advice will generally be sought. Delaware law expressly permits boards to rely on such advice. While independent financial advice is not required, any conflicts of interests of a financial advisor (such as in providing financing to the offeror or otherwise) will be scrutinized in any shareholder litigation. |

5. Acquisitions Resulting In Obligation To Offer Minimum Level Of Consideration

| Hong Kong | Singapore | UK | USA |

| Rule 24:If, during the offer period or after an announcement of a firm intention to make an offer, the offeror or any person acting in concert with it purchases shares in a target company at a price higher than the value of the offer, then the offer must be increased to not less than the highest price paid for any shares so acquired. | Rule 21:If the offeror acquires an interest in shares in a target company either during the offer period or (in the case of a voluntary offer) in the three month period or (in the case of a mandatory offer) in the six month period prior to its commencement, at a price higher than the value of the offer, the offer must be increased accordingly. | Rule 6:If the offeror acquires an interest in shares in a target company either during the offer period or in the three month period prior to its commencement, at a price higher than the value of the offer, the offer must be increased accordingly. | Generally there are no price-setting requirements (e.g. if an offeror acquires shares during the offer period or shortly before, at a price higher than the offer value). However, all purchases made during the offer must be at the same price and that price must be available to all holders (the “best price all holders” rule).In a tender offer for shares of a company listed on a US national securities exchange, the offeror must offer all shareholders of the target the same ability to participate in the offer and pay them all the same price.

Various states (though not Delaware) have antitakeover rules that require a specified amount be paid to shareholders in certain hostile circumstances. |

6. Disclosure Of Dealings And Positions

| Hong Kong | Singapore | UK | USA |

| Rule 22:

There are stringent and detailed requirements for disclosure of dealings in relevant securities during an offer period.

Prompt disclosure of positions and dealings in relevant securities is required by the parties to an offer and their associates. Associates include any person who owns or controls 5% or more of any class of such securities as well as directors.

Part XV of the Securities and Futures Ordinance requires disclosure of dealings taking a shareholder’s interest in a company’s voting rights above or below 5% and each whole percentage point above 5%. |

Rule 12:

There are stringent and detailed requirements concerning the disclosure of dealings in relevant securities during an offer.

Prompt disclosure of positions and dealings in relevant securities is required by the parties to an offer (and their associates, including directors). Associates include any person who owns or controls 5% or more of any class of such securities as well as directors.

Subdivision 2 of Part VII of the Securities and Futures Act (Cap. 289) requires disclosure of dealings taking a shareholder’s interest in a company’s voting rights above or below 5% and each whole percentage level above 5%. |

Rule 8:

There are stringent and detailed requirements concerning the disclosure of dealings in relevant securities during an offer.

Prompt disclosure of positions and dealings in relevant securities is required by the parties to an offer (and their concert parties, which would include directors) and any person who is interested (directly or indirectly) in 1% or more of any class of relevant securities of either the target company or any securities exchange offeror.

The Disclosure and Transparency Rules require disclosure of dealings taking a shareholder’s interest in a company’s voting rights above or below 3% and each whole percentage point above 3%. |

The acquisition of 5% or more of a class of securities listed on a US national securities exchange generally requires public disclosure within 10 days of such acquisition.

Such disclosure must include information concerning the offeror and any persons with which it is acting together, all recent dealings, intentions with regard to the target, the sources of financing and other information.

Any material change in such disclosure (including a change in 1% or more of the class) requires that such information be promptly (the next business day) amended.

In addition, the acquisition of 10% or more of a class of securities listed on a US national securities exchange generally requires additional public disclosure and subjects such holder to disgorgement of “short swing profits” (i.e. profits (or avoidance of losses) due to offsetting sales and purchases (or purchases and sales) during any six month period). |

7. Mandatory Offer Requirement

| Hong Kong | Singapore | UK | USA |

| Rule 26:

When a person (acting alone or in concert) acquires:

(a) 30% or more of the voting rights of a company, or

(b) shares carrying more than 2% of the voting rights when it is already holding not less than 30% but not more than 50%,

they must make a cash offer to all other shareholders at the highest price paid during the offer period and in the 6 months before the start of the offer period. |

Rule 14:

When a person (acting alone or in concert) acquires:

(a) interests in shares carrying 30% or more of the voting rights in a company, or

(b) shares carrying more than 1% of the voting rights when it is already interested in not less than 30% but not more than 50%,

they must make a cash offer to all other shareholders at the highest price paid in the 6 months preceding the offer announcement |

Rule 9:

When a person (acting alone or in concert) acquires:

(a) interests in shares carrying 30% or more of the voting rights of a company, or

(b) increases the aggregate percentage interest it has when it is already interested in not less than 30% but not more than 50%,

they must make a cash offer to all other shareholders at the highest price paid in the 12 months before the offer was announced (30% of the voting rights of a company is treated as the level at which effective control is obtained). |

There is no mandatory offer requirement prescribed under US law (either federal or state).

