Hong Kong Stock Exchange Implements Reforms To Optimise The IPO Price Discovery Process And Open Market Requirements.

On 1 August 2025, The Stock Exchange of Hong Kong Limited (Exchange) published Conclusions and Further Consultation Paper on proposals to optimise IPO price discovery and open market requirements, and launched a further consultation on ongoing public float proposals.

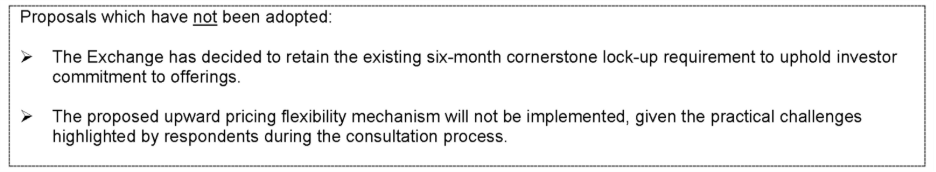

Most of the IPO price discovery and open market reform proposals have been adopted with some modifications and clarifications. The new requirements under the Rules Governing the Listing of Securities on the Exchange (Listing Rules) have taken effect on 4 August 2025 and apply to all issuers and all new applicants with listing documents published on or after that date.

As for the ongoing public float requirements, the Exchange is seeking market feedback on its proposals over a two-month period ending on 1 October 2025.

Prior to the implementation of the proposed new ongoing public float requirements (if adopted), the Exchange has made transitional consequential amendments to the ongoing public float requirements under the Listing Rules so that they are compatible with the new initial public float requirements that have come into effect on 4 August 2025.

1. New requirements on IPO offering mechanism

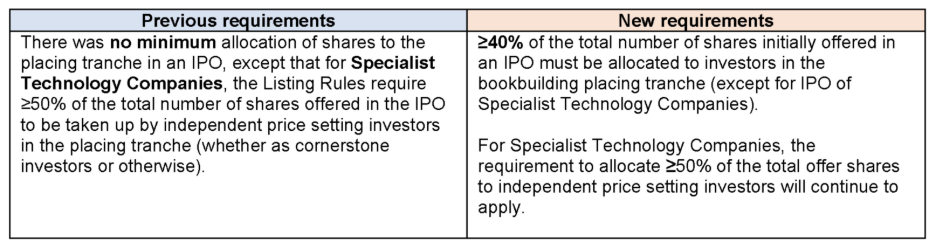

(1) Minimum allocation to the “bookbuilding” placing tranche (i.e. part of the placing tranche not taken up by cornerstone investors in an IPO):

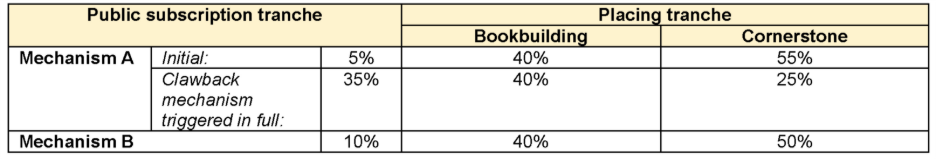

(2) Initial allocation to the public subscription tranche and clawback mechanism:

(3) Consequential indirect cap on cornerstone investments:

The new requirements of (i) 40% minimum allocation to the bookbuilding placing tranche and (ii) the minimum allocation to the public subscription tranche of 5% under Mechanism A and 10% under Mechanism B would mean an initial indirect cap on the cornerstone placing tranche of 55% (in the case of Mechanism A) and 50% (in the case of Mechanism B).

For an issuer adopting Mechanism A, where the clawback mechanism is triggered in full (resulting in a 35% allocation to the public subscription tranche), the number of offer shares that can be allocated to cornerstone investors may be scaled back if these investors agreed upfront to subscribe for more than 25% of the shares initially on offer.

