24 July, 2018

What is BEPS?

Base Erosion & Profit Shifting (BEPS) refers to tax planning strategies taken by multinational enterprises (MNEs) to exploit gaps and mismatches in tax rules worldwide, reducing tax payable by shifting their profits to jurisdictions with lower tax rates.

The BEPS project was initiated by the OECD and G20 countries in 2013. In October 2015, a comprehensive 15-point Action Plan was released in response to growing concerns about the inability of the international tax system to keep up with globalisation. The BEPS package sets out 15 actions along the key pillars of (i) improving coherence of corporate income taxation to reduce loopholes in the interaction of countries’ domestic tax laws, (ii) establishing substance requirements in international standards, and (iii) ensuring a transparent tax environment as well as certainty. It is expected that once implemented, measures recommended under the BEPS package will result in the taxation of profits where the economic activities that generate them take place and where value is created.

The OECD established the Inclusive Framework (IF) in January 2016 so that countries and jurisdictions can collaborate on the implementation of the BEPS package. At the IF meeting on 25–27 January 2017 in Paris, Malaysia announced its intention to join the IF. In March 2017, the OECD welcomed Malaysia officially as a BEPS Associate. As such, Malaysia now has a voice in the development of standard setting and BEPS implementation monitoring.

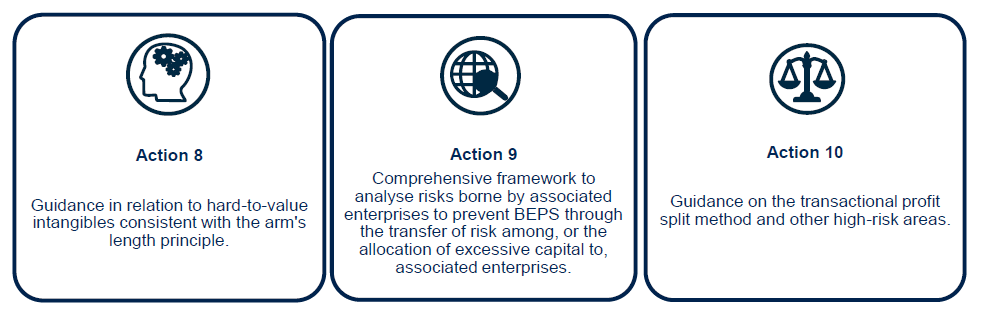

BEPS Actions 8–10: Aligning Transfer Pricing Outcomes with Value Creation

Overview

Transfer pricing is now a key topic in international tax disputes and controversies. This is especially so given the quantum and frequency of cross-border related party transactions conducted across the globe in tandem with the opening of significant emerging economies and the need for tax authorities to protect and expand their revenue base.

In October 2015, the OECD issued its Final Report on Aligning Transfer Pricing Outcomes With Value Creation ("Final Report") under BEPS Actions 8–10, which is intended to align international transfer pricing standards with value creation and substance requirements. The Final Report was subsequently incorporated into the updated OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations ("OECD TP Guidelines"), which was published in July 2017.

The key outcomes in Actions 8–10 that were subsequently incorporated in the OECD TP Guidelines include:

Please click on the image to enlarge.

Actions 8–10 Recommendations

1. Action 8

Action 8 looks at the prevention of BEPS that is caused by the misallocation of profits associated with the use and transfer of intangibles among related parties.

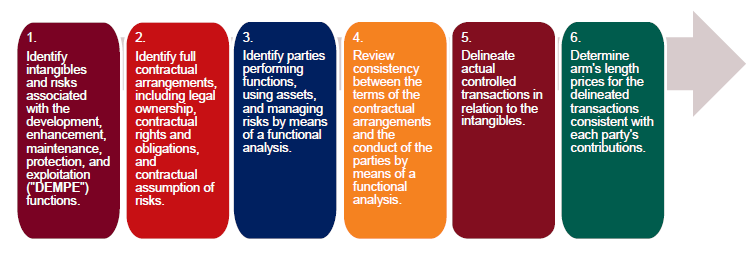

1.1 Framework for analysing transactions involving intangibles

The OECD TP Guidelines has incorporated the framework recommended by Action 8 for analysing transactions involving intangibles, which focuses on a specific and meaningful control requirement and the financial capacity to assume risks.

The framework for analysing transactions involving intangibles as set out in the OECD TP Guidelines involves the following steps:

1.2 Intangibles for which valuation is highly uncertain at the time of the transaction and hard-to-value intangibles

Please click on the image to enlarge.

Where the valuation of an intangible is uncertain at the time of the transaction or where an intangible is a hard-to-value intangible,1 the OECD TP Guidelines has incorporated specific guidance to assist taxpayers and tax authorities in establishing an arm's length price. For example, the OECD TP Guidelines considers the usage of projections of anticipated benefits to fix a price at the time of the transaction (ex ante pricing) by taxpayers. If pricing based on anticipated benefits alone does not provide adequate protection against the risks posed by the uncertainty in valuing the intangible, taxpayers might consider using shorter term agreements, including price adjustment clauses in the agreement, or adopting a payment structure involving contingent payments. The OECD TP Guidelines also considers the usage of ex post evidence (i.e., evidence that is available after the event) by tax authorities during audits to assess ex-ante prices.

