2 June, 2017

The Draft Decree detailing and guiding the implementation of the Law on Social Insurance (Draft Decree) has recently been released by the Ministry of Labor, Invalids and Social Affairs (MOLISA) for public comment. The Draft Decree provides that as of 1 January 2018, compulsory social insurance will apply to foreign employees working in Vietnam. This requirement will lead to increased employment costs for companies doing business in Vietnam.

According to this Draft Decree, foreign employees that satisfy the following conditions, as well as their employers, will be subject to compulsory social insurance contribution. This includes foreign employees who:

- are working in Vietnam under indefinite-term labor contracts, definite-term labor contracts, or seasonal or specific job contracts with durations of more than one (1) full month with employers based in Vietnam; and

- have been granted with either (i) a work permit ("giấy phép lao động" in Vietnamese), (ii) practicing certificate ("chứng chỉ hành nghề" in Vietnamese), or (iii) practicing license ("giấy phép hành nghề" in Vietnamese).

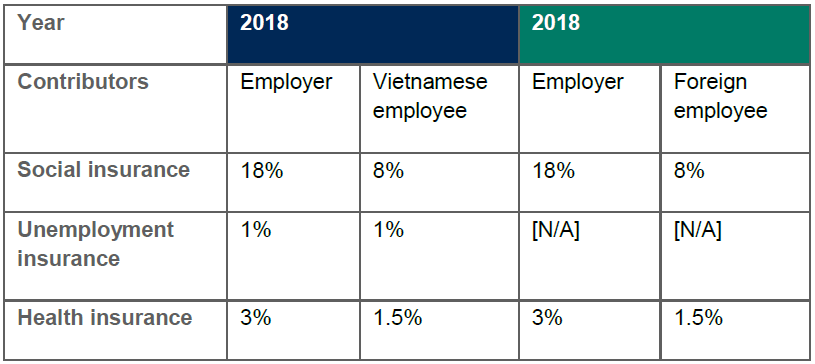

The Draft Decree proposes that foreign employees will be covered for all five compulsory social insurance regimes, which are currently applicable to Vietnamese employees. These include: (i) illness, (ii) maternity, (iii) labor accidents and occupational diseases, (iv) retirement, and (v) survivorship allowance. The contribution rates imposed on both employers and foreign employees will be the same as those applicable to Vietnamese employees, ie, currently 8% from the employees and 18% from the employers, based on their actual monthly salaries capped at 20 times the applicable General Minimum Wage.

Accordingly, the processes and procedures for foreign employees to participate in the above compulsory social insurance regimes would not differ from the current procedures applicable to Vietnamese employees, as regulated under the 2014 Law on Social Insurance. Details on the dossiers for foreign employees' participation and settlement of all compulsory social insurance regimes are also provided under this Draft Decree.

The Draft Decree and the Proposal Statement that introduce it address some potential concerns. For instance, with regards to the accumulation of periods of social insurance premium contribution, the Proposal Statement provides that the Draft Decree does not regulate on this issue, and that this issue would only apply to nationals whose countries have signed bilateral agreements with Vietnam on this matter. This is attributed to difficulties that may arise when calculating contribution periods for foreign employees that work in many different countries.

In addition, foreign employees subject to this Draft Decree would be entitled to a lump-sum social insurance allowance upon request if their labor contracts or work permits expire and they do not continue working under the contracts or extend their work permits. Such foreign employees should make their allowance requests within 30 days prior to the expiry date of their contracts or work permits. The insurance authority shall be responsible for settling and paying the allowance to the employees within 10 days upon the date of the receipt of proper requests. The calculation of the lump-sum social insurance allowance applicable to foreign employees would be the same as what is currently applicable to Vietnamese employees according to the Law on Social Insurance.

