7 February, 2017

Recent developments

On 23 December 2016 the Financial Services Authority (OJK) issued Regulation No. 67/POJK.05/2016 on Licensing and Institution of Insurance Companies, Syariah Insurance Companies, Reinsurance Companies and Syariah Reinsurance Companies (Regulation 67). Regulation 67, which became effective on 28 December 2016, provides more comprehensive provisions on licenses and requirements for insurance and reinsurance companies.

Before the issuance of Regulation 67, many provisions were stipulated under Government Regulation (GR) No. 73 of 1992 (GR 73) on Implementation of Insurance Business, as amended by GR No. 63 of 1999, GR No. 39 of 2008, GR No. 81 of 2008 and Minister of Finance Decree No. 426/KMK.06/2003 on the Licensing and Institution of Insurance and Reinsurance Companies (Decree 426).

Regulation 67 does not clearly revoke the provisions of GR 73 and Decree 426. Based on Law No. 21 of 2011 on the Financial Services Authority, regulations are still valid to the extent that the provisions do not contradict the OJK regulations, and the OJK has not issued a new OJK regulation to replace the existing regulations.

Implications

Regulation 67, among other things:

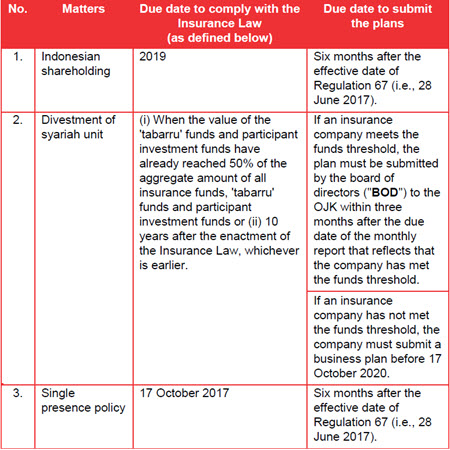

- Provides that companies must prepare implementation plans and business plans to comply with (i) the Indonesian shareholding requirement, (ii) the divestment of syariah unit, and (iii) the single presence policy, and all within certain periods of time (including the Indonesian shareholding and single presence policy plans before June 2017).

- Provides for increased capital requirements, which must be met where there are changes in shareholdings.

- Restricts funding shareholders to buy shares and requires Indonesian companies not to invest more than their own shareholder equity in an insurance company (effectively removing local shareholder/nominee arrangements).

- Requires insurance companies to appoint "controllers" by 28 June 2017.

- Requires insurance companies to establish working units that cover underwriting, actuary, claim administration settlement, marketing, financial (including investment management), risk management, internal audit (with at least one expert and an actuary), administration and accounting, compliance, anti-money laundering and anti-terrorism funding, and services and settlement of complaints (effectively ensuring companies are self contained in line with the OJK's policy in this respect).

- Requires directors, commissioners and officers one level below the directors to obtain risk management certifications (details unknown).

- Limits foreign employees as actuaries or as consultants with limited functions, i.e., underwriting, actuary, marketing and/or information systems.

- Restricts the funding sources/avenues for capital increases (and restricts capital injections in the form of non-liquid assets, e.g. land and buildings).

- Clarifies that an increase of paid-up capital proportionally by existing shareholders is not considered as a change of ownership and therefore does not need to be approved by the OJK.

Consequently, insurance companies must develop plans to comply with the requirements of the Insurance Law (on Indonesian shareholdings, single presence and syariah spin off) and adjust their operational procedures (e.g. establishing working units, considering expatriate staffing etc).

Noteworthy Provisions

Below are some of the noteworthy provisions of Regulation 67.

1. Obligation to prepare implementation plans and business plans

In short:

Click on the image to enlarge.

a. Implementation Plan to Comply with Indonesian Shareholding Requirement

Law No 40 of 2014 on Insurance (Insurance Law) provides that the insurance companies must comply with the Indonesian shareholding requirement within five years after the issuance of the Insurance Law, i.e. in 2019. Regulation 67 provides that an insurance company must prepare an implementation plan to comply with the Indonesian shareholding requirement. The implementation plan must state information on the adjustment method, the step plan and the timeline.

The implementation plan must be approved by the shareholders of the company. Further, the BOD must submit the approved plan to the OJK within six months after the effective date of Regulation 67 (i.e. 28 June 2017).

The OJK will approve the implementation plan or will ask for revisions within 20 working days after the OJK receives the plan. A company may amend a plan that has been approved by the OJK (a maximum of three times). Any amendments of the implementation plan must be approved by the shareholders and the OJK.

Companies must submit a report regarding the realization of the approved plan within 10 working days after the realization of the plan or after realization of the stages set out in the plan (if the plan is to attend to matters in stages).