See an illustration below:

(4) Restrictions on reallocation / over-allocation to the public subscription tranche:

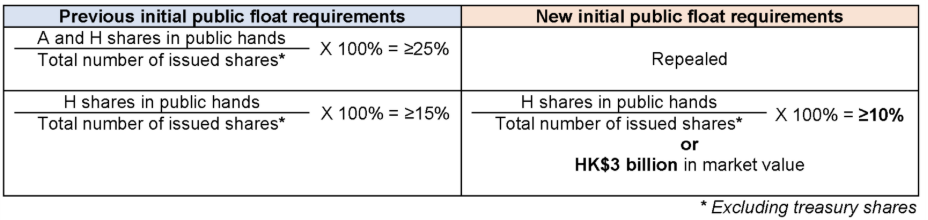

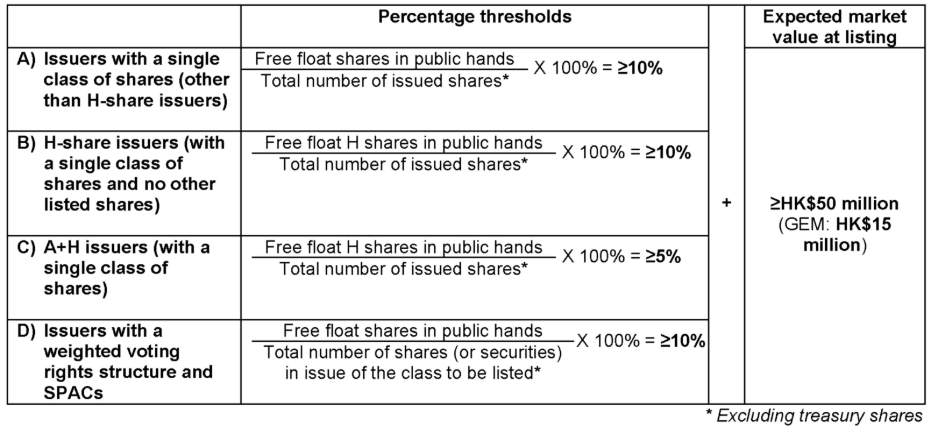

2. New requirements on initial public float

A) Issuers with a single class of shares (other than H-share issuers):

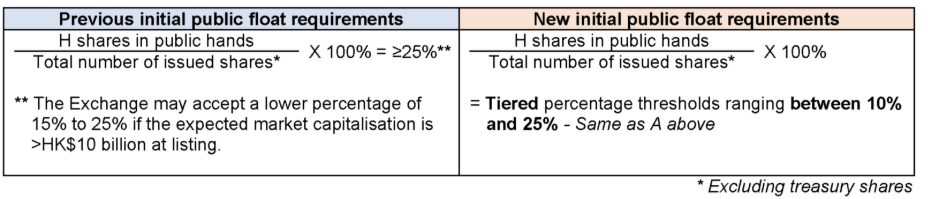

B) H-share issuers (with a single class of shares and no other listed shares):

C) A+H issuers (with a single class of shares):

D) Issuers with a weighted voting rights structure and SPACs:

3. New requirements on initial free float

Previously, there was no requirement for issuers to ensure that some of their shares are free from disposal restrictions, except for those imposed on:

- Biotech Companies (under Chapter 18A of the Listing Rules) – The applicant must ensure that a portion of the total number of its issued shares with a market capitalisation of ≥HK$375 million are held by the public at the time of its initial listing. For this purpose, any shares allocated to a cornerstone investor and any shares subscribed by existing shareholders of the Biotech Company at the time of listing shall not be considered as held by the public; and

- Specialist Technology Companies (under Chapter 18C of the Listing Rules) – The applicant must ensure that a portion of the total number of its issued shares listed on the Exchange with a market capitalisation of ≥HK$600 million are not subject to any disposal restrictions (whether under contract, the Listing Rules, applicable laws or otherwise) at the time of listing.

The amended Listing Rules now require all new applicants to ensure that shares for which listing is sought on the Exchange held by the public and not subject to any disposal restrictions at the time of listing (i.e. free float in public hands):

either: (a) meet the following requirements:

or (b) have an expected market value of ≥HK$600 million at the time of listing.

