Corporate/M&A

Amendments to Bursa Malaysia Securities Berhad Main Market Listing Requirements in Relation to Sustainability Training for Directors

On 6 June 2023, the Bursa Malaysia Securities Berhad (“Bursa Malaysia”) has amended the Main Market Listing requirements (“Main LR”) on sustainability training for directors. For this purpose, Bursa Malaysia has reviewed and enhanced the scope of the Mandatory Accreditation Programme (“MAP”) for directors under the Main LR. The MAP will now be conducted in two parts as follows:

(a) the existing training for directors in relation to corporate governance and a director’s roles, duties and liabilities will remain as Part I (“MAP Part I”); and

(b) a new Part II which will focus substantively on sustainability will be introduced (“MAP Part II”).

Key Amendments

The key amendments are as follows:

(a) expanding the MAP to two parts, comprising MAP Part I and MAP Part II; (

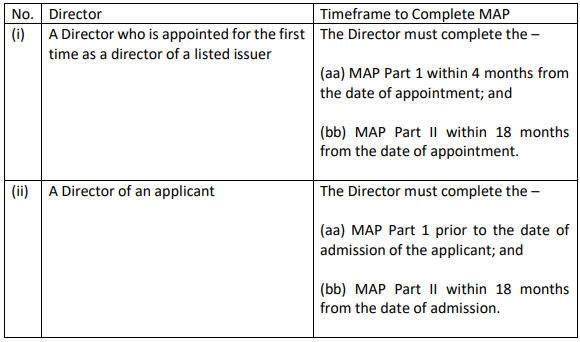

b) requiring a first-time director of a listed issuer and a director of a listing applicant, to complete MAP Part II within the prescribed timeframe as follows; and

(c) streamlining and updating the relevant terms used in the Main LR for clarity and consistency, as well as removing operational provisions, from the Main LR.

The amendments take effect as follows:

(a) a director who is appointed on or after 1 August 2023 for the first time in a listed issuer must complete MAP Part II within 18 months from the date of his/her appointment; and

(b) a director of a listing applicant which is admitted to the Main Market on or after 1 August 2023 must complete MAP Part II within 18 months from the date of admission.

Existing directors

(c) In addition to the above, existing directors of listed issuers who are appointed prior to 1 August 2023 must complete MAP Part II on or before 1 August 2025.

Other directors

(d) With regard to other directors not specified under paragraphs (a), (b) and (c) above, they must complete MAP Part II within 18 months from the date of their appointment.

The full text of the amendments as discussed above can be assessed here. To facilitate better understanding on this, Bursa Malaysia has also issued:

(a) “Questions and Answers” in relation to the amendments to facilitate a listed issuer and its directors’ better understanding of, and compliance with, the amendments, which can be accessed here.

The letter dated 6 June 2023 issued by Bursa Malaysia on the amendments to the Main LR in relation to sustainability training for directors can be accessed here.

CONTACT US FOR FURTHER INFORMATION REGARDING CORPORATE/M&A MATTERS.

Financial Services

Exposure Draft on Disposal and Purchase of Impaired Loans/Financing

On 19 June 2023, Bank Negara Malaysia (“BNM”) issued an exposure draft on a new Disposal and Purchase of Impaired Loans/Financing policy document. The exposure draft sets out the requirements and guidance with respect to the disposal and purchase of impaired loans/financing by banking and non-banking institutions. It seeks to ensure that the interests of affected borrowers will be protected under such arrangement.

Further, the exposure draft aims to lower the barriers to entry for buyers into the impaired financing market and nurture greater efficiency in the disposal or purchase of impaired financing.

BNM invited feedback on the exposure draft until 19 July 2023. The feedback may include recommendations on alternative proposals that BNM should consider.

Exposure Draft on Claims Settlement Practices

On 30 June 2023, BNM issued an exposure draft on the upcoming Claim Settlement Practices policy document. The exposure draft sets out the minimum standards that licensed insurers carrying on general business, takaful operators carrying on general takaful business and registered adjusters must meet in conducting general insurance and general takaful claims. The exposure draft seeks to ensure fair, transparent and timely results in respect of claims settlement practices.

BNM welcomes feedback on the exposure draft by 17 August 2023 from interested parties and relevant stakeholders in the general insurance and takaful claims settlement processes, particularly the motor industry.

Security Commission Malaysia (“SC”) launched FIKRA ACE to Spur Islamic Fintech Innovation

On 27 June 2023, the SC officially launched FIKRA ACE, a fintech initiative designed to enhance the Islamic capital market (“ICM”) ecosystem. The programme aims to foster the growth of Islamic fintech by implementing a structured approach. FIKRA ACE represents an enhanced version of SC’s initial Islamic fintech accelerator programme, FIKRA, which was introduced in May 2021.

The programme consists of three components:

• Accelerator — which is an Islamic-solutions focused accelerator programme;

• Circle — a networking platform to connect relevant stakeholders of the Islamic capital market and fintech industry; and

• Excel — a platform for collaborations with higher learning institutions for capacity building.

Under this initiative, FIKRA ACE will identify companies with fintech solutions and provide them with support to nurture, grow and facilitate their integration into the ICM ecosystem. The programme also seeks to strengthen the Islamic fintech sector by fostering a talent pipeline for the industry. In 2023, FIKRA ACE will primarily focus on three areas, namely Islamic social finance, Shariah-compliant sustainable and responsible investment, and Islamic fund and wealth management.

In the year 2021, Islamic fintech transactions within the Organisation of Islamic Cooperation countries amounted to USD 79 billion. Although this figure accounts for only 0.8% of the global fintech transaction volume. By 2026, it is estimated that this segment will grow up to USD 179 billion, which is 17.9% compounded annual growth rate. FIKRA ACE accelerator programme for the 2023 cohort is scheduled to commence in August.

CONTACT US FOR FURTHER INFORMATION REGARDING FINANCIAL SERVICES MATTERS.