However, certain state anti-takeover laws (including in Delaware) prevent a hostile offeror that acquires a specified percentage of shares from acquiring additional shares absent satisfaction of specified conditions (i.e. board approval). |

8. Requirement For Cash Offer

| Hong Kong | Singapore | UK | USA |

| Rule 23:

When interests in shares carrying 10% or more of the voting rights have been acquired for cash by an offeror and any person acting in concert with it during the offer period (i.e. before the shares subject to the offer have been acquired, hence not including such shares) and within the previous 6 months, the offer must be in cash or include a cash alternative for all shareholders at a price not less than the highest price paid by the offeror during that period. |

Rule 17:

When interests in shares carrying 10% or more of the voting rights of a class have been acquired for cash by an offeror in the offer period (i.e. before the shares subject to the offer have been acquired, hence not including such shares) and the previous 6 months, the offer must include a cash alternative for all shareholders of that class at the highest price paid by the offeror in that period. |

Rule 11.1:

When interests in shares carrying 10% or more of the voting rights of a class have been acquired for cash by an offeror in the offer period (i.e. before the shares subject to the offer have been acquired, and hence not including such shares) and the previous 12 months, the offer must include a cash alternative for all shareholders of that class at the highest price paid by the offeror in that period.

Further, if an offeror acquires for cash any interest in shares during the offer period, a cash alternative must be made available at that price at least. |

There is no mandatory requirement for a cash offer prescribed under US law (either federal or state), whether the acquisition is to be effected through a tender offer or a merger.

However, as noted in section 7 above, various state anti-takeover laws may be applicable in certain hostile situations. |

9. Special Deals With Favourable Conditions

| Hong Kong | Singapore | UK | USA |

| Rule 25:

Favourable deals for selected shareholders are generally banned, except in certain cases where independent shareholder approval is given and the arrangements are regarded as fair and reasonable in the opinion of the financial adviser to the target company.

Arrangements made by an offeror with its concert party whereby the shares in the target are acquired by the concert party on the basis that the offeror will bear all the risks and receive all the benefits, are not prohibited by this Rule.

Arrangements with management may be permitted provided that the arrangements are “fair and reasonable” in the opinion of the financial adviser to the target, and in cases where management holds more than 5% of a target, the arrangements are approved by the target’s independent shareholder. |

Rule 10:

Favourable deals for selected shareholders are banned, except in certain cases where independent shareholder approval is given and the arrangements are regarded as fair and reasonable in the opinion of the financial adviser to the target company.

Where two or more persons form a consortium and each of them can properly be considered to be a joint offeror, Rule 10 is not contravened if one (or more) of them is already a shareholder in the target company and they have agreed between them a special deal.

The Securities Industry Council should be consulted if the management of the offeree company is to remain financially interested in the business after the offer is completed. |

Rule 16.1:

Favourable deals for selected shareholders are banned, except in certain cases where independent shareholder approval is given and the arrangements are regarded as fair and reasonable in the opinion of the financial adviser to the target company. Where two or more persons form a consortium and each of them can properly be considered to be a joint offeror, Rule 16 is not contravened if one (or more) of them is already a shareholder in the target company and they have agreed between them a special deal. Arrangements with management are not generally prohibited, but disclosure, shareholder approval and a financial adviser opinion that the arrangements are “fair and reasonable”, may be required by Rule 16. |

As noted above, in a tender offer for shares of a company listed on a US national securities exchange, all shareholders of the target must be afforded the same ability to participate in the offer and the same consideration.

There is a safe harbour available to prevent compensation payable to employees of the target (who also are shareholders of the target) from being considered as having been received in respect of their shares, thus avoiding a potential violation of this rule.

In a merger (which is effected under the various state laws, rather than under the federal tender offer regime), it is possible to offer differential consideration to certain shareholders, though doing so would result in enhanced legal scrutiny of the transaction and the board process by which such differential consideration was approved in any shareholder litigation. |

10. Information Standards

| Hong Kong | Singapore | UK | USA |

| Rule 9.1:

Each document issued or statement made in relation to an offer or possible offer, or during an offer period, must satisfy the highest standards of accuracy. The information given must also be adequately and fairly presented. This applies whether it is issued or made by the company directly, or by an adviser on its behalf, or by any other relevant person.

