24 October, 2018

What is BEPS?

Base Erosion & Profit Shifting (BEPS) refers to tax planning strategies taken by multinational enterprises to exploit gaps and mismatches in tax rules worldwide, reducing tax payable by shifting their profits to jurisdictions with lower tax rates.

The BEPS project was initiated by the OECD and G20 countries in 2013. In October 2015, a comprehensive 15-point Action Plan was released in response to growing concerns about the inability of the international tax system to keep up with globalisation. The BEPS package sets out 15 actions along the key pillars of (i) improving coherence of corporate income taxation to reduce loopholes in the interaction of countries’ domestic tax laws, (ii) establishing substance requirements in international standards, and (iii) ensuring a transparent tax environment as well as certainty. It is expected that once implemented, measures recommended under the BEPS package will result in the taxation of profits where the economic activities that generate them take place and where value is created.

The OECD established the Inclusive Framework (IF) in January 2016 so that countries and jurisdictions can collaborate on the implementation of the BEPS package. At the IF meeting on 25 – 27 January 2017 in Paris, Malaysia announced its intention to join the IF. In March 2017, the OECD welcomed Malaysia officially as a BEPS Associate. As such, Malaysia now has a voice in the development of standard setting and BEPS implementation monitoring.

BEPS Action 13 – Transfer Pricing Documentation and Country-by-Country Reporting

Overview

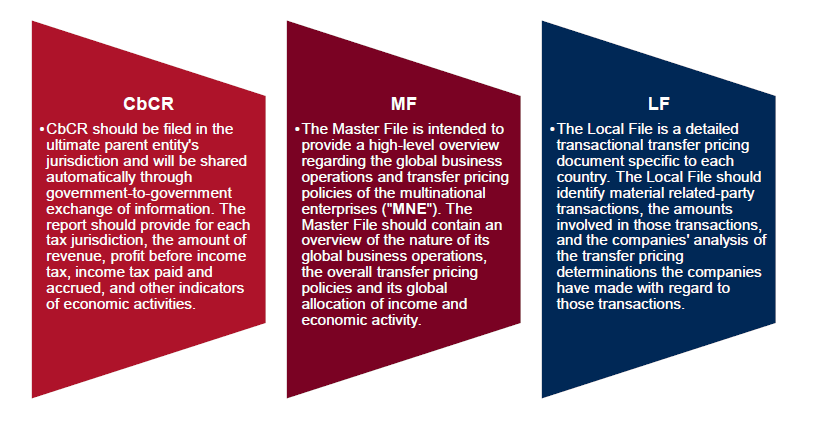

The Action 13 Final Report, in its effort to enhance transparency for tax administrations while taking into consideration the compliance costs for businesses, has revised the standards for transfer pricing documentation. The Action 13 Final Report sets out a three-tiered standardized approach to transfer pricing documentation: the Master File (MF), the Local File (LF), and the Country-by-Country Report (CbCR). The objectives of the three-tiered approach are, among others, to ensure taxpayers articulate consistent transfer pricing positions and to provide tax administrations with useful information to assess transfer pricing risks.

Please click on the image to enlarge.

Peer Review Reports – Malaysia

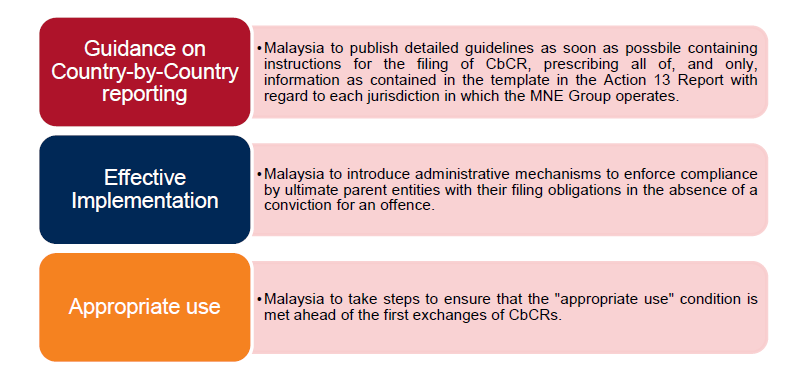

As one of the four BEPS minimum standards, the Country-by-Country reporting requirements contained in the Action 13 Final Report are subject to peer review in order to ensure timely and accurate implementation.

