29 May, 2018

Real Estate Investment Trusts (“REITs”) are investment vehicles that own, operate, develop, manage, acquire, or finance real estate-related assets, and allows individual investors to earn income produced through ownership of commercial real estate without actually having to buy any assets. REITs were first established in the United States in 1960 as a means to provide retail investors access to larger and more diversified portfolios of commercial real estate, similar to mutual funds. In India REITs are trusts holding income generating properties, earnings from which are distributed to its unitholders/shareholders.

This note aims to summarize and consolidate the prevailing Indian regulatory and legal framework for the establishment and operation of REITs in India. This note will focus on:

- Indian Legal Scenario;

- Possible structures of REITs in India;

- Eligibility criteria for preliminary parties;

- Eligibility requirement for RETIs;

- Possible fundraising options;

- Listing requirements and timelines;

- Investment by REITs;

- Conditions on investment by REITs;

- Foreign investment into REITs;

- Taxation perspective with respect to REIT’s; and

- Current status of REITs in India.

INDIAN LEGAL SCENARIO

The Securities and Exchange Board of India (Real Estate Investment Trusts) Regulations, 2014 (“REITs Regulations”) were issued by the Indian capital market regulator i.e. Securities and Exchange Board of India (“SEBI”) in September 2014 to govern the market for real estate investment in India. The REITs Regulations were framed towards regulating investments in REITs. The REITs Regulations, inter alia, set out the registration requirements, procedure of registration, and eligibility requirements of REITs as well as that the primary parties of the REITs.

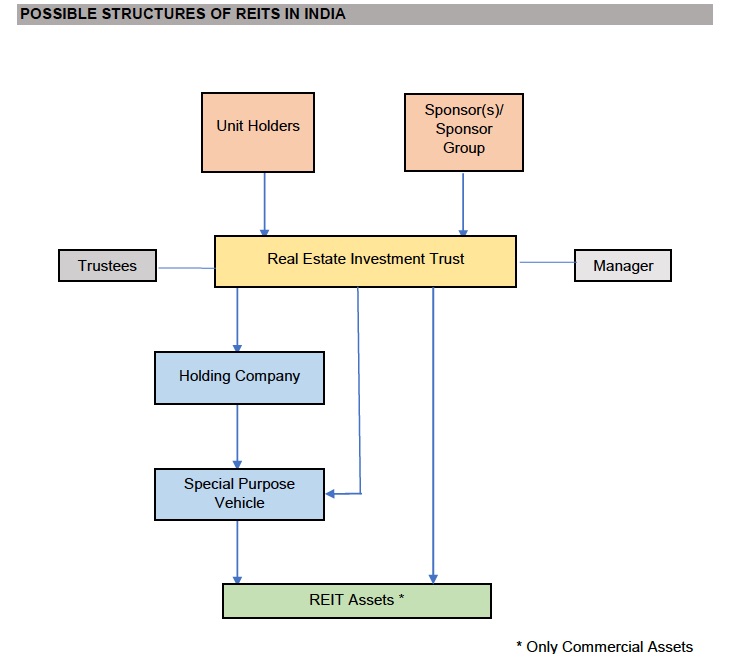

REITs are set up as a trust under the Indian Trusts Act, 1882 and instrument of trust is in the form of a deed duly registered in India under the provisions of the Registration Act, 1908. The trust deed is required to set out its main objective is to undertake the activity of REITs and should also include the responsibilities of the trustees. Preliminary Parties to a REIT are sponsor(s), manager and trustee (registered with SEBI and should not be an associate of the sponsor(s) or manager).

Please click on the image to enlarge.

