15 June, 2018

What is BEPS?

Base Erosion & Profit Shifting (BEPS) refers to tax planning strategies taken by multinational enterprises to exploit gaps and mismatches in tax rules worldwide, reducing tax payable by shifting their profits to jurisdictions with lower tax rates.

The BEPS project was initiated by the OECD and G20 countries in 2013. In October 2015, a comprehensive 15-point Action Plan was released in response to growing concerns about the inability of the international tax system to keep up with globalisation. The BEPS package sets out 15 actions along the key pillars of (i) improving coherence of corporate income taxation to reduce loopholes in the interaction of countries’ domestic tax laws, (ii) establishing substance requirements in international standards, and (iii) ensuring a transparent tax environment as well as certainty. It is expected that once implemented, measures recommended under the BEPS package will result in the taxation of profits where the economic activities that generate them take place and where value is created.

The OECD established the Inclusive Framework (IF) in January 2016 so that countries and jurisdictions can collaborate on the implementation of the BEPS package. At the IF meeting on 25 – 27 January 2017 in Paris, Malaysia announced its intention to join the IF. In March 2017, the OECD welcomed Malaysia officially as a BEPS Associate. As such, Malaysia now has a voice in the development of standard setting and BEPS implementation monitoring.

BEPS Action 5 – Harmful Tax Practices

Introduction

The Malaysian Government has been undertaking work to review and modify Malaysia's tax incentives regimes, given the minimum standards of the BEPS package.

Countering harmful tax practices (BEPS Action 5) is one of the four minimum standards of the BEPS package, and requires substantial activity for both intellectual property (IP) and non-IP preferential regimes.1 Other key factors that can lead to a preferential regime being considered harmful are ring-fencing, lack of transparency, and no effective exchange of information.

This alert discusses the potential changes to Malaysia's regimes in view of BEPS Action 5.

Status of Malaysia's Regimes

In October 2017, the OECD released the 2017 Progress Report on Preferential Regimes, which contains the results of the review of preferential regimes by the Forum on Harmful Tax Practices (FHTP). According to the report, the Malaysian Government has communicated to the FHTP its commitment to amend the features of Malaysia's regimes that are of concern.

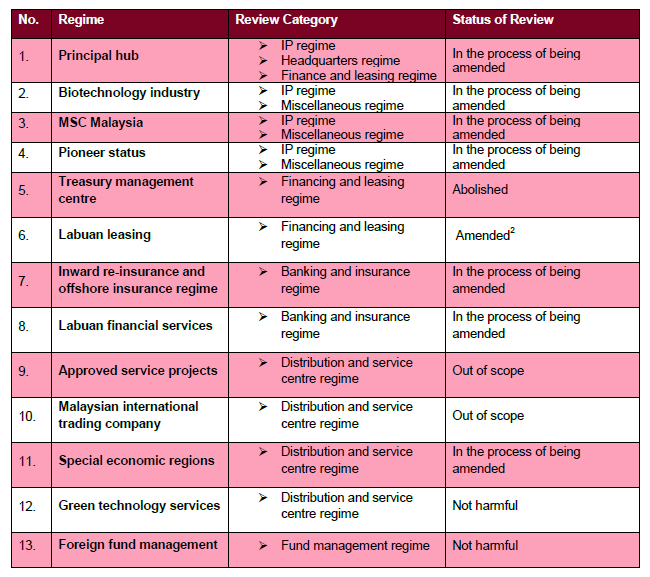

On 17 May 2018, the report was updated. Currently, the status of Malaysia's regimes is as follows:

Potential Changes to Malaysia's Regimes

IP Regimes

It is noted that Malaysia's current incentives for the principal hub, biotechnology industry, MSC Malaysia, and pioneer status regimes are being reviewed by the FHTP as IP regimes as well as non-IP regimes. To the extent that these incentives are regarded as IP regimes, they will need to comply with the nexus approach in the Action 5 Report which requires that taxpayers in fact incur qualifying R&D expenditures that are directly connected to the IP asset and contribute to the IP income. For now, the scope of changes is uncertain, but it is understood that the Malaysian Investment Development Authority (MIDA) is scrutinising these regimes closely to determine the extent of amendments required. We understand that particular focus is currently given to the R&D expenditure requirements as well as the scope of IP income (including embedded IP income from the sale of goods).

As an observation, Malaysia's tax incentives are designed to promote economic development and require substantial business functions and activities to be performed in Malaysia. The tax incentives are generally subject to extensive investment requirements in terms of capital expenditure, annual business spend and headcount, and are not targeted at income from geographically mobile activities.

Non-IP Regimes

This is a key area of focus for the Malaysian Government. For Malaysia's non-IP regimes, when re-designing legislation and guidelines, one of the Malaysian Government's most important tasks is to ensure that qualifying taxpayers undertake core income generating activities. Wong & Partners have been engaging in discussions with MIDA and the Labuan Financial Services Authority (Labuan FSA), and providing comments.

Attention is being given to the discussion in the Action 5 Report of what constitutes core income generating activities. The Action 5 Report states that such activities could include the following:

- Financing and leasing regimes ‒ agreeing on funding terms, identifying and acquiring assets to be leased, setting the terms and duration of the financing and leasing arrangement, monitoring and revising agreements, and managing risks.

- Banking regimes ‒ raising funds, managing risks including credit, currency, and interest risks, hedging, providing loans, credit, or other financial services, managing regulatory capital, and preparing regulatory reports and returns.

- Insurance regimes ‒ predicting and calculating risks, insuring or re-insuring, and providing client services.

- Distribution and service centre regimes ‒ transporting and storing goods, managing stocks and taking orders, and providing consulting and other administrative services.

The Guidelines on the Establishment and Operations of Labuan Leasing Business was revised to introduce new substance requirements for Labuan leasing companies. With effect from 1 January 2018, Labuan leasing companies are required to establish substantial activities and perform strategic functions in Labuan. Factors considered in determining compliance with the substance requirements include the maintenance of physical presence in Labuan, performance of key income-generating activities in Labuan, employment of adequate full-time employees, and annual business spending to undertake the leasing business. Please refer to our previous alert here for more details.

Other important tasks for the Labuan FSA will be to address ring-fencing concerns and step up transparency rules for the Labuan preferential tax regime.

Comments

The recent changes to Malaysia's leadership will likely encourage more investments and propel its economy forward. Given the increased competition for investment among countries in the jurisdiction, the Malaysian Government will be putting in much effort to offer tax incentives that are attractive and comply with prevailing international standards. We expect that more new legislation and/or guidelines will be introduced soon that will contribute towards the transformation of the economy.

1 Taxpayers may benefit from IP regimes only to the extent that the taxpayer itself has incurred the qualifying research and development (R&D) expenditures that generate the IP. For non-IP regimes, taxpayers should undertake the core income generating activities relevant to the type of regime.

2 Pursuant to updated results released by the FHTP on 17 May 2018.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com