1 March 2021

The long-awaited Omnibus Law has been finally issued in 2020 by the issuance of Law Number 11 of 2020 on Job Creations. As expected, this regulation provides big changes to the investment environment in Indonesia. The 1,187 pages law amends or revokes approximately 78 prevailing laws and regulations. To promote a smooth transition of the Omnibus Law, Mr. Joko Widodo has instructed his cabinets to issue implementing regulations to the Omnibus Law. The implementing regulations were finally issued three months after the promulgation of the Omnibus Law. Forty-nine new governing regulations were issued this early February. Some of these implementing regulations will have an impact on investment, among others: Presidential Regulation Number 10 of 2021 on Investment Business Field (Positive List) and Government Regulation Number 35 of 2021 on Definite Employment Agreement, Outsourcing, Working Hours and Resting Hours, and Termination of Employment (PP Manpower).

This publication will highlight the key regulations of Positive List and PP Manpower, which are relevant to the investment environment in Indonesia.

POSITIVE LIST

Before the issuance of the Positive List, foreign investment in Indonesia was subject to a negative list regulated under Presidential Regulation Number 44 of 2016 on the List of Business which are Closed and Conditionally Opened in Capital Investment (Old Negative List). The Old Negative List often became the Achilles’ heel to investors as it contained 345-ish lines of businesses that were either closed for foreign investment or conditionally open. Opposite to the Old Negative List, the Positive List may become a new favorite of foreign investors. The Positive List only contains (i) 51 lines of businesses that are reserved for cooperatives and micro, small and medium enterprises (SME), (ii) 46 lines of businesses that are either closed or conditionally open for foreign investment, (iii) 6 business fields that are completely prohibited to FDI (narcotics, gambling/casinos, harvesting of fish listed in the Convention on International Trade in Endangered Species of Wild Fauna and Flora, utilization or harvesting of coral, chemical weapons, and chemicals that might damage the ozone layer), and (iv) 38 businesses fields that are open to foreign investments if in partnership with co-ops and SMEs.

Briefly, we note that some line of businesses which are popular amongst foreign investors are now permitted to be 100% owned by foreign investors (subject to further regulations relating to a specific line of businesses, which may be issued in the future), among others:

-

Distributor (wholesale trading) – previously generally only opened for 67% foreign investment;

-

Hospital – previously only opened for 67% foreign investment (70% if the investors are from ASEAN countries);

-

Marketplace (portal web) – previously opened for 100% foreign investment only if the issued and paid-up capital of the company is equal to IDR 100 bio (approx. USD 7.14 Mio), otherwise only open for 49% foreign investment;

-

Telecommunication provider – previously generally opened for 67% foreign investment;

-

Construction – previously generally opened for 67% foreign investment;

-

Department store with floor size between 400 – 2,000 sqm – previously opened for 67% foreign investment.

Although this change looks promising, it still needs to be observed whether it is subject to other restrictions contained in sectoral regulations.

Other good news brought by the Positive List are:

-

Tax Facilities for Priority Industries

The Positive List also regulates prioritized lines of businesses (priority industries) that will be given be given fiscal and non-fiscal incentives. To be categorized as priority industries, the line of businesses must fulfill the following criteria:

-

it can be considered as national strategic projects,

-

it is capital intensive,

-

it is labor-intensive,

-

it uses high technology,

-

it is a pioneer industry,

-

it is an export-oriented industry, and/or

-

it is a research, development, and innovation-oriented industry.

Comprehensive lists of these industries, including additional criteria that must be fulfilled for certain industries, can be found in Attachment 1 to the Positive List.

The selective line of businesses that fulfill the criteria of priority industries will be given fiscal incentives in the form of a tax holiday, tax allowance, investment allowance, customs incentives. They will also enjoy non-fiscal incentives in the form of easement of licensing procedures, support on procurement of infrastructures, immigration matter, manpower matter.

-

Lower Investment Requirement for Certain Businesses

The Positive List provides capital easement for foreign technology start-up companies that are located in a Special Economic Zone (Tech Start-Up). Even though the Positive List does not define “Special Economic Zone”, it can be assumed that it refers to those established under Law Number 39 of 2009 on Special Economic Zone. These Tech Start-Ups may have an investment value of less than IDR 10 bio as opposed to more than IDR 10 bio (the general requirement for foreign direct investment in Indonesia). Nevertheless, as the regulation is relatively new, we are not aware of the application of this easement yet in practice. Further implementing regulation may need to be issued to establish the ground rules for foreign direct investment in this Tech Start-Up.

