15 December 2020

In line with the development of technology, consumers’ behavior in using financial services has shifted. Nowadays, consumers demand fast, easy and reliable services. These needs play a big part in the rise of financial technology (fintech) companies whose services cross paths with the services offered by banks. To survive the competition against the fast-paced fintech companies, banks are required to adapt and provide better services, especially in connection to the Information Technology (IT) services.

The Indonesian Financial Authority Services (Otoritas Jasa Keuangan or OJK) is quick to notice the urgency for banks to adapt to the current needs of customers. They fully understand that as part of heavily regulated industries, banks cannot wiggle easily without the back up of OJK as the regulator. Due to this, OJK has prepared a draft amendment of commercial banks’ business activities (Draft), which has been uploaded on its website for the public’s input. OJK states in the Draft that one of the reasons for this amendment is to help banks providing better services towards their customers, among others by changing the perspective of the current regulation from providing core-capital-related bank products to providing customer-centric bank products.

Based on a glance at the Draft, the authors note that OJK intends to loosen up the regulation of commercial banking activities in Indonesia, especially the one related to IT services, without compromising the public’s safety and interest. Thus, banks are expected to create a responsible innovation in providing their services to customers. To achieve this goal, this Draft will amend several prevailing regulations, among others:

-

OJK Regulation No. 6/POJK.03/2016 on Business Activities and Office Networks of Commercial Banks Based on Core Capital (POJK 6);

-

OJK Circular Letter No. 27/SEOJK.03/2016 on Business Activities and Office Networks of Commercial Banks Based on Core Capital;

-

OJK Regulation No. 18/POJK.03/2016 on Implementation of Risk Management for Commercial Banks (POJK 18);

-

OJK Regulation No. 16/POJK.03/2017 on Intermediary Banks (POJK 16).

This article will focus on the key provisions of the Draft and the relevant amendment to the abovementioned regulations.

Banking Products

Different from the current regulation in POJK 18, the Draft does not differentiate banking products and banking activities anymore. In POJK 18, products are described as financial instruments issued by the banks, while activities are described as services provided by the Bank for the customers, e.g., agency and/or custodian services. By eliminating “activities”, the Draft combines all financial instruments and services provided by the Bank as “products” only.

The Draft also categorizes and separates the bank’s products into two types of products, namely:

1. Basic Products

The Draft categorizes Basic Products as product and/or services that cover:

-

fund collection activities, e.g., a demand deposit (giro), saving, and issuance of deposit certificate;

-

fund distribution activities, e.g., credit, factoring, granting guarantee, and trade finance;

-

other basic activities stipulated by OJK, e.g., fund transfer provider, electronic money, safe deposit box, sale and purchase of foreign exchange banknotes, derivatives transaction in the form of plain vanilla, Sovereign Securities (Surat Berharga Negara or SBN) selling agent, and prime customer services.

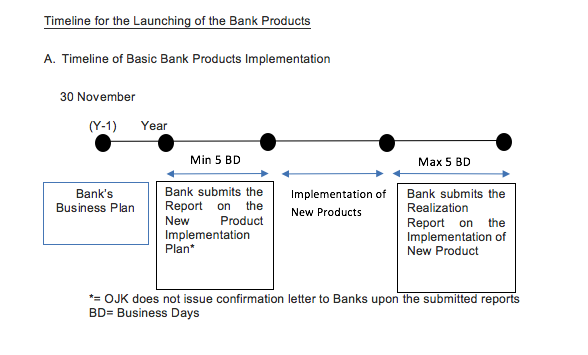

If the banks intend to provide Basic Products services, the Draft only requires them to submit a report on new bank products’ plan to OJK by at least five business days before the launching of the new products.

2. Advance Products

The Draft categorizes Advance Products as product and/or services that cover:

-

IT-based activities, e.g. electronic banking services, digital banking services, and Laku Pandai (internet banking services used for officeless financial services in the framework of inclusive finance);

-

activities concerning insurance, capital market, and/or other financial services institutions, e.g. bancassurance, issuance of promissory notes, custodian, trust, etc.;

-

activities that require approval or license from other authorities, e.g. clearing organizer, settlement organizer, and digital financial provider; or

-

other complex activities, e.g. asset securitization, complex derivatives transactions, structured products, and trust.

While the Draft only requires banks to submit a report for providing Basic Products, it is a little bit different for providing Advance Products. The Draft requires Banks to (i) conduct piloting review; and (iii) obtain a license from OJK first before the launch of new Advance Products. The piloting review obligation could be exempted if:

-

the products are related to insurance, capital market and/or other financial services activities – in which license is already pre-requisite to launch such products;

-

the products are already required to obtain a license from regulators;

-

the products are for the implementation of the government’s program; or

-

the banks can prove that piloting review is not necessary for the launching of such products – nevertheless, the Draft does not further elaborate on what element needs to be proved by the banks for the exemption.