Eligibility Criteria for Sponsor(s), Sponsor group and their associates:

|

Person |

Category |

Criterion |

|---|---|---|

|

Sponsor/ Sponsor group |

Number of units |

Each to hold minimum 5% of units of REIT on post initial offer basis. Cumulative holding to be at least 15% of all outstanding units at all times. |

|

Sponsor/ Sponsor group |

Number of Units |

Should collectively hold minimum 25% of the total number of units of REIT after initial offer on post issue basis. Lock-in period of 3 years for upto 25% of the units and lock-in period of 1 year for holding exceeding 25%. |

|

Sponsor/ Sponsor group |

Net Worth |

Cumulative net worth not less than INR 1 billion (~ USD 15.38 million); individual net worth not less than INR 200million (~ USD 3.07 million) [Note: For the purposes of this paper the exchange rate is USD 1 = INR 65] |

|

Sponsor/ associate(s) |

Experience |

At least 5 years in development of real estate or fund management in real estate industry |

Eligibility Criteria for Managers and their associates:

|

Person |

Category |

Criterion |

|---|---|---|

|

Manager |

Net Worth |

Not less than INR 100 million (~USD 1.53 million) for a body corporate or company. Net tangible assets not less than INR 100 million (~USD 1.53 million) for a LLP |

|

Manager/ associate(s) |

Experience |

Not less than 5 years in fund management or advisory services or property management in the real estate industry or in development of real estate |

|

Manager |

Resources |

At least two key personnel having not less than five years’ experience in fund management or advisory services or property management in the real estate industry or in development of real estate. |

|

Manager |

Board Composition |

At least half of directors/ members of governing board to be independent and not directors or members of any other REIT |

Conditions for holding company

Holding company (“Hold Co”) can be a company or LLP. REITs shall hold not less than 50% of the equity share capital or interest in Hold Co. and HoldCo is permitted to make investments in other special purpose vehicles (“SPV”), which ultimately hold the property(ies). The Hold Co shall not be engaged in any other activity other than holding of the underlying SPV(s), holding of real estate/properties and any other activities pertaining to and incidental to such holdings. If the REITs is investing in properties through Hold Co, it shall ensure that the Hold Co has an ultimate holding interest of at least 26% in the underlying SPV. SEBI vide SEBI (Real Estate Investment Trusts) (Amendment) Regulations, 2016 dated November 30, 2016 has permitted REIT to invest in two level SPV structure through holding company, subject to sufficient holding in the holding company and the underlying SPV and other safeguards including (i) the right to appoint majority Directors in the SPV; and (ii) the requirement by the holding company to distribute 100% cash flows realized from underlying SPVs and at least 90% of the remaining cash flows.

Conditions for SPV

SPV can be a company or LLP in which the REIT shall hold or proposes to hold not less than 50% of the equity share capital or interest. Further, such SPV shall hold not less than 80% of its assets directly and shall not invest in other SPVs. The SPV shall not be engaged in any activity other than holding and developing property and any other activity incidental to such holding or development of property.

POSSIBLE FUNDRAISING OPTIONS/INSTRUMENTS

As per the REITs Regulations, REITs can raise funds through two options/instruments i.e. (i) through issue of units; and/or (ii) through issue of debt securities. REITs are often classed into “equity-type” REITs and “mortgage-type REITs”. The equity-type REITs own properties and the latter simply create mortgages on properties. The mortgage-type REITs take exposures in properties and are economically similar to commercial mortgage backed securities.

Issuance of units by REITS

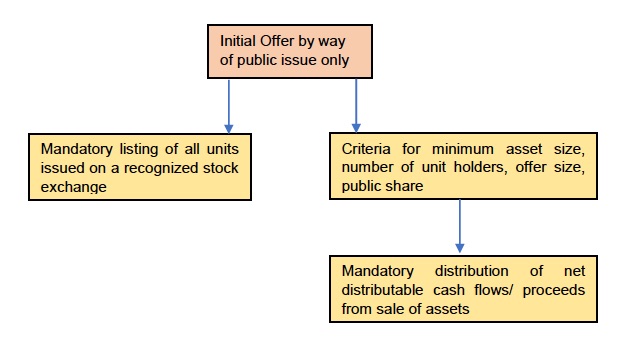

Following is the legal framework for issue of units by REITs:

Please click on the image to enlarge.

