21 June, 2016

Introduction

On 17 June 2016, the Securities and Futures Commission (“SFC”) and The Stock Exchange of Hong Kong Limited (“SEHK”) jointly launched a 3-month consultation on their proposals to enhance the SEHK's decision-making and governance structure for listing regulation (“Proposals”).

Under the Proposals, the SEHK will continue to be the frontline regulator for listing matters, and the Listing Committee, together with the Listing Department, will continue to decide a large majority of IPO applications and post-IPO matters. However, two new SEHK committees – the Listing Policy Committee and the Listing Regulatory Committee – each with equal representation from the SFC and the SEHK, will be set up to decide listing policy and policy-related listing matters with advice from the Listing Committee.

Salient points of the Proposals

New SEHK committees

The Listing Policy Committee will initiate, steer and decide listing policy proposals and proposed Listing Rule amendments; and will oversee the Listing Department on listing regulation. It will comprise representatives from the Listing Committee, the Takeovers Panel,the SFC and Hong Kong Exchanges and Clearing Limited (“HKEX”).

The Listing Regulatory Committee will decide listing matters that have suitability concerns or broader policy implications (“LRC IPO cases”or“LRC matters”). It will also replace the existing Listing (Review) Committee as there view body for decisions made by theListing Committee (except on disciplinary matters) and the Listing Department in specified circumstances. It will comprise representatives from the Listing Committee and the SFC.

The Listing Regulatory (Review) Committee will replace the existing Listing Appeals Committee as the final review body for certain listing decisions of the Listing Regulatory Committee. It will comprise SFC board members and former members of the Listing Committee.

Changes to the Listing Committee

For matters reserved for the Listing Policy Committee and the Listing Regulatory Committee, the Listing Committee will put forward non-binding views to them.

The Chief Executive of HKEX will no longer be a member of the Listing Committee (instead, he will become a member of the Listing Policy Committee).

Changes to the vetting and approval process for IPO applications

The SFC will no longer as a matter of routine issue a separate set of comments on the filings made by new applicants.

LRC IPO cases can only be approved or rejected by the Listing Regulatory Committee. The Listing Committee will continue to have the discretion to approve or reject non-LRC IPO cases.

The Listing Department is responsible for deciding whether to designate an IPO application as an LRC IPO case, subject to the Listing Committee’s discretion to designate any IPO application presented to it as an LRC IPO case.

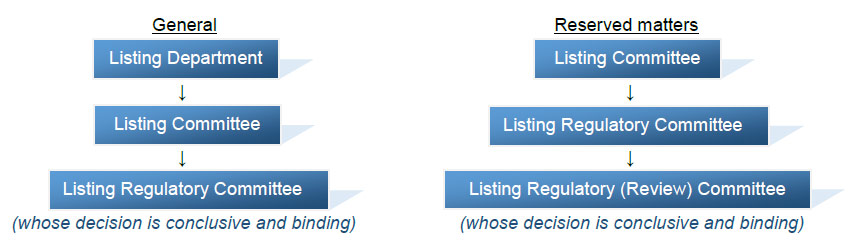

Changes to the review structure for IPO applications

For LRC IPO cases, the review structure is as follows:

For non-LRC IPO cases, the review structure is as follows:

Changes to the vetting and approval process for post-IPO matters

For LRC matters, the Listing Department may decide in the first instance after obtaining the consent or approval of the SFC staff, or will otherwise refer them to the Listing Regulatory Committee. For non-LRC matters, the Listing Department will continue to decide in the first instance except for reserved matters for the Listing Committee (e.g. cancellation of listing).

The Listing Department is responsible for deciding whether to designate a matter as an LRC matter, subject to the Listing Committee’s discretion to designate any post-IPO matter as an LRC matter.

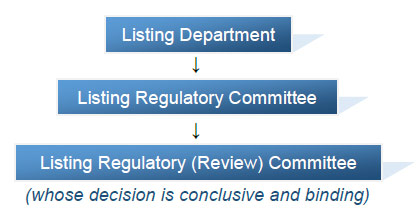

Changes to the review structure for post-IPO matters

For LRC matters, the review structure is as follows:

For non-LRC matters, the review structure is as follows:

Changes to the conduct of disciplinary proceedings

Each disciplinary hearing (whether at first instance or upon review) will be chaired by a practicing or retired senior counsel (or other individuals of equivalent qualifications).

To the extent that any question or issue that is an LRC matter arises in relation to a potential disciplinary matter, the Listing Department will seek guidance from the Listing Regulatory Committee prior to the commencement of the

relevant disciplinary proceedings.

Publication of listing decisions

The Listing Regulatory Committee, the Listing Regulatory (Review) Committee, the Listing (Disciplinary) Committee and the Listing (Disciplinary Review) Committee will routinely publish their decisions, and the reasons for those decisions, on the HKEX’s website as soon as reasonably practicable after the relevant hearing. However if a request is made for a review of the first instance decision, the decision will be published upon completion of the final review. The Listing Regulatory Committee and the Listing Regulatory (Review) Committee may each permit a decision by the committee on an IPO application to be published on a “no-names” basis under exceptional circumstances if disclosure of the applicant’s identity would be unduly prejudicial to its interests.

The Listing Department and the Listing Committee shall publish their rulings on specific matters where, in the Listing Department’s opinion, publication would assist the market’s understanding of the Listing Rules or the activities of the Listing Department or the Listing Committee. Normally, this will be done on a “no-names” basis in accordance with

current practice.

Consultation period ends on 19 September 2016.

Full version of the joint consultation paper issued by the SFC and the SEHK can be accessed via the link below:

http://www.sfc.hk/edistributionWeb/gateway/EN/consultation

For further information, please contact:

Ronny Chow, Partner, Deacons

ronny.chow@deacons.com.hk