PP MANPOWER

One of the major concerns for parties while conducting merger and acquisition transactions in Indonesia is the trigger of employee’s right to request for termination, which will result in the payment of their severance package – a factor to be added as a cost of the transaction. The Omnibus Law and PP Manpower provide some changes to this severance payment package regulation. Besides, they also provide more regulations in fixed-term employment and termination procedures.

a. Severance Pay Package

Some changes on the severance pay package of the old regulations compared to the PP Manpower are:

-

the PP Manpower regulates severance pay package for a spin-off;

-

the PP Manpower reduces the severance pay package for some circumstances, among others: (i) request of termination from the employers due to merger, consolidation, spin-off, or acquisition transaction, (ii) request of termination from the employees due to acquisition transaction;

-

the PP Manpower emphasizes that the employees’ rights for requesting termination due to acquisition transactions are only applicable if there are changes to the terms of employment that are detrimental to the employees.

Below is the comparison of the calculation of severance pay for the case of merger and acquisition transactions based on the regulation under the old manpower law and the PP Manpower:

-

Merger, Consolidation, or Spin-off*

a. By Request of the Employees

|

|

Old Regulation |

PP Manpower |

|

Severance Pay |

1x |

1x |

|

Reward Pay |

1x |

1x |

|

Compensation Pay |

Compensation pay for:

|

Compensation pay for:

|

b. By Request of the Employers

|

|

Old Regulation |

PP Manpower |

|

Severance Pay |

2x |

1x |

|

Reward Pay |

1x |

1x |

|

Compensation Pay |

Old Compensation Pay |

New Compensation Pay |

*remark: the old regulation does not regulate spin-off.

-

Acquisition Transaction

a. By Request of the Employees*

|

|

Old Regulation |

PP Manpower |

|

Severance Pay |

1x |

0.5x |

|

Reward Pay |

1x |

1x |

|

Compensation Pay |

Old Compensation Pay |

New Compensation Pay |

*remark: the PP Manpower adds limitation that the employees’ rights for requesting termination only applicable if there are changes to the terms of employment that are detrimental to the employees. This was not regulated under the previous regulations.

b. By Request of the Employers

|

|

Old Regulation |

PP Manpower |

|

Severance Pay |

2x |

1x |

|

Reward Pay |

1x |

1x |

|

Compensation Pay |

Old Compensation Pay |

New Compensation Pay |

Besides, the PP Manpower also provides detailed severance payment package calculation for other circumstances, among others due to: illness, efficiency, business closure not due to losses, the employers is under the process of suspension of payment proceedings, business closure due to force majeure, business closure due to bankruptcy.

b. Fixed Term Employment

The PP Manpower changes the regime of fixed-term employment in Indonesia. Before the issuance of the PP Manpower, fixed-term employment is allowed for a maximum term of two years, which can be extended once for a maximum of one year and may be renewed for a maximum of two years after 30 days break period. After the issuance of PP Manpower, this term is changed to a maximum of five years. The term also includes extension/renewal – hence, it can be concluded that the maximum term of fixed-term employment, including extension/renewal, is five years.

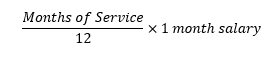

Another major change is that the employer must now pay for compensation once the fixed-term employment agreement has reached an end. This requirement also applies even if the employer extends the term of the fixed-term employment. The formula for calculating this compensation is:

Other things to note relating to fixed-term employment regulation under the PP Manpower are that (i) expatriates are excluded from the regulation of fixed-term employment in the PP Manpower, and (ii) the employers are obliged to report the fixed-term employment to the relevant manpower office within three business days (if submitted online) or seven business days (if submitted offline) as of the signing date of the agreement.

c. Termination Procedures

Employee termination procedures are simplified under the PP Manpower. As opposed to the previous regulations which require a court ruling for each termination, the PP Manpower provides that the employer can terminate employment by issuing a termination notification at least 14 business days before the date of the termination. If there is no dispute from the employee on the termination, the termination will be effective on the effective date of the termination, then the employer needs to report the termination to the relevant manpower office. Otherwise, if the employee opposes the termination by sending an objection letter within seven business days after receipt of the termination notice, the termination procedures must follow the mechanism as regulated by the prevailing laws and regulations, e.g., bipartite meeting, mediation, court disputes.

AUTHOR’S NOTE

The changes brought by the Positive List and the PP Manpower seem to endorse the Government’s policy in creating a more business-friendly environment in Indonesia to the investors. Even though the implementation itself remains in question, the positive vibes brought by the spirit are good enough to boost Indonesia’s rank as an investor-friendly country in the eyes of foreign investors. Hopefully, these changes will be beneficial for Indonesia’s economic development.

For further information, please contact:

Freddy Karyadi, Partner, ABNR

+62 818 103 949

fkaryadi@abnrlaw.com

Anastasia Irawati, Senior Associate, ABNR

airawati@abnrlaw.com

Sevril Renishanti, Associate, ABNR

srenishanti@abnrlaw.com