(a) An initial offer of its units shall be made by way of public issue only and subsequent issues may be made by way of follow-on offer, preferential allotment, qualified institutional placement, rights issue, bonus issue or offer for sale.

(b) Units issued by a REIT are required to be mandatorily listed on a recognized stock exchange.

(c) Minimum asset size shall be INR 5 billion (~ USD 76.9 million)

(d) Minimum number of unit holders other than sponsor(s), its related parties and its associates forming part of public shall not be less than 200.

(e) Minimum offer size shall not be less than INR 2.5 billion (~ USD 38.45 million)

(f) Minimum public share in initial offer should not be less than 25% of the number of units of the REIT on post-issue basis.

(g) Mandatory distribution of at least 90% of the net distributable cash flows to the unit holders on a half-yearly basis.

(h) Mandatory distribution of at least 90% of the proceeds from sale of assets to unit holders, unless reinvested in another property within 1 year.

Issuance of debt securities by REITS:

Please click on the image to enlarge.

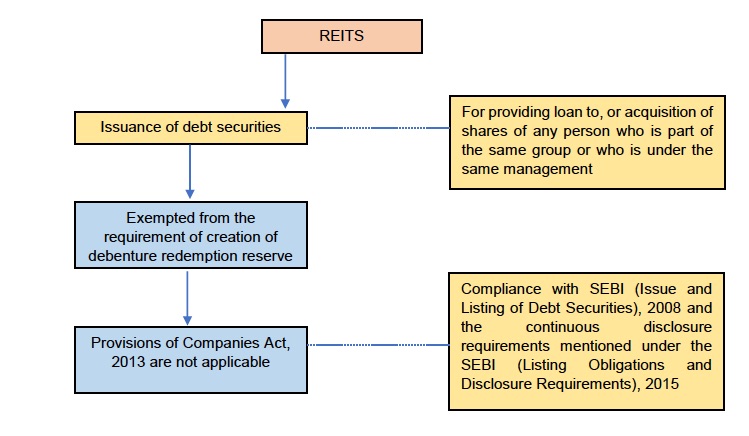

SEBI amended the REITs Regulations by notifying the SEBI (Real Estate Investment Trusts) (Amendment) Regulations, 2017 in December 2017 (“Amendment”). Prior to the Amendment, REITs were not allowed to issue debt securities of any kind. REITs whose units are listed on a recognized stock exchange, have now been allowed to raise funds by way of issue of non-convertible debentures and bonds, whether by way of public issue or private placement, in the manner specified by SEBI. It may be noted that issue of ‘convertible’ debt securities by REITs are still not permitted.

SEBI has now issued a circular dated 13 April 2018 for prescribing guidelines for issuance of debt securities. The circular emphasizes on the requirement of complying with the continuous disclosure requirements mentioned under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. Also, the said circular exempts REITs from the following:

(a) REITs shall follow the provisions of SEBI (Issue and Listing of Debt Securities), 2008 except for regulations 4(5) and 16(1) respectively i.e. REITs may issue debt securities for providing loan to, or acquisition of shares of any person who is part of the same group or who is under the same management;

(b) Requirement of creation of debenture redemption reserve; and

(c) Application of the provisions of Companies Act, 2013 to issuance of debt securities by REITs.

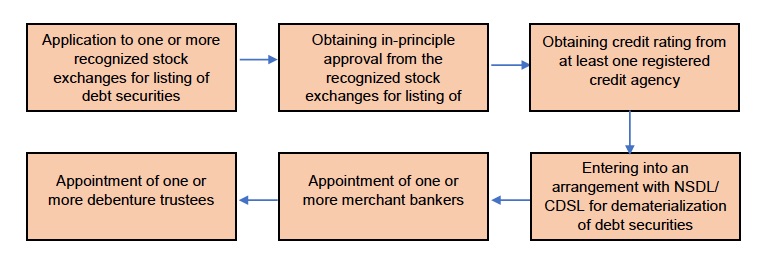

A. Eligibility criteria for issuance and listing of debt securities

(a) Issuer / persons in control of the issuer / promoters / directors shall not be debarred from accessing the securities market.

