25 April, 2018

What is BEPS?

Base Erosion & Profit Shifting (BEPS) refers to tax planning strategies taken by multinational enterprises to exploit gaps and mismatches in tax rules worldwide, reducing tax payable by shifting their profits to jurisdictions with lower tax rates.

The BEPS project was initiated by the OECD and G20 countries in 2013. In October 2015, a comprehensive 15-point Action Plan was released in response to growing concerns about the inability of the international tax system to keep up with globalisation. The BEPS package sets out 15 actions along the key pillars of (i) improving coherence of corporate income taxation to reduce loopholes in the interaction of countries’ domestic tax laws, (ii) establishing substance requirements in international standards, and (iii) ensuring a transparent tax environment as well as certainty. It is expected that once implemented, measures recommended under the BEPS package will result in the taxation of profits where the economic activities that generate them take place and where value is created.

The OECD established the Inclusive Framework (IF) in January 2016 so that countries and jurisdictions can collaborate on the implementation of the BEPS package. At the IF meeting on 25 – 27 January 2017 in Paris, Malaysia announced its intention to join the IF. In March 2017, the OECD welcomed Malaysia officially as a BEPS Associate. As such, Malaysia now has a voice in the development of standard setting and BEPS implementation monitoring.

BEPS Action 4 – Limiting Base Erosion Involving Interest Deductions and Other Financial Payments

Overview

In October 2015, the OECD issued its initial report on Limiting Base Erosion Involving Interest Deductions and Other Financial Payments. The initial report was subsequently updated with additional guidance in December 2016 (Final Report).

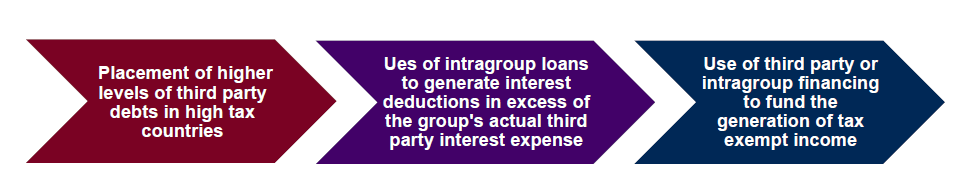

Action 4 focuses on the use of third party and intra-group debt to achieve excessive interest deductions or to finance the production of exempt or deferred income. In the Final Report, it was observed that base erosion and profit shifting could potentially arise from the following arrangements:

Please click on the image to enlarge.

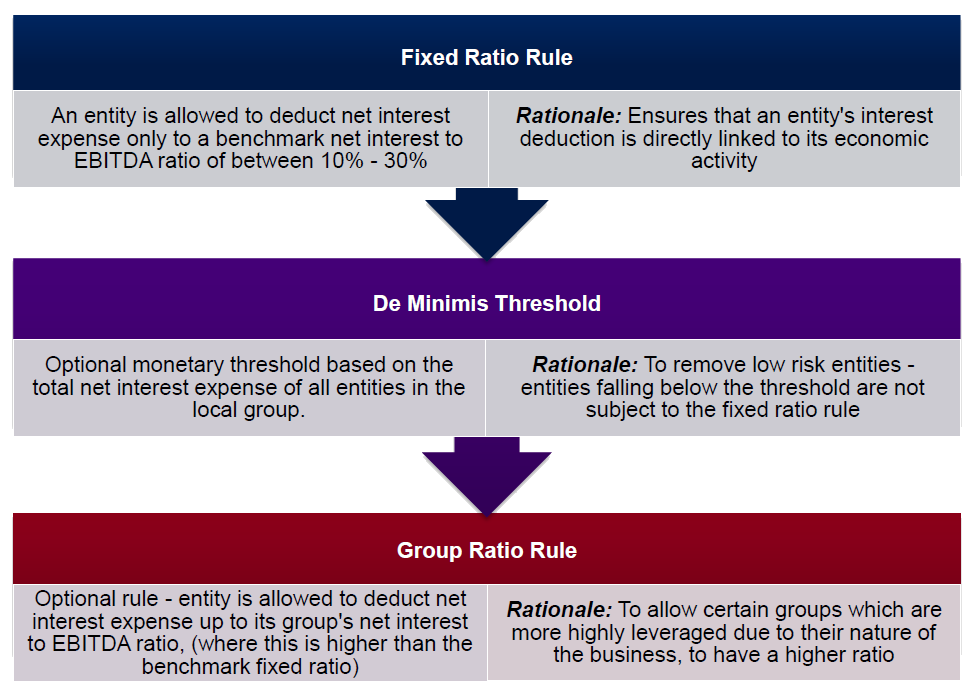

To address these risks, the Final Report analysed several best practices and recommended an approach that would directly address the identified risks. The recommended approach centers around the fixed ratio rule, which seeks to limit an entity's deduction for interest (or other economically equivalent) expenses to a percentage of its income before interest, taxes, depreciation and amortisation (EBITDA).