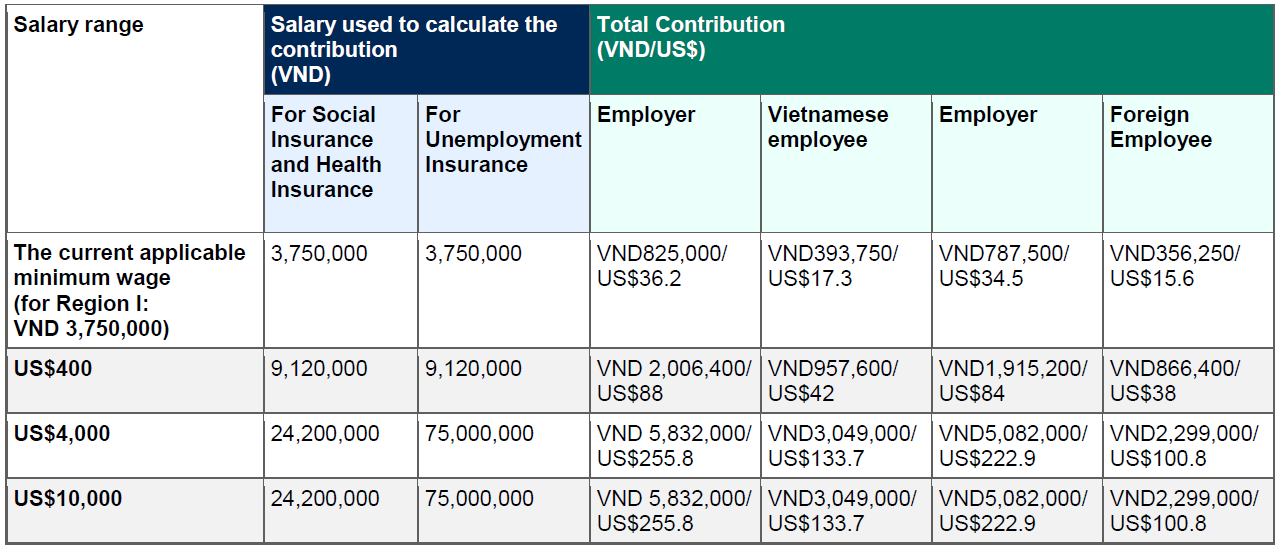

To assess the impact of the Draft Decree, we include below a table to calculate how much the change would cost your business, using the current applicable General Minimum Wage and Regional Minimum Wage:

Please click on the table to enlarge.

This scenario assumes:

Social insurance and health insurance are calculated based on actual monthly salary capped at VND 24.2 million (approximately USD 1,100), which is 20 times the current General Minimum Wage, VND 1.21 million at present.

Unemployment insurance is calculated based on actual monthly salary capped at VND 52 million to 75 million (approximately USD 2,400 to 3,400), meaning 20 times the Regional Minimum Wage, which ranges from VND 2.58 million to VND 3.75 million, depending on the region, at present.

To illustrate, the chart below shows the actual costs of employment in regards to the total contribution to the three social insurance funds at four levels of wages for an employer based in Ho Chi Minh City, which belongs to Region 1, using the current applicable General Minimum Wage and Regional Minimum Wage:

Exchange rate: USD 1 = VND 22.800

Please click on the table to enlarge.

A combined contribution of USD 323.70 for an employee with wages of USD 4,000 per month will be considered burdensome by many, especially if there are any issues with redemption, pay-out and remittance at the end of the contract period.

By way of background, the 2014 Law on Social Insurance provided that as of 1 January 2018, foreign employees working in Vietnam under a work permit, practicing certificate, or practicing license issued by a competent body of Vietnam, would be allowed to participate in the compulsory social insurance program. However, the language of the 2014 Law on Social Insurance is vague as to whether it would be a right or an obligation by the employers and foreign employees to participate in a compulsory social insurance program.

The language of the Draft Decree, however, presents this very much as a new tax obligation that will have to be borne by virtually all foreigners working in Vietnam. Vietnam's taxes on foreign employees will be among the highest in the region, taking into account the number of taxes, high rates, and other broad bases. Such changes will raise major concerns, especially from employers who depend on mid-level foreign employees to help manage their Vietnam-based businesses.

This Draft Decree is now pending for opinions until 12 June 2017, and if adopted, will come into force on 1 January 2018.

For further information, please contact:

Frederick Burke, Partner, Baker McKenzie

frederick.burke@bakermckenzie.com