(b) Issuer / its promoters / directors shall not be a willful defaulter or shall not have defaulted in payment of interest or repayment of principal amount in respect of debt securities issued by it to the public, if any, for a period of more than six months.

B. Pre-conditions for issuance and listing of debt securities

Please click on the image to enlarge.

CONSULTATION PAPER ON REDUCTION IN TIMELINES FOR PUBLIC ISSUE OF DEBT SECURITIES UNDER THE SEBI (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS, 2008

The present timeline of T+12 for listing and commencement of trading in case of public issue of debt securities is inefficient in terms of cost and time and does not ensure smooth functioning for the public issuance process. In order to ensure uniformity, standardization and streamlining of issuance of debt securities with that of equity shares and convertibles, SEBI has proposed to reduce the time lines for the public issue of debt securities from T+12 to T+6 (wherein the T day is issue closing date) vide a consultation paper dated 29 April 2018.

The consultation paper proposes that allotment and subscription of debt securities in dematerialized mode (i.e., electronic form) may be made compulsory for public issue of debt securities under the SEBI (Issue and Listing of Debt Securities) Regulations, 2008 for all classes of investors, without providing any flexibility of subscription in physical mode under the Depositories Act, 1996.

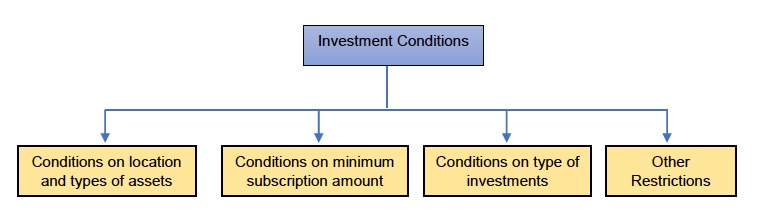

CONDITIONS ON INVESTMENTS BY REITS

Please click on the image to enlarge.

i. All assets shall be situated in India. Real estate or properties which may be held by a REIT / holding company / SPV shall include land and any permanently attached improvements to it, whether leasehold or freehold and includes buildings, sheds, garages, fences, fittings, fixtures, warehouses, car parks, etc. and any other assets incidental to the ownership of real estate, hotels, hospitals and convention centers, forming part of composite real estate projects, whether rent generating or income generating; hotels, hospitals and convention centers, forming part of composite real estate projects, whether rent generating or income generating, but does not include mortgage and any asset falling within the purview of ‘infrastructure’ as defined by Ministry of Finance;

ii. At least 80% of the value of the REIT assets shall be invested in completed and rent and/or income generating properties.

iii. Not more than 20% of the value of the REIT assets shall be invested in the following:

- Under-construction properties which shall be held by the REIT for at least 3 years post completion;

- Under-construction properties which are a part of the existing income generating properties owned by the REIT which shall be held by the REIT for not less than three years after completion;

- Completed and not rent generating properties which shall be held by the REIT for not less than three years from date of purchase;

- Listed or unlisted debt of companies or body corporate in real estate sector (other than investment in debt of holding company and / or SPVs);

- Mortgage backed securities;

- Equity shares of listed companies in India which derive not less than 75 percent of their operating income from real estate activity as per the audited accounts of the previous financial year;

- Government securities;

- Unutilized FSI of a project where it has already made investment; and

- TDR acquired for the purpose of utilization with respect to a project where it has already made investment;

- Money market instruments or cash equivalents.