So the OJK is forcing companies to focus now, identify the issues, and resolve a plan soon. Previously this information was requested by the OJK by way of a letter to companies but now is given the force of regulation.

b. Business Plan to Comply with Divestment of Syariah Unit

The Insurance Law requires insurance companies to spin off their sharia businesses at the latest (i) when the value of the 'tabarru' funds and participant investment funds have already reached 50% of the aggregate amount of all insurance funds, 'tabarru' funds and participant investment funds or (ii) 10 years after the enactment of the Insurance Law, whichever is earlier.

Regulation 67 provides that if an insurance company has met the requirement set out in point (i), the company must prepare a business plan. The business plan must state information on the divestment method, the step plan and timeline for the spin off. The business plan must be approved by the shareholders of the company. Further, the approved plan must be submitted by the BOD to the OJK within three months after the due date of the monthly report that reflects that the company has fulfilled the requirement.

If an insurance company has not met the requirement set out in point (i), the company must submit a business plan before 17 October 2020.

c. Implementation Plan to Comply with Single Presence Policy

An insurance company must comply with the single presence policy before 17 October 2017.

Regulation 67 provides that an insurance company must prepare an implementation plan to comply with the single presence policy. The implementation plan must state information on the adjustment method, the step plan and the timeline.

The implementation plan must be approved by the shareholders of the company. Further, the approved plan must be submitted by the BOD to the OJK within six months after the effective date of Regulation 67 (i.e., by 28 June 2017).

The OJK will approve the implementation plan or will ask for revisions within 20 working days after the OJK receives the implementation plan. A company may amend the implementation plan that has been approved by the OJK (one time only). Any amendments to the implementation plan must be approved by the shareholders and the OJK.

Companies must submit a report on the realization of the approved plan within 10 working days after the realization of the plan or after the realization of any stage set out in the plan.

To comply with the single presence policy, a controlling shareholder can merge or consolidate the companies under its control, or partially sell its shares in the companies under its control or do other corporate actions based on the OJK's approval.

2. Capital Requirements

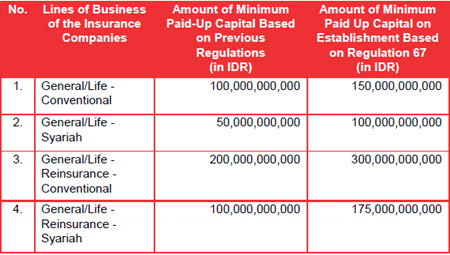

Under Regulation 67 the OJK has increased capital requirements for insurance and reinsurance companies, as follows:

Click on the image to enlarge.

An existing company must comply with the minimum paid-up capital requirement if there is any change of ownership in the form of a statutory acquisition (usually through a capital injection) and/or upon a transfer of shares to a new shareholder.

On an establishment of a company, the payment of paid-up capital must be made into a term deposit or a checking account.

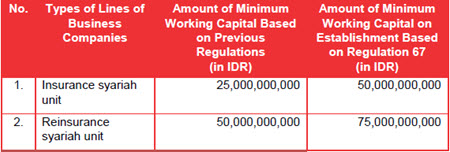

The OJK has increased working capital requirements for syariah units, as follows:

Click on the image to enlarge.

3. Statement letter from the shareholder that the funds for a capital injection are not from loans

For the process of obtaining a business license and the process of notifying the OJK on the increase of paid-up capital proportionally done by the existing shareholders, the shareholders are required to submit a statement letter to explain that the source of funds are not from a loan.

On a change of ownership (e.g. a transfer of shares and/or a capital injection by a new shareholder), Regulation 67 does not require that a new shareholder submit a statement letter to explain the source of funds.

However, the OJK has stated to us that the OJK may also require a similar statement letter as a matter of policy.

Regulation 67 does not clearly explain whether the loan prohibition will also apply to loans obtained at a higher corporate level (e.g. to the shareholders of the entities investing in an insurance company (as occurs with securities companies also regulated by the OJK)).

The OJK has stated to us that the prohibition is applicable for direct and indirect loans used to fund the acquisition of shares in an insurance company.

This prohibition clearly restricts a foreign shareholder funding an Indonesian shareholder to subscribe for shares in an insurance company (thereby prohibiting loans to friendly Indonesian shareholders under local shareholder arrangements).

4. Limitation on local shareholders ownership

Regulation 67 provides that, for an Indonesian company, the maximum direct investment is the amount of the shareholders' equity in that Indonesian legal entity. So Indonesian companies cannot invest more than their own shareholder equity in an insurance company (to ensure that the Indonesian shareholders themselves are adequately capitalized, and re-enforces the loan prohibition).