Those who issue or make any such document or statement must ensure that it remains accurate and up to date throughout the offer period, and must notify shareholders of any material changes as soon as possible.

Rule 18.1:

Parties to an offer or possible offer and their advisers must take care not to issue statements which, while not factually inaccurate, may mislead shareholders and the market or may create uncertainty.

Rule 12.1:

Except for the documents set out in the Post-Vet List issued by the Takeovers Executive, all documents issued in a takeover must be filed with the Takeovers Executive for comment before release or publication. |

Documents issued in a takeover or merger should not be submitted to the Securities Industry Council in advance, except where required by the Securities Industry Council (e.g. circulars to shareholders in relation to whitewash resolutions).

This means that anything contained in them which the Securities Industry Council finds misleading or incomplete (in terms of the information shareholders can reasonably expect) will require correction by further circulars or announcements.

Rule 8.5:

Responsibility for the contents of documents rests with the offeror, the offeree company, their directors and advisers. Any correction to an advertisement must be made immediately. |

Rule 19:

Misleading, inaccurate or unsubstantiated statements made in documents or to the media must be publicly corrected immediately. |

Generally, any material misstatement or omission from the offer materials, or from the materials provided to shareholders in connection with a vote on a merger, could result in liability for the person making such misstatement or responsible for such omission (whether the offeror or the target). |

11. Responsibility For Documents

| Hong Kong | Singapore | UK | USA |

| Rule 12:

It is the sole responsibility of the issuer of the document (and its directors and advisers) to ensure that the HK Code is fully complied with.

Rule 9.3:

All documents should contain a statement that the directors accept full responsibility for its contents.

Parties who issue HK Code announcements and documents which are found to contain false or misleading information may also face criminal liability under the Securities and Futures Ordinance.

Introduction To The HK Code:

In addition to the responsibilities provided for in the HK Code, any others issuing circulars or advertisements to shareholders in connection with takeovers must observe the highest standards of care and consult with the Takeovers Executive prior to the release thereof. |

Introduction to the SG Code:

Responsibility for the contents of documents rests with the offeror, the offeree company, their directors and advisers.

Rule 8.3:

All documents should contain a statement that the directors accept responsibility to ensure that the facts and options are fair and accurate and no material facts have been omitted. |

Rule 19.2:

Those issuing takeover circulars must include statements taking responsibility for the contents. This can include non-issuers taking responsibility for certain sections of such circulars where the information relates to such non-issuer. |

Both the target and the offeror have the obligation to provide shareholders with documents in connection with the offer. Each has responsibility for the documents that it provides. |

12. Equality Of Information To Shareholders And Competing Offerors

| Hong Kong | Singapore | UK | USA |

| Rule 8.1:

Information about companies involved in an offer must be made equally available to all shareholders as nearly as possible at the same time and in the same manner.

Rule 6:

Any information given to one offeror or potential offeror, whether named or unnamed, must, on request, be given equally and promptly to another offeror or bona fide potential offeror, even if that other offeror is less welcome. |

Rule 9.1:

Information about companies involved in an offer must be made equally available to all shareholders as far as possible at the same time and in the same manner.

Rule 9.2:

Any information given to one offeror or potential offeror, whether publicly identified or not, must, on request, be given equally and promptly to another offeror or bona fide potential offeror. The Securities Industry Council should be consulted if trade and business secrets given to one offeror are not equally given to another offeror. |

Rule 20.1:

All shareholders must be given the same information.

Rule 20.2:

Any information given to one offeror or potential offeror, whether publicly identified or not, must, on request, be given equally and promptly to another offeror or bona fide potential offeror even if that other offeror is less welcome. |

The offeror must make all material information available to all holders of securities in order to satisfy the relevant disclosure rules. However, if there are competing offerors, the target is not required to afford both offerors (or either) with access to information regarding its business.

There is no legal requirement (either federal or state) that prescribes that the target provide competing offerors with equality of information. However, in a situation where the target does not do so, the decisions of the target board will likely be subject to more enhanced legal scrutiny in any shareholder litigation. |

13. Restrictions On Frustrating Action

| Hong Kong | Singapore | UK | USA |

| Rule 4:

Actions during the course of an offer by a target company which might frustrate the offer or cause the shareholders of the target to be denied an opportunity to decide on the merits of an offer are generally prohibited unless shareholders approve them.

Frustrating actions include issuing shares, granting rights to subscribe for shares, selling or acquiring assets of a material amount in the target, entering into contracts (including service contracts) otherwise than in the ordinary course of business, or causing the target or its subsidiary or associated company to buy back or redeem shares or to provide financial assistance for the same. |

Rule 5:

Actions during the course of an offer by the target company which might frustrate the offer are generally prohibited unless shareholders approve them.