iv. Minimum subscription amount per investor in a public offer shall be at least INR 200 thousand (~ USD 3,076);

v. Minimum unit size and trading lot shall be INR 100 thousand (~ USD 1,538);

vi. Prohibited Investments – vacant land or agricultural land or mortgages other than mortgage backed securities;

vii. At least 51% of the revenues of the REIT, holding company and the SPV (other than gains on disposal of properties) shall be from rental, leasing and letting real estate assets;

viii. Any completed and rent generating property shall be held for a period of not less than 3 years;

ix. Approval of unit holders by way of ordinary resolution shall be required for sale of any property exceeding 10% of the value of REIT assets in a financial year;

x. Approval of unit holders by way of ordinary resolution shall be required for sale of shares or interest in the SPV by the holding company or the REIT exceeding 10% of the value of REIT assets in a financial year;

xi. A REIT shall not invest in units of other REITs; and

xii. Lending by REIT is permissible only to the holding company and the SPV, however, investment in debt securities is permitted. Such lending is mandatorily required to be disclosed in the Annual Report.

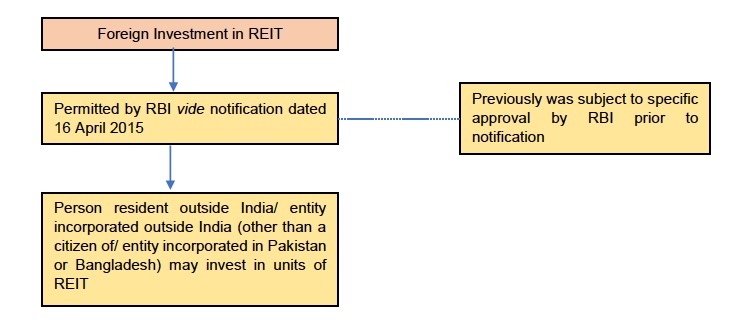

FOREIGN INVESTMENT IN REITS

Please click on the image to enlarge.

As a step towards achieving ease of doing business in India and with a view to expand the foreign investment inflows in the real estate sector, the Reserve Bank of India (“RBI”) had, vide a notification dated 16 April 2015 (“said Notification”), inter alia permitted foreign investment in REITs registered and regulated under REITs Regulations without any approval requirements. NRIs and FPIs have also been allowed to invest in REITs units. Prior to the said Notification, any foreign investments in REITs were subject to specific approval from RBI.

Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations, 2017 (“FEMA Regulations”) provide that a person resident outside India (other than a citizen of Pakistan or Bangladesh) or an entity incorporated outside India (other than an entity incorporated in Pakistan or Bangladesh) may invest in units of a REIT.

A REIT is permitted to invest in capital instruments or the capital of another Indian entity (i.e. an Indian company or a limited liability partnership). In terms of the RBI Circular dated 21 April 2016, downstream investment made by a REIT shall be regarded as foreign investment if either the sponsor or manager or the investment manager is not Indian ‘owned and controlled’ as defined in the FEMA Regulations. As per the FEMA Regulations, a REIT cannot receive downstream investment from an Indian entity or any other investment vehicle (i.e. REITs, Infrastructure Investment Funds and Alternative Investment Funds).

TAXATION PERSPECTIVE

Any investment through the structure of REITs shall be subject to applicable tax laws of India. Accordingly, it is strongly advised that expert tax advice is obtained to understand taxability of income in the hands of the REITs, its sponsors and unit holders prior to finalizing the REIT structure.

CURRENT STATUS OF REITS IN INDIA

In July 2017, Embassy Office Parks in association with Blackstone became the first REITs to get registered with SEBI. The application for registration was made in 2016 with an aim to list a $600 million REIT, which would include more than 20 million sq. ft of office assets. However, till date the units of the REITs are not listed on any of the stock exchanges in India yet.

For further information, please contact:

Souvik Ganguly, Partner, Acuity Law

al@acuitylaw.co.in

.jpg)