5. Calculation of security funds

Under Regulation 67, on the establishment of a company, the security funds that need to be held are calculated based on 20% of the minimum paid-up capital.

6. Appointment of a controller

Regulation 67 provides that an insurance company that has obtained a business license and has not appointed a controller must appoint a controller and notify the OJK within six months after the effective date of Regulation 67 (i.e. by 28 June 2017).

Regulation 67 explains that a controller of insurance company can be a controller and a controlling shareholder (as defined under other regulation). Under Circular Letter No.31/SEOJK.05/2016 on Fit and Proper Test for Financial Services Institutions and Primary Parties, a controller is subject to a fit and proper test.

7. Organization structure

Regulation 67 provides that insurance companies must establish an organization structure that covers several functions, i.e., risk management, financial management and services.

A company must also establish working units that cover several functions, i.e., underwriting, actuary matters, claim administration settlement, marketing, financial (including investment management), risk management, internal audit (with at least one expert and an actuary), administration and accounting, compliance, anti-money laundering and anti-terrorism funding, and services and settlement of complaints.

Effectively the OJK is mandated that Indonesian insurance companies operate on a stand alone basis and these functions are not centralized regionally or outsourced. This has always been the OJK's policy and Regulation 67 reduces this policy clearly into regulation.

8. Risk Management Certification

Directors and commissioners and any employee, whose position is one level below the BOD, must obtain risk management certifications (details as yet unknown).

The OJK will issue circular letters on the risk management certification process.

9. Restriction on use of foreign employees

Regulation 67 provides strict requirements on engaging foreign employees, including limits on the positions that foreign employees may hold. Under Regulation 67 a foreign employee can hold a position one level below the BOD and would be appointed as an actuary or as a consultant. In addition, an insurance company can only use a foreign employee to attend to limited functions, i.e., underwriting, actuary, marketing and/or information systems.

If a company, before the effective date of Regulation 67, employs any foreign employees outside of the functions that have been specified under Regulation 67, the employee can hold his position until his employment agreement ends.

Regulation 67 requires an insurance company that uses foreign employees to notify the OJK at within 20 working days before the employees are hired.

These restrictions likewise seek to localize positions and decisions, and to ensure that technical skills are developed locally.

10. Expert, actuary and internal audit

A general or life insurance company or reinsurance company (conventional and syariah) must employ at least one expert and an actuary and must establish an internal audit working unit. The appointment (or termination) of any auditor, actuary or member of an internal audit working unit must be notified to the OJK within 20 working days after the date of appointment (or termination).

A company cannot appoint an actuary who is also a member of the BOD, board of commissioners (BOC) or syariah supervisory board.

We set out below the transition provisions related to the appointment of experts, actuaries and internal auditors:

a. A company must comply with the requirement on the appointment of an expert within two years after the effective date of Regulation 67.

b. A company must comply with the requirements on the appointment of an actuary before 1 January 2018.

c. An actuary who also holds a position as a member of the BOD, BOC or syariah supervisory board must comply with the non-dual position requirement within three years after the effective date of Regulation 67.

11. Change of ownership, capitalizations and change of corporate information

Any change of ownership must be approved by the OJK. However a proportionate increase in paid-up capital by existing shareholders is not considered as a change of ownership and therefore does not need to be approved by the OJK.

Regulation 67 provides that a change of ownership by way of an increase in paid-up capital can only be done only through a cash injection, profit reinvestment, loan conversions and/or share dividends. The OJK has explained that to maintain its financial liquidity, the insurance company cannot receive a capital injection in a form of non-liquid assets, e.g. land and building (as has been offered recently by Indonesian shareholders who have not wanted to inject cash).

The OJK will issue its approval (or comments) within 20 working days after the application is received.

A company must notify the OJK on the implementation of the change of ownership within 15 working days after the issuance of approval or acknowledgment receipt from the authorized agency (usually the Ministry of Law and Human Rights). The following documents must be submitted together with the notification:

a. copy of amended articles of association

b. the deed of transfer

c. evidence of fund transfer.

Any changes of the following corporate information must be notified to the OJK within 15 working days after the issuance of approval or acknowledgment receipt from the authorized agency:

a. Change in name

b. Change in the company's domicile

c. Any decrease in authorized capital

d. Any increase in paid-up capital

e. A change in status to a public listed company (or no longer being a public listed company).

Any change in members of the BOD, BOC and syariah supervisory board must be notified to the OJK within 15 working days after the registration of change of members in the company's register at the Ministry of Law and Human Rights, the approval of a members' meeting for a cooperation or date of appointment to the syariah supervisory board.

For further information, please contact:

Mark Innis, Hadiputranto, Hadinoto & Partners

mark.innis@bakernet.com