12 September, 2017

A significant issue for power and energy companies looking to enter into Myanmar, is investment protection treaties.

Myanmar is continuing its offshore engagement with a new economic agreement underway with one of its closest Asian partners, Singapore. The countries already have a number of ties through ASEAN investment and co-operation treaties, however, this week U Aung Naing Oo (the Director General of Myanmar's Directorate of Investment and Company Administration (DICA)) announced that discussions were progressing for a further investment promotion and protection agreement between the two close countries.

Singapore is already one of the preferred hubs for businesses looking to invest in Myanmar because of the favourable ASEAN cooperation agreements in place between the countries, which effectively increase the ease of doing business in Myanmar. A direct bilateral investment treaty would reinforce this.

For foreign investors, increasing bilateral investment treaties mean an increase in the ease and attractiveness of doing business in Myanmar. Bilateral investment treaties generally mean favourable tax benefits, streamlined application and investment processes, and, traditionally, the loosening of tighter regulations in key markets, leading to greater development and investment opportunities. These are the benefits that foreign investors will continue to observe from Myanmar's current approach to its international relationships.

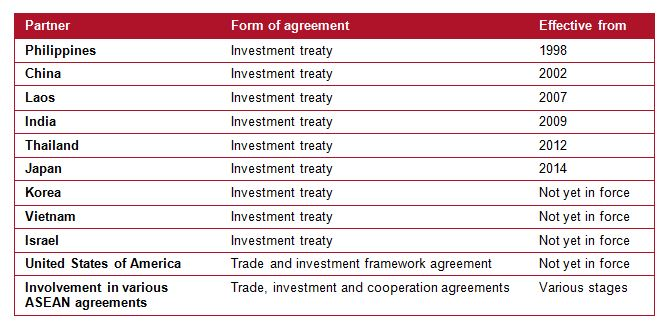

Currently, Myanmar has agreements with eight nations including:

Please click the table to enlarge.

Myanmar is also in negotiations on a direct investment and protection agreement with the European Union.

Myanmar remains a positive investment opportunity, and with growing international connections adding to its extensive internal capacity building, the country is working to make itself a stable and profitable option for offshore investors.

Data from Investment Policy Hub, available at http://investmentpolicyhub.unctad.org/IIA/CountryBits/144

Establishing an appellate tax regime in Myanmar

In May this year, the Union Government announced changes to the structure of tax appeals by implementing Notification 54/2017 (the Notification), which reformed the appeal tribunal to hear objections from decisions by Government bodies under a number of Myanmar's tax laws (Tax Appellate Tribunal).

The Notification extends the quasi-judicial assistance that the Government is providing for the court system, adding to the Arbitration Law enacted early last year. It seems likely that this development will assist to limit the time taken to address tax disputes, and ensure that companies operating in Myanmar (including foreign investors) will reach resolution of their tax disputes in shorter periods of time.

The Tax Appellate Tribunal (the body created under the Notification) will be able to hear appeals from companies or individuals disputing fact or law under:

- The Income Tax Law;

- The Commercial Tax Law;

- The Special Commodity Tax Law;

- The Union Tax Law;

- The Sea Customs Act and the Land Customs Act; and

- Any subordinate legislation released under those laws.

The Notification implements a number of key changes to the current tax appeal structure. These include:

First, responsibility for tax decisions is spread across a number of departments, increasing the wealth of experience that the Tax Appellate Tribunal may draw upon, and responsibility is passed to members of Government departments with more time to address tax dispute concerns (rather than requiring Ministers to attend). The Tax Appellate Tribunal will comprise three members, including the independent Director General (who shall sit as Chairman), a Director appointed from the Supreme Court of the Union Office and a Director assigned by the Ministry of Planning and Finance (MOPF) (both of whom shall be ordinary members of the Tax Appellate Tribunal).

Second, objections to decisions under any of the laws mentioned above are not required to be made directly to Myanmar's judicial system (note that it is not clear from the Notification whether an aggrieved party might be able to apply to the courts directly, or whether the Tax Appellate Tribunal is mandatory). This will assist to ease the caseload burden on Myanmar's court system, which is dealing with a dynamically changing commercial legislative environment, currently including a broad scope of tax law amendments, as well as new Investment Law (2016), Competition Law (in force from 2017), Petroleum and Petroleum Products Law (2017), and soon to be added a brand new Companies Law (expected later in 2017) and a new employment law (also expected later this year).

Third, a set of forms and directives will be created by MOPF, which will outline the process and timeframes for appealing a tax determination directly to the Tax Appellate Tribunal. This will, most likely, provide objectors with a detailed process for lodging an appeal, hopefully streamlining the steps and making it a more attractive option for local and foreign investors who feel aggrieved by a decision made against them.

Fourth and importantly, the Notification states that decisions of fact made by the Tax Appellate Tribunal are considered final. This leaves open the opportunity to appeal to a court for any instance where an aggrieved party feels that the Tax Appellate Tribunal erred in law, but it subsequently seems unlikely that the court will permit appeals from the Tax Appellate Tribunal based on errors of fact.

The Notification is another clear step by the Government in respect of improving and streamlining the commercial structures in Myanmar, increasing the ease of doing business and, subsequently, providing confidence to foreign and local investors that there is a robust regulatory regime in respect of tax assessments. Investors should be aware of this development both for the possibility to utilise the system themselves in the case of incorrect tax assessments, and also for any instance where they are required to assist with or appear in any claim made by one of their employees.

For further information, please contact:

Jo Daniels, Partner, Baker McKenzie

jo.daniels@bakermckenzie.com

See our full Doing Business In Myanmar Report via this link. https://www.investingmyanmar.com

.jpg)