Frustrating actions includes any attempts at introducing any poison pills such as lengthening notice periods for directors under their service contracts or agreeing to sell off material parts of the target group. |

Rule 21.1:

Actions during the course of an offer by the target company which might frustrate the offer are generally prohibited unless shareholders approve these plans.

Frustrating actions include any attempts at introducing any poison pills such as lengthening notice periods for directors under their service contracts or agreeing to sell off material parts of the target group. |

An extremely complicated and nuanced topic in the US. Generally, the target is permitted to take actions to prevent a hostile offeror from successfully completing a tender offer that is not recommended by the target’s board of directors. The “Just say no” defense remains available in the US, and is generally effected through the use of a shareholder rights plan (or “poison pill”). However, such defensive actions are subject to enhanced scrutiny under state corporate law to ensure that such actions are consistent with the board’s fiduciary duties. If, however, the target decides to sell itself for cash, the board is generally charged with getting the highest price possible.

In a negotiated merger context, the target generally may not fully “lock up” the agreed transaction so as to prevent competing offerors from participating. Any attempts to do so will be subject to enhanced scrutiny as noted above. However, certain deal protection mechanisms, including break fees, noshop provisions, rights to match competing offers and others, are generally acceptable, as they do not preclude the possibility of a competing proposal succeeding. |

14. Break Fees

| Hong Kong | Singapore | UK | USA |

| Rule 33:

In all cases where a break fee is proposed, certain safeguards must be observed.

In particular, a break fee must be minimal (normally no more than 1% of the offer value) and the target company board and its financial adviser must confirm to the Takeovers Executive that the break fee is in the best interests of shareholders. |

Rule 13:

In all cases where a break fee is proposed, certain safeguards must be observed.

In particular, a break fee must be minimal (normally no more than 1% of the value of the offeree company calculated by reference to the offer price) and the offeree company board and its financial adviser must provide certain confirmations in writing to the Securities Industry Council, including the following: that the break fee arrangements are a result of normal commercial negotiations; that there is full disclosure; and that the arrangements are in the best interests of offeree company shareholders. |

Rule 21.2:

Break fees are generally prohibited, except if paid to a “white knight” or to the winner of a formal sale process, provided the fee is de minimis and subject to a cap of no more than 1% of the value of the offer and the break fee is payable only upon the relevant offer becoming or being declared wholly unconditional. |

Break fees and other deal protection mechanisms (including “no shop” provisions) in a negotiated transaction agreement may be acceptable, but are subject to review under state fiduciary duty principles.

Provisions that are not entirely preclusive of a competing proposal are acceptable. Break fees in the range of 3-4% of the target’s equity value are generally acceptable, though higher ones may be problematic. |

15. Disclosure Of Fees And Expenses, Financing Arrangements And Cash Confirmation

| Hong Kong | Singapore | UK | USA |

| No requirement to disclose fees and expenses and financing for the offer.

Schedule I: Where the offer is in cash or includes an element of cash, then the offer document must include a confirmation by a financial adviser or appropriate independent party that resources are available to the offeror sufficient to satisfy full acceptance of the offer.

The offer document must also include a description of how the offer is to be financed and the source of the finance. |

No requirement to disclose fees and expenses and financing for the offer.

Rule 23.8:

Where the offer is for cash or includes an element of cash, the offer document must include an unconditional confirmation by an appropriate third party (e.g. the offeror’s banker or financial adviser) that resources are available to the offeror sufficient to satisfy full acceptance of the offer. |

Rule 24.16:

The offer document must contain an estimate of the aggregate fees and expenses expected to be incurred in connection with the offer and, in addition, separate estimates of the fees and expenses expected to be incurred broken down by category of advisers, and (for the offeror) the fees and expenses for the offer financing arrangements.

Rule 24.3(f):

The offer document must contain a detailed description of how the offer is to be financed and the source(s) of the finance.

Rule 26.1(b):

Any documents relating to the financing of the offer must be published on a website during the offer period.

Rule 24.8:

When the offer is for cash or includes an element of cash, the offer document must include confirmation by an appropriate third party (e.g. the offeror’s bank or financial adviser) that resources are available to the offeror sufficient to satisfy full acceptance of the offer. This is a key element of any bid, on which a lot of attention is focussed, and something that overseas investors in particular need to ensure is addressed up front and as quickly as possible. |

In a tender offer, fees and expenses likely to be incurred by the offeror must be disclosed, including detailed disclosure about fees payable to its financial advisor. In addition, detailed disclosure concerning the offeror’s arrangement for financing the offer is also required. Note that in the US, certain funds are not required and an offer can be conditioned on the offeror’s receipt of financing, although the offeror must have a reasonable belief in its ability to fund the offer.