Different from the Draft which separates the products of the banks, the current regulation on business activities of commercial banks, i.e., POJK 6 does not categorize the products and activities that may be carried out by commercial banks.

Capital Requirement

Currently, POJK 6 differentiates the type of activities that can be conducted by the banks based on their core capital. The higher core capital a bank has, the more activities it can conduct. For example, to be able to provide internet banking services and to conduct capital participation in sharia financial institutions, POJK 6 requires a minimum core capital of IDR 1 trillion (approx. USD 71 million). Meanwhile, the Draft no longer differentiates the type of activities based on its core capital. Thus, the Draft opens opportunities for small banks that want to carry out innovative business activities, especially IT-related ones, to compete with other fintech companies.

Below are other examples of banking products opportunities that may be developed by smaller banks after the issuance of the Draft:

-

issuing credit cards;

-

participating in syndicated loans as an arranger, underwriter, agent, or participant;

-

issuing Letter of Credit and local Letter of Credit (for shariah banks or shariah business unit);

-

participating in plain vanilla derivatives transactions.

Under the current regulation in POJK 6, the abovementioned activities can only be provided by banks with a minimum core capital of IDR 1 trillion (approx. USD 71 million). Under POJK 6, smaller banks can only provide basic banking activities, among others: basic fundraising (money collection), basic fund distribution, trade finance – all are in IDR currency, foreign exchange traders.

Reporting Obligations on New Products

The Draft requires banks to submit a plan for implementation of new products (either online through OJK’s system or delivered by hand) in a Bank Product report. The report must be submitted by last November before the implementation of the new products. Amendment to this report could only be made one time, by June of the current year, unless the products relate to IT activities – which can be amended three times (at the end of March, June and September of the current year). If the banks do not have any plan to launch a new product, the Draft still requires the banks to submit a nil report by November of the current year.

The Draft determines new products as products that meet the criteria of:

-

has never been launched or conducted previously by the banks; or

-

has been launched or conducted previously by Bank but further developments, combinations, or variations have materially changed or increased certain risk exposures on the banks’ products.

In addition to this, the Draft also requires banks to submit a (i) realization report on the implementation of the new products; or (ii) realization report on a suspension of new products; by at least five business days after the launching or suspension of the new products, as applicable.

Currently, POJK 18 also requires banks to submit a report of new products or activities to OJK. But the regulation is not as detailed as the one regulated in the Draft.

Risk Management and Customer Protection

To ensure the public’s safety and interest, OJK requires banks to have written policies and procedures for the risk management of their products. This requirement is already regulated under POJK 18 and adopted in the Draft. The difference between POJK 18 and the Draft is only on the differentiation of products and activities. As the Draft no longer differentiates banks’ products and activities, the Draft only requires such policies and procedures for banks’ products. The Draft also requires banks to review and update the policies and procedures regularly.

The Draft also requires banks to consider the following aspects in implementing their products:

-

customer’s needs;

-

capital sufficiency (to cover the risks that may arise upon Bank’s Products);

by requiring the banks to consider their capital sufficiency in the implementation of their products, it can be assumed that the Draft implements a self-evaluating system, in which the banks themselves must first review and determine their readiness before launching certain products

-

the readiness of supporting infrastructures;

-

the readiness of human resources;

-

customer education (to ensure that the customer understands the risk of Bank’s Products);

-

conformity with the laws and regulations.

In addition to the above, the Draft also requires banks to implement consumers protection principle in the implementation of their products by (i) having a 24-hour mechanism for handling customers’ queries and complaints; and (ii) abiding the prevailing laws and regulations on consumer protection for financial services consumers. The principle should at least cover transparency, equal treatment, reliability, personal data protection and easiness of dispute settlement mechanism.

Licensing Mechanism

The Draft has provided a series of documents that need to be submitted to OJK for applying for a license concerning to New Bank Products, namely the document that explains:

-

General explanation on the New Product (name, type, launching time, market target, transaction value target for the first year, schemes/features/or business model);

-

Benefit, Cost, and the risk of Products for the Bank and the Customers;

-

Standard Operational Procedure;

-

Policies and Procedures Plan concerning the anti-money laundering and anti-terrorism financing;

-

Identification, measurements, supervision, and control over the risks inherited by the New Products;

-

Analysis of legal aspect and compliance on the New Product, including consumer protection;

-

Accounting Information System on the New Product, including the accounting records and the explanation;

-

The readiness aspect and piloting review (if any) upon New Product;

-

Other supporting documents.

