23 December 2020

On 24 September 2020, Statistics Indonesia (Badan Pusat Statistik ─ “BPS”) issued BPS Regulation No. 2 of 2020 on Indonesian Standard Business Classifications (Klasifikasi Baku Lapangan Usaha Indonesia ─ “KBLI”), which is known as the 2020 KBLI. The 2020 KBLI came into force on its issuance date and revoked BPS Regulation No. 95 of 2015 on the KBLIs, as amended by BPS Regulation No. 19 of 2017, which is known as the 2017 KBLI. The 2020 KBLI introduces more than 200 new 5-digit KBLI numbers to keep up with the rapid development of new types and divisions of businesses in Indonesia. Included among the new KBLI numbers, the 2020 KBLI introduces the long-awaited KBLI numbers specifically to accommodate fintech related business activities.

The New KBLI Numbers in Fintech Before the issuance of the 2020 KBLI, there was only one KBLI number that specifically referred fintech in its description ie. KBLI No. 63122, a web portal for commercial purposes according to which included in this KBLI are web sites/portals and digital platforms for commercial purposes (profit), which are applications used to facilitate or mediate electronic transaction services, such as marketplaces, digital advertising, fintech and online on-demand services.

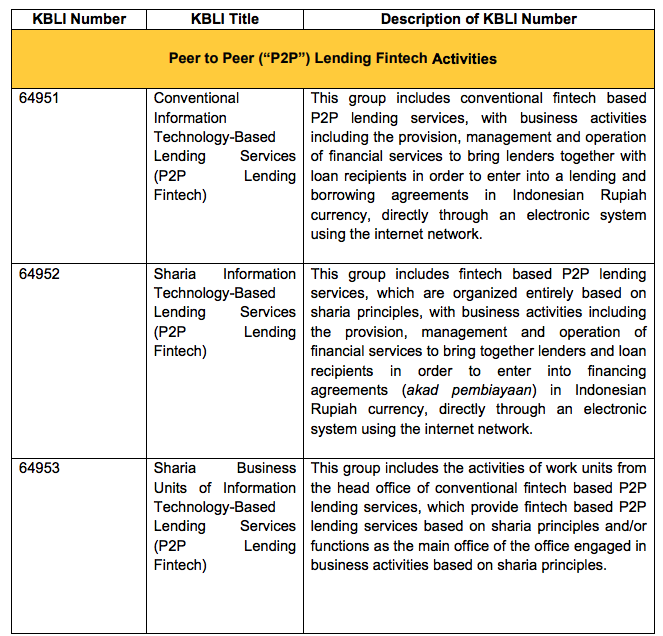

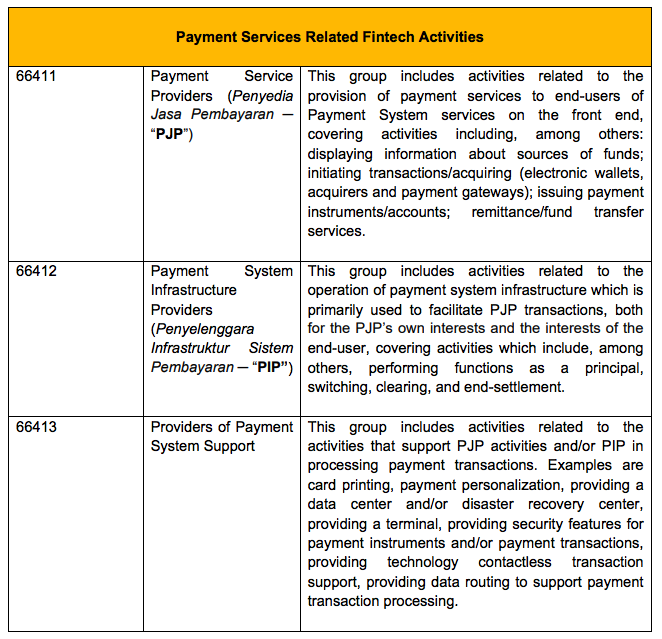

In practice, this (old) KBLI number had been used for a number of different fintech activities. It was not uncommon for fintech players to also use other KBLI numbers which they believe are the appropriate KBLI number for their business activities in Indonesia. Not only that, the absence of specific KBLI numbers for different fintech activities have also resulted in the reference to varying KBLI numbers in the fintech companies’ articles of association or Business Identification Number (Nomor Induk Berusaha ─ “NIB”). Due to these reasons and the rapid development of fintech activities in Indonesia, one KBLI number to cover all kinds of fintech activities was no longer appropriate. In the 2020 KBLI, KBLI No. 63122 explicitly states that this KBLI no longer includes fintech because now several new KBLI numbers cover fintech activities in Indonesia. The following are the new KBLI numbers covering fintech activities:

Please click on the tables to enlarge.

The above new KBLI numbers in fintech are a breath of fresh air for fintech players and potential investors in Indonesia, as there is now more certainty regarding the KBLI numbers for different fintech activities in Indonesia. How the New KBLI Numbers Will Affect Existing Fintech Companies in Indonesia Although by law, the 2020 KBLI came into force on its issuance date, in practice, to date the Online Single Submission (“OSS”) system still uses the 2017 KBLI. Therefore, until the OSS System has started using the KBLI 2020, the new KBLI numbers technically do not immediately impact fintech operations.

As you may be aware, on 11 October 2018 The Ministry of Law and Human Rights (“MOLHR”) and the Coordinating Ministry for Economic Affairs (“CMEA”) issued a joint announcement announcing that all existing companies at that time had to adjust their lines of business to the 2017 KBLI within 1 year of the date of the announcement. Strictly based on the announcement, if a company failed to comply with the obligation to adjust to the 2017 KBLI, the OSS agency may freeze the company’s NIB, potentially hampering the company’s business activities. Given this, it is possible that in the future, when the OSS system has started using the KBLI 2020, the Government may issue a similar requirement. When it happens, all existing fintech companies in Indonesia should be ready to adjust their KBLI numbers. How to Adjust to the New KBLI Numbers In order to adjust to the new KBLI numbers, a fintech company must convene a General Meeting of Shareholders whereby the agenda for which is to amend the company’s purposes and objectives stated in its Articles of Association (“AOA”) so that the wordings of the purpose and objective are in line with the descriptions set out in the relevant KBLI number. Once the AOA have been amended, then through a notary public, the company must submit the amendments to the AOA to the MOLHR through the MOLHR’s online system. Once the amendments to the AOA has received approval from the MOLHR, the OSS system will automatically adjust the company’s KBLI number in the company’s NIB to the new one; effecting the adjustment.

For further information, please contact:

Maria Sagrado, Partner, Makarim & Taira S

maria.sagrado@makarim.com

.jpg)