The key recommendations in Peer Review Reports for Malaysia are as follows:

Please click on the image to enlarge.

Malaysia – Response and Implementation

Malaysia is taking an active role in realizing the consistent and effective implementation of the transfer pricing documentation standards. In addition to being a signatory of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters, Malaysia has also submitted a Unilateral Declaration to align the effective date of the Convention with the first intended exchanges of CbCRs under the Multilateral Competent Authority Agreement on the exchange of CbCRs. The filing obligation for a CbCR in Malaysia commences in respect of fiscal years commencing on or after 1 January 2017. This requires annual CbCR for the financial year (FY) to be filed not later than twelve months from the close of FY of the reporting entity.

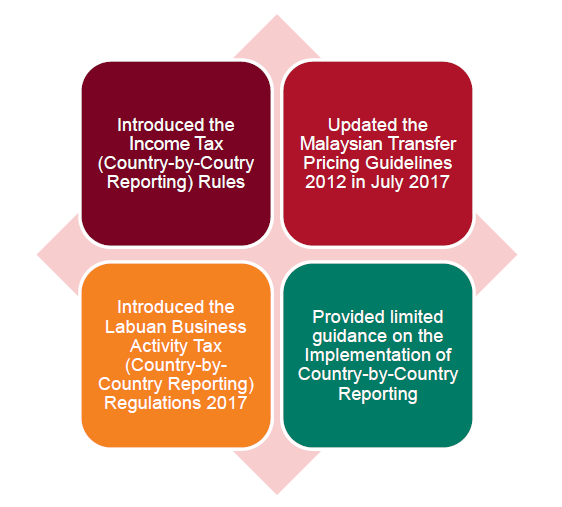

Following the recommendations published in the Peer Review Reports, Malaysia has issued a number of updates in aligning its transfer pricing standards with that of the OECD standard.1 The Malaysian Inland Revenue Board (MIRB) has introduced the following rules, guidelines and guidance which imposes additional compliance burden for taxpayers:

Please click on the image to enlarge.

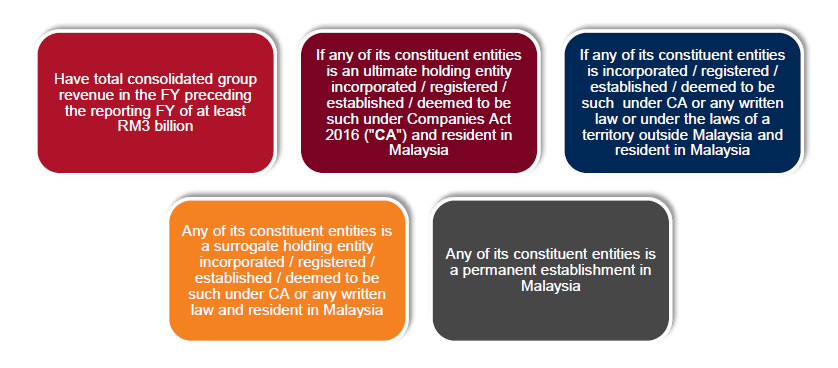

Implementation of Legislation

On 23 December 2016, the Income Tax (Country-by-Country Reporting) Rules 2016 (CbCR Rules 2016) is issued to introduce the Country-by-Country reporting requirements in line with Action 13 Final Report. Notably, the CbCR Rules 2016, including the amendments made in the Income Tax (Country-by-Country Reporting) (Amendment) Rules 2017, applies to MNEs that meet the following criteria to prepare and file a CbCR in Malaysia:

Please click on the image to enlarge.

