On October 9, 2023, Laos issued Presidential Decree No. 003, which raised excise tax rates for certain goods, effective immediately.

The move to increase excise tax rates comes amid the marked depreciation of the Lao kip (LAK). The Lao government is trying to monitor and discourage imports of non-essential products in order to reduce the outflow of foreign currency from the country. Increasing the tax rate for some of these products is part of these efforts.

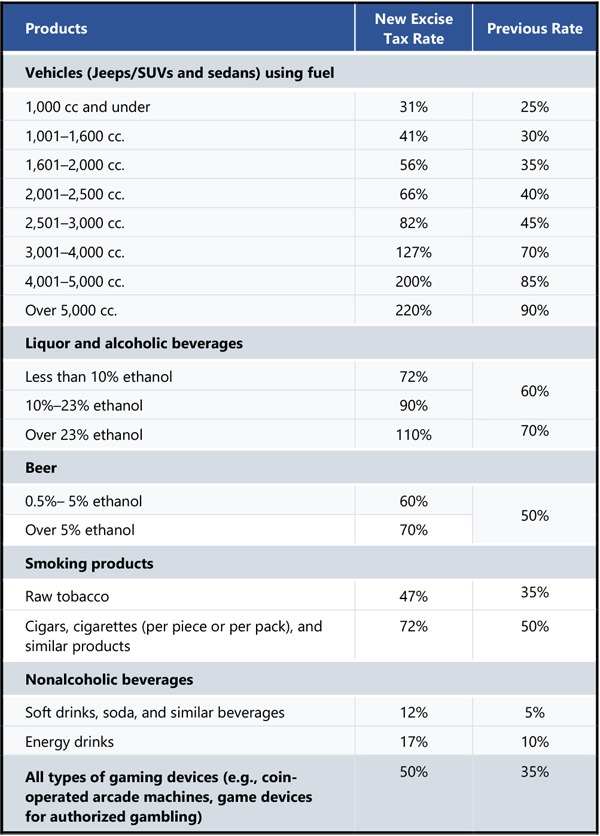

The specific products and excise tax rates are listed in the table below.

This new rate policy is also in line with recent government efforts to encourage avoiding payment in foreign currency to prevent the depletion of foreign currency reserves in Laos. In this regard, commercial banks have already taken action to ration the supply of foreign currency by prioritizing imports of essential goods, such as fuel. The products listed above formalize this impetus to prioritize certain imports and discourage others deemed not essential. In addition, the increased excise tax rates on fuel-powered vehicles show the commitment of the Lao government to move toward electric vehicles, which would also lessen the country’s dependence on fuel imports.

For more information on these excise tax changes, or on any aspect of Laos’ international trade regulations, please contact Tilleke & Gibbins at laos@tilleke.com.