17 January, 2018

Hong Kong Stock Exchange will push forward proposals to allow pre-revenue biotech companies and “innovative” companies with weighted voting structures to list on the Main Board, and to allow existing overseas listed “innovative” companies to achieve a secondary listing on the Main Board

Executive Summary

The Hong Kong Stock Exchange (the “ Exchange”) has taken a strong step forward towards liberalising its listing platform, deciding to:

- allow listing of biotech companies that are pre-revenue and pre-profit;

- allow weighted voting structures (“ WVRs”) for “new economy”, “innovative” companies, subject to additional disclosures and safeguards; and

- broaden the secondary listing channel to attract “innovative” companies which are already listed on “qualified exchanges”, including those who were previously denied this avenue due to having WVRs or a “centre of gravity” in Greater China.

There are plenty of questions that remain around the finer points of these proposals, which detailed rules are being drafted with the aim of commencing formal consultation on the detailed rules before the end of Q1 2018. Nevertheless, the proposals do represent a fresh and measured approach to further develop and liberalise the Hong Kong market, one which will stimulate conversations with potential HK listing applicants who have been sitting on the sidelines waiting to see how the wind would blow on these issues.

Publication of Consultation Conclusions

Last Friday, the Hong Kong Stock Exchange released two consultation conclusions:

- Consultation Conclusions to the New Board Concept Paper; and

- Consultation Conclusions to the Review of the GEM and changes to the GEM and Main Board

Listing Rules

See our alert for a summary of the key changes proposed in the New Board Concept Paper and the Review of the GEM and Main Board Listing Rules.

In taking the three key steps listed above, the Exchange has abandoned the idea to segregate the current listing structure via the creation of a New Board to facilitate the listing of new economy companies, citing feedback that a New Board may introduce unnecessary complexity in the listing framework. Instead, ring-fencing and other means of accommodation of “new economy”, “innovative” companies should be explored. We were pleased to see this, having raised the same concern during the consultation.

We summarise below some key points from the two Conclusions.

“Innovative” companies may list with weighted voting structures

The Exchange proposes to open the Main Board to companies with weighted voting structures (“ WVR companies”) to list by way of a primary listing or the concessionary secondary listing regime. There are three key concepts which WVR companies have to satisfy.

First, WVR companies must be “innovative”. To be “innovative”, the WVR company must be successful through the application of new technologies, innovations or a unique business model, which serves to differentiate the company from other existing players. R&D should be a major activity of the company and a significant contributor to the company’s expected value, with the company’s success demonstrably attributable to such unique features or intellectual property. The company should also have an outsized market capitalisation/ intangible asset value relative to its tangible assets value.1 In addition, it needs to have a track record of high business growth to be measured by objective metrics such as business operations, customers, unit sales, revenue, profits and/or market value. Recognising that these characteristics are on the whole more subjective than objective, the Exchange proposes to publish a guidance letter setting out in greater detail these required characteristics.

Second, the persons eligible to hold WVRs shall be limited to persons who are materially responsible for the growth of the business, by way of their skills, knowledge and/or strategic direction where the value of the company is largely attributable or attached to intangible human capital. Each such person must hold an active executive role within the business, and have contributed to a material extent to the growth of the business. In addition, each such person must be a director of the company at the time of the listing. As soon as such person ceases to be a director, dies or is incapacitated, or if the shares held by him or her are transferred to another person, the WVRs attached to such shares will lapse permanently.

Third, the Exchange has prescribed a detailed list of safeguards which are required to accompany the use of WVR structures, drawing on the feedback to the New Board Concept Paper and the discussion contained in the 2015 WVR Concept Paper conclusions. These include ring-fencing provisions such that only new applicants are able to list with WVRs; after listing, a WVR company is unable to increase the proportion of WVRs in issue or to issue any further WVR shares. The WVR company must have received “meaningful third party funding” from “sophisticated investors”, with 50 per cent of such investors’ holding at the time of listing being subject to a six months lock-up period. WVRs shall be limited to share based structures with capped voting power (not more than 10 times voting power of ordinary shares), and certain fundamental issues affecting the company (e.g., changes to the constitutional documents, variation of class rights and, importantly, the appointment and removal of independent non-executive directors) are to be determined on a one share one vote basis. Enhanced corporate governance measures (e.g., engagement of a compliance adviser on a permanent basis) and constitutional backing for the WVR safeguards to allow private legal action by shareholders are also required.

In terms of other listing qualifications and enhanced corporate governance / disclosures, requirements applying to WVR companies are relatively straight forward in comparison:

(a) the customary eligibility and suitability for listing criteria applicable to all Main Board listing applicants (including the profits test, the market capitalisation/ revenue/ cashflow test or the market capitalisation/ revenue test currently set out in Rule 8.05 of the Main Board Listing Rules) will continue to apply;

(b) the WVR company must have a corporate governance committee comprised of INEDs to monitor the company’s compliance with the Listing Rules; and

(c) enhanced disclosure on the WVR structure, rationale and associated risks will be required.

Commentary

Exactly how these will all work out in practice remains to be seen. Whilst the Exchange has made a valiant attempt at defining which companies qualify as being “innovative”, this remains fundamentally a subjective test, with a listing applicant unable to know with certainty whether it qualifies or not. By definition, what is “innovative” continues to evolve over time, and what is considered “innovative” today may cease to be “innovative” in five, or even two to three years’ time.