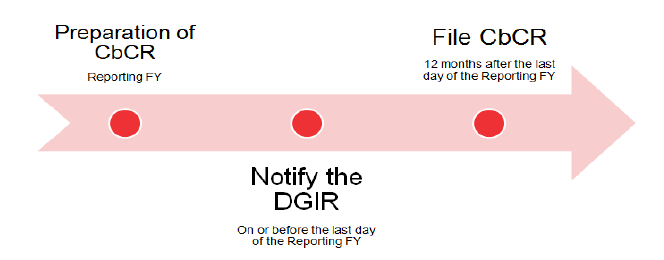

The key milestones under the CbCR Rules 2016 are depicted in the diagram below:

Please click on the image to enlarge.

Malaysia allows for a surrogate entity to file the CbCR. This may be a "surrogate parent" nominated by the MNE or alternatively a surrogate that is resident in Malaysia. These include cases where:

- the ultimate holding entity is not resident in Malaysia and is not obliged to file a CbCR in its jurisdiction of tax residence;

- the jurisdiction in which the ultimate holding entity is resident for tax purposes has an International Agreement but not a Qualifying Competent Authority Agreement with Malaysia at the time of filing the CbCR; or

- there has been a systemic failure of the jurisdiction of tax residence of the ultimate holding entity that has been notified by the Director General of Inland Revenue to the constituent entity resident for tax purposes in Malaysia.

In this regard, where the jurisdiction in which the ultimate holding entity is resident for tax purposes has an International Agreement but not a Qualifying Competent Authority Agreement with Malaysia at the time of filing the CbCR, and the ultimate holding entity has filed its CbCR in its country of residence, the Malaysian constituent entity will not be required to file the CbCR and will be treated as a non-reporting entity rather than a surrogate holding entity. This provision results in an anomaly, in particular for US companies because both the US and Malaysia are signatories to the Convention on Mutual Administrative Tax Matters which satisfy the definition of "International Agreement" but have yet to conclude a Qualifying Competent Authority Agreement.

The consequence is that the Malaysian subsidiary of a US company can be considered as a surrogate holding company which is required to file the CbCR, failing which penalties would apply. At the time of writing this alert, the MIRB has not yet issued any guidance or clarification on this issue.

The Labuan Business Activity Tax (Country-by-Country Reporting) Regulations 2017 ("Labuan CbCR Rules") is in substance very similar to the CbCR Rules 2016. One main difference is that the Labuan CbCR Rules applies to an MNE which has a total consolidated group revenue in the FY preceding the reporting FY of at least RM 3 billion and its ultimate holding entity or any of its constituent entities is a Labuan entity carrying on a Labuan business activity.

Further, the Finance Act 2017 also introduced penalties for the failure to furnish the CbCR, incorrect reporting or omission of information, and failure to comply with mutual administrative assistance. In addition to the penalty, the court may issue an order for the taxpayer to comply with the rules within 30 days or such other period as the court deems appropriate.

Introduction and implementation of CbCR Guidelines

The MIRB has published on its website, guidance on the implementation and preparation of CbCR and the model template for CbCR, which are largely adopted from the Action 13 Final Report. The MIRB has also provided sample notification letters and user guides which aims to assist taxpayers in fulfilling their Country-by-Country reporting obligations.

Implications for MNEs

Following the implementation of the domestic legislation and the guidelines on the implementation of Country-by-Country reporting by the MIRB, it would be prudent for MNEs to assess its global tax and transfer pricing structures to ensure that it complies with Malaysian transfer pricing obligations.

Additionally, to ensure consistency in the information reported, MNEs should share the relevant documentation and information reported within the group to ensure that the local entities are aligned in the way they respond to any queries from tax authorities. In the age of tax transparency, consistency is key.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com