1.3 Cost Contribution Arrangements (CCAs)

CCAs are used by business enterprises to share contributions and risks in the joint development, production, or acquisition of intangibles, tangible assets, or services with the understanding that the intangibles, tangible assets, or services provided under the CCA are expected to create benefits for the individual businesses of each of the participants. The OECD TP Guidelines has introduced additional guidance for the appropriate valuation of the contributions and benefits under the CCA, to ensure that each participant's contributions commensurate with expected benefits under the CCA.

The BEPS project's enhanced documentation requirements mean that MNEs will likely need to report their CCAs and supporting documentation will be required, either as part of the local file or upon request.

2. Action 9

Action 9 has introduced additional guidance for the application of the arm's length principle, specifically with respect to the risk analysis process under a functional analysis. A functional analysis is required, amongst other things, to identify material risks assumed by each party and how the actual assumption of risks would influence the price and other conditions of the associated enterprise. Contractual allocations of risk will be respected only when supported by actual decision-making and exercise of control over these risks. An enterprise that merely provides capital (i.e., a "cash box" without substance) will generate no more than risk-free returns for the funding itself.

Please click on the image to enlarge:

The diagram below summarises the risk analysis process in a controlled transaction, as prescribed in the OECD TP Guidelines:

3. Action 10 – Other High Risk Transactions

Action 10 has focused on transfer pricing in relation to high-risk transactions and developed rules to prevent transactions which would not, or would rarely occur between independent parties.

One of the main clarifications provided by Action 10 relates to the application of the transactional profit split method (PSM) in the context of global value chains. The OECD TP Guidelines has introduced guidance for the application of the PSM in greater detail and elaborated on instances where it would be appropriate to use the PSM.

Additionally, the OECD TP Guidelines incorporates the new guidance proposed by Action 10 in relation to the application of the comparable uncontrolled price (CUP) method for commodity transactions.

Action 10 has also developed transfer pricing rules to provide protection against common types of base eroding payments (such as management fees and head office expenses) by introducing an elective, simplified approach for low value-adding services.

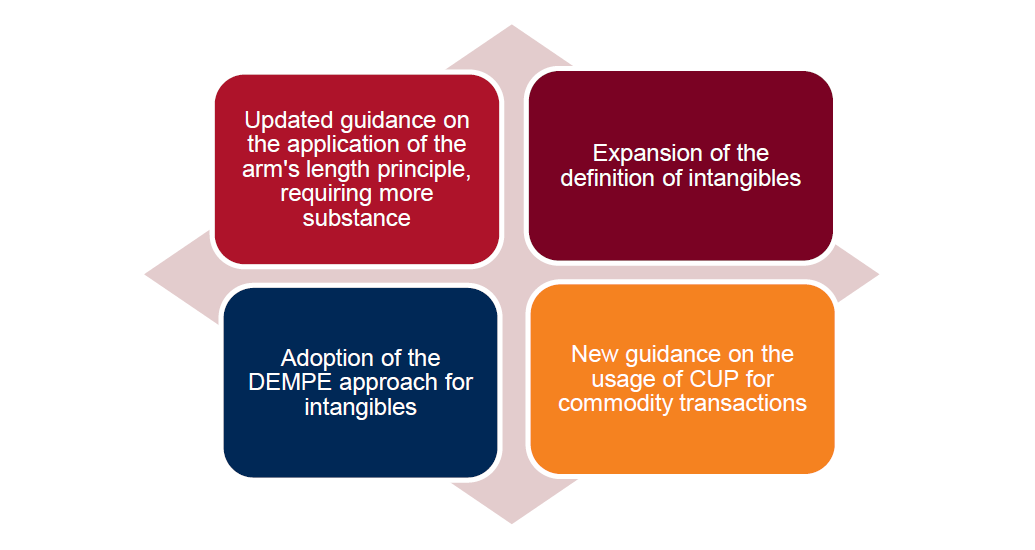

Malaysia – Response and Implementation

Whilst the recommendations under Actions 8–10 are not mandatory for Malaysia as a BEPS Associate2, the Malaysian government has demonstrated a keen interest in the transfer pricing issues covered under Actions 8–10. In July 2017, the Malaysian Inland Revenue Board (MIRB) updated the Transfer Pricing Guidelines 2012 (Malaysian TP Guidelines) to align itself with the updates under the OECD TP Guidelines. The Malaysian TP Guidelines amended and introduced the following:

Please click on the image to enlarge:

1 The term "hard-to-value intangible" is defined to cover an intangible or a right in intangibles for which at the time of transfer between related enterprise has, (i) no reliable comparable; and (ii) at the time the transaction was entered into, the projections of future cash flows or income expected to be derived from the transferred intangible, or the assumptions used in valuing the intangible, are highly uncertain, making it difficult to predict the ultimate success of the intangible at the time of the transfer.

2 BEPS Associates are required to commit to the implementation of four minimum standards under the BEPS package, namely Action 5 (Countering Harmful Tax Practices), Action 6 (Preventing Treaty Abuse), Action 13 (Country-by-Country Reporting), and Action 14 (Enhancing Dispute Resolution Mechanisms).

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com