The requirement that WVRs lapse as soon as their holders cease to be directors of the WVR company is also interesting. If the New Board Concept Paper Conclusions are to be taken at face value, a WVR holder must have an active executive role within the business at the time of listing (including acting as a director), but that the WVR would automatically lapse if he or she ceases to be a director – without referring to retaining any active executive role. While most entrepreneurial founders will want to be directors of the listing applicant during the early listed phase, some may be put off by the fact that their WVR fall away if they wish to introduce younger family members to “take the reins” on the board in due

course. In addition, in a modern world of trust arrangements, total return swaps and economic passthrough arrangements, it remains to be seen how this will be enforced in practice, and whether it may encourage controlling shareholders to establish more enduring holding structures to own their stakes, like family trusts, so as to overcome any de facto sunset risk upon the passing of the founder for these WVR powers.

Pre-revenue companies to list must be biotech companies

The Exchange will introduce a new chapter in the Main Board Listing Rules to permit the listing of preprofit, pre-revenue biotech companies. It is recognised that such companies would not meet the profits test, the market capitalisation/ revenue/ cashflow test or the market capitalisation/ revenue test currently set out in Rule 8.05 of the Main Board Listing Rules. The Exchange proposed to limit the pre-profit, prerevenue applicants to biotech companies only, because biotech companies’ businesses usually are regulated under a regulatory regime that sets external milestones on development progress. The Exchange considers that such regulatory regimes should provide investors with a frame of reference to judge the value of companies that do not have traditional indicators of performance (e.g. revenue and profit).

In term of the listing qualifications, biotech companies are expected to have:

(a) been operating its current business (e.g., R&D) for at least two years prior to listing;

(b) a minimum expected market capitalisation at the time of listing of not less than HK$1.5 billion;

(c) a working capital requirement of 125% of the company’s current requirements in the 12 months after listing;

(d) at least one sophisticated pre-IPO investor.

In terms of other requirements, shares held by cornerstone investors at the time of listing will not count towards meeting the public float requirement. This is to ensure a truly market driven book-building process and post-listing liquidity.

New concessionary secondary listing regime

With the market supporting the creation of a new secondary listing regime which provides an exemption from Hong Kong equivalent shareholder protection standards (“Exemption to HK Standards ”) to new economy companies listed on a recognised exchange, even if they have a centre of gravity in Greater China, the Exchange concluded that it will allow “established innovative” companies with at least two years of primary listing on a “qualified exchange” and a healthy compliance track record to list on the Main Board by way of a secondary listing. However, the Exchange stressed the Exemption to HK Standards is not a “blank cheque” and such secondary listed companies still need to comply with the

six Key Shareholder Protection Standards (as contained in the 2013 Joint Policy Statement). These do not need to be written into the constitutional documents of the secondary listing applicants, but rather than they will become conditions for their continued secondary listing in Hong Kong.

Qualified exchanges will comprise the New York Stock Exchange, NASDAQ and the premium segment of the London Stock Exchange.

An established innovative company wishing to seek a secondary listing in Hong Kong under this new concessionary regime must have a minimum expected market capitalisation of HK$10 billion.

Companies with a “centre of gravity” in the Greater China region, or WVR companies must satisfy the revenue test of HK$1 billion in its most recent audited financial year if its market capitalisation is expected to be less than HK$40 billion.

The Exchange has proposed concessions for non-Chinese and grandfathered Chinese companies with WVR structures from compliance with most of the WVR structures safeguards discussed above.

Changes to re-position the GEM and almost all the proposed changes to the two sets of Listing Rules will be implemented

This Consultation Conclusion is likely to get a lot less attention by comparison. The Exchange has decided to implement substantially all the proposals contained in the consultation paper, with the exception of the proposals regarding (a) the track record period requirement prior to a GEM Transfer;

and (b) extending the post-IPO lock up period for controlling shareholders of the Main Board listing applicants.

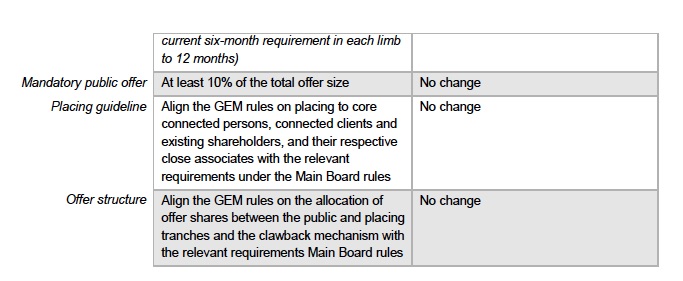

The admission criteria for GEM applicants and Main Board applicants will be adjusted as set out below.

Please click on the table to enlarge.

The rule amendments will take effect from 15 February 2018. This means all listing applications received by the Exchange prior to the effective date will be processed in accordance with the GEM or Main Board Listing Rules as currently in force, but only one renewal of the application under the existing rules will be permitted.

1 The Exchange has initially set a minimum market capitalisation benchmark of HK$10bn for WVR companies. For a WVR company with expected market capitalisation of less than HK$40bn, it must also demonstrate minimum revenue of HK$1bn in the most recent audited financial year.

For further information, please contact:

Alex Bidlake, Linklaters

alex.bidlake@linklaters.com