BD= Business Days

Notes:

-

For the implementation of Basic Products, the banks shall submit the implementation of the new products plan report by the timeline stipulated in timeline A.

-

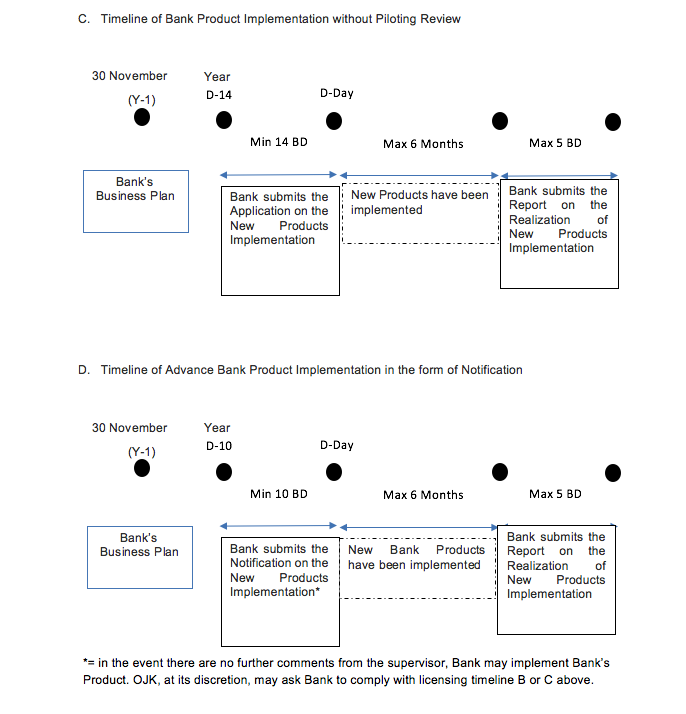

For the implementation of Advance Products, the banks must first secure a license from OJK by carrying out a piloting review. The Bank must report the piloting review plan to OJK at the latest 5 Business Days (BD) before the commencement of the piloting review (please refer to timeline B above). The piloting review is used for estimating the risks (e.g. operational and reputational risks) arising from the products. The Bank’s director shall guarantee that Bank will bear the liability upon any risks during the piloting review. OJK then will issue the license or reject the application within 14 business days as of the date the documents are deemed complete.

-

If OJK views that the piloting review is unnecessary, the Bank may directly apply for a license and submit the application form as well as the supporting documents (please refer to timeline C above). OJK will issue the license or reject the application within 14 business days as of the date the documents are deemed complete.

-

Especially for IT-related Bank Products, the timelines may be ignored if the Bank meets the following criteria:

-

Upon the assessment of the risk-based rating by OJK, the Bank is deemed in the first or second rank of bank soundness level;

-

Upon the assessment of the good corporate governance by OJK, the Bank is deemed in the first or second rank of bank soundness level;

-

poses IT infrastructure and capable IT infrastructure management.

In exchange for the process in timelines A, B, and C, the Bank shall submit a notification to OJK at the latest 10 BD before the implementation of the product (please refer to timeline D above). However, OJK has the authority to ask for the Banks to comply with timeline B and C if:

-

the implementation plan is not following the prevailing laws and regulations;

-

has never been carried out by the bank previously; and/or

-

the OJK views that the new product may potentially cause significant risks.

Sanctions

OJK seems to intend to impose a stricter sanction in the Draft compared to the previous regulations. It adds some new administrative sanctions, such as (i) prohibition for the banks to implement new products; and (ii) prohibition for primary parties of the banks (controlling shareholders, member of the board of directors, and member of the board of commissioners) to act as primary parties of any financial institutions under OJK’s supervision.

In addition to administrative sanctions, the Draft also implements a fine mechanism for certain violations. The range of the monetary fines is from IDR 1 Mio (approx. USD 71) per day to a cumulative amount of IDR 100 Mio (approx. USD 7,100) – depending on the types of violations conducted by the banks.

Transitional Provisions

After the promulgation of this Draft, several provisions concerning banking activities that are not in line with the regulation in the Draft will be either revoked or amended. Also, the Draft regulates that for application of new products which has been submitted before the promulgation of this Draft, the requirement for such application will be reviewed based on the previously applicable regulations when such application is made.

For further information, please contact:

Freddy Karyadi, Partner, ABNR

+62 818 103 949

fkaryadi@abnrlaw.com

Anastasia Irawati, Senior Associate, ABNR

airawati@abnrlaw.com

Ivander F. Irawan, ABNR

iirawan@abnrlaw.com