In a merger, the target is required to make detailed disclosures concerning the fees payable to its financial advisor, as well as detailed disclosures concerning amounts that will be paid or become payable to directors and executive officers as a result of the transaction. Disclosure regarding the offeror’s financing arrangements is also required. |

16. Profit Forecasts And Asset Valuations

| Hong Kong | Singapore | UK | USA |

| Rules 10 and 11:

Profit forecasts and asset valuations must be made to specified standards and must be reported on by professional advisers.

In a securities exchange offer, the target and offeror need to be careful that statements they make during an offer period do not amount to a profit forecast as this will need to be reported on. In particular, a quantified statement about the expected financial benefits of a proposed takeover is deemed to be a profit forecast statement for the purpose of Rule 10. |

Rules 10 and 11:

Profit forecasts and asset valuations must be made to specified standards and must be reported on by professional advisers.

In a securities exchange offer, the target and offeror need to be careful that statements they make during an offer period do not amount to a profit forecast as this will need to be reported on. In particular, a quantified statement about the expected financial benefits of a proposed takeover is deemed to be a profit forecast statement for the purpose of Rule 10. |

Rules 28 and 29:

Profit forecasts and asset valuations must be made to specified standards and must be reported on by professional advisers.

The target company and a securities exchange offeror therefore need to be careful that statements they make during an offer period do not amount to a profit forecast as this will need to be reported on. |

Forecasts that the target shares with the offeror generally must be disclosed in the offer materials, as such information is generally considered to be material to a shareholder’s decision as to whether to tender its shares into the offer.

If the target does not provide the offeror with such forecasts, there is generally no disclosure obligation. Absent special circumstances (e.g. where the target may be a natural resources company with a limited number of large assets), asset valuations would not typically be considered material and would not be disclosable. |

17. Schemes Of Arrangement

| Hong Kong | Singapore | UK | USA |

| A takeover conducted by way of a scheme of arrangement will bind all of the target shareholders if:

(a) approved by target shareholders representing at least 75% of the voting rights present and voting at the shareholders’ meeting, and

(b) votes cast against the scheme do not exceed 10% of the total voting rights attached to all disinterested shares in the target. |

A takeover conducted by way of a scheme of arrangement will bind all of the target shareholders if a majority in number holding 75% in value of the target shares vote in favour. | A takeover conducted by way of a scheme of arrangement will bind all of the target shareholders if a majority in number holding 75% in value of the target shares vote in favour. | Not applicable |

18. Compulsory Acquisition

| Hong Kong | Singapore | UK | USA |

| If the offeror acquires at least 90% in value of the shares in the target company “to which the offer relates” (i.e. the shares held by the shareholders other than the offeror or persons acting in concert with it) within four months of the start of the offer, the remaining shares may be acquired compulsorily by the offeror.

If the offeror or persons acting in concert with it held, or contracted to acquire, shares in the target company on the date that the offer is made, these shares will not be counted towards the 90% threshold for calculating whether the offeror can implement the compulsory acquisition procedure. |

An offeror may “squeeze out” minority shareholders after acquiring 90% of the shares to which the offer relates. | An offeror may “squeeze out” minority shareholders after acquiring 90% of the shares to which the offer relates. | A tender offer is generally conditioned upon a majority of the shares of the target being tendered into the offer. Any shares not tendered are generally converted into the offer consideration through a “second step” merger.

Historically, unless 90% of the shares were tendered, such second step merger required a shareholder vote (even if the outcome of such vote was predetermined) and the related holding of a meeting and solicitation of votes.

Recently, however, Delaware has revised its corporate law to permit, under certain circumstances, such second step merger to be completed without a vote if the offeror obtains a majority of the shares in the offer. |

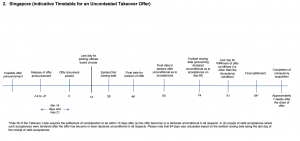

Indicative Takeover Offer Timetables

Indicative takeover offer timetables for Hong Kong, Singapore and the UK are set out below. In the US, the timetable for takeovers is variable. Actual timing in a particular takeover transaction may differ from the indicative timetables below for various reasons, including due to the time required to obtain necessary regulatory approvals.

(Click to enlarge)

For further information, please contact:

Steven Tran, Partner, Hogan Lovells

steven.tran@hoganlovells.com

Michael Chin, Partner, Hoganl Lovells

michael.chin@hoganlovells.com

Stephanie Keen, Partner, Hogan Lovells

stephanie.keen@hllnl.com