4. Proposals on ongoing public float requirements

(1) Ongoing public float thresholds

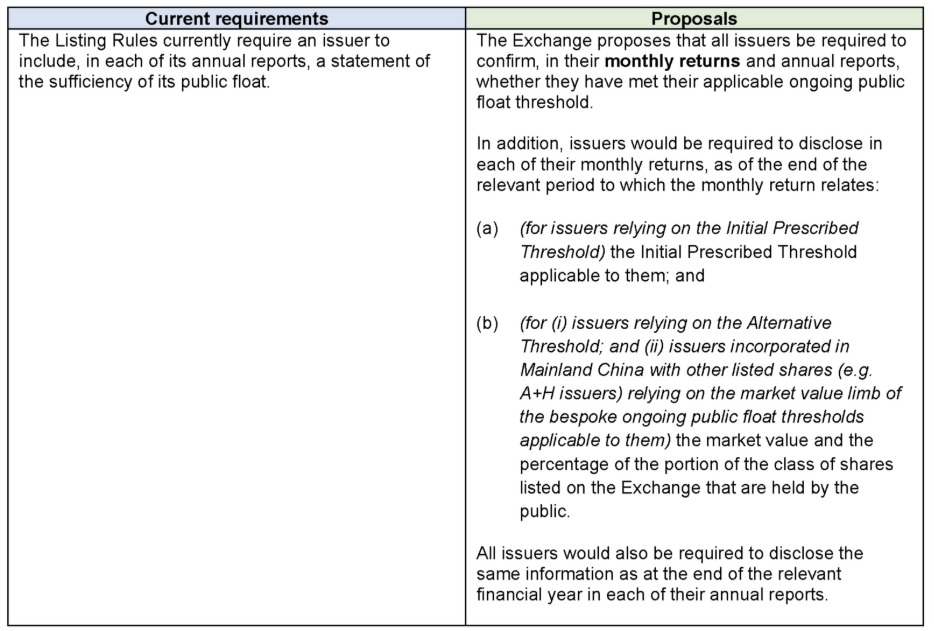

(2) Regular public float reporting

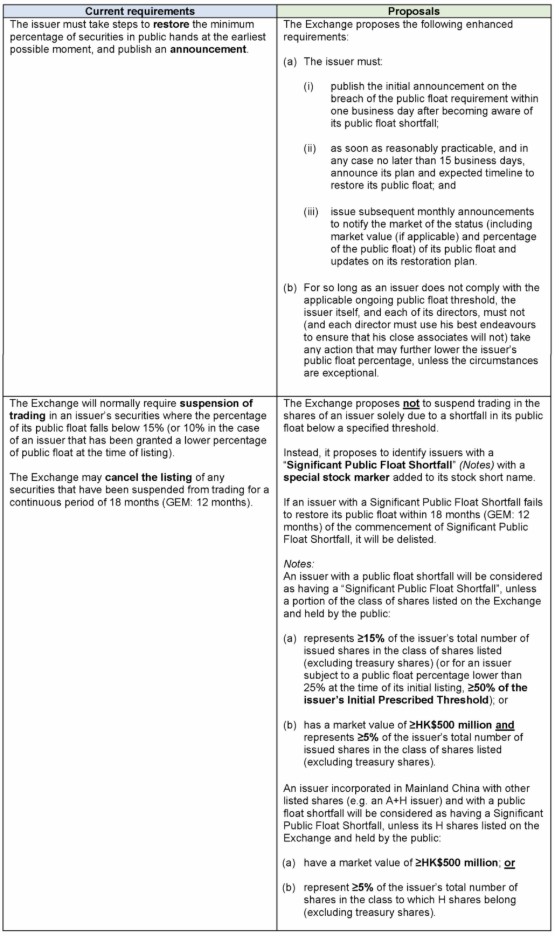

(3) Consequence for public float shortfall

5. Transitional consequential amendments regarding ongoing public float requirements

New applicants listed on the Exchange with listing documents published on or after 4 August 2025 must maintain the relevant minimum public float percentage prescribed at the time of their listing, at all times, until the implementation of the new ongoing public float requirements (if adopted).

All other issuers will continue to be subject to the existing minimum ongoing public float thresholds, based on the existing basis for calculation.