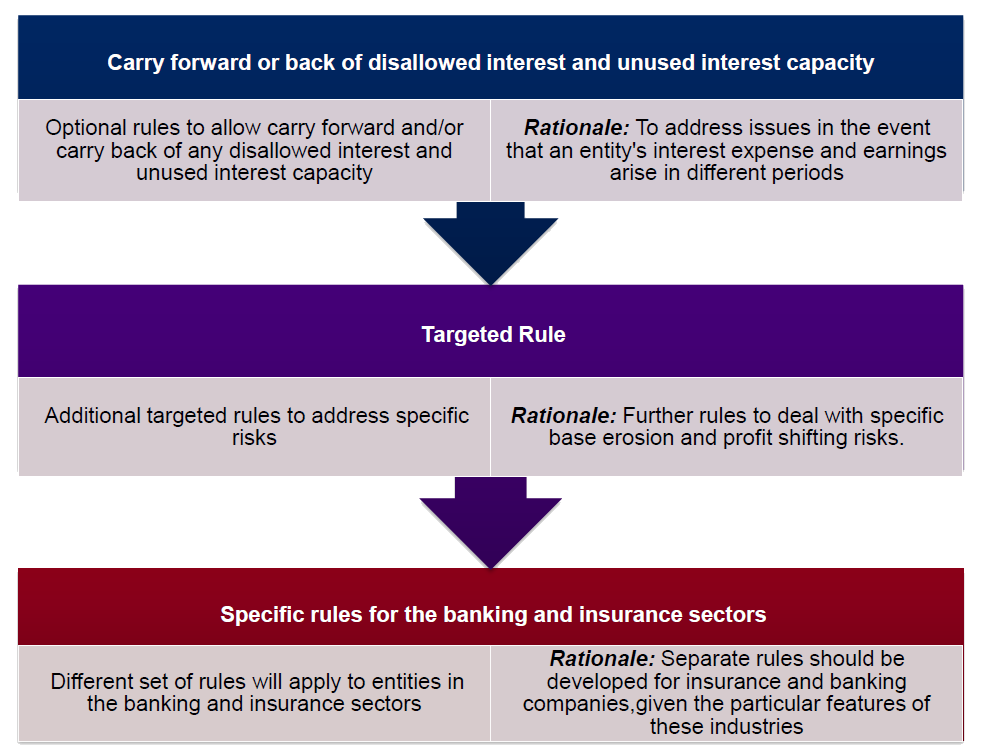

Recommendations in the Final Report

The key features of the recommendation in the Final Report include:

Malaysia – Response and Implementation

It is not mandatory for Malaysia to implement the recommendations in the BEPS Action 4 Final Report as a BEPS Associate. However, in the 2018 Budget speech released in October 2017, the Malaysian Prime Minister announced that earning stripping rules (ESR), similar to those proposed under the Final Report, will be introduced.

It was previously proposed that thin capitalisation rules would be enforced in Malaysia from 1 January 2018 onwards. The thin capitalisation rules were intended to stipulate conditions under which deductions for interest charges would be disallowed, based on the debt to equity ratio of the entity. The thin capitalisation rules have now been repealed, and will be replaced with the proposed ESR regime.

Under the ESR, it is proposed that the interest deduction on loans between related companies within the same group will be limited to a ratio to be determined by the Malaysian Inland Revenue Board (MIRB), ranging between 10% – 30% of the company's profit before tax.

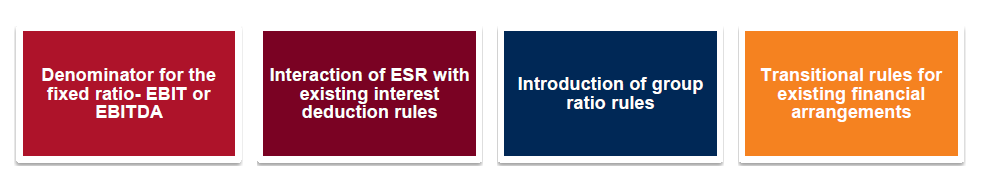

At current time, the MIRB has yet to publish the draft guidelines or regulations relating to the ESR. Some of the key considerations that should be addressed in the formulation of the ESR regime include the following:

Please click on the image to enlarge.

The ESR rules are proposed to be effective from 1 January 2019, and it is expected that more detailed rules and guidelines relating to the ESR will be released by the MIRB in due course.

Given that the ESR rules will have far-reaching implications on the financing arrangements for businesses, it is also hoped that the MIRB will consider carrying out a formal consultation process on the draft ESR regulations to obtain feedback from businesses, professional bodies as well as trade associations in developing the ESR rules.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com