4 July, 2018

On 3 May 2018, the Bank of Indonesia (“BI”) issued a new regulation No. 20/6/PBI/2018 (“PBI 20/2018”) on electronic money or e-money, which repealed the previous e-money regulations. E-money regulations was first issued in 2009 and subsequently amended in 2014 and 2016.

E-money is defined as a payment instrument that is (a) issued based on the value of money deposited in advance to the issuer, (b) is stored electronically in a server or a chip, and (c) managed by the issuer not as savings as defined in the prevailing banking laws and regulations.

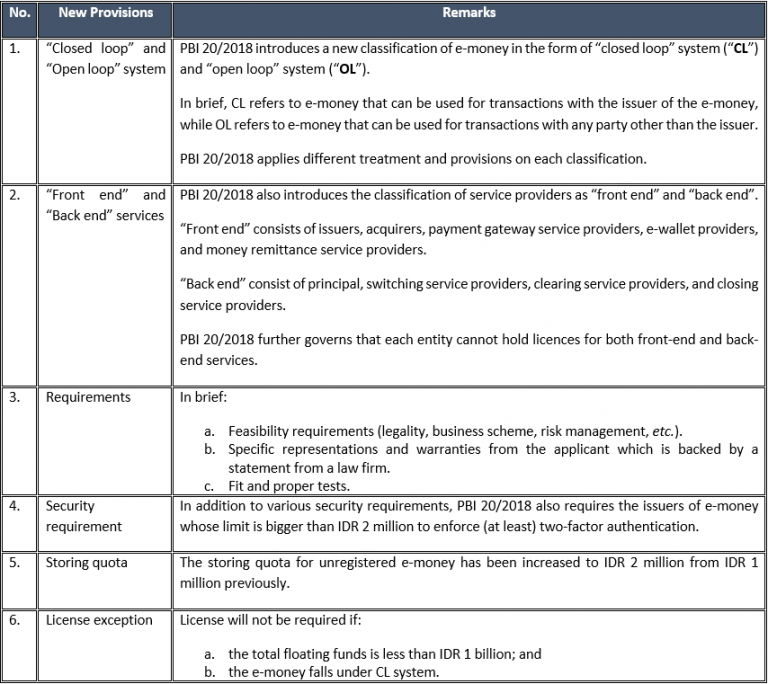

Some of the new provisions are:

Please click on the image to enlarge.

CONCLUSION

PBI 20/2018 reacts to the trend in Indonesian financial market by focusing its provisions on non-bank entities in e-money sector as it introduces new provisions to non-bank entities to make them, to certain extent, on par with banks in terms of regulatory screenings. Further, it is also important for stakeholders and entrepreneurs in e-money business to note these relevant changes.

For further information, please contact:

Leoni Silitonga, Partner, Roosdiono & Partners

leoni.silitonga@zicolaw.com